In the grand circus of life, financial risks are the clowns that make us wince more than laugh. They sneak up on us with their floppy shoes and oversized mallets, threatening to turn our financial dreams into pie-in-the-face moments. But fear not, dear reader! Just as every circus has its ringmaster, every personal finance saga can have its savvy strategist—you. Welcome to the high-wire act of “.” In this exhilarating performance, we’ll juggle the concepts of risk assessment, dance along the tightrope of smart investments, and tame the lions of market volatility. Prepare to be simultaneously enlightened and entertained as we show you how to keep your financial show running without a hitch. Grab your popcorn, sit back, and let’s dive into the wonderfully wacky world of managing financial risks!

Befriending Your Balance Sheet: Turning Fear into Foresight

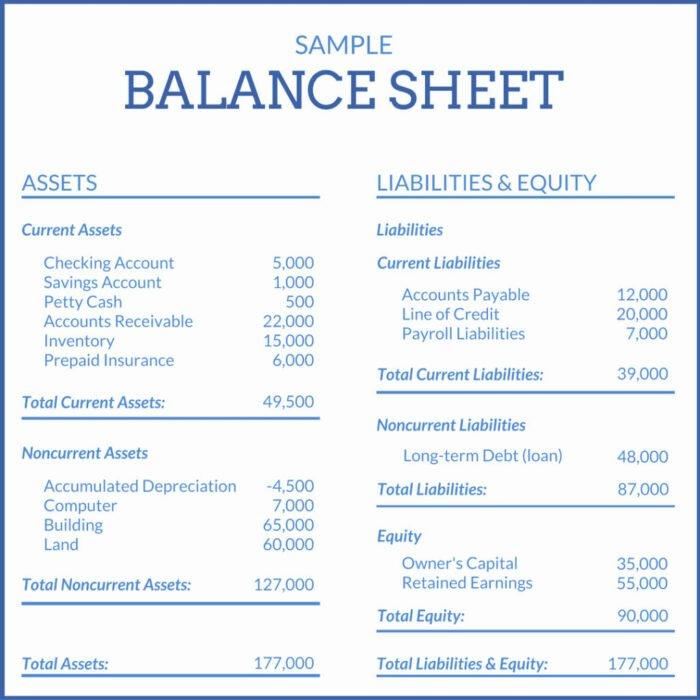

Financial risks can seem as elusive as a ghost in a horror movie, but understanding them is as crucial as making sure your popcorn is ready for the climax. To turn fear into foresight, you need to get comfortable with your balance sheet. Start by recognizing what’s lurking there. Here are some financial spooks you might encounter:

- Debts: These are like those unexpected jump scares. You can’t always avoid them, but knowing they’re there helps you prepare.

- Assets: Think of these as your trusty flashlight in a dark, creepy forest. They show you the way and offer some comfort.

- Liabilities: These are the eerie sounds in the background. They may not be immediately threatening, but you need to be aware of them.

So, how do you tame these financial phantoms? Consider these simple yet powerful strategies:

- Keep it steady: Avoid sudden financial moves that are as unpredictable as a cat in a haunted house.

- Build a safety net: Treat your emergency fund like garlic against vampires—it’s essential protection.

- Regular check-ups: Think of this like checking for monsters under the bed. It might seem unnecessary, but it prevents nasty surprises.

| Type of Financial Risk | Example | Quick Tip |

|---|---|---|

| Credit Risk | Over-borrowing | Monitor debt levels |

| Market Risk | Stock market crash | Diversify investments |

| Liquidity Risk | Cash flow issues | Keep cash reserves |

The Hilarious Truth About Diversification: Don’t Put All Your Eggs – Or Dollars – In One Basket

Imagine if you put all your eggs in one basket and then tripped. Splat! No more eggs, no more breakfast, and a seriously messy floor. The same idea applies to your finances. Putting all your money in one investment is like daring fate to pull out the rug from under you. Diversification is the amusingly simple art of spreading your investments around, much like a prudent parent hiding Easter eggs in different parts of the yard. Here’s how you can diversify without slipping on any financial banana peels:

- Stocks and Bonds: A classic mix, like peanut butter and jelly. Stocks are the high-flying risk-takers, while bonds are the reliably boring ones.

- Real Estate: Yep, buying property isn’t just for Monopoly. It can be a steady income source or a wealth generator over time.

- Commodities: Think gold, silver, or even oil. They can be the spices in your financial recipe, adding a unique flavor that stocks and bonds can’t.

- Mutual Funds and ETFs: These are like a financial smoothie, blending various investments into one tasty mix.

| Investment Type | Risk Level | Potential Reward |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Moderate |

| Real Estate | Moderate | High |

| Commodities | Variable | Variable |

| Mutual Funds | Moderate | Moderate |

Laughing at Losses: Mitigating Market Madness with a Smile

When it comes to navigating the choppy waters of financial risk, sometimes it helps to laugh a little. After all, worrying about every market dip can turn anyone into a sleepless stock zombie. Instead, take a lighter approach. Did your favorite tech stock just plummet 10%? Think of it as a 10% off sale — only you don’t need a coupon! The key is to maintain a balanced portfolio so a bad day in the tech world doesn’t turn into a financial meltdown. And remember, diversification is not just a fancy word finance people use to sound smart. It’s your safety net, ensuring that not all your eggs are in one very risky basket.

Here’s a list of what you can do to keep your sanity intact during market fluctuations:

- Stay Diversified: Spread your investments across various sectors.

- Set Limits: Know your risk tolerance and set boundaries accordingly.

- Keep Cash Handy: Liquidity can be your best friend during market downturns.

Want a snapshot of how different assets might perform? Have a look at this table:

| Asset Type | Average Return | Risk Level |

|---|---|---|

| Stocks | 8-10% | High |

| Bonds | 3-5% | Medium |

| Cash | 1-2% | Low |

Remember, the market is kind of like a teenager—moody and unpredictable. But with a sprinkle of humor and a dash of smart strategy, you can ride out the ups and downs without losing your cool (or your shirt!).

Investment Strategies That Won’t Bore You (We Promise)

When it comes to protecting your hard-earned cash, the last thing you want is to get bogged down in dry, sleep-inducing financial jargon. Let’s make this fun! Imagine you’re a knight, and your money is the kingdom you’re sworn to protect. One of the best ways to shield your kingdom is by diversifying your investments. Spreading your money across different assets (stocks, bonds, real estate, the works!) is like adding multiple layers to your armor. It keeps you from being completely taken out by one unlucky hit.

Secondly, keep an emergency fund that’s as robust as your favorite superhero’s secret stash. This fund acts like a financial force field, safeguarding you when unexpected expenses come swooping in. Think of it as your personal safety net, there to catch you if you fall. Not knowing where to start? Here are some simple options:

- High-yield savings account – Easy access and higher interest rates.

- Money market funds – A bit more growth potential.

- Short-term bonds – Perfect for balancing risk and reward.

Feeling adventurous? Here’s a quick comparison:

| Option | Pros | Cons |

|---|---|---|

| High-yield Savings | Easy access, safe | Lower returns |

| Money Market Funds | Bigger growth | Moderate risk |

| Short-term Bonds | Great balance | Requires research |

Choose your path wisely, young squire, and remember: your financial adventure should be anything but boring!

Q&A

Q&A:

Q: What exactly is financial risk?

A: Imagine your finances are a banana peel on a slippery sidewalk. Financial risk is the probability of you ending up comically sprawled on the pavement. More formally, it’s the possibility of losing money on an investment or business venture. Whether it’s stock market volatility, interest rate fluctuations, or unexpected expenses, financial risk is ever-lurking like a cat waiting to pounce on the unattended lasagna of your savings.

Q: How can I identify financial risks?

A: Identifying financial risks is like playing detective in a cheesy mystery novel. Look for the obvious clues: unstable income, heavy debt, and investments that involve terms like “high yield” (a fancy way of saying ”high risk“). Don’t forget to scrutinize subtler suspects, such as the cancellation of a Star Wars prequel. If people are losing faith in the Force, imagine what else might stumble.

Q: What are some common types of financial risks?

A: Financial risks come in as many flavors as there are jellybeans in Willy Wonka’s factory. Here are a few:

-

Market Risk: The stock market can share more drama than a telenovela. Prices can rise and fall unpredictably, often caused by economic or political factors.

-

Credit Risk: This is when someone who owes you money suddenly decides to become Houdini and disappear. Basically, a default on a loan or bond.

-

Liquidity Risk: Imagine needing to pay for dinner, but all you have are Monopoly money and lint. Liquidity risk happens when you can’t easily convert assets to cash.

-

Operational Risk: Think of this as Murphy’s Law in action—if something can go wrong internally within your company (like a cyber-attack or a CEO scandal), it will.

Q: How can I manage these financial risks?

A: Managing financial risks is a bit like juggling flaming swords—daunting but doable with practice. Here are some techniques:

-

Diversification: Don’t put all your eggs, or your retirement hopes, in one basket. Spread your investments across various asset types.

-

Emergency Fund: Stash away funds like a squirrel hoarding nuts for winter. Aim for at least three to six months of living expenses.

-

Insurance: Think of insurance as a safety net for when life decides to throw a curveball. From health to property, make sure you’re covered.

-

Stay Informed: Knowledge is power, and Google… is full of it. Keep yourself updated on financial news, and Antiques Roadshow markets to savvy up your financial literacy.

Q: What’s the biggest mistake people make with financial risks?

A: The biggest mistake is playing financial “ostrich”—burying your head in the sand and pretending risks don’t exist. Ignoring risks won’t make them go away; it’ll just make your eventual encounters with them more like a surprise party where all the guests are creditors.

Q: Can professional help in managing financial risks?

A: Absolutely! Financial advisors are like Gandalf guiding you through the perilous Mines of Moria (your finances). They can provide expert insight, suggest tailored strategies, and keep emotional decision-making at bay. Just make sure they’re certified and not someone who picked up a few finance terms from Reddit.

Q: Any final tips on managing financial risks?

A: Just remember, managing financial risks is a journey, not a destination. It’s like maintaining a garden; you weed out the bad (risks), water the good (investments), and occasionally fend off squirrels (unforeseen challenges). Stay vigilant, take calculated risks, and always have a back-up chocolate bar for emergencies—because let’s face it, dark times require sweet solutions.

Final Thoughts

And there you have it, folks—your crash course in managing financial risks! It’s like wearing armor made of dollar bills; fashionable and functionally safeguarding your hard-earned cash. Whether you are making investments, planning for retirement, or simply protecting yourself from financial calamities that seem to come out of nowhere—like that one uncle who shows up to every party uninvited—the principles of managing risk are your best defense.

Remember, the world of finance is full of twists and turns, much like a rollercoaster, but without the handy safety bar. With a calm demeanor, a disciplined approach, and perhaps a quirky sense of humor, you can navigate these ups and downs and land safely on the ground with your bank account—and sanity—intact.

So, grab your financial toolkit, keep an eye out for monetary potholes, and continue marching forward. Happy budgeting, investing, and, most importantly, laughing all the way to the bank!

Disclaimer: Economize at your own risk, steer clear of get-rich-quick schemes, and always read the fine print—because sometimes, it’s a comedy of errors out there in the financial jungle.