In a world where you can order a pizza with extra cheese and track the delivery driver’s every move on your smartphone, it’s safe to say that technology has infiltrated almost every aspect of our daily lives. Yet, while we can summon a ride with a tap or ask our smart speakers burning questions like ”Why do cats purr?”, one area has been lounging in the analog past for far too long—financial planning. Enter the virtual financial advisor, your new digital best friend in the quest for fiscal nirvana. These tech-savvy wizards are here to shake up the world of money management, making it as easy—and dare we say, as fun—as binge-watching your favorite Netflix series. So, buckle up as we dive into how these virtual virtuosos of finance can add some serious swagger to your financial future.

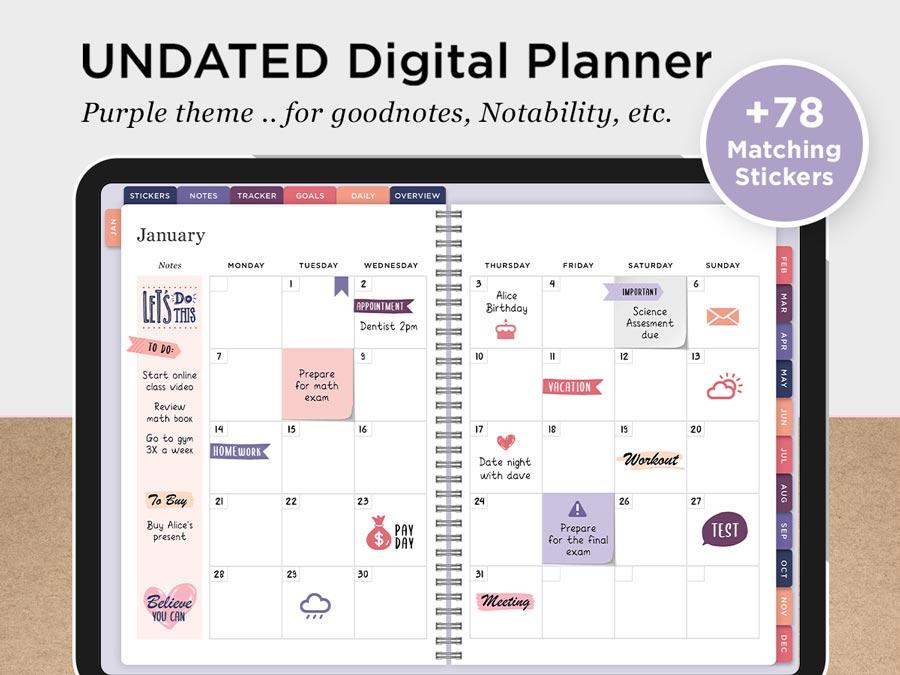

A New Era with A Digital Planner: Say Goodbye to Face-to-Face Awkwardness

Are you tired of those awkward face-to-face meetings where you feel like you’re on the spot, trying to remember every single financial detail? Virtual financial advisors are here to save the day. With just a few clicks, you can get expert advice without ever leaving your sofa. Plus, you can say goodbye to those infernal paper stacks and hello to real-time updates and transparency. No more guessing what your advisor is scribbling down—it’s all there in black and white on your screen!

Here’s what’s cool about switching to digital planning:

- 24/7 Availability: Financial advice at your fingertips, even at 3 AM.

- Cost-Effective: Save money on consultations and coffee shop meetings.

- Data Security: Safeguard your info with top-of-the-line encryption.

- Eco-friendly: Less paper, more trees. 🌲

| Traditional | Virtual |

|---|---|

| Paper piles | Digital documents |

| In-person meetings | Video calls |

| Fixed hours | Flexibility |

So why stick to outdated methods? Make your life easier, greener, and a lot more comfortable by embracing the virtual world for your financial planning needs.

Your Money, Your Sofa: Personalized Financial Advice Without Pants

Imagine getting top-notch money advice while lounging on your sofa in your comfiest pajamas—that’s what virtual financial advisors offer! It’s like having a financial genie who’s just a few clicks away. Whether you want to save for a vacation, invest wisely, or manage debt, they have got you covered. Plus, they tailor their recommendations to fit your unique needs and goals. No need to iron a shirt or even comb your hair—just sit back, relax, and get personalized guidance.

Here’s what makes virtual financial advising an absolute game-changer:

- Convenience: Say goodbye to commuting and waiting rooms.

- Personalization: Get advice that’s custom-fit to your financial situation.

- Accessibility: Reach out to your advisor anytime, anywhere.

- Affordability: Often less costly than traditional, face-to-face consultations.

| Feature | Traditional Advisors | Virtual Advisors |

|---|---|---|

| Convenience | Low | High |

| Personalization | Medium | High |

| Accessibility | Low | High |

| Cost | High | Low |

Data-Driven Decisions: The Algorithms That Care More Than Your Uncle Fred

Imagine this: A virtual financial advisor uses complex algorithms to analyze your financial habits and opportunities. Unlike your Uncle Fred, who might offer questionable investment tips at family cookouts, these algorithms are driven by hard data. They look at your spending patterns, income flow, and even your risk tolerance to create personalized financial plans. This means you get advice based on facts and figures, not on who shouted the loudest during Thanksgiving dinner.

Here are a few things these smart algorithms can do:

- Track your daily expenses and suggest areas to cut down

- Analyze market trends to recommend the best stocks and bonds

- Estimate your retirement needs based on current savings

| Task | Your Busy Uncle | Virtual Advisor |

|---|---|---|

| Investment Tips | Hot stock tips he heard from a friend | Data-driven analysis of market trends |

| Expense Tracking | Makes you write it down in a notebook | Real-time tracking and suggestions via app |

| Retirement Planning | ‘Save a lot and hope for the best!’ | Detailed projections and milestones |

Instant Gratification: How to Hit Financial Milestones Without Breaking a Sweat

Imagine hitting your financial milestones while sipping a margarita on the beach! With virtual financial advisors, you can achieve your goals effortlessly. These savvy digital wizards utilize cutting-edge technology to create personalized financial plans, automate investments, and offer round-the-clock advice, leaving you more time for life’s pleasures. No stuffy offices or mountain of paperwork here—everything’s available right on your smartphone.

Some perks you’ll enjoy:

- Customized Plans: Tailored strategies that align with your goals and risk tolerance.

- 24/7 Access: Financial advice and support whenever you need it, even during those 3 AM snack breaks.

- Cost Efficiency: Lower fees compared to traditional advisors, saving you money while you make money.

| Perk | Benefit |

|---|---|

| Customized Plans | Strategies designed just for you |

| 24/7 Access | Advice anytime, anywhere |

| Cost Efficiency | Lower fees, more savings |

Q&A

Q&A:

Q: What exactly is a virtual financial advisor?

A: Picture a financial guru who lives in your computer—or on your smartphone, if we’re being modern. They offer financial advice through the magic of the internet, using cost-effective-approach-to-mental-health-for-millennials/” title=”Telehealth: A Cost-Effective Approach to Mental Health for Millennials”>video calls, chat, and fancy algorithms to guide your money choices. It’s like having a money-savvy best friend who never raids your fridge.

Q: How can a virtual financial advisor really help me with my finances?

A: Great question! Virtual financial advisors can create personalized financial plans, help with investments, manage retirement funds, and even provide budgeting tips. They take the guesswork out of ”Do I really need that third streaming service?” Spoiler: Probably not.

Q: Are virtual financial advisors just for tech-savvy millennials?

A: Not at all! They’re for anyone who has a Wi-Fi connection and a dream. Whether you still think “the cloud” is just for weather forecasts or you’re coding your own apps, virtual financial advisors are designed to be user-friendly. They might even throw in a sprinkle of tech support for good measure.

Q: What are the main benefits of using a virtual financial advisor over a traditional one?

A: Convenience tops the list! Imagine getting financial advice in your PJs. Virtual advisors are also usually more economical since they skip the overhead costs of fancy offices. Plus, they often use advanced software to provide up-to-the-minute financial insights, so you always know if you should buy that avocado toast… or, you know, a house.

Q: But can they really replace human interaction?

A: Let’s be real, sometimes you need face-to-face time to discuss your intention to drop everything and start an alpaca farm. Many virtual advisors offer video consultations, so you can still see a human face—they’re just not able to reach over and slap your wrist when you propose dubious investments.

Q: Will a virtual financial advisor secure my personal data?

A: Absolutely! These advisors are well-versed in the art of digital security—think Fort Knox but with more encryption and fewer gold bars. They use robust security measures to ensure your data remains as private as the fact that you still have Beanie Babies in the attic.

Q: Do virtual financial advisors provide investment advice?

A: They sure do! They’ll help you navigate the stock market, bond funds, and even nudge you away from investing in your cousin’s “can’t-miss” cat café idea. They use state-of-the-art algorithms to suggest investment opportunities that align with your financial goals. So, go ahead and entrust them with your moolah while you binge-watch that new series.

Q: Are there any downsides to using a virtual financial advisor?

A: Every rose has its thorn, right? The main downside is that if you prefer face-to-face meetings where you can dissect next quarter’s financial strategy over a cup of chamomile, you might miss the in-person camaraderie. Also, some folks may be wary of technology—yes, even in this day and age.

Q: How do I choose the right virtual financial advisor?

A: Start by considering your financial goals and looking for advisors with strong credentials and good reviews. It’s like choosing a restaurant—do your homework and listen to fellow diners’ (err, investors’) experiences. Make sure their platform is user-friendly and offers the services you need. Compatibility is crucial; after all, you wouldn’t marry someone without at least checking their Yelp reviews.

Q: What’s the final takeaway on virtual financial advisors?

A: Virtual financial advisors are here to revolutionize your financial planning with convenience, cost-effectiveness, and high-tech solutions. They may not save you from every questionable financial decision (looking at you, neon fanny pack collection), but they’ll certainly make navigating personal finance a whole lot easier—and maybe even a tad enjoyable.

Concluding Remarks

virtual financial advisors are not just another buzzword; they’re here to revolutionize our financial landscapes. They combine the brainpower of a financial whiz with the convenience of your favorite app — without the need for those awkward coffee meetings. So, if you’re tired of wrestling with spreadsheets or just want a financial whisperer on speed dial, maybe it’s time to give virtual financial advisors a spin. After all, your future self might thank you, preferably while lounging on a yacht bought with your expertly managed investments. Happy planning — and may your financial goals be as lofty as the fees you won’t miss!