Imagine walking through a marketplace bustling with stalls, each offering a myriad of financial tools designed to secure your future. Among the throng of complex investment options and intricate banking instruments, there lies a modest, yet powerful gem that often goes unnoticed: the Health Savings Account, or HSA. In a world where healthcare costs can sometimes appear as bewildering as a maze, HSAs stand as a beacon of simplicity and efficiency, guiding you towards more astute health-related financial decisions.

This article embarks on a journey to demystify Health Savings Accounts, shedding light on how these unassuming accounts operate and revealing the strategies for harnessing their full potential. Whether you’re considering an HSA for the first time or you’re a seasoned account holder seeking deeper insights, our aim is to empower you with knowledge and practical tips. So, let’s delve into the world of HSAs, where the path to financial and health security becomes a little clearer with each step.

Maximizing Contributions: The Backbone of Your HSA Strategy

It’s essential to maximize your contributions to get the most out of your Health Savings Account (HSA). When you regularly contribute, you not only build a robust financial cushion for eligible medical expenses but also benefit from significant tax advantages. Contributions to your HSA are tax-deductible, reducing your overall taxable income. This means you could save more in the long run just by prioritizing your HSA contributions. Furthermore, the funds in your HSA roll over year to year, ensuring nothing goes to waste.

Here are steps to effectively maximize contributions:

- Set up automatic transfers: Making regular, automatic contributions ensures you consistently fund your account.

- Take advantage of employer contributions: Many employers offer to contribute to your HSA. Don’t leave free money on the table!

- Utilize catch-up contributions: If you’re 55 or older, you can contribute an extra $1,000 annually.

Here’s a simple table to help you understand contribution limits:

| Category | Limit |

|---|---|

| Individual | $3,850 |

| Family | $7,750 |

| Catch-up (55+) | $1,000 |

Smart Spending: Harnessing Your HSA for Immediate Healthcare Needs

Your HSA isn’t just a long-term savings tool; it can be a real lifesaver when it comes to immediate healthcare needs. By smart spending on eligible medical expenses, you not only get the medical care you need but also benefit from tax savings. Common eligible expenses include prescriptions, doctor’s visits, dental procedures, and even over-the-counter medications with a prescription. Imagine needing a set of new eyeglasses or paying for that sudden emergency room visit—your HSA has got you covered.

What’s great about HSAs is the flexibility. Unlike a Flexible Spending Account (FSA), your HSA funds roll over year after year, so you don’t feel pressured to deplete it by year’s end. Here’s a quick look at some frequent uses for your HSA:

- Co-payments for doctor’s visits

- Deductibles and coinsurance payments

- Prescribed medications and treatments

- Dental cleanings and fillings

Let’s break down a simple usage example:

| Expense | Cost | Covered by HSA? |

|---|---|---|

| Doctor Visit Co-pay | $25 | Yes |

| Prescription Medication | $45 | Yes |

| Over-the-Counter Pain Reliever (with prescription) | $10 | Yes |

Investment Opportunities Within Your HSA

Maximize Growth Potential

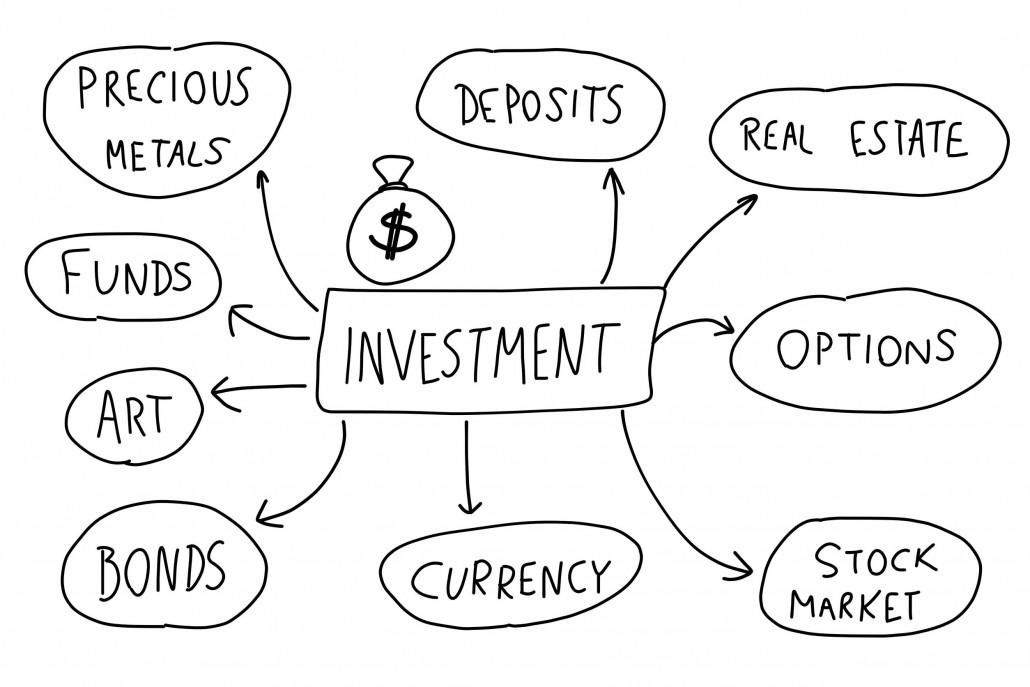

Your Health Savings Account (HSA) isn’t just a way to save for medical expenses—it’s also a fantastic investment vehicle. By investing funds within your HSA, you can potentially grow your savings tax-free. Instead of letting your money sit idle, many HSAs allow you to invest in mutual funds, bonds, stocks, and more. Consider your individual risk tolerance and investment goals to decide how you’d like to allocate your HSA funds. Investing early lets your money compound over time, potentially giving you a sizable nest egg for future medical—or even non-medical—expenses once you turn 65.

Diversify to Minimize Risk

Diversification is key when investing your HSA funds. Not putting all your eggs in one basket helps you manage risk. Here are some investment options to consider:

- Mutual Funds: Pooled investments managed by financial professionals.

- Stocks: Shares of individual companies, providing potential for higher returns with higher risk.

- Bonds: Debt investments, often offering more stability.

- Index Funds: Funds that track a specific market index, providing broad market exposure.

The table below highlights the characteristics of different investment options:

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Mutual Funds | Medium | Varies |

| Stocks | High | High |

| Bonds | Low | Low to Medium |

| Index Funds | Medium | Market-Dependent |

Tax Benefits and Implications: Navigating the Financial Landscape

When it comes to reducing your tax burden, Health Savings Accounts (HSAs) can be a real game-changer. By contributing pre-tax dollars to your HSA, you effectively lower your taxable income. Here’s a quick rundown of the primary tax benefits you can enjoy with an HSA:

- Tax-Free Contributions: Money you put into your HSA isn’t subject to federal income tax.

- Tax-Free Growth: The investment earnings in your HSA aren’t taxed.

- Tax-Free Withdrawals: Funds used for qualified medical expenses can be withdrawn tax-free.

However, it’s essential to navigate the financial landscape carefully to maximize these benefits. Consider these implications for smart HSA management:

| Implication | Description |

|---|---|

| Contribution Limits | For 2023, individuals can contribute up to $3,850 and families up to $7,750. |

| Investment Options | Your HSA can grow through investments, much like a retirement account |

| Withdrawal Restrictions | Non-qualified expenses will incur income tax and a 20% penalty if you’re under 65. |

Q&A

### : Your Questions Answered

Q: What exactly is a Health Savings Account (HSA)?

A: An HSA, or Health Savings Account, is a tax-advantaged savings account specifically designed to help individuals save for medical expenses. These accounts are available to those with high-deductible health plans (HDHPs) and offer enticing benefits like tax-free growth on investments, tax-deductible contributions, and tax-free withdrawals for qualifying medical expenses.

Q: Who is eligible to open an HSA?

A: To open and contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). Additionally, you shouldn’t be enrolled in Medicare or claimed as a dependent on someone else’s tax return. Certain other insurance coverages may also affect your eligibility.

Q: What constitutes a high-deductible health plan (HDHP)?

A: For 2023, the IRS defines an HDHP as a plan with a minimum annual deductible of $1,500 for an individual or $3,000 for a family. The maximum out-of-pocket expenses must not exceed $7,500 for individuals or $15,000 for families. These amounts can change yearly based on IRS guidelines.

Q: How much can I contribute to my HSA?

A: For 2023, the contribution limits are $3,850 for an individual and $7,750 for families. If you’re 55 or older, you can make an additional “catch-up” contribution of up to $1,000, giving you even more room to save.

Q: Can my employer contribute to my HSA?

A: Yes, employers can contribute to your HSA, and their contributions are tax-free. However, keep in mind that both your contributions and those made by your employer count towards the annual contribution limit.

Q: What are the tax benefits of an HSA?

A: HSAs come with a triple tax advantage: contributions are tax-deductible, investment growth within the account is tax-free, and withdrawals for qualifying medical expenses are also tax-free. This combination makes HSAs a powerful tool for managing healthcare costs.

Q: Can I invest the money in my HSA?

A: Absolutely! Many HSA providers offer investment options similar to retirement accounts, such as mutual funds, stocks, and bonds. Investing your HSA funds can be a prudent way to grow your savings over the long term, especially if you don’t anticipate needing those funds immediately for medical expenses.

Q: What happens to my HSA if I change jobs or retire?

A: Your HSA is yours alone. It remains under your control even if you change jobs or retire. You can continue using the funds for qualified medical expenses, and if you retire after age 65, you can even withdraw funds for non-medical expenses; however, those withdrawals will be taxed as ordinary income.

Q: What types of expenses can HSA funds be used for?

A: HSA funds can be used tax-free for a wide range of qualified medical expenses, including doctor visits, prescription drugs, dental and vision care, and more. The IRS provides a comprehensive list of eligible medical expenses, so it’s wise to review these guidelines to maximize your HSA’s value.

Q: Are there any downsides to having an HSA?

A: While HSAs offer many benefits, they’re not without potential drawbacks. High-deductible health plans require you to pay more out of pocket before insurance kicks in, which might not be ideal for everyone. Additionally, improper use of HSA funds for non-qualified expenses can result in taxes and penalties.

Q: How do I get started with an HSA?

A: To start benefiting from an HSA, you first need to enroll in a qualified high-deductible health plan. Next, choose an HSA provider, which can be a bank, credit union, or specialized HSA custodian. Once your account is set up, you can begin making contributions and exploring investment options to grow your medical savings.

With proper understanding and strategic use, HSAs can be a valuable asset in managing your healthcare costs and building a financially secure future.

Insights and Conclusions

In weaving through the intricate mosaic of Health Savings Accounts, we’ve journeyed from the foundational bedrock to the nuanced avenues that HSAs present. Whether you’re an advocate for forward-thinking health management or someone simply looking to make the most of available resources, grasping the ins and outs of HSAs can open a gateway to financial prudence and informed healthcare choices.

Embrace the art of mindfulness as you navigate these waters — understanding that each contribution today can be a safeguard for tomorrow. Your path to effective healthcare and fiscal health is intertwined with the diligence and strategy you apply today.

So, as you embark on your own HSA odyssey, remember: it’s not just about dollars and cents. It’s about crafting a balanced narrative for your life, where health and wealth coexist in harmony. Here’s to your journey—both healthy and wise.