Welcome! So, you’re here because you want to decode the mysterious numbers known as your credit score. Excellent move! You’re essentially Indiana Jones with a credit report instead of a whip (although, we’ve heard a decent credit score can help you buy a whip one day if that’s your thing). Whether you’re planning to buy a house, a car, or just want to impress dinner guests with your financial savvy, understanding your credit score is crucial. But fear not, brave explorer, because this guide is tailored just for beginners—no financial jargon that requires a secret decoder ring. So, tighten your seatbelt (if you’re reading this at home, feel free to strap into an office chair for dramatic effect) and get ready to embark on a journey to discover what those three magical digits really mean and how they can impact your life. Spoiler alert: There’s no treasure chest at the end, but achieving a high credit score might just be worth its weight in gold!

What the Heck is a Credit Score and Why Should You Care?

Ever wondered what those mysterious three digits are that seem to hold so much power over your financial life? Yep, we’re talking about your credit score. Think of it as your financial report card. A credit score tells lenders how good you are at borrowing money and paying it back. If you’ve got a high score, you’re like the straight-A student of the finance world. If not, well… let’s just say there’s room for improvement. But don’t worry, even if your score looks more like a roller coaster, there’s plenty you can do to make it shine!

So why should you care? Here’s the deal:

- Interest Rates: The higher your score, the lower your interest rates on loans.

- Loan Approval: A good score boosts your chances of getting that loan for your dream house.

- Credit Cards: Better scores mean better card offers with awesome perks.

- Rental Applications: Landlords love high scores – it shows you’re reliable with payments.

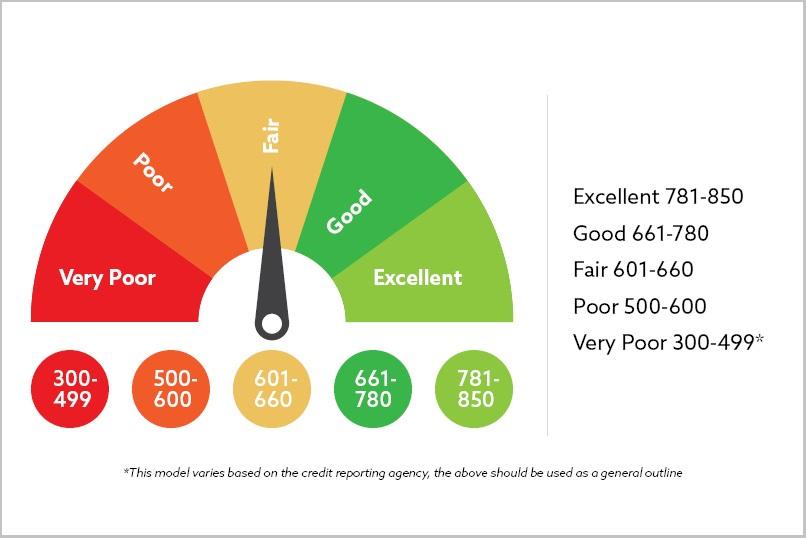

| Score Range | Ratings |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Decoding the Credit Score Matrix: It’s Not Rocket Science, Promise!

Imagine your credit score as the report card of your financial health—minus the looming dread of parent-teacher conferences. It’s a number that tells lenders how trustworthy you are with borrowing money. But hey, it’s not as mysterious as it seems! Your score is primarily shaped by a few key factors, such as payment history, amounts owed, and length of credit history. Think of these as the ingredients in the secret sauce of your financial credibility.

Picture this: you’re cooking up your perfect credit score recipe. Here’s what you need to add:

- Payment History: This is the juiciest ingredient, making up about 35% of your score.

- Amounts Owed: The next biggie at 30%, showing how much credit you’re using compared to your limits.

- Credit History Length: Like a fine wine, older is often better here, and it counts for 15%.

- New Credit: Be careful with this spice! Too much can be a red flag, impacting around 10% of your score.

- Credit Mix: A little variety can make your score tastier, accounting for 10%.

Still with me? Great! Here’s a little table to bring it all together:

| Factor | Percentage |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

Top Secret Tips for Boosting Your Score: Shhh… Don’t Tell the Lenders!

Did you know there are sneaky little moves you can make to spike your credit score without breaking a sweat? Here’s a collection of our top-secret tricks to keep your credit in the spectacular zone. First up, pay your bills on time like your credit score depends on it (because it does!). Missing even one payment can put a nasty dent in your score. Next, keep your credit utilization low. Picture your credit limit like a plate and your spending like a buffet. Don’t stack it too high! Try to use less than 30% of your credit limit if possible.

Another tip: don’t close old accounts. They’re like fine wine; they get better with time! Even if you’re not using them, these old timers help build a longer credit history. Lastly, consider asking for a credit limit increase. If you’ve been a good borrower, lenders might say yes, and this can lower your credit utilization instantly! It’s all about showing those lenders you’re responsible, without actually giving them a head’s up. Here’s a quick summary of what we talked about:

- Pay Bills on Time

- Keep Credit Utilization Low

- Don’t Close Old Accounts

- Ask for Credit Limit Increase

In case you’re wondering, here’s a small cheat sheet:

| Tip | Effect |

|---|---|

| Pay Bills on Time | Prevents score drops |

| Keep Utilization Low | Improves credit availability |

| Keep Old Accounts | Lengthens credit history |

| Request Limit Increase | Lowers utilization instantly |

Oops, I Tanked My Credit Score! Here’s How to Fix It Without a Time Machine

So you’ve managed to turn your once spotless credit score into a disastrous number that feels more like a low-rolling bowling score—not to worry! Even though there’s no DeLorean waiting to transport you back in time to fix your financial mishaps, you can still remedy the situation. Here’s a master plan to get yourself back on track:

- Review Your Credit Report: First things first, snag a copy of your credit report. Think of it as your very own “detective mission” to identify any glaring errors or suspicious activities. Mistakes happen, and you might find incorrect info you can dispute.

- Pay Down Balances: Chip away at your existing debt, especially on those high-interest credit cards. Imagine you’re a woodchuck with a carrot—just keep nibbling away and soon you’ll get to the green.

- Set Up Payment Reminders: Technology to the rescue! Use your phone’s calendar, a financial app, or an old-fashioned sticky note on your fridge to remind you when bills are due.

- Avoid New Credit Applications: Hold off on applying for new credit cards or loans. Every application can ding your score, and it’s like trying to row a sinking boat while drilling holes in the bottom.

| Action | Result |

|---|---|

| Review Credit Report | Easier error detection |

| Pay Down Balances | Lower debt utilization |

| Payment Reminders | On-time payments |

| Avoid New Credit | Prevent score drops |

Q&A

Article Title: Understanding Your Credit Score: A Beginner’s Guide

Q&A Section

Q: What exactly is a credit score?

A: Think of your credit score as the Mona Lisa of financial portraits. It’s a three-digit number (ranging from 300-850) that paints a detailed picture of how trustworthy you are with borrowing money. In essence, it’s a snapshot of your creditworthiness, minus the enigmatic smile.

Q: Why should I care about my credit score?

A: Well, unless you plan to pay for everything in cash like an old-school mob boss, your credit score matters. It influences whether you can get a loan, a credit card, a mortgage, or even a swanky apartment. Plus, treat your credit score right, and it might just reward you with lower interest rates—a win-win!

Q: What factors affect my credit score?

A: Imagine your credit score as a five-course meal prepared by a super-strict chef (here’s looking at you, Gordon Ramsay). The key ingredients are:

- Payment History (35%): Did you miss a payment? Cue the chef’s disappointment.

- Amounts Owed (30%): Are you maxing out your cards? That’s like trying to serve cold soup. Not good.

- Length of Credit History (15%): How long have those accounts been cooking? The longer, the better.

- New Credit (10%): Applying for lots of new credit at once? That’s like adding too much salt—be cautious.

- Types of Credit Used (10%): Variety is key. A mix of revolving and installment credit adds some spice.

Q: How can I check my credit score?

A: You can get your credit score from a variety of places, including your bank, credit card issuer, or by using one of those popular (rhymes with “ankle”) apps. You’re also entitled to one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. So, if you’re feeling especially industrious, you can stagger those requests to check up on yourself thrice a year. Think of it as your personal financial check-up.

Q: What’s a good credit score?

A: Picture your score as a gold star chart from elementary school. Anything below 580 is like an “incomplete” (um, yikes!), 580-669 is a solid “needs improvement,” 670-739 gets you a ”good job!”, 740-799 hits the “very good” category, and 800+ is like getting a “teacher’s pet” sticker. Aim for that sweet spot above 670, and you’ll be in the good graces of lenders everywhere.

Q: How can I improve my credit score?

A: First off, don’t panic. We’re not defusing a bomb here.

- Pay Your Bills On Time: Set reminders, use auto-pay, hire a carrier pigeon—whatever it takes to avoid late payments.

- Reduce Debt: You want your credit utilization ratio (the amount of credit you’re using vs. what’s available) below 30%. Think of it as trying to impress a date; being responsible is attractive.

- Don’t Close Old Accounts: Even if you’ve moved on, your old credit card from college can still offer value (kind of like a retro mixtape).

- Limit New Credit Inquiries: As cool as new cards look, too many hits on your credit can lower your score faster than a soggy soufflé.

Q: Can my credit score really impact my love life?

A: Ah, the million-dollar question. While your credit score isn’t scribbled across your forehead on a first date, financial responsibility is an attractive quality. According to some studies, a good credit score signals stability and responsibility—traits many people look for in a partner. So yes, a healthy credit score may just earn you brownie points in the romance department.

Q: Any final words of wisdom?

A: Yes! Remember, your credit score isn’t a reflection of your self-worth (leave that to your social media followers). It’s simply a tool to help you manage your financial life more effectively. Keep an eye on it, work on it, but don’t let it stress you out. After all, even your credit score would agree—life’s too short to obsess over numbers, unless they’re in your bank account.

End of Q&A Section

Insights and Conclusions

And there you have it—your crash course on understanding your credit score! By now, you should be ready to tackle your credit report with the finesse of a financial ninja. Remember, it’s not just a random number; it’s like your financial report card that says, “You’ve got this adulting thing (mostly) under control!”

So, go forth and monitor that credit score like it’s the latest episode of your favorite binge-worthy show. Keep practicing those good financial habits—pay your bills on time, keep your credit card balances in check, and don’t apply for every shiny new card like a kid in a candy store.

And if your credit score isn’t quite where you want it to be, don’t stress. Think of it as a video game: it takes time, practice, and sometimes a few extra lives (or phone calls to your credit issuer) to level up. Just keep pushing forward, and one day you’ll unlock the ultimate achievement—a stellar credit score!

Stay credit-savvy, and remember: even financial superheroes had to start somewhere. Now go conquer that credit score! 🚀💳