Money makes the world go ’round—or so the saying goes. Yet, when it comes to teaching kids about money, many parents and educators find themselves at a loss. Should financial literacy be part of the curriculum? How do we even start these conversations without them turning into a snooze-fest or, worse, a source of anxiety? Teaching kids about money isn’t just about dollars and cents; it’s also about fostering a healthy emotional relationship with finances. In this article, we’ll dive into why financial and emotional intelligence should go hand-in-hand and explore practical tips for helping the next generation make smart money moves, all while keeping their mental well-being in check. Ready to turn piggy banks into opportunities for life lessons? Let’s get started!

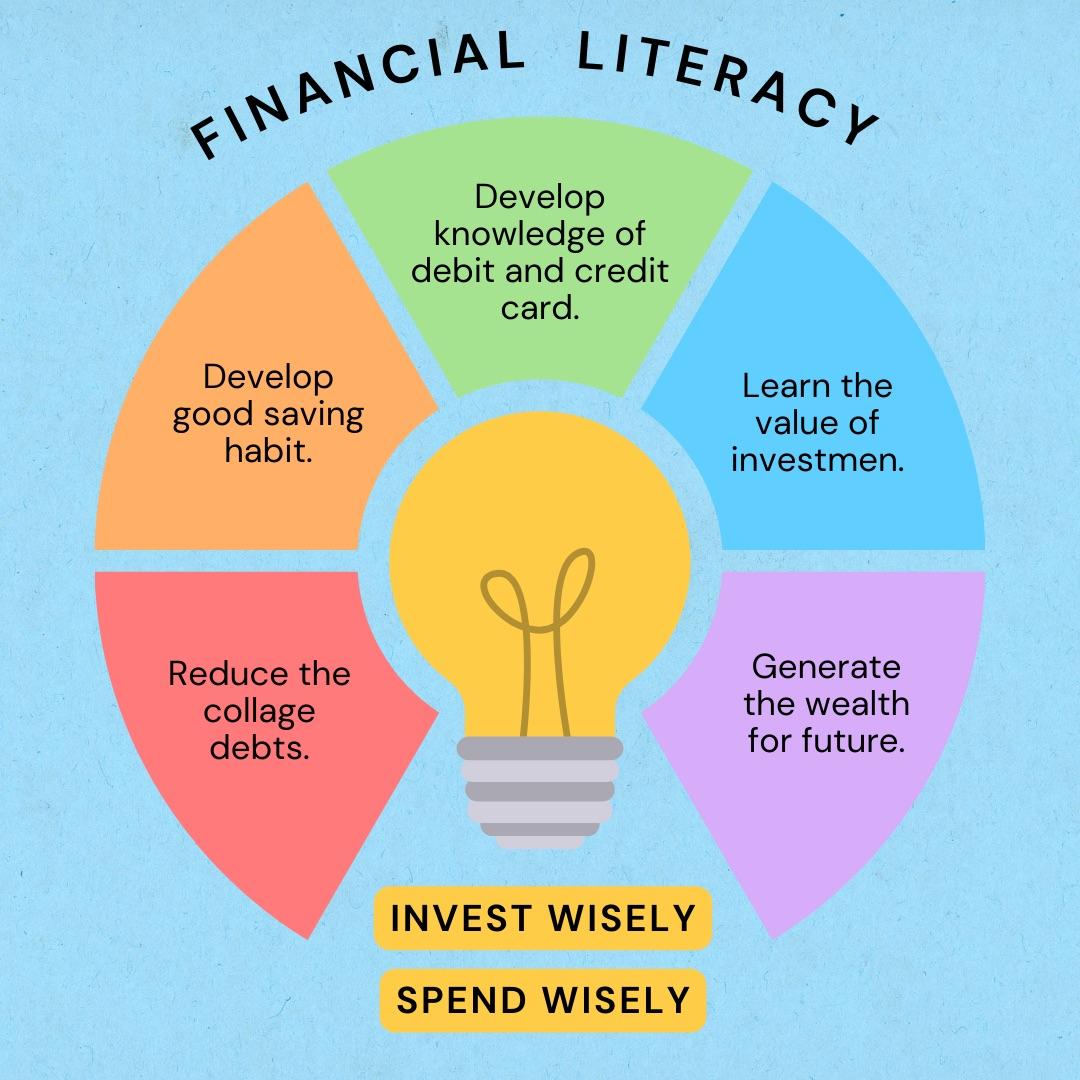

Understanding the Importance of Financial Literacy Early On

Kids who learn about money early tend to make smarter financial decisions as they grow up. Teaching financial literacy from a young age helps children develop critical thinking skills and fosters emotional intelligence. It’s not just about counting coins and bills—it’s about understanding the value of budgeting, saving, and making informed choices. For instance, setting small goals for saving can instill a sense of accomplishment and build confidence in their decisions.

- Budgeting: Creating a simple budget helps kids learn to plan and prioritize spending.

- Saving: Encourage saving a portion of allowances or gifts received.

- Smart Spending: Discuss the difference between needs and wants.

These small steps can be fun and engaging, making the learning process a positive experience. Consider using a clear jar for savings so they can see their progress. You could also set up a basic table to track their goals and achievements:

| Goal | Amount | Progress |

|---|---|---|

| New Toy | $20 | $5 saved |

| Book | $10 | $3 saved |

This visual representation helps kids see the tangible results of their efforts, reinforcing the concepts of saving and delayed gratification.

Engaging Activities to Teach Money Management

Teaching kids about money can be both fun and effective with engaging activities. Consider implementing hands-on experiences like setting up a mock store at home. Kids can use play money to buy and sell items, learning about prices, budgeting, and the concept of value. You can also introduce allowance and chores: give your child a small weekly allowance in exchange for completing household tasks. This practice not only teaches the value of earning money but also instills responsibility and work ethic.

Incorporate interactive games into your lessons. Online platforms and board games designed for financial literacy can make learning enjoyable. For a creative twist, involve the whole family in a ‘Family Financial Night’ where you can play money-related games or even have a bake sale where everyone has to manage their own mini-business. Don’t forget to celebrate their small wins with incentives like reward charts. Here’s a simple example:

| Task | Reward |

|---|---|

| Completing chores on time | $5 weekly allowance |

| Savings goal achieved | Special outing |

- Play Store: Practice buying and selling with play money.

- Allowance System: Earn money by completing chores.

- Online Games: Use interactive platforms for fun learning.

- Family Financial Night: Incorporate money-related games with family.

Encouraging Healthy Emotional Responses to Money

Kids often pick up on emotional cues from their parents, including how they feel about money. This makes it essential for parents to discuss and model healthy emotional responses to financial matters. Start by talking to your kids about how different emotions can affect decisions involving money. Use everyday experiences like grocery shopping or saving pocket money as teachable moments. Through these discussions, explain the difference between needs and wants and how sometimes waiting for something can be beneficial.

Encouraging a positive attitude towards money can be achieved using simple activities. Here are a few ideas:

- Talk openly about your own feelings regarding money.

- Celebrate milestones, like reaching a savings goal.

- Introduce the concept of charity and the joy of giving.

- Use games or apps that make learning about money fun.

| Activity | Benefit |

|---|---|

| Starting a small savings jar | Teaches patience and goal-setting |

| Playing finance-related board games | Makes learning about money enjoyable |

| Involving kids in budgeting for family outings | Provides practical experience with money management |

| Volunteer for a charity event together | Instills a sense of social responsibility |

Simple Techniques for Building Financial Responsibility

One great way to help kids develop financial responsibility is through practical experiences. Give them a small, consistent allowance, and let them manage how they spend and save it. It may be tempting to step in and help when they want to buy something frivolous, but let them make mistakes—they’ll learn valuable lessons from the experience. Additionally, setting up a simple money jar system—labeled “Spend,” “Save,” and “Give”—can visually and tangibly teach them about budgeting and priorities.

Open conversations about money are also crucial. Share your own financial decisions and thinking with your kids, like why you choose to save for certain things and how you budget. Get them involved with everyday tasks like grocery shopping. Teach them to compare prices and stick to a list. You can use simple tables to make comparisons easy and fun. For example:

| Item | Brand A | Brand B |

|---|---|---|

| Milk (1L) | $1.50 | $1.75 |

| Bread | $2.00 | $1.80 |

Q&A

Q&A:

Q: Why is it important to teach kids about money at an early age?

A: Teaching kids about money early helps them develop essential financial skills that can lead to better financial decisions in the future. By understanding money basics like saving, budgeting, and spending wisely, kids can build a strong foundation for financial stability. Additionally, learning about money early can also enhance their emotional intelligence by teaching them the value of hard work, patience, and delayed gratification.

Q: What are some simple ways to introduce money concepts to young children?

A: You can start by giving them a small allowance and encouraging them to manage it. Show them how to save a portion of it, spend wisely, and perhaps even donate a bit. Simple activities like setting up a savings jar or playing pretend store can make money concepts fun and understandable. Books and educational games about money can also be great tools.

Q: How can parents help foster emotional intelligence through financial education?

A: Parents can help by discussing the emotional aspects of money, like how it feels to save up for something special or the satisfaction of giving to others. Encouraging kids to set goals and work towards them can teach perseverance and responsibility. It’s also crucial to talk about disappointments and setbacks, helping kids understand that it’s okay to make mistakes and learn from them.

Q: Are there any common mistakes parents make when teaching their kids about money?

A: A common mistake is shielding kids from all money-related discussions. While it’s important to keep things age-appropriate, involving kids in basic financial planning and decision-making can be very beneficial. Another mistake is not setting a good example; kids learn a lot by observing their parents’ financial habits, so it’s important to model good behavior.

Q: How can schools complement what kids are learning about money at home?

A: Schools can play a significant role by integrating financial literacy into the curriculum. Programs that teach budgeting, saving, investing, and charity can be incredibly valuable. Interactive activities such as mock stock markets, business projects, or simulations can make learning about money engaging and practical.

Q: What role does technology play in teaching kids about money today?

A: Technology can be a fantastic aid in teaching kids about money. There are numerous apps designed to teach financial literacy through games and interactive lessons. These tools can make learning about money fun and accessible. Additionally, online banking and digital payments offer real-world applications where kids can practice and understand modern financial transactions.

Q: Any tips for making financial education a part of everyday life?

A: Yes! Try to incorporate learning moments into daily routines. This could be as simple as involving kids in grocery shopping to understand budgeting, or explaining how bills and payments work when they see everyday transactions. Regularly reviewing their savings and discussing financial goals can also keep the conversation ongoing and relevant.

Q: How can parents encourage their children to save money?

A: Parents can encourage savings by setting goals together and creating visual aids like a savings chart or using a clear jar so kids can see their money grow. Matching their savings or providing small rewards for reaching savings milestones can also be motivating. Additionally, explaining the benefits of saving for future larger rewards can help them understand its value.

Concluding Remarks

And there you have it – a guide to helping your kids become financially savvy and emotionally intelligent. It might seem like a lot to take on, but remember, it’s a journey you’re taking with them. Small steps, consistent conversations, and leading by example can make a huge difference. So, start today, have fun with it, and watch your kids grow into financially responsible and emotionally intelligent adults. Here’s to raising the next generation of smart, savvy, and balanced individuals! Happy teaching!

Thank you, Fashion! I’m glad to hear that our articles are helpful to you. It’s wonderful to know that you enjoy the topics we cover. If you have any specific topics you’d like us to explore in the future, feel free to let us know!

Thank you for sharing your insights, Hairstyles. It’s indeed a complex issue many face, especially the younger population, as they often prioritize other expenses over health insurance. Your point about the gap in insurance coverage for students, the self-employed, and the jobless due to high costs is very relevant. This highlights the importance of financial education, like the concepts discussed in the post, to help individuals of all ages make informed decisions about managing their finances, including the significance of health insurance. Thank you for contributing to this important conversation!

Thank you so much for your kind words! I’m delighted to hear that you’re planning to start your own blog. It’s a wonderful journey, and I’m happy to share some insights to help you get started.

1. **Platform Choice**: Starting with a free platform like WordPress.com can be a great way to get your feet wet. It allows you to explore the blogging world without any financial commitment. Once you find your footing and audience, you can consider upgrading to a paid plan for more customization options and your own domain.

2. **Content Focus**: Identify your niche or the topics you’re passionate about. Consistency in content will help establish your brand and attract a dedicated audience.

3. **Engagement**: Interact with your readers through comments and social media to build a community around your blog.

4. **Learning Resources**: There are plenty of free resources and forums out there to help improve your writing and blogging skills. Take advantage of them!

5. **Patience and Persistence**: Growing a blog takes time, so be patient and persistent. Focus on creating quality content and the rest will follow.

Good luck with your blogging journey! If you have any more questions, feel free to ask.