We’ve all been there—you walk into the doctor’s office, hand over your insurance card, and then brace yourself for the inevitable mental math gymnastic routine when that bill arrives. Did I just pay for healthcare or did I subsidize the weekends of an entire hospital staff?! Health Savings Accounts, or HSAs, might just be your ticket to navigating this labyrinthine healthcare finance system with a little less stress and a smidge more dough in your pocket.

Picture this: an account that not only helps you pay for medical expenses pre-tax but also operates as a stealthy retirement weapon if wielded properly. It’s like finding out your pet goldfish is secretly a money-managing genius. In this article, we’ll dive into the ins and outs, ups and downs, and twists and turns of HSAs, all while keeping things light enough so you won’t need an extra visit to the cardiologist. So, grab your proverbial safety goggles and let’s dissect the fascinating anatomy of Health Savings Accounts—scalpel not required!

What the Heck is an HSA and Why Should You Care?

Ever heard the term HSA thrown around and wondered if it was some new fashion trend? Nope, it stands for Health Savings Account – and unlike bell-bottom jeans, it’s actually pretty useful! Think of it as a magical piggy bank where you deposit tax-free money specifically for medical expenses. That means less out-of-pocket cash for doctor’s visits, medications, and even those surprise medical bills that pop up when you’re least expecting them. It’s like having a financial first-aid kit, minus the band-aids and weird smelling ointments!

So, why should you care? Well, apart from the obvious tax savings (which, let’s face it, make everyone do a little happy dance), there are a bunch of other perks too. Here are some highlights:

- Triple Tax Benefits: Contributions are tax-deductible, growth is tax-free, and distributions for qualified medical expenses are tax-free.

- Roll Over Funds: Unlike your vacation days, the money in your HSA rolls over year after year.

- Investment Opportunities: Yeah, you heard that right. You can invest the funds and watch them grow – it’s like planting a money tree in your backyard!

| Feature | HSA | Traditional Savings |

|---|---|---|

| Tax Deductible | ✔️ | ❌ |

| Roll-Over Balance | ✔️ | Sometimes |

| Investment Options | ✔️ | Limited |

In short, having an HSA is like having a Swiss Army knife for your healthcare expenses. It’s flexible, tax-advantaged, and can save you a ton of money in the long run. Plus, you can show off your financial savvy at dinner parties (if that’s your kind of thing). So, grab your metaphorical piggy bank and start saving!

Crunching the Numbers: Making Your HSA Work for Your Wallet

When it comes to making your Health Savings Account (HSA) work for you, it’s like finding money under your couch cushions, but better. First rule of thumb is to always max out your contributions if you can. The IRS sets limits on how much you can contribute each year, and taking full advantage of this is like having a golden ticket to savings town. Here’s a quick rundown of how much you can stash away:

- Individuals: $3,650/year

- Families: $7,300/year

- Catch-Up Contributions (age 55 and older): An extra $1,000/year

Just imagine your HSA as a calorie-free savings smoothie that gets sweeter with every sip. Not only do contributions lower your taxable income, but any growth or earnings from those contributions are also tax-free if used for qualified medical expenses. That means from Band-Aids to brace faces, your medical costs are getting a major tax-boost discount. Need some motivation? Check out this quick glance comparison of potential savings:

| Scenario | Potential Savings |

|---|---|

| Annual $1,000 Contribution | $200 in Tax Savings |

| Max Individual Contribution | $730 in Tax Savings |

| Max Family Contribution | $1,460 in Tax Savings |

So, dive into that savings smoothie and let your HSA work its magic. Who knew that paying for meds could be as rewarding as hunting for couch change?

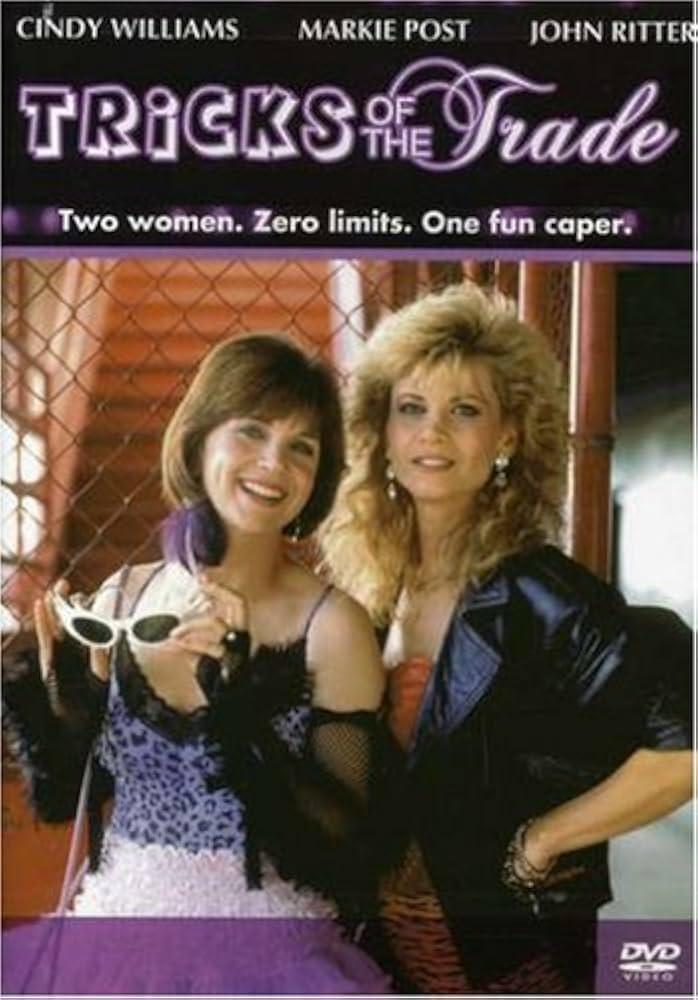

Tricks of the Trade: Maximizing HSA Benefits Without Losing Your Mind

Unlock the magical world of Health Savings Accounts (HSAs) with these insider tricks that will have you juggling your finances like a pro, and all without needing a PhD in personal finance! First up, contribute the maximum amount allowed each year. Why? Because the more you stow away, the more you save on taxes, and who doesn’t love less taxes? Here’s a cheat sheet to make your contributions work like a charm:

- Individual: Up to $3,850 per year

- Family: Up to $7,750 per year

- Catch-Up Contributions: An extra $1,000 if you’re 55 or older

Next, let’s talk about those hidden investment opportunities within your HSA. Did you know your HSA can double as a mini retirement fund? Yes, you heard it right! Once your account balance hits a certain threshold, you can start investing in stocks, bonds, or mutual funds. Picture this: while your HSA sits there, it’s also growing faster than your waistline during the holidays. Here’s a quick comparison table to show how your money could amplify:

| Scenario | Savings After 20 Years |

|---|---|

| Regular Savings | $20,000 |

| Hot Investment | $50,000 |

From Contributions to Withdrawals: Navigating the HSA Roller Coaster

Imagine your Health Savings Account (HSA) as a financial theme park filled with thrilling rides. The first ride you’ll experience? Contributions, where the excitement begins. These are deposits you make into your HSA, often done automatically through payroll deductions or manual deposits. Each time you contribute, your account grows tax-free! It’s like adding more passengers to your ride for extra fun. Plus, if you’re lucky enough, some employers might even add a few tickets (read: dollars) to your park.

- Pre-Tax Contributions: Your deposits come straight from your paycheck, reducing your taxable income.

- After-Tax Contributions: Put money in from your own pocket and later enjoy the joyride of tax deductions during filing season.

But wait, after all those contributions, there’s another thrilling ride: Withdrawals. This is the moment where you can finally use those savings for qualified medical expenses. Think of withdrawals as buying a fast pass that lets you skip the line for medical bills. Eligible expenses range from doctor visits to prescription medications, and yes, even that chiropractor visit after your roller coaster mishap.

| Expense Type | Qualified? |

|---|---|

| Doctor Visits | Yes |

| Prescription Glasses | Yes |

| Gym Membership | Nope! |

So remember, with an HSA, be strategic about your contributions and mindful of your withdrawals to maximize your savings and enjoy the ride!

Q&A

Q&A:

1. So, what exactly is a Health Savings Account (HSA)?

Ah, the ever-mystical HSA. Think of it as a magical piggy bank specifically for your healthcare expenses. It’s like that jar you kept for rainy days, but with more tax benefits and fewer nickels.

2. Who can join the HSA club?

You need a high-deductible health plan (HDHP) to be granted access to this exclusive club. No secret handshakes required—just a minimum deductible and maximum out-of-pocket limits that meet IRS guidelines. HDHP in, HSA out!

3. What’s so special about contributions?

Glad you asked! Contributions to your HSA are tax-deductible. It’s like getting a discount from Uncle Sam, but he doesn’t even know he gave it to you.

4. Can I use my HSA for anything, like buying a pet llama?

Nice try! While owning a llama might be a dream, HSAs are specifically for qualified medical expenses—think doctor visits, prescriptions, and oddly enough, chiropractor bills. Keep your llama acquisitions elsewhere.

5. Can I take money out whenever I want?

Yes, but with a caveat. If you withdraw money for non-medical expenses before age 65, you’ll face a hefty 20% penalty plus taxes. After 65, it’s more like a normal retirement account. So, wait on the llama.

6. What happens if I don’t use all my money by the end of the year?

Here’s the beautiful part: it rolls over! Unlike your leftover vacation days, every cent in your HSA stays until you need it, whether that’s next year or in 30 years when you’ve finally retired (and can now afford multiple llamas).

7. How does investing with an HSA work?

Yes, you can invest your HSA funds—you read that right. Think of your HSA as morphing into a mini 401(k) for your healthcare. Just make sure to read the fine print and understand the investment options, lest your money ends up riding the volatility llama.

8. Any contribution limits I should be aware of?

Indeed, there are limits. For 2023, the maximum contributions are $3,850 for individual coverage and $7,750 for family coverage. If you’re 55 or older, you get to add an extra $1,000 because age has its privileges.

9. Can I use my HSA to pay premiums for my health insurance?

Nice try again, but no. HSAs generally can’t be used for insurance premiums. There are special exceptions, like long-term care insurance, COBRA coverage, and health coverage while you’re receiving unemployment.

10. Is an HSA worth having if I’m young and healthy?

Absolutely! Consider it future-you’s superhero. The funds you save now grow tax-free, rolling over year’s end, while future-you can use them even decades later. And by then, you can surely afford that llama farm you’ve always dreamt of.

11. Can HSAs be passed on when I kick the bucket?

Yes, HSAs can be passed on to a spouse without incident. For non-spousal inheritors, the HSA becomes taxable income. So, adding “HSA heir” to your dating profile might not win you extra points, but it’s good to know.

whether you’re young, older, or somewhere in between, mastering the HSA game can save you money, grow your investments, and give you peace of mind. Just remember, HSAs aren’t for llamas—but they are for smart, future-focused individuals like yourself!

Key Takeaways

navigating Health Savings Accounts (HSAs) may initially feel like deciphering a secret code that only accountants and mystics understand. But hey, now you’ve got the decoder ring! By understanding their ins and outs, HSAs can transform from a bewildering three-letter acronym into the superhero of your financial planning. Whether you’re all about tax savings, eyeing future medical expenses like a hawk, or just like the idea of having a financial safety net that grows as you do, HSAs are your trusty sidekick. So, go forth and wield your newfound HSA knowledge like a pro—your future (financially secure and health-conscious) self will high-five you.