Freelancing can be a dream come true, offering the ultimate flexibility and the freedom to be your own boss. But along with the perks come unique financial challenges that can sometimes feel downright overwhelming. Between unpredictable income streams, complex taxes, and the need for self-provided benefits, managing money as a freelancer requires a different playbook. In this guide, we’ll dive into the essentials of financial wellness tailored just for freelancers, blending savvy money management tips with strategies to keep your mind at ease. Ready to take control of your finances and find peace of mind in your freelance journey? Let’s get started!

Saving Strategies Tailored for Freelancers

As a freelancer, building a strong financial foundation is key. One way to do this is by creating a separate savings account solely for your business expenses and taxes. This helps in staying organized and ensures that tax surprises don’t disrupt your finances. Develop a habit of transferring a portion of each paycheck into this account, especially accounting for estimated taxes. Consider using an app to automate these transfers so you don’t have to worry about missing any contributions.

Another effective strategy is to set multiple savings goals using ‘buckets’ or sub-accounts. This approach can help you manage different priorities like emergency funds, vacation savings, and investment opportunities. Here’s a simple way to start:

- Emergency Fund: Aim to save at least three to six months’ worth of expenses.

- Retirement Savings: Contribute regularly to an IRA or Solo 401(k).

- Professional Development: Set aside funds for courses and certifications.

You can track your savings progress using a simple table like this:

| Goal | Target Amount | Current Amount |

|---|---|---|

| Emergency Fund | $5,000 | $1,200 |

| Retirement Savings | $10,000 | $3,500 |

| Professional Development | $2,000 | $650 |

Balancing Business and Personal Finances

Balancing your business and personal finances can be tricky, but it’s crucial for sustained success and peace of mind. Start by maintaining separate bank accounts for business and personal expenses. This makes it easier to track your income and spending, and simplifies tax time. Consider setting up a budget for both your business and personal finances—allocate specific amounts for essentials like rent, utilities, and groceries. Regularly review your financial statements to ensure you’re on track.

Automate as much as you can to save time and avoid missing payments. Set up automatic transfers to your savings account, and schedule bill payments to prevent late fees. Use apps to track your expenses and categorize them to see where your money is going. Here are some tips to keep your finances balanced:

- Save for taxes: Put aside a portion of each payment to cover tax obligations.

- Emergency fund: Aim to have 3-6 months’ worth of expenses saved.

- Invest in your business: Regularly put money back into your business for growth.

| Quick Tips | |

|---|---|

| Tip | Why It Matters |

| Track Expenses | Keeps you informed and controlled |

| Create Budgets | Prevents overspending |

| Automate Payments | Avoids late fees |

| Save Regularly | Builds financial security |

Mastering Variable Income Management

Freelancers often face the challenge of irregular income, which can make budgeting and financial planning trickier. The first step in mastering your finances is understanding your cash flow. Track your earnings and expenses meticulously. Consider using tools like expense tracking apps or spreadsheets to categorize where your money goes. By keeping a close eye on your financial patterns, you can spot trends and plan better for the future.

- Separate personal and business finances: Ensure you have distinct accounts for personal and freelance income.

- Save for lean times: Set aside a percentage of each paycheck into an emergency fund.

- Automate savings: Make saving automatic by setting up regular transfers to your savings account.

- Review periodically: Regularly revisit your budget and adjust as necessary.

| Category | Percentage of Income |

|---|---|

| Taxes | 20% |

| Savings | 15% |

| Living Expenses | 50% |

| Business Investments | 10% |

| Discretionary | 5% |

Mental Health and Money: Stress Less, Earn More

Freelancers often juggle multiple projects, which can take a toll on both mental health and financial stability. One essential tip is to maintain a healthy division between work and relaxation to reduce stress and boost productivity. Incorporate mindfulness practices and regular breaks into your routine to keep your mind fresh. Small steps, like setting specific hours for work and sticking to them, can make a significant difference. Also, consider using apps or tools that help manage time and tasks efficiently, so you don’t feel overwhelmed.

- Create a budget: Track your income and expenses to avoid surprises.

- Automate savings: Set up automatic deductions to save without thinking.

- Invoice promptly: Ensure you get paid on time by sending invoices promptly.

- Invest in health: Consider health insurance or a gym membership for peace of mind.

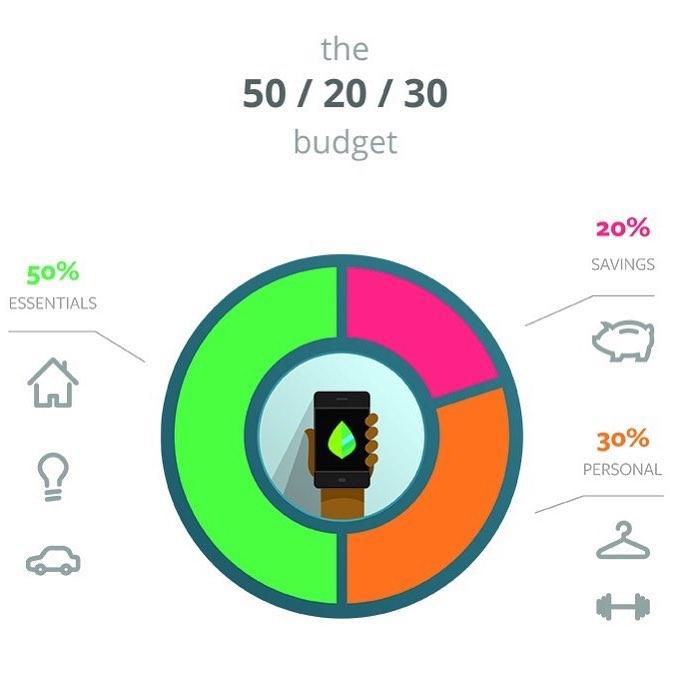

Here’s a simple comparison of two common budgeting methods:

| Method | Pros | Cons |

|---|---|---|

| 50/30/20 Rule | Easy to follow, Ensures savings | May not suit variable income |

| Envelope System | Visual, Helps limit overspending | Time-consuming, Requires discipline |

These strategies can help reduce financial anxiety and allow you to focus on your work more effectively. Balancing the mind and wallet can pave the way to a more stable and prosperous freelance career.

Q&A

Q&A:

Q1: What exactly is “financial wellness” for freelancers?

A: Financial wellness for freelancers is about having a healthy relationship with your money – knowing you have enough for now and in the future, reducing financial stress, and feeling confident about your financial decisions. It’s a balance of managing income, expenses, savings, and investments while also ensuring your mental well-being isn’t compromised by money worries.

Q2: Freelancing seems financially unpredictable. How can I manage the ups and downs?

A: Ah, the classic freelancer roller-coaster! The key is to build a solid financial buffer. Start by saving a portion of every paycheck – ideally, enough to cover three to six months of expenses. This gives you a cushion during lean periods. Also, consider diversifying your income streams and setting a budget that accommodates those fluctuations.

Q3: Budgeting sounds dull. How do I start without feeling overwhelmed?

A: Totally get it! Start small. Track your income and expenses for a month. There are loads of apps that can help make this painless. Once you see where your money goes, set realistic goals – like cutting unnecessary expenses and allocating funds for savings, taxes, and fun (because, hey, you deserve it!).

Q4: How can I make sure I’m saving enough for retirement when I don’t have a traditional employer plan?

A: Good question! Freelancers need to be proactive. Look into options like IRAs, Roth IRAs, or SEP IRAs. Each has its perks, but the idea is to regularly contribute. Again, even small, consistent amounts add up over time. You might consider consulting a financial advisor if this feels too complex.

Q5: Taxes are a nightmare. Any tips?

A: They can be intimidating, but you can tame the tax beast with some organization. Keep track of your income and expenses throughout the year. Set aside a portion of your earnings for taxes – commonly 25-30% – to avoid a nasty surprise come tax season. And don’t forget to take advantage of deductions related to your business. When in doubt, it pays (literally) to work with a tax professional.

Q6: How do I manage the mental stress that comes with irregular income?

A: Great point! Financial stress can take a toll on your mental health. Apart from having a safety net and a budget, ensure you’re taking regular breaks, maintaining a social network, and practicing self-care. Mindfulness techniques or talking to a therapist can help keep anxiety at bay. Remember, financial wellness isn’t just about numbers; it’s about peace of mind too.

Q7: Any last tips for staying financially well as a freelancer?

A: Sure! Always keep learning. The financial world changes, and staying informed can help you make better decisions. Networking with other freelancers can also provide support and fresh ideas. don’t be too hard on yourself. Everyone makes money mistakes – what counts is learning from them and moving forward.

Hope this helps you on your freelancing journey. You’ve got this!

Future Outlook

navigating the financial seas as a freelancer might feel like balancing on a surfboard during a storm, but with the right tools and mindset, you’ll be riding those waves with confidence. Remember, it’s all about planning, staying organized, and occasionally cutting yourself some slack. Building financial wellness isn’t about being perfect; it’s about making smart choices that suit your unique situation. So take a deep breath, keep learning, and trust in your ability to manage both your money and your mind.

Happy freelancing, and may your balance sheet always be in the green!