If you’ve ever found yourself lost in the labyrinth of your finances, you’re not alone. Bills, budgets, and baffling bank statements can make your head spin faster than a roulette wheel in Las Vegas. But what if we told you there’s a digital cavalry ready to rescue you from the clutches of financial mayhem? Enter financial apps – the superhero sidekicks of the modern money manager. They’re here to help you slay your financial dragons with the swipe of a finger. From budgeting your latte habit to turning spare change into investment gold, these apps are making dollars out of digital sense. Buckle up and get ready to dive into the world of financial wizardry, where your smartphone is the wand and your bank account is the magic kingdom. Let’s explore “.”

Cash is So Last Year: Why Financial Apps Are Taking Over

Remember when finding out your account balance involved a trip to the bank and standing in line, glaring at the slow person ahead of you? Financial apps have blissfully canceled that unnecessary field trip. These digital marvels bring everything you need to your fingertips, anytime, anywhere. Imagine transferring money while binge-watching your favorite show or paying bills while lying in bed—yes, it’s as glorious as it sounds. And you don’t even have to wear pants. Say goodbye to tiresome trips and hello to effortless finance management!

What’s more delightful? Financial apps aren’t just about checking balances or *yawn* paying bills. They come with awesome features that make us question why anyone still touches physical cash. Some goodies include:

- Instant money transfers

- Expense tracking with those fancy colorful charts

- Budgeting tools that actually make saving fun

- Investment opportunities at the tap of a button

| App Features | Old-School Method |

|---|---|

| Instant Transfers | Waiting Days |

| Expense Tracking | Manual Logs |

| Budgeting Tools | Spreadsheets |

| Online Investments | Broker Visits |

Meet Your New Money Nerd: Inside the Features of Top Financial Apps

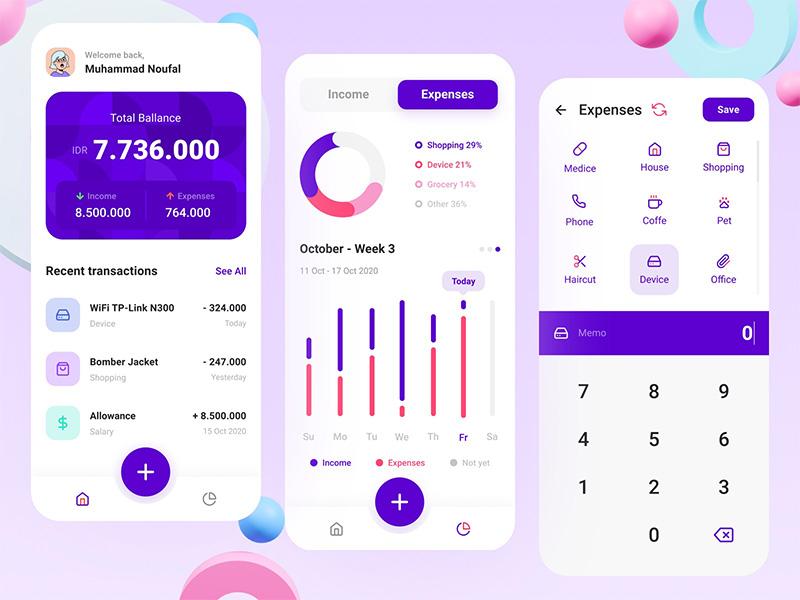

Ever noticed how your phone keeps getting smarter? It’s now basically a pocket-sized money wizard! Today’s finance apps are like having a mini financial advisor in your pocket. They can track spending, help you save money, and make investment decisions. Here are a few features you’ll absolutely love:

- Automated Budgeting: No more guessing where your money is going. These apps categorize your expenses automatically.

- Investment Guidance: Ever thought of investing but don’t know where to start? These apps offer personalized recommendations to get you started.

- Goal Setting: Save for that dream vacation or new gadget by setting financial goals within the app.

Some apps even include features that make your traditional bank look like it’s stuck in the Stone Age. Check out the comparison of a typical app vs your bank:

| Feature | Typical Bank | Financial App |

|---|---|---|

| Real-Time Notifications | Nope | Yes |

| Spending Insights | Occasionally | Yes, Daily |

| Investment Tips | Maybe from a banker | Yes, constantly |

Avoid Appocalypse: Tips for Choosing the Right Financial App

Finding the right app to manage your finances doesn’t have to be a wild goose chase. You just need to focus on a few key features to dodge any financial mishaps. Start by looking for an app that offers easy-to-understand visualizations. Buckets of numbers are no fun, but colorful charts and graphs can make tracking your spending a breeze. Also, make sure the app has budgeting features that can help you set and stick to your goals. It’s like having a personal finance coach in your pocket — minus the whistle.

You’ll also want to check out the app’s security features. No one wants their hard-earned cash to end up in hacker heaven. Look for apps with two-factor authentication and data encryption. When in doubt, a quick trip to user reviews can reveal a lot about an app’s performance. Here’s a quick breakdown of must-have features to make your choice easier:

| Feature | Why You Need It |

|---|---|

| Easy Visualizations | Helps you quickly grasp your financial status |

| Budgeting Tools | Makes goal setting and tracking easier |

| Security Measures | Protects you from potential cyber threats |

| User Reviews | Offers real-world insights into app performance |

Don’t Swipe Left on These Tips: Making the Most of Your Financial App

The world of financial apps is bigger and better than ever, but how do you make the most of these digital wonders? First off, customize your notifications. You don’t want your phone buzzing every minute, so tweak those settings to alert you only about important stuff: bill reminders, low balances, or suspicious activities. Trust us, the last thing you want is to miss a real emergency because your app keeps pinging you about $3 coffee purchases.

Another tip is to take advantage of budgeting tools. These nifty features can help you track spending and save more without major effort. For instance, many financial apps offer categories like groceries, entertainment, and dining out. The goal is to make it fun, so think of it as a game to see if you can beat your last month’s spending! Plus, some apps allow you to set saving goals which can make saving feel like a personal victory. Look at it this way: the more you save, the more you have for that spontaneous trip or new gadget.

| Tip | Benefit |

|---|---|

| Customize Notifications | Avoids unnecessary distractions |

| Use Budgeting Tools | Helps track and manage spending |

| Set Saving Goals | Makes saving more engaging and fun |

Q&A

Q&A:

Q: What’s the big deal about financial apps anyway? Aren’t spreadsheets enough?

A: Ah, the humble spreadsheet. It’s like the Swiss Army knife of finance: trusty, sharp, and often the culprit of many ”I forgot to save” tragedies. Financial apps, however, are the Ferraris in the garage of your financial life. They automate those monotonous tasks, help track expenses in real-time, and can even provide insights as if they have some kind of financial crystal ball. So, yeah, they’re a pretty big deal compared to our beloved yet archaic spreadsheets.

Q: Are these financial apps really safe? I’ve got trust issues, you know.

A: Good news! Your trust issues are somewhat justified, but financial apps are like that friend who never forgets your birthday – they’re built on trust. Most reputable financial apps use bank-level security, which means they are more secure than your roommate’s Wi-Fi network (you really should change that password from ‘password123’). Look for apps with strong encryption, two-factor authentication, and those that are backed by reputable financial institutions. Remember, reading user reviews can also be a good sanity check.

Q: Cool, but are there options for financially-challenged individuals such as myself?

A: Absolutely! Financial apps cater to all kinds of wallet sizes – from the minimalist’s thin billfold to the CEO’s fat money clip. Plenty of apps are free and come with no strings attached, apart from expecting you to, you know, use them. They offer budgeting tools, expense tracking, and even bill reminders to prevent those “Oops, forgot to pay that” moments. A little financial TLC without costing you a dime!

Q: So, which financial app should I use? There are like a million out there!

A: True, the financial app market is crowded, like a Black Friday sale but without the panic-induced elbow jabs. The best app for you depends on your needs. Are you a budgeting newbie? Apps like Mint have your back. Need to invest but scared of Wall Street jargon? Robinhood’s got your six. Want to save without feeling the pinch? Try Digit or Qapital. Think of it like dating apps for your money – swipe right for the one that suits your financial personality.

Q: Okay, but will using these apps turn me into a financial guru overnight?

A: If only it were that easy! While financial apps are powerful tools, they aren’t magic wands or time machines – you won’t wake up as Warren Buffet. They can guide, remind, and educate you, but at the end of the day, you still need to do the legwork (or finger work, in this case). Regularly checking in, setting goals, and staying committed to your financial health – that’s the secret sauce, my friend.

Q: Final thoughts on embracing the financial app revolution?

A: Embracing financial apps is like stepping into the 21st century and leaving your financial worries in the dusty past. They can simplify complex tasks, keep you on track, and might even make managing money feel a bit like a game (without the annoying in-app purchases). So go ahead, dive in, find the app that suits you, and let your financial phoenix rise!

There you have it! Financial apps aren’t just a fad; they’re your new pocket-sized, digital financial advisors. Enjoy the ride, and may your finances flourish with as little effort as possible!

In Conclusion

And there you have it, folks—the wild and wonderful world of financial apps. They’re like having a pocket-sized financial advisor who never sleeps, never judges you for that extra latte, and knows exactly where all your pennies are hiding. Whether you’re a savvy investor, a budgeting newbie, or someone who wants to get their financial house in order without breaking a sweat, there’s a financial app out there with your name on it.

So go ahead, dive into the app store and explore your options. Just remember to look up from your phone occasionally—you know, to make sure you’re not walking into traffic while checking your stock portfolio. With the right app, a little bit of tech-savviness, and maybe some good old-fashioned luck, you’ll be well on your way to mastering the art of money management. Who knows? Your bank account might just thank you with a big smiley face emoji. Happy app-ing!

I am continuously looking online for posts that can facilitate me. Thx!

Thank you, Short Hairstyles, for your kind words! I’m glad you enjoyed the post and found the subject interesting. Financial apps are indeed changing the way we manage our money, making things more convenient. Feel free to share any thoughts or insights you have on the topic – I’d love to hear them!