Hey there! Ever had one of those moments where life throws a curveball your way and you suddenly need cash, like, yesterday? Whether it’s your car breaking down, an unexpected medical bill, or even a job layoff, these financial emergencies can seriously stress you out. But what if you had a little safety net to catch you when you fall? That’s where an emergency fund comes in! In this article, we’re going to dive into the nitty-gritty of building an emergency fund, step by step. Think of it as your financial security blanket, helping you sleep a little easier at night. Ready to learn how to set one up? Let’s get started!

Understanding the Importance of an Emergency Fund

Imagine your car suddenly breaks down or you have an unexpected medical bill. Without a safety net, these surprises can leave you scrambling. An emergency fund acts as a financial cushion that helps you cover unexpected expenses without having to rely on credit cards or loans. It ensures that life’s unexpected moments won’t throw your entire financial plan off track.

Building an emergency fund may seem daunting, but it can be done one step at a time. Start by setting aside small amounts on a regular basis. Consider the following tips to make it easier:

- Automate your savings

- Curb non-essential spending

- Direct any windfalls, like bonuses or tax refunds, into the fund

Even small contributions add up over time, giving you a buffer for when the unexpected happens.

Setting Realistic Savings Goals

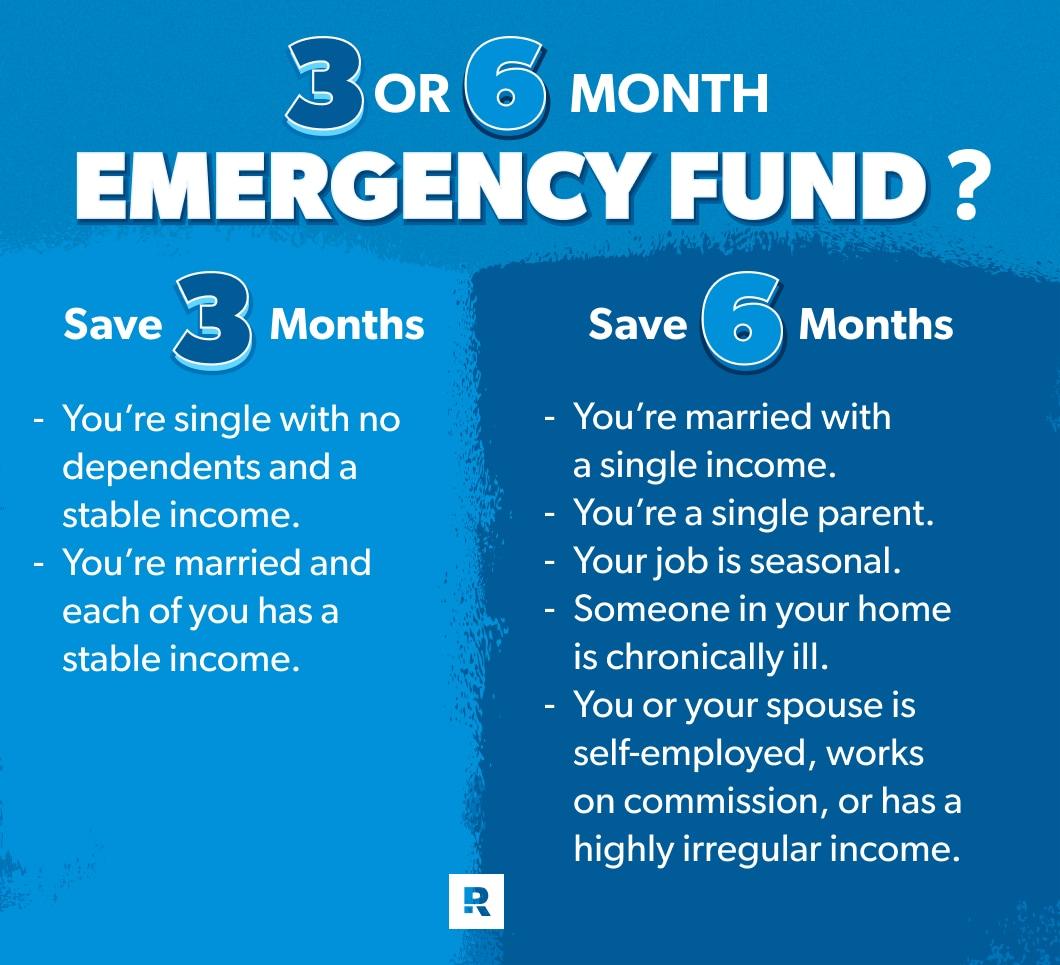

When it comes to growing your emergency fund, it’s crucial to have a clear and manageable plan. Firstly, evaluate your monthly expenses. Knowing how much you spend on essentials like rent, food, and bills will give you a baseline for how much you need to save. Aim to save three to six months’ worth of these expenses. Don’t feel pressured to achieve this overnight—saving even a small amount each month can make a big difference over time.

Here are some simple strategies to help you get started:

- Automate your savings: Set up an automatic transfer from your checking account to your savings account.

- Cut unnecessary expenses: Review your monthly spending and find areas where you can reduce costs, like dining out less or canceling unused subscriptions.

- Earn extra income: Consider taking on a side job or selling items you no longer need.

| Monthly Expense | Amount |

|---|---|

| Rent/Mortgage | $1,000 |

| Food | $300 |

| Bills | $200 |

| Transportation | $100 |

Easy Ways to Kickstart Your Emergency Fund

One of the simplest steps to start your emergency fund is by setting a clear savings goal. Knowing exactly how much you need for that buffer can give you a solid target to work towards. Start with a small, manageable amount, like saving $500 or your first month’s worth of expenses. Here are some easy ways to kick off:

- Automate Your Savings: Set up an automatic transfer from your checking account to your savings account every payday.

- Cut Back on Non-Essentials: Identify areas where you can reduce spending such as dining out or entertainment subscriptions.

- Use Cash Windfalls: Save bonuses, tax refunds, or any unexpected money directly to your emergency fund.

Another great strategy is to find ways to increase your income. Even small additional earnings can make a big difference over time. Consider these options:

| Income Booster | Description |

|---|---|

| Freelancing | Offer your skills online during weekends or evenings. |

| Sell Unused Items | Declutter your space and make money by selling items you no longer need. |

| Part-Time Job | Take up a part-time gig that fits your schedule and interests. |

Making Your Savings Automatic

Setting up automatic savings can be a game-changer for your finances. Firstly, choose a fixed amount to transfer from your main account to a savings account regularly. This could be weekly, bi-weekly, or monthly. Explore these ideas:

- Direct Deposit: Arrange with your employer to split part of your paycheck directly into savings.

- Online Banking: Use your bank’s app to schedule automatic transfers on payday.

- Savings Apps: Consider using dedicated apps that round up your spending and save the difference.

Want to make it even easier? Take advantage of tools offered by your bank. Here are some handy features to look out for:

| Feature | Description |

|---|---|

| Automatic Transfers | Schedule recurring transfers to your savings account. |

| Goal Setting | Set and track savings goals within your banking app. |

| Alerts | Get notifications to keep track of your progress. |

By automating your savings, you’ll be able to grow your emergency fund without even thinking about it, providing peace of mind and financial security.

Q&A

### Q&A:

Q: What exactly is an emergency fund?

A: An emergency fund is like your financial safety net. It’s a stash of money set aside specifically for unplanned expenses, like medical bills, car repairs, or sudden job loss. Think of it as insurance for life’s little surprises.

Q: Why do I need an emergency fund?

A: Imagine your car breaks down or you suddenly need to fly across the country for a family emergency. Without an emergency fund, you’d likely have to rely on credit cards, loans, or dipping into your retirement savings. An emergency fund helps you avoid debt and gives you peace of mind.

Q: How much should I save in my emergency fund?

A: Aiming for three to six months’ worth of living expenses is a good rule of thumb. If you’re single with no dependents, you might be comfortable with three months. Have a family or a less stable job situation? Then six months or more might be better.

Q: Where’s the best place to keep my emergency fund?

A: You want to keep it somewhere accessible, but not so easy to access that you’re tempted to dip into it for non-emergencies. High-yield savings accounts are a popular choice because they offer better interest rates than regular savings accounts while keeping your money liquid.

Q: How do I start building my emergency fund?

A: Start small. Set a goal to save $500 or $1,000 initially. You can automate your savings by setting up monthly transfers from your checking account to your emergency fund. Every little bit helps and it adds up quicker than you think!

Q: What if I’m currently struggling to make ends meet?

A: That’s tough, but don’t get discouraged. Even saving just $10 a week can make a difference. Analyze your budget, cut unnecessary expenses (bye-bye, daily lattes), and consider picking up a side gig if possible. The key is to start where you are and build gradually.

Q: Can I use my emergency fund for any unexpected expense?

A: Ideally, it should be reserved for true emergencies—like unforeseen medical expenses, major car problems, or losing your job. It’s not for vacations, new gadgets, or other “wants.” Try to keep a clear boundary so your fund is there when you really need it.

Q: What if I have debt? Should I still build an emergency fund?

A: Yes, but prioritize it differently. Aim to save at least $1,000 while paying down high-interest debt. This small cushion can prevent you from diving deeper into debt when an emergency crops up. Once your debt is manageable, shift more focus to growing that fund.

Q: How do I keep growing my emergency fund once I’ve started?

A: Continue to automate your savings and review your budget periodically to make sure you’re still on track. When you get any windfalls—like tax refunds, bonuses, or even birthday money—consider putting at least a portion into your emergency fund.

Q: How do I know when I’ve saved enough?

A: When your emergency fund can cover three to six months of living expenses, you’re in a pretty secure spot. But remember, life changes—so regularly reassess your needs and adjust accordingly. It’s always better to have more than to come up short in a crisis.

Building an emergency fund takes time and patience, but the peace of mind it provides is well worth the effort. Start small, stay consistent, and watch your financial security grow!

The Conclusion

And there you have it! We’ve taken the mystery out of building an emergency fund and laid down some simple steps to get you started on your path to financial peace of mind. Remember, it doesn’t matter if you start small—every little bit adds up. It’s all about creating that cushion for life’s unexpected moments and giving yourself the confidence to handle anything that comes your way. So, get out there, set your goals, and start saving. Your future self will definitely thank you for it! Got any tips or personal stories about your own emergency fund journey? Drop them in the comments below. Let’s keep the conversation going! 🚀💪 #FinancialSecurity #SavingsGoals