In the ever-evolving landscape of personal finance management, the debate between digital planners and traditional budgeting methods has garnered significant attention. As technology continues to transform our daily lives, many individuals find themselves at a crossroads, deciding whether to adopt sophisticated digital tools or remain loyal to conventional paper-based systems. This article aims to dissect the nuances of both approaches, evaluating their efficacy, user experience, and practicality. By examining the strengths and limitations of digital planners and traditional budgets, we seek to provide a comprehensive analysis that aids in determining the superior method for maintaining financial health and achieving economic goals.

Comparative Analysis: Core Features of Digital Planners and Traditional Budgeting Tools

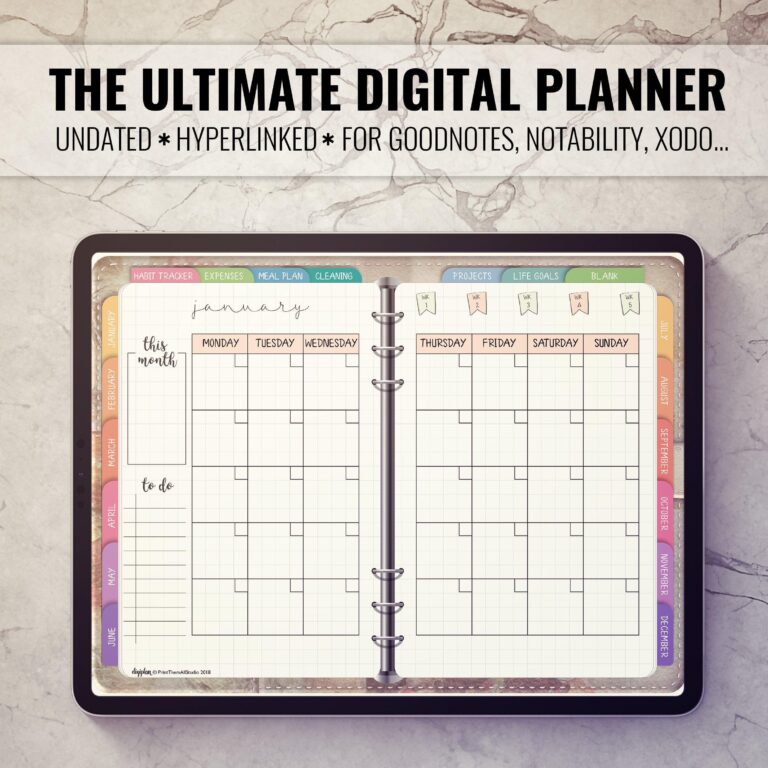

When examining digital planners, you will find robust features such as cloud synchronization, real-time updates, and automation capabilities. These tools offer numerous advantages for those tech-savvy users who appreciate immediate accessibility across various devices. The flexibility and adaptability of digital planners allow users to tailor their budgeting experience extensively. Key features often include:

- Automatic Expense Tracking

- Customizable Budget Templates

- Detailed Analytics and Reports

- Shared Access for Family Planning

- Visual and Interactive Charts

In contrast, traditional budgeting tools such as pen and paper or spreadsheet-based systems offer simplicity and tangibility. These tools do not rely on technology, which can be a significant advantage for individuals who prefer a hands-on approach. Though they lack the automation and interactivity of digital planners, traditional tools benefit from being distraction-free and straightforward. Essential features include:

- Manual Entry for All Transactions

- Custom-Designed Budget Layouts

- No Reliance on Battery Life or Internet

- Highly Personalizable Formats

- Ease of Use with Minimal Learning Curve

User Experience and Accessibility: Evaluating Digital and Traditional Approaches

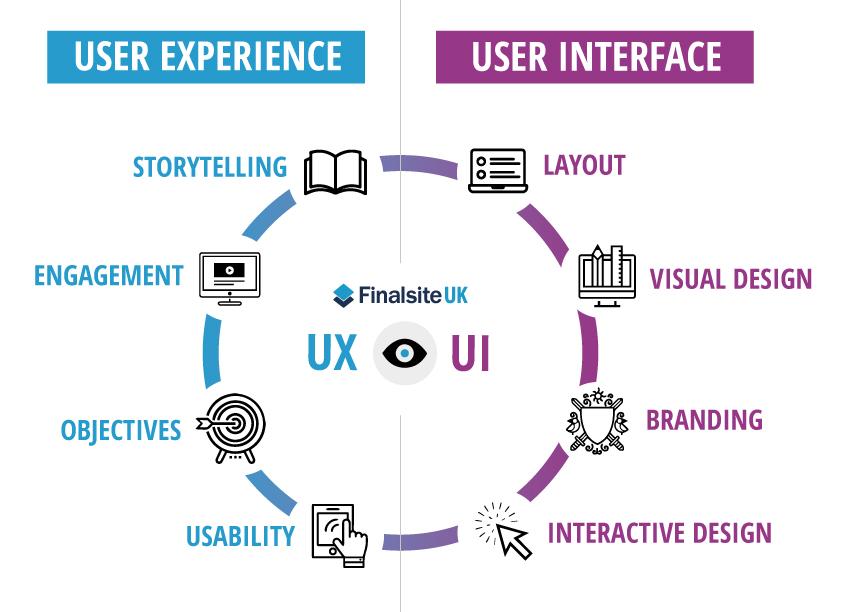

When it comes to usability, digital planners provide a dynamic and interactive interface, offering features like automatic calculations, expense tracking, and goal setting. They enable real-time updates and convenient reorganization, making budgeting more efficient. On the other hand, traditional budgeting methods like pen and paper or physical planners rely heavily on manual entries, which might be comforting for those who prefer a tactile, hands-on approach. While digital planners often come with adjustable visual themes and sync options, traditional planners offer a straightforward user experience without the need for tech-savviness.

Accessibility-wise, digital planners have the edge in terms of adaptability and convenience. They can be accessed from multiple devices, offering cloud synchronization which ensures that your budgeting data is always up-to-date, no matter where you are. Digital tools often come with screen reader compatibility and customizable font sizes, making them more inclusive for users with visual impairments. Traditional methods, however, require no electronic devices and can be more accessible in low-tech environments or for individuals who find digital tools challenging to navigate.

| Feature | Digital Planners | Traditional Budgeting |

|---|---|---|

| Interactivity | Highly Dynamic | Manual |

| Accessibility | Customizable, Multi-Device | Universal, Low-Tech |

| Real-Time Updates | Automatic | Nonexistent |

| Learning Curve | Steeper | Shallow |

Cost Efficiency: Assessing the Financial Implications of Each Budgeting Method

When it comes to assessing the financial implications of budgeting methods, both digital planners and traditional methods have their own set of cost factors to consider. Digital planners often come with a one-time purchase cost or subscription fee. Additionally, there might be costs associated with software updates or premium features. On the plus side, digital planners can frequently integrate with other applications, potentially saving money on additional organizational tools. Here are some common costs for digital planners:

- Software purchase or subscription: $5 – $50/year

- Device maintenance or upgrades: Varies

- Internet access: $20 – $100/month

In contrast, traditional budgeting methods usually involve purchasing physical items like notebooks, pens, and folders. While these are typically low-cost, they are recurring expenses. Moreover, there’s often a need for additional storage space, such as shelves or filing cabinets. These can add to the overall cost, not to mention the time spent manually tracking each expense. Here’s a quick glance at the costs associated with traditional methods:

| Item | Cost |

|---|---|

| Notebooks | $1 – $10 |

| Pens | $0.50 – $5 |

| Folders & binders | $2 - $15 |

Implementation Strategies: Action Plans and Best Practices for Effective Budget Management

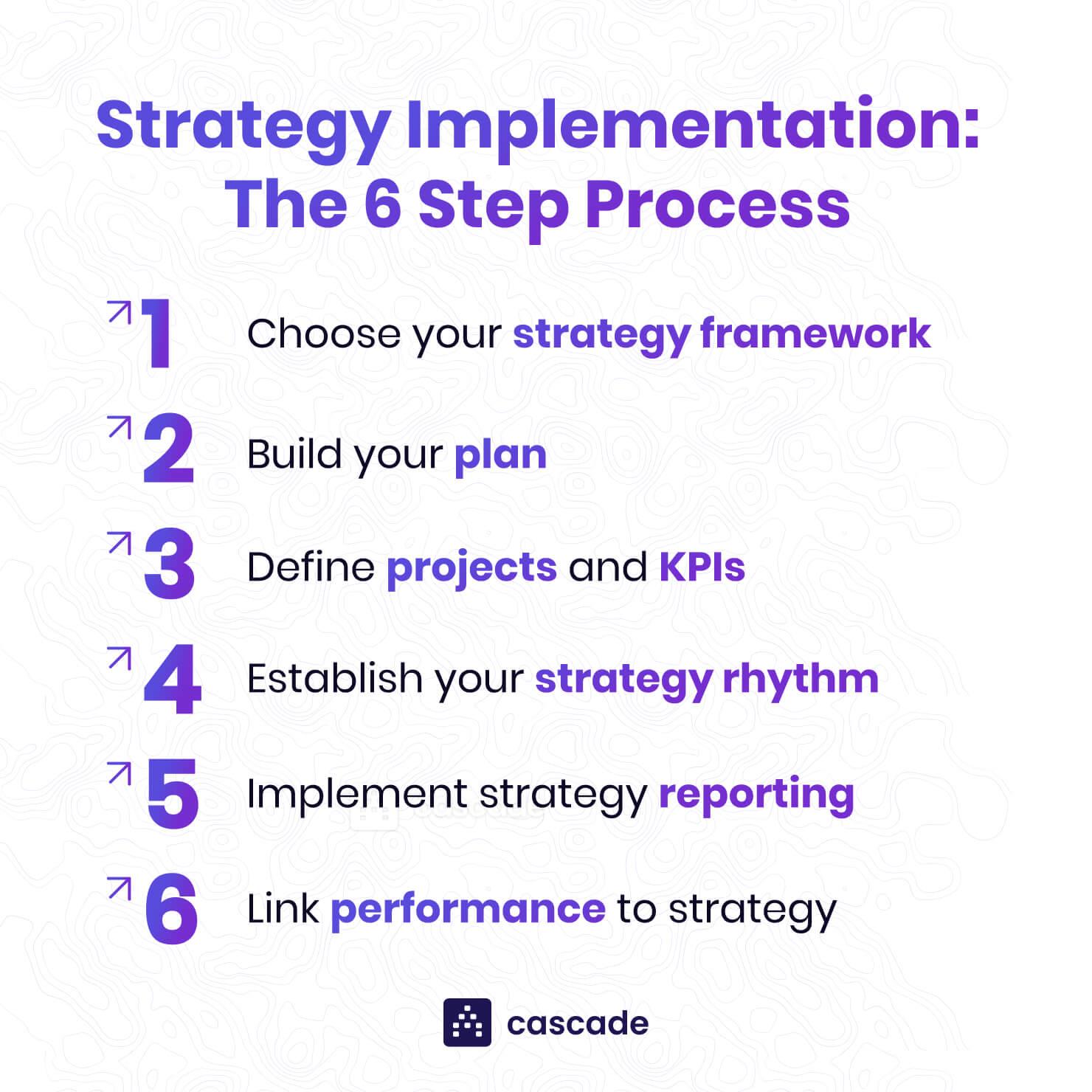

For those looking to streamline their financial processes, consider implementing digital planners. These platforms offer advantages such as real-time updates, automatic tracking, and integration with other financial tools. When planning your budget with digital tools, establish clear financial goals and leverage built-in features like reminders and alerts to stay on track. Evaluate various apps based on user reviews, functionality, and customer support to find one that best meets your needs.

| Digital Planners | Traditional Budgeting |

| Automatic Updates | Manual Entry |

| Cloud Storage | Physical Records |

However, traditional budgeting offers its own set of benefits, particularly for those who prefer hands-on approaches and tangible tracking methods. Start by categorizing your expenses and allocating funds in associated envelopes or folders. This tactile methodology can sometimes lead to a better understanding and discipline in managing finances. Additionally, traditional budgeting doesn’t rely on internet access or electronic devices, thus eliminating technical issues or software updates as potential disruptions.

Q&A

Q&A:

Q: What are digital planners and traditional budgeting methods?

A: Digital planners are software applications or online tools designed to manage financial plans, track expenses, and set budgets. These tools often come with features like automated categorization, alerts, and synched bank information. Traditional budgeting methods typically involve the use of pen-and-paper systems, spreadsheets, or ledger books to manually track and plan financial activities.

Q: How does the cost compare between digital planners and traditional budgeting tools?

A: Digital planners may come with various costs, ranging from free applications with limited features to subscription-based services that offer more comprehensive tools and support. Traditional budgeting methods generally involve minimal to no costs aside from the initial purchase of stationery or spreadsheet software, making them potentially more cost-effective initially.

Q: What are the primary benefits of using digital planners over traditional budgeting methods?

A: Digital planners offer several advantages:

- Automation: They can automatically categorize expenses and generate reports.

- Accessibility: Many are accessible from multiple devices, allowing for real-time updates and collaboration.

- Integration: They often integrate with bank accounts and credit cards, reducing manual data entry.

Q: Are there any advantages to traditional budgeting that digital planners may not offer?

A: Traditional budgeting has its own set of benefits:

- Customization: Users can tailor their budgeting approach without software limitations.

- Tangibility: Physical records can be easier for some individuals to manage and review.

- No Dependence on Technology: Traditional methods are immune to software glitches, data breaches, or hardware failures.

Q: How do digital planners and traditional budgeting methods differ in terms of user experience?

A: Digital planners often provide a user-friendly experience with intuitive interfaces, interactive charts, and real-time tracking. They can also set reminders and alerts to help users stay on top of their finances. Traditional methods, while potentially more cumbersome due to manual data entry, offer a hands-on approach that can be more satisfying and easier to grasp for visual or tactile learners.

Q: In terms of data security, how do both methods compare?

A: Digital planners use encryption and other security measures to protect user data; however, they are still vulnerable to cyber threats and breaches. Traditional budgeting methods, being offline, naturally avoid risks related to hacking and data breaches but can be prone to physical loss or damage from events such as fire or theft.

Q: What type of user might prefer digital planners over traditional budgeting methods?

A: Digital planners are ideal for tech-savvy individuals who appreciate automation, real-time tracking, and accessibility across various devices. They are particularly beneficial for users who prefer minimal manual entry and those who wish to leverage technology for enhanced financial analysis and planning.

Q: Who might benefit more from using traditional budgeting methods?

A: Individuals who favor a tactile approach to financial management or those who are less comfortable with technology might prefer traditional budgeting methods. It is also suitable for users who value customizability and want to avoid potential technological issues.

Q: Can a hybrid approach of using both digital planners and traditional budgeting be effective?

A: Yes, a hybrid approach can leverage the strengths of both methods. For example, a user might use a digital planner for tracking expenses in real time and generating reports, while maintaining a physical ledger or spreadsheet for overall financial planning and long-term goals. This can offer a balance of automation and hands-on involvement.

Q: What is the final verdict on which method is better?

A: There is no definitive answer as to which method is better, as both digital planners and traditional budgeting have their respective strengths and weaknesses. The choice largely depends on individual preferences, comfort with technology, specific financial needs, and personal habits. Whether one prioritizes automation and integration or hands-on customization and tangibility will guide the decision of which method to use.

The Conclusion

the debate between digital planners and traditional budgeting methods is far from settled, with each approach offering distinct advantages tailored to different user preferences and needs. Digital planners stand out for their unparalleled convenience, real-time updates, and integration capabilities, making them particularly suitable for tech-savvy individuals seeking efficiency and automation. Conversely, traditional budgeting continues to appeal to those who value tactile engagement and the tangible aspect of manual tracking, often resulting in a more mindful financial oversight.

Ultimately, the choice between digital and traditional budgeting methods hinges on personal inclination and specific financial goals. As technological advancements continue to shape the landscape, users are encouraged to evaluate their priorities and experiment with both methods to determine the optimal approach for their financial management. The ongoing evolution in this sector promises further innovations, ensuring that regardless of the chosen method, tools for effective budgeting will continue to improve.