We’ve all been there. One minute you’re perusing cat memes on your phone, and the next minute, an Amazon package containing a portable neck massager and a ceramic cactus arrives at your doorstep, courtesy of 2 a.m. you. Impulse buying—those spontaneous, can’t-live-without-it purchases—might seem like a harmless way to add a little excitement to your day or fill a void in your soul. However, these spur-of-the-moment decisions often come with price tags heftier than the ones hanging from the stuff we buy. Let’s dive into the true cost of impulse buying, exploring both the psychological and financial impacts, and uncover why those fun-sized splurges might be costing you more than just your hard-earned cash. Spoiler alert: it involves a lot more than just a robust collection of slightly ‘what-was-I-thinking’ items and an ever-decreasing bank balance.

Why Your Wallet Weeps: The Financial Fallout of Impulse Buys

Impulse buys may seem harmless, but your wallet knows better. Those sneaky little purchases add up faster than you can say ”retail therapy.” Every time you grab that extra coffee or splurge on an unnecessary gadget, you’re essentially taking a hammer to your budget. A few dollars here and there might not seem like a lot, but over time, these small expenses can add a hefty sum to your monthly spending.

<ul>

<li>Extra snacks - $10</li>

<li>Unplanned clothes - $50</li>

<li>Gadgets you didn't need - $100</li>

</ul>

<table class="wp-block-table">

<thead>

<tr>

<th>Item</th>

<th>Cost</th>

</tr>

</thead>

<tbody>

<tr>

<td>Latte</td>

<td>$5</td>

</tr>

<tr>

<td>T-shirt</td>

<td>$20</td>

</tr>

<tr>

<td>Phone accessory</td>

<td>$15</td>

</tr>

</tbody>

</table>

<p>Even if it feels good at the moment, buying on a whim often leaves you with buyer's remorse and a crying wallet. That instant gratification quickly fades, and you're left with yet another thing you didn't really need. Your budget feels the impact, and soon enough, so do your financial goals. Repeated impulse buying can derail your plans to save up for something truly meaningful, like a trip or a new apartment. It's like financial death by a thousand cuts, and each little slice hurts more than the last!</p>

Retail Therapy? More Like Retail Tragedy: The Emotional Toll of Unplanned Purchases

Feeling down and deciding to buy that $100 designer shirt might give you a momentary high, but it can quickly lead to a wave of regret. Impulse buying is like playing emotional roulette – you may get a quick thrill, but you’re more likely to end up with a sense of guilt and a thinner wallet. Common emotional aftermaths of those unplanned purchases often include:

- Buyer’s remorse: That “Why did I buy this?” feeling.

- Stress and anxiety: Yep, your shopping spree can cause your blood pressure to rise.

- Regret over missed opportunities: Realizing you could have spent that money on something more meaningful or productive.

Financially, spontaneous shopping doesn’t just make your heart ache; it can empty your pockets faster than you can say “sale.” Consider the following table demonstrating potential monthly expenses:

| Category | Cost (Monthly) |

|---|---|

| Coffee Runs | $75 |

| Fast Fashion | $150 |

| Gadget Add-Ons | $100 |

All these seemingly small purchases quickly add up, turning your budget into a tragic comedy. It’s as if your bank account is performing a magic trick – now you see the money, now you don’t.

Your Brain on Bargains: The Psychology Behind Those Flash Sales

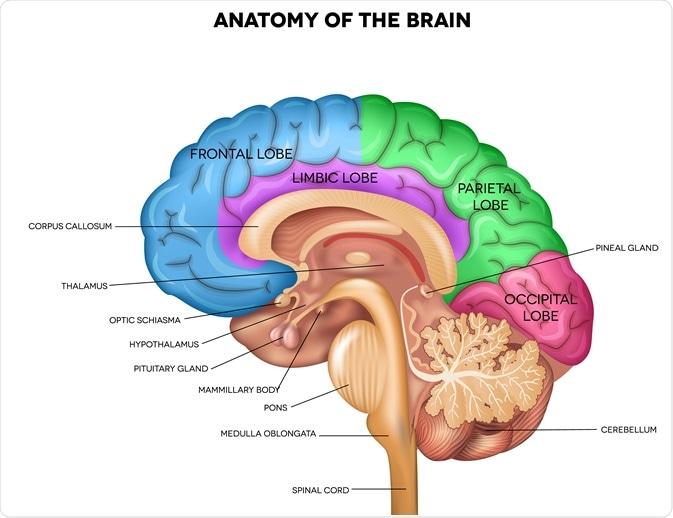

Ever wondered why you can’t resist that ‘limited-time offer’? Your brain is hardwired to seek instant gratification. Flash sales trigger a region in your brain called the nucleus accumbens, which releases dopamine, making you feel super happy! It’s like a mini party in your head. This rush makes it hard to think critically, driving you to splurge on items you might not even need. Here’s what typically happens during a flash sale:

- Heart races with excitement.

- Sense of urgency kicks in.

- You click “Buy Now” without second thoughts.

- Regret may follow shortly after.

Impulse buying impacts not just your brain but your wallet too. Small purchases here and there add up. Consider this:

| Weekly Spend | Monthly Cost | Yearly Total |

|---|---|---|

| $10 | $40 | $480 |

| $20 | $80 | $960 |

| $50 | $200 | $2,400 |

Before you know it, those “bargains” could be costing you a small fortune. Your brain might love the thrill, but your bank account will thank you for a bit of restraint!

Impulse Buying Rehab: Practical Tips to Stop Before You Shop

Impulse buying can feel like a delightful thrill at first, but it quickly morphs into a hangover for your wallet and your well-being. Did you know that 65% of impulse purchases are often described as “regretful”? Imagine a diet of cupcakes: delicious today, but tomorrow you’re left with crumbs and a tummy ache. Here are some signs that you might be a shopaholic:

- Buying items because they’re on sale.

- Purchasing things you don’t need or already own.

- Feeling a rush when you swipe your card.

Your bank account starts to look more like a karaoke machine—everything’s off-key. Financial stress can also creep in, making it difficult to pay for essentials like rent or groceries. The cost adds up quicker than a toddler in a candy store.

| Impulse Buys | Costs |

|---|---|

| Daily coffee runs | $150/month |

| Gadget upgrades | $500/year |

| Trendy clothes | $100/month |

So next time you feel the urge to splurge, take a deep breath, count to ten, and ask yourself: do you really need that third avocado peeler?

Q&A

—

Q: What exactly is impulse buying?

A: Ah, impulse buying! It’s that joyous moment when you stroll into a store for, say, milk, and exit with a shiny new kitchen gadget, a pair of shoes, and a scented candle that promises to “change your life.” Simply put, impulse buying is when you purchase something on the spur of the moment, without any pre-planned intention.

Q: Why is impulse buying so common?

A: Because, let’s face it, retailers are wizards. They design stores to be magical wonderlands where you can’t help but fall in love with things you didn’t even know existed. Plus, human brains are wired to chase instant gratification. That dopamine hit from buying something new? I mean, who can resist that, right?

Q: What are the financial impacts of impulse buying?

A: Imagine your bank account is a pizza. Each impulse purchase is like taking a bite of that pizza. Before you know it, you’re left with a sad, lonely crust and a stomach full of regret. It adds up! Those cute little trinkets and must-have gadgets can wreak havoc on your budget, leading to debt, savings depletion, and potential fights with your wallet.

Q: How does impulse buying affect mental health?

A: Initially, it feels like a high—woohoo, new stuff! But often, it’s followed by a crash, starring guilt and buyer’s remorse. Chronic impulsive buying can fuel stress, anxiety, and even depression. Think emotional rollercoaster, but without the fun theme park.

Q: What strategies can help curb impulse buying?

A: One word: Mindfulness. Pause before purchasing. Ask yourself important questions like, “Do I need this?” and “Will this item spark joy after 48 hours?” Budgeting apps and lists are your friends. Also, avoid shopping when you’re emotional—it’s like grocery shopping when you’re hungry. You’ll end up with an absurd amount of snack packs and zero actual meals.

Q: How do retailers entice us to impulse buy?

A: Oh, they’ve got tricks up their sleeves! From strategic store layouts and flashy signs to limited-time offers and sensory experiences (mmmm, that bakery smell). Let’s not forget the wonders of online shopping—one-click purchases and personalized recommendations that seem to read your mind. It’s a trap, I tell you!

Q: Can impulse buying ever be a good thing?

A: In moderation, maybe! Sometimes a spontaneous purchase can bring joy or introduce you to something unexpectedly awesome. It’s kind of like seasoning on food—a dash can be delightful, but overdo it, and you’ll regret it.

Q: What’s the takeaway from all this?

A: Impulse buying is a double-edged sword. Sure, it can provide a quick thrill, but the financial and psychological aftermath often isn’t worth it. So next time you feel that urge, think twice, breathe deeply, and remember: your future self (and your bank account) will thank you!

Laugh in the face of impulse buys, but wield your wallet wisely!

—

The Conclusion

while that spontaneous splurge on a glittery unicorn coffee mug or the latest gadget might seem harmless, it’s essential to recognize the psychological thrill and financial chills that can follow. The lure of impulse buying taps into our deepest desires for instant gratification, leaving us with an emotional high and, sometimes, a monetary low. It’s like riding a roller coaster; exhilarating in the moment, but potentially nauseating when the ride ends and you realize you’ve left your wallet up in the clouds.

So, next time you find yourself enamored by the aisle of last-minute temptations or entranced by those sneaky “limited-time offers,” take a breath, think twice, and ask yourself if you’re purchasing joy or just another dust collector for your shelf. Remember, your future self might thank you for a moment of pause rather than another quirky knick-knack. After all, who needs another fuzzy llama keychain when you can have the peace of mind—and a robust bank account—that comes with thoughtful spending? Happy budgeting, and may your impulse buys be few and your financial health thrive!