Hey there! Have you ever wondered if life insurance is really just about preparing for the worst, or if it actually plays a bigger part in your overall financial picture? You’re not alone—most folks think of life insurance as that “just in case” safety net, but what if I told you it’s more like a crucial puzzle piece in the grand scheme of your financial game plan? Yep, you heard right! In this article, we’re diving into the nitty-gritty of how life insurance fits snugly into a comprehensive financial plan. Get ready to see life insurance in a whole new light and discover how it can offer much more than just peace of mind. So grab a cup of coffee, get comfy, and let’s chat about what life insurance can really do for you and your financial future!

Understanding Life Insurance: Why It’s a Must-Have

Life insurance is like a safety net. It’s something you hope you’ll never need, but if the unexpected happens, it provides financial support to your loved ones. It’s especially important if you have dependents who rely on your income. Imagine a world where, in your absence, your family doesn’t have to worry about mortgage payments, education costs, or even daily expenses. That’s what life insurance offers—a bit of financial peace of mind in tough times.

Think of life insurance as a cornerstone of a solid financial plan. Here are some key reasons why it’s a must-have:

- Income Replacement: It ensures your family can maintain their lifestyle.

- Debt Coverage: It helps pay off any lingering debts, including your mortgage.

- Future Planning: It covers long-term expenses like education or retirement.

| Benefit | Description |

|---|---|

| Income Replacement | Replaces lost income |

| Debt Coverage | Pays off remaining debts |

| Future Planning | Secures education/retirement funds |

In short, life insurance is not just about end-of-life planning. It’s about ensuring your family’s future is safeguarded, even when you’re not around to see it. Can you imagine a more thoughtful gift?

Breaking Down the Types of Life Insurance: What Fits Your Needs

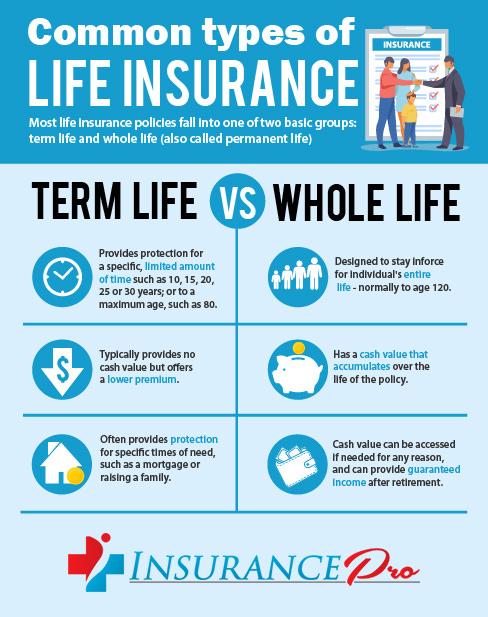

Choosing the right insurance can seem like a daunting task, but it becomes manageable when you understand the different types available. Term life insurance is straightforward. You pay premiums for a specific period, like 10, 20, or 30 years. If something happens to you during that time, your beneficiaries get a payout. It’s usually the cheapest option but doesn’t build any cash value. Next up is whole life insurance, which covers you for your entire life and includes a savings component. This means part of the money you pay can grow over time, but it also means higher premiums.

Another option is universal life insurance, offering flexibility in premiums and death benefits. You can adjust how much you pay and even use the policy’s savings to cover premiums as long as there’s enough cash value. For those more investment-savvy, variable life insurance allows for investment in sub-accounts similar to mutual funds. This can potentially grow your policy’s value, but it also comes with higher risk. Each type has its pros and cons, so think about your long-term goals and current financial situation.

| Type | Pros | Cons |

|---|---|---|

| Term Life | – Low cost – Simple to understand |

- No cash value – Coverage ends after term |

| Whole Life | - Lifetime coverage - Builds cash value |

– Higher premiums – Less flexibility |

| Universal Life | – Flexible premiums & benefits – Builds cash value |

– Requires monitoring – Potential policy lapse |

| Variable Life | – Investment opportunities – Builds cash value |

– High risk – Complex management |

How Much Life Insurance Do You Actually Need?

Determining the right amount of life insurance can feel daunting, but it’s essential to make sure your loved ones are taken care of. A good rule of thumb is to consider all your financial obligations and how long your family will need support. Here’s a quick list to help you out:

- Income Replacement: How much does your family need to maintain their current standard of living?

- Debt: Any outstanding debts like mortgages, car loans, or credit card balances.

- Future Expenses: Think about college tuition for the kids or any planned future expenses.

- Daily Living Costs: Everyday expenses like groceries, utilities, and other essential costs.

Still unsure? Let’s break it down with a simple table:

| Factor | Consideration |

|---|---|

| Income | 5-10 times your annual salary |

| Debts | Total remaining balances |

| Future Needs | Estimate major expenses like college |

| Living Costs | Yearly cost of living x number of years needed |

Add these up, and you’ll get a ballpark of how much coverage might be right for you. Remember, it’s always a good idea to review this with a financial advisor to tailor it to your specific situation!

Smart Tips for Incorporating Life Insurance into Your Financial Plan

Life insurance isn’t just a safety net; it’s a critical piece of your financial puzzle that can offer peace of mind and security for your loved ones. To effectively integrate it into your plan, start by evaluating your current and future financial needs. Ask yourself: Who depends on me financially? How much debt do I carry? From covering daily expenses to paying off mortgages or funding your child’s education, understanding these needs will help you determine the appropriate coverage amount. Also, consider the different types of life insurance policies available, such as term life and whole life, and choose one that aligns with your long-term goals.

Another smart tip is to periodically review your life insurance policy. Life changes, and so do financial needs. Reevaluating your policy annually ensures it still meets your requirements. Factors to review include:

- Changes in income or job status

- Major life events like marriage, divorce, or the birth of a child

- Alterations in debt, such as paying off or taking on a mortgage

Keep in mind, maintaining a flexible and comprehensive approach allows you to adapt as circumstances shift, making sure your policy continues to protect what you value most.

Q&A

Q: What’s the deal with life insurance in a financial plan?

A: Great question! Life insurance is like your financial safety net. It’s there to provide financial protection to your loved ones if something were to happen to you. Imagine it as a way to make sure your family can cover expenses like mortgage payments, daily living costs, or even education fees when you’re not around to help out.

Q: Is life insurance really that important?

A: Absolutely! Think of it this way: you wouldn’t want your loved ones to struggle financially on top of dealing with the emotional stress if you passed away unexpectedly. Life insurance can step in to cover those big expenses and help them maintain their lifestyle.

Q: How does life insurance fit into a holistic financial plan?

A: Life insurance plays a pivotal role in a comprehensive approach to finances. It’s not just about covering immediate expenses but also ensuring long-term financial stability for your family. Alongside retirement planning, savings, and investment strategies, life insurance helps round out a financial plan by addressing risk management and providing peace of mind.

Q: What types of life insurance are there?

A: There are mainly two types: term life and whole life insurance. Term life insurance covers you for a specific period, say 10, 20, or 30 years. It’s generally cheaper and straightforward. Whole life insurance, on the other hand, covers you for your entire life and also has a savings component, which means it can build cash value over time.

Q: How much life insurance do I really need?

A: It depends on your personal situation. A good rule of thumb is to consider what expenses you’d want covered if you weren’t there, like paying off debt, funding your kids’ education, or covering living costs. Many financial advisors suggest having a policy worth 5 to 10 times your annual income, but it can vary based on your unique financial goals and obligations.

Q: When’s the best time to get life insurance?

A: Sooner rather than later! Life insurance premiums are typically lower when you’re younger and healthier. Plus, securing a policy early ensures your family is protected no matter what life throws your way.

Q: Can life insurance be used while I’m still alive?

A: Yup, certain types of life insurance, like whole life or universal life policies, accumulate cash value that you can borrow against or withdraw. People often use this as a backup fund for emergencies or major expenses. It’s like having an added layer of financial security.

Q: Any last tips about life insurance?

A: Don’t procrastinate! It’s one of those things that’s super easy to push to the side, but it’s really crucial for a solid financial foundation. Talk to a financial advisor if you’re unsure where to start – they can help tailor a plan that fits your needs and budget. Plus, the peace of mind it offers is totally worth it.

Remember, it’s all about securing not just your future, but your family’s too. So, jump in and explore your life insurance options!

Insights and Conclusions

And there you have it—a handy guide to why life insurance is more than just another thing to check off your financial to-do list. It’s a cornerstone of any solid financial strategy, providing that all-important peace of mind for you and your loved ones. Whether you’re just starting out or fine-tuning an existing plan, don’t underestimate the power of a good life insurance policy. It’s not just about preparing for the unexpected; it’s about ensuring your financial goals stay on track, no matter what life throws your way. So, take a moment, review your options, and make sure life insurance fits snugly into your comprehensive financial picture. Trust us, your future self will thank you!