Ever felt like you’re dragging through the day, clutching your coffee like it’s a lifeline? We’ve all been there. But what if we told you that catching those extra Z’s could actually boost your bank account? It might sound a bit far-fetched, but there’s real science behind how a good night’s sleep can positively impact your finances. In this article, we’ll dive into the unexpected ways that better sleep can save you money, enhance your productivity, and even improve your decision-making skills. So grab a comfy seat and maybe a cozy blanket—because you’re about to discover how hitting the hay could be your secret weapon for financial success.

How Better Sleep Can Boost Your Work Performance

Getting quality sleep can significantly enhance your productivity at work. When you rest well, your brain functions at its best, leading to better decision-making, increased creativity, and more efficient problem-solving skills. Imagine being able to tackle tasks with a clear mind and a focused approach—that’s what a good night’s sleep can do for you.

Lack of sleep can lead to a host of issues that directly impact your work performance. Here are some negative effects of poor sleep:

- Reduced cognitive function: Struggles with memory, attention, and decision-making.

- Increased errors: Higher likelihood of making mistakes and poor judgment calls.

- Lowered morale: Feelings of moodiness and frustration that can affect teamwork.

| Sleep Quality | Work Performance |

|---|---|

| Good | High productivity, fewer errors |

| Poor | Low productivity, frequent mistakes |

Saving Money on Healthcare with Quality Rest

A solid amount of quality sleep isn’t just good for your well-being; it also helps protect your wallet. When you get enough rest, your body is better at healing and fighting off illnesses. Fewer trips to the doctor mean less money spent on healthcare. It’s a win-win situation where good sleep equals fewer medical costs.

To improve your sleep quality, consider the following:

- Create a bedtime routine: Going to bed at the same time each night helps regulate your sleep cycle.

- Limit screen time before bed: Blue light from phones and tablets can interfere with your sleep.

- Optimize your sleep environment: A comfortable mattress and dark, quiet room can make a big difference.

Here is a simple comparison of estimated yearly savings based on improved sleep:

| Without Quality Sleep | With Quality Sleep | Potential Savings |

|---|---|---|

| $500 in doctor visits | $200 in doctor visits | $300 saved |

| $200 on medications | $50 on medications | $150 saved |

Improving Decision-Making through Better Sleep Habits

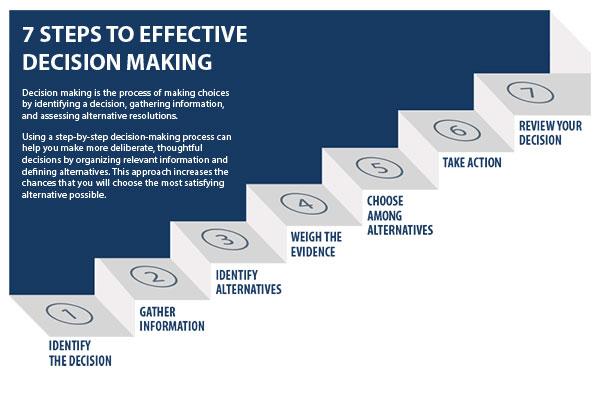

Imagine waking up every morning feeling refreshed and ready to tackle the day’s challenges. Well, better sleep habits can help you achieve just that, leading to sharper thinking and smarter financial decisions. Quality sleep improves cognitive function, enabling you to analyze facts and data more effectively, avoid hasty choices, and foresee potential outcomes with greater clarity.

Here are a few quick tips for improving your sleep and boosting your decision-making skills:

- Stick to a consistent sleep schedule – go to bed and wake up at the same time every day.

- Create a calming bedtime routine to signal to your body that it’s time to relax.

- Limit exposure to screens and bright lights before bed.

- Ensure your sleep environment is quiet, dark, and cool.

| Sleep Habit | Financial Benefit |

|---|---|

| Consistent Sleep Schedule | Better decision-making consistency |

| Calm Bedtime Routine | Reduced impulsive spending |

| No Screen Time Before Bed | Enhanced focus and productivity |

Simple Tips to Enhance Your Sleep for Financial Gains

Getting quality sleep can boost productivity and improve decision-making skills, two essential traits for financial success. Here are some super-easy tips to help you get that restful sleep:

- Stick to a Schedule: Go to bed and wake up at the same time every day, even on weekends.

- Create a Relaxing Bedtime Routine: Reading, light stretching, or listening to soothing music can help you unwind.

- Avoid Caffeine and Heavy Meals: Stay clear of caffeine and big meals right before bed.

- Keep Your Sleeping Environment Comfortable: Ensure your bedroom is cool, dark, and quiet.

Investing in a good night’s sleep can lead to better financial outcomes, as shown in the table below:

| Sleep Quality | Financial Impact | Benefit |

|---|---|---|

| High | Positive | Enhanced Focus |

| Medium | Neutral | Moderate Energy |

| Low | Negative | Poor Decision-Making |

Q&A

Q&A:

Q: Why is sleep considered important for financial well-being?

A: A good night’s sleep directly affects your ability to make sound decisions, stay productive, and maintain good health, all of which are closely tied to your financial stability. When you’re well-rested, you’re less likely to make costly mistakes at work and more likely to perform your best, potentially earning raises and promotions.

Q: How does lack of sleep impact productivity?

A: Sleep deprivation can lead to decreased concentration, slower cognitive processing, and higher error rates. This drop in productivity can cause you to fall behind at work, miss deadlines, or even make significant mistakes that could be financially detrimental.

Q: Are there any studies linking sleep to workplace performance?

A: Yes, numerous studies have found strong connections between sufficient sleep and workplace performance. For instance, research from the Harvard Medical School shows that employees who get enough sleep are more effective, engaged, and have fewer sick days compared to their sleep-deprived peers.

Q: Can poor sleep quality affect other financial aspects of life?

A: Absolutely. Poor sleep quality can lead to health problems like depression, anxiety, and chronic conditions such as diabetes and heart disease. Treating these health issues often requires medical intervention, which can be costly. Moreover, poor sleep can impair judgment, leading to poor financial decisions like overspending or risky investments.

Q: What are some practical tips for improving sleep quality?

A: There are several steps you can take to improve your sleep quality:

- Establish a consistent sleep schedule.

- Create a restful sleeping environment (cool, dark, and quiet).

- Limit exposure to screens before bedtime.

- Avoid heavy meals, caffeine, and alcohol close to bedtime.

- Incorporate relaxation techniques like meditation or deep-breathing exercises.

Q: Is there a specific amount of sleep recommended for optimal financial performance?

A: The National Sleep Foundation recommends that adults aim for 7-9 hours of sleep per night. However, the exact amount can vary depending on individual needs. The key is to find a sleep routine that makes you feel rested and capable of performing your best.

Q: How can employers support better sleep health among their employees?

A: Employers can play a significant role by promoting work-life balance, offering flexible working hours, and creating a culture that values rest and wellness. Some companies also provide sleep pods, on-site naps, or wellness programs that emphasize the importance of sleep.

Q: Are there financial benefits for businesses that encourage good sleep for their staff?

A: Definitely. When employees are well-rested, they tend to be more productive, engaged, and less likely to call in sick. This can lead to higher overall performance, reduced turnover rates, and even lower healthcare costs for the company. Investing in the sleep health of employees can result in substantial long-term financial gains for businesses.

In Retrospect

And there you have it! A good night’s sleep isn’t just a luxury; it’s a smart financial move. From boosting productivity at work to aiding in better decision-making, the ripple effects of getting those precious hours of rest are pretty impressive. So, next time you’re tempted to binge-watch another episode or scroll through social media until the early hours, remember that your wallet might thank you for choosing sleep instead. Sweet dreams and even sweeter savings!