In an era where financial stability is increasingly intertwined with digital proficiency, managing family finances requires not only sound budgeting principles but also the right technological tools. “” delves into the modern solutions designed to simplify and streamline the budgeting process for families. As financial pressures mount amidst evolving economic landscapes, a myriad of applications and platforms have emerged, offering unprecedented control and insight into household spending. This article explores the best-in-class tech tools that are reshaping family budgeting, providing an analytical overview of their functionalities, strengths, and potential drawbacks. By leveraging these innovations, families can navigate their financial journeys with greater confidence and less stress, setting the stage for improved financial wellness and security.

Identifying Key Features of Essential Budgeting Apps

When selecting a budgeting app that suits your family needs, focus on user-friendly interfaces. Easy navigation is crucial to ensure that everyone in the family can participate without feeling overwhelmed. Look for apps that feature clear financial dashboards and simple expense tracking options. A well-designed interface can turn complex budget planning into an accessible task for all family members.

Another key feature is customizable financial categories. It’s advantageous when budgeting apps allow users to create and edit expense categories specific to their needs. This ensures all spending is accounted for accurately. Additionally, prioritize apps that offer synchronization across multiple devices, ensuring that each family member has real-time access to the latest financial information. Here is a quick comparison table of essential features:

| Feature | Importance |

|---|---|

| User-Friendly Interface | High |

| Customizable Categories | Essential |

| Device Synchronization | Critical |

In-Depth Review of Top Budgeting Software for Families

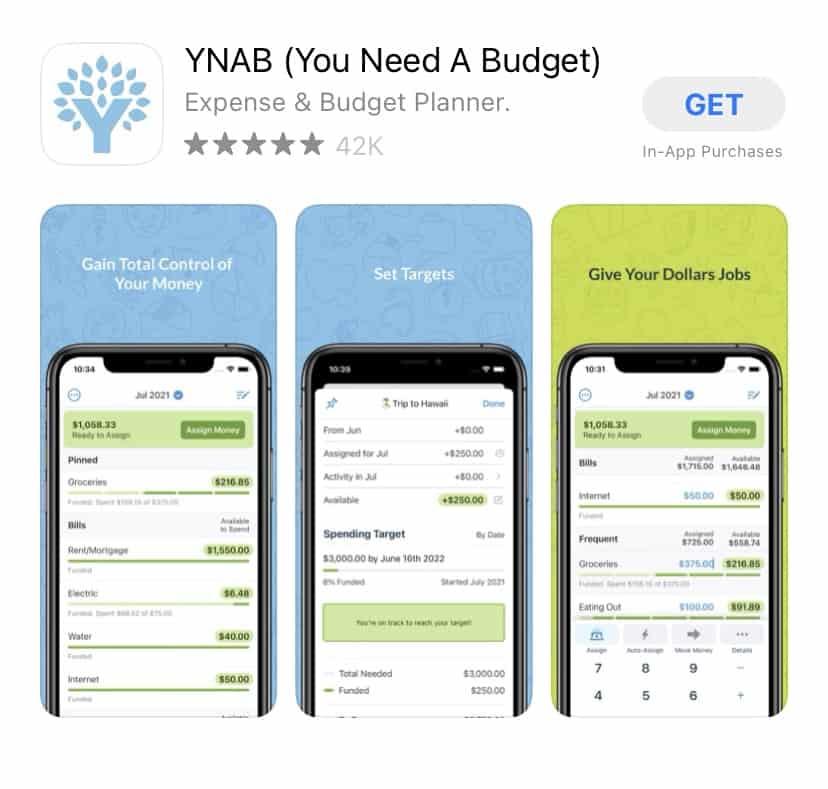

Finding the best tool for managing your family’s finances can be daunting, but several excellent budgeting software options make this task easier. YNAB (You Need A Budget) is a top choice, designed to help families allocate every dollar effectively. It offers real-time synchronization across multiple devices, which is ideal for busy families. EveryDollar is another great option, especially for those following the Ramsey system. Its user-friendly interface lets you create and customize a budget in just a few minutes without complicated features.

Mint has been a long-standing favorite, primarily for its robust financial tracking capabilities. It automatically categorizes transactions from linked accounts, providing a comprehensive overview of your spending. For families looking for free solutions, Goodbudget offers an envelope-budgeting approach that’s simple yet powerful. Here are some key features of these budgeting tools:

<ul>

<li><strong>YNAB:</strong> Real-time syncing, goal tracking, detailed reporting</li>

<li><strong>EveryDollar:</strong> Quick setup, Ramsey integration, easy-to-use</li>

<li><strong>Mint:</strong> Automatic categorization, bill tracking, free</li>

<li><strong>Goodbudget:</strong> Envelope budgeting, financial goals, free and paid versions</li>

</ul>

<table class="wp-block-table">

<thead>

<tr>

<th>Software</th>

<th>Best For</th>

</tr>

</thead>

<tbody>

<tr>

<td>YNAB</td>

<td>Detailed budgeting and goal setting</td>

</tr>

<tr>

<td>EveryDollar</td>

<td>Ease of use and quick setup</td>

</tr>

<tr>

<td>Mint</td>

<td>Comprehensive financial tracking</td>

</tr>

<tr>

<td>Goodbudget</td>

<td>Envelope budgeting</td>

</tr>

</tbody>

</table>

Integrating Budgeting Tools with Family Financial Goals

Managing family finances can be much simpler when using budgeting tools tailored to align with your financial goals. These tools help break down complex tasks into manageable parts, making it easier to track spending, allocate funds, and set savings objectives. Popular apps like YNAB (You Need a Budget) or Mint offer features such as automatic expense tracking, goal setting, and real-time updates. Integrating these tools with your family financial plans ensures that everyone is on the same page and working towards the same objectives.

Benefits of Integrating Budgeting Tools:

- Transparency: Each family member knows where the money goes.

- Accountability: Helps in tracking who spends what.

- Efficiency: Automated features save time and reduce errors.

Using technology to manage finances not only makes budgeting less stressful but also creates an opportunity for financial education and inclusion within the family. Here’s a quick comparison of popular budgeting tools:

| Tool | Best For | Key Feature |

|---|---|---|

| YNAB | Detailed Budgeting | Goal Setting |

| Mint | Expense Tracking | Bill Alerts |

Implementing Effective Budgeting Strategies Through Technology

One effective way to harness technology for family budgeting is by utilizing budgeting apps. These applications can automatically track your expenses, categorize your spending, and even alert you when you’re nearing your limit in a specific category. Some popular choices include Mint, YNAB (You Need A Budget), and PocketGuard. These tools integrate seamlessly with your bank accounts and credit cards, ensuring that all your financial data is up-to-date and accurate. Additionally, they offer insightful reports and charts to help you visualize your spending patterns:

- Mint – Provides comprehensive budget tracking and credit score monitoring.

- YNAB – Focuses on proactive budgeting techniques to reduce debt.

- PocketGuard – Simplifies budgeting by tracking income and expenses in real time.

Another technological advancement that aids in family budgeting is the use of expense management software. These programs go beyond basic budgeting to offer features like bill reminders, investment tracking, and financial goal setting, making it easier to manage various financial tasks from one platform. For instance, tools such as Quicken and Personal Capital not only assist with day-to-day spending but also provide long-term financial planning support:

| Software | Key Features |

|---|---|

| Quicken | Bill management, investment tracking, and comprehensive reporting. |

| Personal Capital | Investment management and retirement planning tools. |

Q&A

Q&A:

Q1: What are some common challenges families face when creating and maintaining a budget?

A1: Many families struggle with several issues when it comes to creating and maintaining a budget. Common challenges include inconsistent income streams, unexpected expenses, lack of financial literacy, and miscommunication among family members regarding spending priorities. These challenges can lead to stress and ineffective budgeting practices.

Q2: How can technology aid in mitigating these challenges?

A2: Technology can significantly mitigate these challenges by providing tools that offer real-time tracking of expenses, predictive analytics for future spending, and collaborative platforms where all family members can access and manage the budget. Additionally, many tools provide educational resources to improve financial literacy and offer alerts for overspending or unusual transactions.

Q3: What are the key features to look for in a budgeting app designed for families?

A3:

Key features to look for in a family budgeting app include:

- Real-Time Syncing: Ensures all family members see the most current financial status.

- Customizable Categories: Allows for tailoring the budget to specific family needs.

- Expense Tracking: Provides detailed tracking of daily expenditures.

- Income Management: Handles multiple income sources and irregular income.

- Collaborative Tools: Lets family members set financial goals together.

- Security: Ensures data is securely encrypted and protected.

- Educational Resources: Improves financial literacy through tutorials and tips.

Q4: Can you name some popular budgeting tools and a brief description of their unique features?

A4:

Certainly, here are a few popular budgeting tools:

- You Need a Budget (YNAB): Emphasizes a proactive approach to budgeting by giving every dollar a job, helping users plan and save for future expenses.

- Mint: Offers a comprehensive look at financial health by linking bank accounts, credit cards, and bills, providing a holistic view of personal finances.

- Goodbudget: Uses the envelope budgeting method, helping families allocate funds for specific expenses and easily track spending.

- PocketGuard: Automatically categorizes transactions and provides a “safe to spend” number, helping families avoid overspending.

- Honeydue: Designed specifically for couples, this app helps track shared expenses, set budgets, and communicate about finances.

Q5: How do predictive analytics enhance the functionality of these budgeting tools?

A5: Predictive analytics enhance budgeting tools by leveraging historical spending data to forecast future expenses and income patterns. This feature can alert families to potential shortfalls or surpluses in their budget, helping them make informed decisions about savings and spending. It can also identify trends and suggest adjustments to better align with financial goals.

Q6: What role do educational resources within these apps play in the overall user experience?

A6: Educational resources significantly improve the user experience by providing insights into financial management, guiding users through the complexities of budgeting, and increasing overall financial literacy. This support helps users make more informed decisions, feel more confident in managing their finances, and ultimately achieve greater financial stability and stress reduction.

Q7: Are there any ethical considerations or potential downsides to using such technology for budgeting?

A7: Ethical considerations and potential downsides include data privacy concerns, as sensitive financial information is stored and transmitted over digital platforms. There is also the risk of over-reliance on technology, which can diminish personal budgeting skills. Moreover, subscription costs for premium features in some apps can add financial strain. It’s crucial for users to carefully review privacy policies, ensure they are using secure platforms, and remain actively engaged in their budgeting process rather than relying entirely on the technology.

In Conclusion

the landscape of family budgeting continues to evolve with the advancement of technology, offering increasingly sophisticated tools designed to make financial management more accessible and stress-free. From intuitive apps that categorize expenses and sync with bank accounts, to robust software solutions equipped with predictive analytics, these tech tools provide a spectrum of features tailored to diverse financial needs. As families navigate the complexities of budgeting, leveraging these technological innovations can not only simplify the process but also enhance financial literacy and control. By integrating these tools into daily financial practices, families can move towards a more organized and less stressful approach to monetary planning, ultimately fostering greater financial stability and well-being.

For further insights on how to implement and maximize these tech tools, future articles will delve into specific user experiences, expert recommendations, and emerging trends in the financial tech industry. Stay informed, stay prepared, and empower your family with the right tools for effective budgeting.