Hey there, ever feel like your finances are in a constant state of chaos? It’s time to introduce a little mindfulness into your budgeting practices. By approaching your money with a clear and focused mindset, you can not only improve your financial situation but also enhance your mental clarity. Let’s explore some mindful budgeting practices that can help you achieve both peace of mind and financial stability.

Mindfulness in Budgeting: A Path to Mental Clarity

Taking a mindful approach to your finances isn’t just good for your wallet; it can also bring peace to your mind. By paying close attention to how you spend and save, you foster a sense of control and awareness that spills over into other areas of your life. Here are a few simple practices:

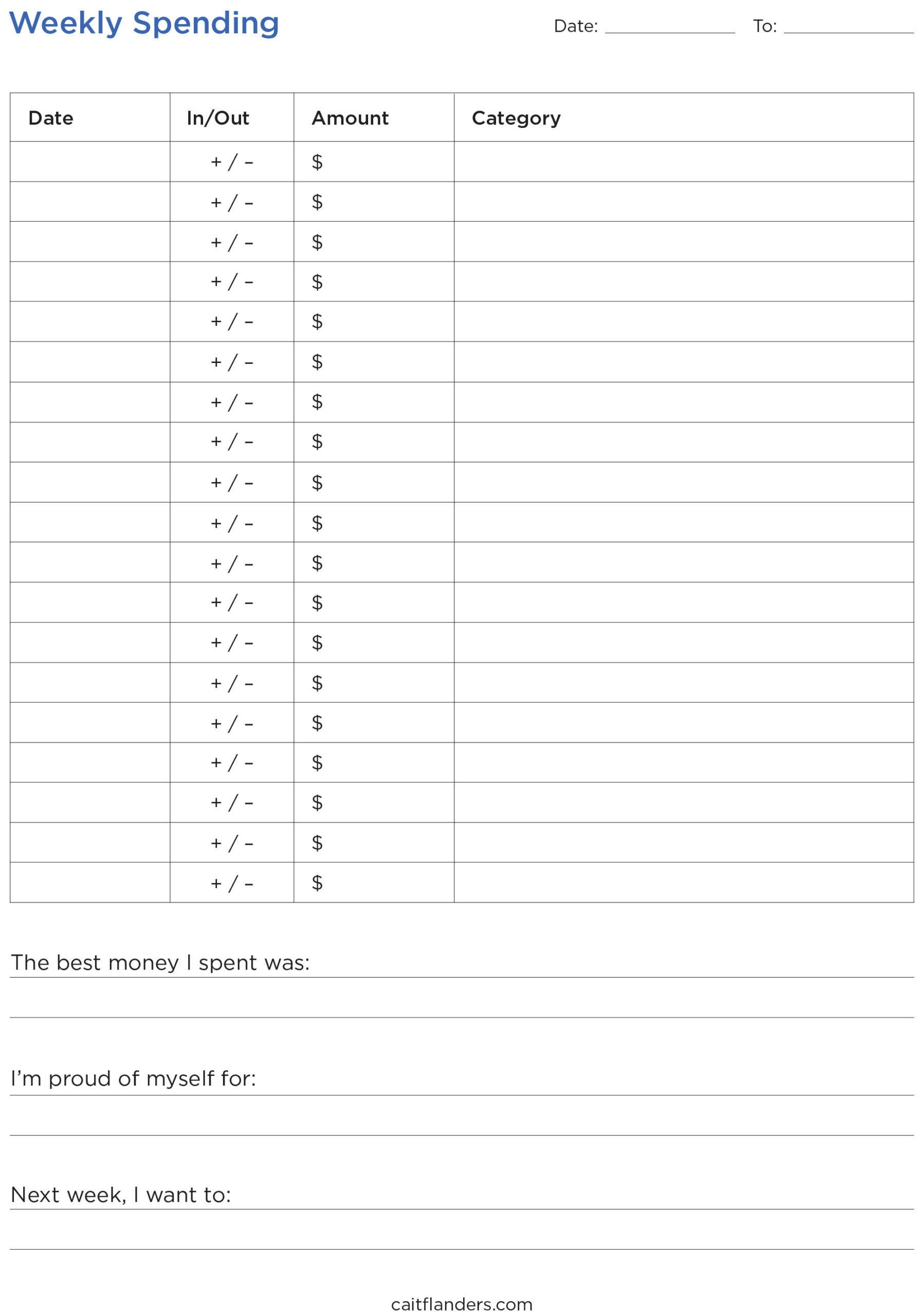

- Track Your Spending: Every time you purchase something, jot it down. This not only helps you stay on budget but also brings awareness to your spending habits.

- Create a Spending Plan: Allocate your income towards necessities, savings, and leisurely pursuits. This way, you know exactly where your money is going and can avoid impulse buying.

- Reflect Regularly: Take some time at the end of each week to review your expenditures and see how they align with your goals.

Having a clear picture of your finances can reduce stress and enhance your overall mental well-being. Here’s a simple table to help you start tracking your monthly budget:

| Category | Budgeted Amount | Actual Spending |

|---|---|---|

| Rent/Mortgage | $1200 | $1200 |

| Groceries | $400 | $380 |

| Utilities | $150 | $145 |

| Entertainment | $100 | $90 |

Understanding the Connection Between Finance and Mindfulness

One effective way to bring mindfulness into your financial life is by adopting mindful spending habits. Instead of making impulsive purchases, take a moment to breathe and think about the necessity and value of each item. This practice involves asking yourself questions like:

- Do I really need this, or is it a want?

- How will this purchase affect my overall budget?

- Is there an alternative that is more cost-effective?

These small pauses can significantly enhance your financial well-being and mental clarity by ensuring that each transaction aligns with your values and goals.

Another helpful strategy is to create a budget that reflects your mindful intentions. Break down your monthly expenses into categories such as essentials, savings, and discretionary spending. This allows you to see where your money is going and make adjustments as needed. Consider setting aside specific amounts for activities that promote mental well-being, such as hobbies or relaxation. The following table provides a simple example of a mindful budget plan:

| Category | Monthly Allocation |

|---|---|

| Essentials (Rent, Utilities, Food) | $1,500 |

| Savings (Emergency Fund, Investments) | $500 |

| Mental Well-being (Hobbies, Self-care) | $200 |

| Discretionary (Dining Out, Shopping) | $300 |

Practical Tips for Incorporating Mindfulness into Budgeting

Integrating mindfulness into your budgeting doesn’t have to be complicated. Start by setting aside a few minutes each week to review your expenses. Make it a habit to look at your spending patterns, categorize them, and reflect on what truly brings you joy and value. Remember, the goal is to align your financial habits with your personal values. Here’s a simple way to start:

- Weekly Review: Dedicate time each week to go over your budget.

- Reflect: Think about the purchases that made you feel good and those that didn’t.

- Adjust: Make small changes based on your reflections to improve your spending habits.

Mindful budgeting also involves being present and patient. Instead of making impulsive purchases, give yourself 24 hours before buying anything non-essential. During this time, consider if the item is a want or a need. Another useful technique is to automate your savings; this keeps your financial goals on track without constant monitoring. Implement these practices, and watch your financial stress reduce while your mental clarity improves. Here’s a quick table to summarize these tips:

| Action | Purpose |

| Weekly Review | Regularly monitor and categorize spending |

| Reflect | Understand your spending feelings |

| Adjust | Fine-tune budgeting based on reflections |

| 24-Hour Rule | Avoid impulsive buys |

| Automate Savings | Effortlessly build savings |

Benefits of Mindful Budgeting for Mental Well-being

Practicing mindful budgeting does more than just keeping your finances in check; it can significantly boost your mental well-being. By carefully planning and reflecting on your spending habits, you can relieve stress and anxiety associated with financial uncertainty. Benefits include:

- Reduced Stress: Knowing you have a plan can help reduce financial-related stress.

- Improved Focus: With a clear budget, you can concentrate on important tasks without money-related distractions.

- Enhanced Confidence: Feeling in control of your finances can boost your overall self-esteem.

Additionally, mindful budgeting encourages healthier financial habits, which contribute to a more stable and peaceful lifestyle. Embracing this practice can lead to positive changes such as:

- Better Sleep: Financial security often translates to better sleep quality.

- More Savings: Conscious spending helps increase savings, providing a safety net for emergencies.

- Reduced Impulsive Purchases: Awareness of your financial goals can help curb impulse buying.

| Benefit | Impact on Mental Well-being |

|---|---|

| Reduced Stress | Less worry about finances |

| Improved Focus | Better concentration |

| Enhanced Confidence | Boosted self-esteem |

Q&A

Q: What is mindful budgeting?

A: Mindful budgeting is the practice of being intentional and present when managing your finances, focusing on your values and priorities.

Q: How can mindful budgeting enhance mental clarity?

A: By reducing financial stress and helping you make intentional spending choices, mindful budgeting can help clear your mind and improve overall mental well-being.

Q: What are some practical tips for practicing mindful budgeting?

A: Some tips include tracking your spending, setting financial goals, practicing gratitude for what you have, and regularly reviewing and adjusting your budget.

Q: How can mindful budgeting benefit your overall quality of life?

A: Mindful budgeting can help you feel more in control of your finances, reduce anxiety about money, improve your decision-making skills, and ultimately lead to a more balanced and fulfilling life.

In Summary

So there you have it – implementing mindful budgeting practices not only helps you manage your finances better, but also has a positive impact on your mental clarity. By being aware of your spending habits and making intentional decisions about where your money goes, you can reduce financial stress and improve your overall well-being. So why not give it a try and see how it can benefit both your wallet and your mind? Happy budgeting!