Imagine a treasure map, meticulously drawn, guiding you through winding paths and cryptic symbols to a bounty of riches. Now envision that instead of gold doubloons and ancient artifacts, the treasure is your financial future—carefully charted out, ready to secure the well-being of loved ones and provide peace of mind. Welcome to the art of estate planning, a comprehensive approach that ensures your assets and dreams are preserved and passed on as you intend.

In an ever-evolving world where uncertainties abound, estate planning emerges as a beacon of foresight and preparedness. It transcends mere asset distribution, encompassing everything from tax strategies and healthcare directives to guardianships and charitable bequests. This intricate process is a testament to love, responsibility, and the profound desire to shape a future that echoes your values and aspirations.

Join us as we delve into the labyrinth of estate planning, unraveling its complexities and highlighting its indispensable role in financial stewardship. Whether you’re just beginning to sketch your map or seeking to refine an existing plan, this journey offers insights and guidance to help you navigate the future with confidence and clarity.

Crafting a Comprehensive Will: Essentials and Best Practices

Creating a thorough will involves more than just listing who gets what. It’s crucial to identify all your assets, including property, savings, and personal belongings. Ensure that you appoint an executor who is responsible, trustworthy, and understands your wishes. This person will manage your estate and execute your will after your death. Additionally, you should consider naming guardians for any minor children to provide clarity and security for their future, ensuring they are cared for by individuals you trust.

To keep things organized and avoid confusion, it’s wise to create a list of beneficiaries and clearly state what each person should receive. Plan for contingencies by specifying what should happen if a beneficiary predeceases you. Review and update your will regularly to reflect changes in your life, such as marriage, divorce, or the birth of a child. Here’s a quick list to help you remember the essentials:

- Identify and list all assets

- Appoint an executor

- Name guardians for minors

- Create a list of beneficiaries

- Plan for contingencies

- Review and update regularly

| Essential Step | Description |

|---|---|

| Identify Assets | List properties, savings, and personal belongings |

| Appoint Executor | Choose a trustworthy individual |

| Name Guardians | Select guardians for minor children |

| List Beneficiaries | Detail who gets what |

| Plan Contingencies | Specify alternatives in case of predeceased beneficiaries |

| Review Regularly | Update to reflect life changes |

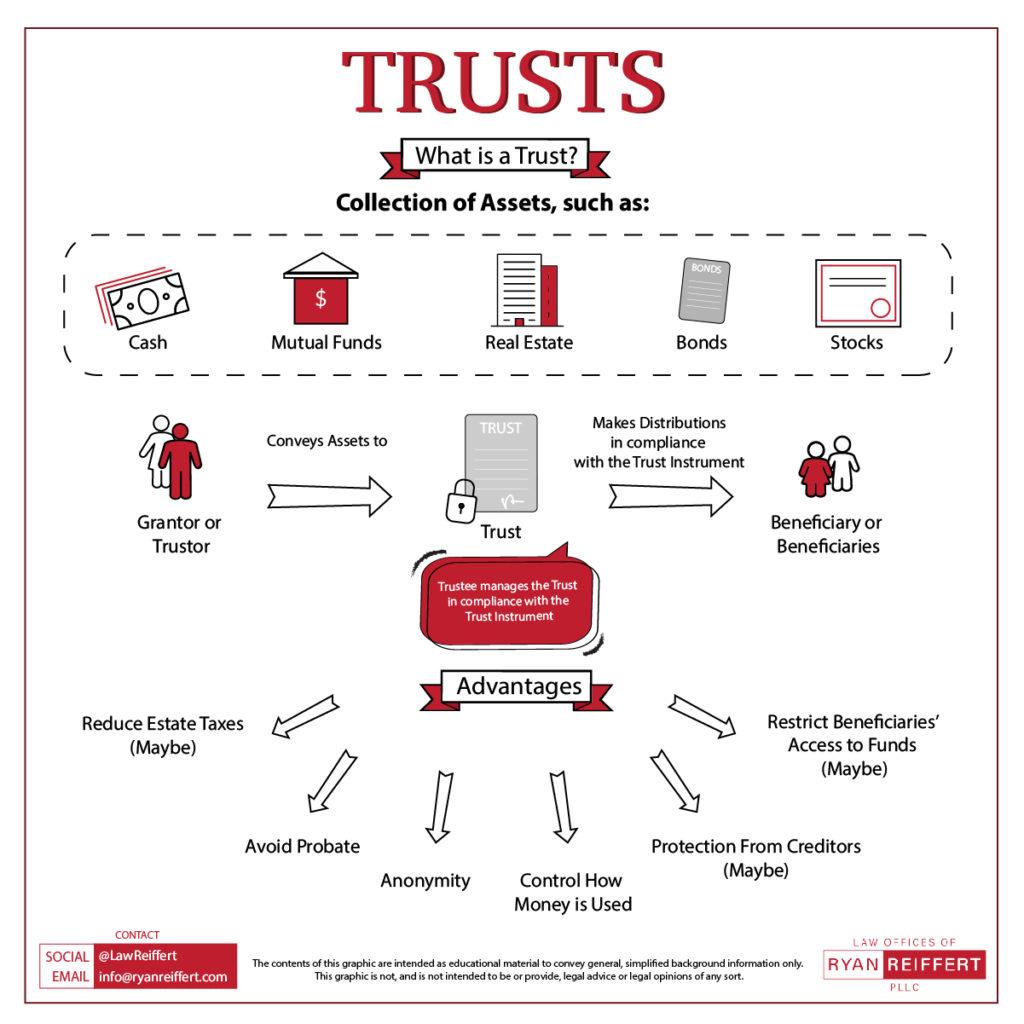

Trusts and Their Benefits: Safeguarding Your Assets

Creating a trust can offer vital protection and flexibility for your assets. One of the biggest advantages of a trust is the ability to avoid probate, a time-consuming and often costly legal process. With a trust, your beneficiaries can receive their inheritance more quickly and with less hassle. Trusts also offer privacy, as the details are not made public like a will. Moreover, they can protect assets from creditors and lawsuits, ensuring your wealth remains intact for your loved ones.

Trusts come in various forms to fit different needs. Here are a few common types:

- Revocable Trusts: Easily modified or revoked during the grantor’s lifetime.

- Irrevocable Trusts: Once established, they cannot be changed, offering significant tax advantages.

- Special Needs Trusts: Designed to provide for a beneficiary with special needs without affecting their eligibility for government benefits.

- Charitable Trusts: Allows you to leave a legacy by donating to a cause close to your heart.

| Trust Type | Main Benefit |

|---|---|

| Revocable Trust | Flexibility |

| Irrevocable Trust | Tax Benefits |

| Special Needs Trust | Preserves Benefits |

| Charitable Trust | Supports a Cause |

Navigating Tax Implications: Strategies for Mitigating Liabilities

Understanding and addressing tax implications is crucial to protecting your estate’s value. Invest in tax-efficient investments such as municipal bonds or tax-managed funds to keep more of your wealth. Take advantage of gift exclusions by transferring assets to family members during your lifetime. Regularly update beneficiaries and leverage life insurance policies to cover potential tax liabilities without burdening your estate.

Consider setting up trusts to efficiently transfer wealth and minimize estate taxes. Trusts like revocable living trusts offer flexibility in managing your assets while you’re alive and can help bypass probate. Additionally, charitable trusts allow you to support causes close to your heart while receiving tax deductions. Here’s a quick overview:

| Type of Trust | Key Benefit |

|---|---|

| Revocable Living Trust | Bypass Probate |

| Charitable Trust | Tax Deductions |

Involving Family in Estate Planning: Communication and Collaboration

Involving family in financial preparations can create clarity and promote peace of mind. Open communication with loved ones ensures that everyone understands the decisions being made and reasons behind them. This transparency can help reduce misunderstandings later on and ensure that your wishes are honored. Some important topics to discuss include:

- Wills and trusts

- Power of attorney

- Healthcare directives

Collaborating with family members can also uncover valuable insights and ideas that might have been overlooked. Setting up regular family meetings to review and update the plans together can be beneficial. Here’s a quick example of what a family meeting schedule might look like:

| Meeting Type | Frequency | Key Topics |

|---|---|---|

| Initial Planning | Once | Overview of estate, establish roles |

| Review | Annually | Update plans, review changes in assets or laws |

| Check-in | Quarterly | Ensure tasks are on track, address concerns |

Q&A

Q&A:

Q: What exactly is estate planning, and why is it essential?

A: Estate planning is the process of arranging and managing an individual’s financial affairs and assets in anticipation of their passing or incapacitation. It’s essential because it ensures that your wishes concerning the distribution of your assets are clearly spelled out, minimizing the potential for disputes and providing a financial roadmap for your loved ones. By planning ahead, you can also reduce the tax burden on your estate, protect your beneficiaries, and set up mechanisms for care in case you become unable to manage your affairs.

Q: At what age should someone start considering estate planning?

A: While there’s no one-size-fits-all answer, it’s wise to begin estate planning as soon as you start acquiring significant assets or have dependents relying on you. This could be in your late twenties or early thirties. However, it’s never too early or too late to start planning. Life’s unpredictability makes preparedness crucial, so even young professionals should consider setting up basic documents like wills and powers of attorney.

Q: What are the key components of a comprehensive estate plan?

A: A comprehensive estate plan typically includes several critical documents:

- A Will: Outlines how your assets should be distributed and names guardians for minor children.

- Trusts: Can help manage and protect assets for beneficiaries, possibly reducing tax implications.

- Power of Attorney: Designates someone to make financial and legal decisions on your behalf if you’re unable to do so.

- Healthcare Directive: Provides instructions for medical care if you become incapacitated.

- Beneficiary Designations: Ensures that retirement accounts, insurance policies, and other financial instruments go to the intended recipients.

Q: How can trusts be beneficial in estate planning?

A: Trusts offer several advantages in estate planning. They can help control how and when beneficiaries receive assets, protecting minors or individuals who may not be adept at managing large sums of money. Trusts can also provide privacy, as unlike wills, trusts typically do not go through probate, a public legal process. Additionally, they can minimize estate taxes and protect your assets from creditors.

Q: What’s the difference between a revocable and irrevocable trust?

A: A revocable trust, also known as a living trust, can be altered or dissolved by the grantor during their lifetime. It offers flexibility and typically avoids probate, making asset distribution smoother and quicker. An irrevocable trust, on the other hand, cannot be changed or undone once it’s been established without the consent of the beneficiaries. It can offer stronger protection from creditors and may have tax advantages, but requires the grantor to relinquish control over the assets placed in the trust.

Q: What role do life insurance policies play in estate planning?

A: Life insurance policies can be a vital component of an estate plan. They provide liquidity to your estate, ensuring that there are funds available to cover taxes, debts, and final expenses without having to rapidly liquidate other assets. Additionally, life insurance proceeds can be designated to beneficiaries, offering financial support to your loved ones during a challenging time. This can be particularly important for providing for dependents or supporting a surviving spouse.

Q: How often should an estate plan be reviewed and updated?

A: It’s recommended to review and update your estate plan every three to five years, or whenever there’s a significant life event, such as marriage, divorce, the birth of a child, or the acquisition of substantial assets. Regular reviews ensure that your estate plan remains aligned with your current wishes, family dynamics, and financial situation, as well as keeps it compliant with any changes in laws and tax regulations.

Q: How can one find a reliable estate planning attorney?

A: Finding a reliable estate planning attorney involves a bit of research. Begin by asking for recommendations from friends, family, or financial advisors. Look for attorneys with a specialization in estate planning and solid credentials. Check online reviews and consider scheduling consultations with a few candidates to discuss their experience, your needs, and their approach. Choose someone you feel comfortable with and who communicates clearly, as estate planning is a deeply personal process requiring mutual trust and understanding.

Final Thoughts:

Remember, estate planning is not just for the wealthy; it’s a vital step for anyone wanting to ensure their wishes are honored and to provide a clearer path for their loved ones. It’s about creating peace of mind and a legacy of order and care.

Concluding Remarks

As the sun sets on our exploration of estate planning, a canvas of possibilities unfurls before you. The steps you take today in preparing financially for the future are more than just numbers and legalities—they are brushstrokes that paint a portrait of security, legacy, and peace of mind. Whether it’s crafting a will, setting up trusts, or simply having that crucial conversation with loved ones, your actions create the architecture of a well-planned tomorrow.

May this guide serve as both a compass and a companion in your journey. Remember, estate planning isn’t merely a task to be checked off—it’s a forward-looking embrace of the life you wish to safeguard and the people you hope to protect. Each decision lays another stone on the path to a future where your desires are respected, and your loved ones are cared for.

So, take a deep breath, gather your thoughts, and begin laying the foundation of a legacy that’s not only financially sound but profoundly meaningful. After all, the future starts now, and with every careful step, you write a story that will be told for generations to come.