Are your palms sweaty just looking at your bank statement? Does the thought of budgeting send a shiver down your spine, faster than the latest horror flick? Welcome to the club—or rather, the financial freak-out society, where dues are free, but the emotional cost is sky-high. Financial anxiety isn’t just a mild case of the jitters—it’s that relentless, nagging worry that can turn even the most serene, Zen-master wannabe into a ball of stress. But fret not, my financially frazzled friends! This article, armed with an arsenal of tools and techniques, is here to transform your money-related angst into a manageable, dare we say, calmly controlled cash flow. So, put away the stress ball, grab a comfy seat, and let’s dive into the world of financial peace of mind—with a chuckle or two along the way.

Understanding Financial Anxiety: It’s Not Just You, It’s Your Wallet

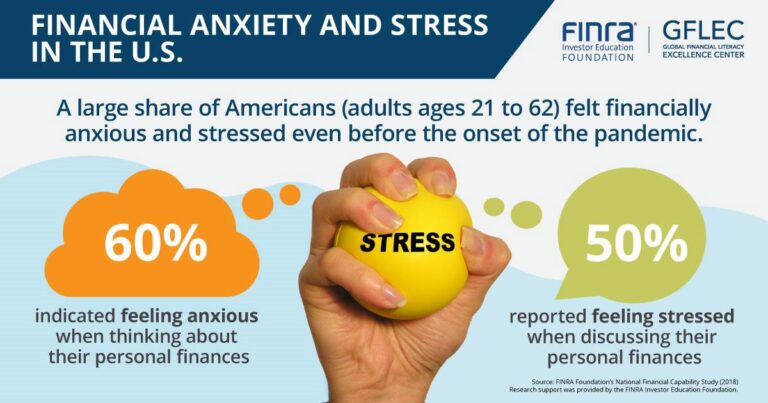

Ever felt a tightening knot in your stomach as soon as you looked at your bank account? That’s financial anxiety — and believe it or not, it’s more common than finding cat videos on the internet. This type of stress isn’t just about not having enough money; it’s also about the swirling thoughts that come with your finances. Are you saving enough? Is spending $5 on that artisanal donut wise? These thoughts can make your wallet feel like it’s judging you just as harshly as your neighbor when your lawn isn’t mowed.

But don’t worry, you’re not alone in this fiscal freak-out. Many people experience financial anxiety, and the good news is there are ways to manage it. Here are a few steps to help put your mind at ease:

- Create a Budget: Think of it as giving your money a job description. Every dollar should know where it’s heading.

- Emergency Fund: This is your financial first-aid kit. Even a small amount can give you peace of mind.

- Talk About It: Financial stress loves secrecy. Sharing your concerns can make them less scary.

To make things even clearer, here’s a quick comparison of how you might feel before and after adopting these practices:

| Before | After |

|---|---|

| Sleepless nights | More rest, less stress |

| Impulse buys | Thoughtful spending |

| Financial confusion | Clear money goals |

Mindful Spending: When Retail Therapy Turns to Retail “Uh-Oh”

Ever caught yourself in the midst of a shopping spree and suddenly realized your cart looks like the opening inventory of a small boutique? Don’t worry, you’re not alone. We all indulge in a bit of retail therapy to shake off stress or celebrate life’s little wins. However, it becomes an “uh-oh” moment when the receipts start to pile up like your grandmother’s antique collection. Here are a few tips to help you keep mindful spending in check:

- Make a list: Only buy what’s on it. Stray items are like stray cats; cute but come with long-term responsibilities.

- Set a budget: Think of it as a fun game. How much can you save while still getting what you need?

- Delay gratification: If you still want that so-cute-it-must-be-buy-now jacket after 48 hours, then it’s more likely a need than a whim.

- Use cash: Once it’s gone, it’s gone. A card can trick your brain into thinking you have a limitless stash of money.

For those already facing a retail “uh-oh” moment, here are some strategies to patch things up without singing the financial blues:

| Strategy | What to Do |

| Return Unneeded Items | Get those dollars back where they belong – in your pocket. |

| Create a Payment Plan | Break down big bills into smaller, less sweat-inducing payments. |

| Seek Support | Join a financial counseling group or use apps that help track spending. |

The Emergency Fund: Your Financial First Aid Kit

Imagine your money is like a pizza. You’ve got your slices apportioned for rent, utilities, groceries, and so on. But what happens when you get an unexpected bill? That’s where your emergency fund comes in – it’s the ultimate pizza saver! This fund is like that extra cheese hiding at the back of your fridge, ready to save the day when your plans go awry. Having an emergency fund means you don’t have to stress about unexpected expenses like medical emergencies or car repairs because you already have a stash for those surprise costs.

To set up your financial first aid kit, start with these simple steps:

- Set a Goal: Aim to save at least three to six months’ worth of living expenses.

- Automate Savings: Set up an automatic transfer to your emergency fund each payday. This way, it’s effortlessly growing without you even noticing.

- Keep it Accessible: Your emergency fund should be in a separate, easily accessible account, but not too accessible that you’re tempted to dip into it for purchases like a new gadget or those irresistible shoes.

| Step | Action |

|---|---|

| 1. Goal Setting | Determine how much you need to save for emergencies. |

| 2. Automatic Transfers | Arrange automatic savings each payday. |

| 3. Accessibility | Use a separate, yet accessible account. |

Budgeting Like a Boss: Turning Pennies into Peace of Mind

When you’re feeling like your wallet’s turning into a black hole, it’s time to budget like a boss. Why? Because knowing where every penny goes can transform your financial stress into peace of mind. Here are some golden rules to get you started:

- Track Everything: Yes, even that daily coffee.

- Set Realistic Goals: Dream big, but start small.

- Emergency Fund: Not just for emergencies, but guilt-free spending too!

Still not convinced? Check out the long-term benefits:

| Benefit | Why It Matters |

|---|---|

| Less Stress | No more sleepless nights over unpaid bills. |

| More Savings | Watch your stash grow month by month. |

| Financial Freedom | More choices and less “I can’t afford it.” |

Q&A

Q: What is financial anxiety and why should I care?

A: Financial anxiety is that jittery feeling in your stomach whenever you think about money—kind of like you’ve swallowed a swarm of bees. It’s the stress and worry about your financial situation, and trust me, it’s important because ignoring it doesn’t make the bees go away. They just learn to dance to a more annoying beat.

Q: Are there any quick fixes for financial anxiety?

A: Quick fixes for financial anxiety are about as real as unicorns flying around with sparkly wands that erase student debt. But fear not! While there’s no fairy godmother in this story, there are some effective tools you can use to manage your stress and keep those bees in check.

Q: What’s the first tool I can use to deal with financial anxiety?

A: Create a budget! I know, I know, the ‘B-word.’ It sounds about as fun as watching paint dry, but a budget is your best friend here. It’s like giving those bees a schedule so they buzz off when they’re not supposed to bother you. List your income and expenses, and you’ll gain a clearer picture of your finances. The bees love clarity.

Q: How do I stick to a budget without losing my mind?

A: Make it fun! Use colorful charts, apps that incorporate gamification, or even better—promise yourself a small reward for sticking to it. Think of it like training a very stubborn cat; it might take some bribery, but it’s possible.

Q: I’m already overwhelmed. Any tips for calming down first?

A: Absolutely! Take a deep breath. Now another. And maybe stop at two because hyperventilating doesn’t help either. Techniques like mindfulness and meditation can work wonders. Picture your worries floating away on clouds, or whatever serene scene helps you relax. Maybe visualize those bees taking a nice vacation far, far away.

Q: Are there any apps or tools that can help manage financial anxiety?

A: Tons! Apps like Mint, You Need a Budget (YNAB), and PocketGuard can help you track your expenses, set goals, and stay on top of your finances without feeling like you’re being grilled by a stern accountant. It’s like having a financial advisor in your phone, minus the judgmental looks.

Q: How can I face unexpected expenses without freaking out?

A: Set up an emergency fund, even if you start small. It’s like having a financial first aid kit for those moments life throws you a curveball—whether it’s a car breakdown or an impromptu ‘treat yourself’ moment. Start with a few dollars a week and let it grow; the bees hate it when you’re prepared.

Q: Should I seek professional help for financial anxiety?

A: Absolutely! If your financial worries feel like they’re going beyond a manageable buzz, talking to a financial advisor or a therapist who specializes in financial stress can provide personalized strategies. Think of them as the bee whisperers—calming the swarm with their sage advice.

Q: Any final advice for someone constantly stressed about money?

A: Remember, it’s okay to laugh at your worries sometimes. Financial anxiety is serious business, but humor can be a fantastic coping mechanism. Just keep taking steps towards better financial health, and soon, those bees will be dancing to your tune.

Future Outlook

And there you have it, folks! You’ve navigated through the murky waters of financial anxiety and surfaced unscathed, armed with a treasure chest of tools and techniques. Whether you’re balancing your budget like a tightrope walker, meditating your stress away, or simply reassessing your avocado toast expenditures, you’ve now got the know-how to keep that financial anxiety monster at bay.

Remember, money may not grow on trees, but managing it well is certainly within your reach. Keep your chin up, your spreadsheets tidy, and don’t forget to treat yourself every now and then. After all, even financial wizards need a break. So go on, give yourself a pat on the back – or better yet, a nice, budget-friendly snack. You’ve earned it!

And if all else fails, just remember: Laughter might not balance your checkbook, but it sure does make the journey a lot more enjoyable. Keep calm, stay savvy, and let your financial anxieties be outfoxed by your newfound wisdom. Until next time, happy budgeting!