In a world where your smartphone probably knows more about your spending habits than you do, guarding your financial data is as crucial as finding a gas station before you’re running on fumes. Whether you’re trying to dodge the next big data breach or just avoid your cat ordering premium catnip via one-click pay, protecting your information while using financial apps should be top of your to-do list. Think of this guide as your trusted friend who warns you before you step in something unpleasant. We’ll arm you with practical tips that are as easy as ordering lattes on your favorite coffee app and as crucial as hitting “reply all” when you definitely shouldn’t. So, sit back, grab your two-factor authentication device, and let’s dive into the sometimes terrifying, often bewildering, and occasionally hilarious world of securing your financial data.

Guard Your Gold: Avoid Digital Pickpockets

In today’s digital age, your data can be more valuable than a chest full of doubloons, and it deserves to be protected with the fierceness of a dragon hoarding its treasure. One clever tactic to keep those digital pickpockets at bay is by crafting a password that’s as tough as a walrus’s hide. Forget “12345”—try combining the names of all the pets you’ve ever owned, topped off with your favorite type of sandwich. And don’t forget to enable two-factor authentication; think of it as the equivalent of locking your front and back door. Or imagine it like wearing both a belt and suspenders—sure, it’s a bit of overkill, but you won’t get caught with your pants down!

If you’d rather not become the star of a cybersecurity horror story, be mindful of where you’re tapping in all that valuable information. Ensure that your financial indulgences take place over a secured Wi-Fi network. Public Wi-Fi is like hosting a cocktail party with the world’s nosiest guests—everyone’s listening, and they’re not shy about peeking over your shoulder. If you’re feeling extra daring, use a VPN to add a cloak of invisibility to your online transactions. And lastly, keep your apps updated more frequently than you post puppy pics on social media. Regular updates patch up vulnerabilities so those clever villains can’t sneak in through the backdoor. Remember, in the world of data protection, a little paranoia can be your best defense.

| Tip | Why It Matters |

|---|---|

| Create Strong Passwords | Prevents easy access to your accounts |

| Enable Two-Factor Authentication | Adds an extra layer of security |

| Use Secure Wi-Fi | Ensures safe data transmission |

| Regular App Updates | Keeps security features up to date |

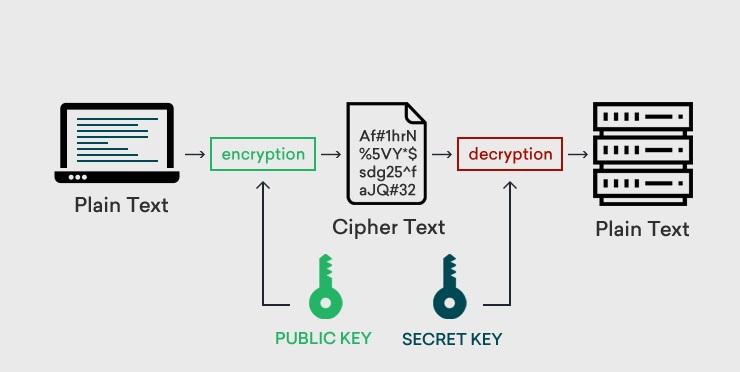

Encryption is Your BFF: Make Friends with Secure Connections

Imagine encryption as the trusty sidekick who guards your data like it’s the crown jewels. Financial apps make great use of encryption to turn your personal info into a secret code that’d only make sense to the fiercest cybersecurity wizard. This means even if some internet robber tries to peek at it, all they’ll see is a jumbled mess that looks like your cat danced on the keyboard. But your app is no solo act—it’s all about teamwork. Make sure your connections are safe too! Ensure you see that little padlock icon in your browser’s address bar before sharing sensitive information. Without it, you’re like a superhero without a cape—you can still be awesome, but slightly less protected.

To really buddy up with secure connections, always use a VPN (Virtual Private Network) when accessing sensitive information over public Wi-Fi. Public networks are like your chatty neighbor who knows everyone’s business, so keeping your financial details private is essential. Also, keep those apps updated! App developers sprinkle magic dust (aka updates) to fix security vulnerabilities, so you stay shielded from pesky data thieves. Here’s a nifty table of everyday encryption do’s and don’ts to make your data’s life a tad safer:

| Do’s | Don’ts |

|---|---|

| Use strong passwords | Share your PINs |

| Enable two-factor authentication | Ignore security updates |

| Check connection security | Use public Wi-Fi for banking |

Passwords that Pack a Punch: Because ‘123456’ Won’t Cut It

It’s no secret that creating a strong password is one of the easiest ways to protect your financial information. Picture your password as a vault door—thin and brittle won’t keep burglars out! Instead of opting for something as predictable as the weather, let’s craft passwords with complexity and a dash of humor. Here’s a recipe to cook up a password that may look like gibberish but is as sturdy as a rock:

- Use at least 12 characters (think of it as your password’s height, taller is better!)

- Sprinkle in uppercase and lowercase letters—they’re like the salt and pepper of password security.

- Add numbers and symbols to give it some bite; imagine numbers crashing the letter party!

- Avoid using easily-found personal information—your pet goldfish doesn’t need that kind of job security.

Consider using a passphrase instead of a traditional password. It’s like writing a mini-story your keyboard will understand, but hackers won’t. A sentence like “Quesadilla 1995! Rodeo Ducks Quack?” might just be your new best gadget against cyber villains. If your brain finds remembering all these creative concoctions a challenge, keep calm and let a password manager do the heavy lifting. After all, with so many things to remember, your brain shouldn’t spend its headspace on whether you used a lowercase ‘l’ or the number ‘1’. And just in case you’re not quite sold on this, peep at this short comparison below:

| Weak Password | Strong Passphrase |

|---|---|

| 123456 | Giraffes!HulaDance*82? |

| password | JazzFlutes4Life@2020! |

Your future self will thank you for putting in this minimal yet mighty effort. Password gaffes—we’ve all been there, so remember: it’s not about making it hard for yourself; it’s about making it harder for anyone else!

Two-Factor Tango: Dance Your Way to Double Security

Imagine your data protected by a virtual bouncer—always on the lookout for party crashers. That’s the magic of enabling two-factor authentication (2FA) on your financial apps. With 2FA, you need not just your password, but an additional confirmation (a quick shimmy of your smartphone perhaps). You might receive a text message, get a call, or even use an authentication app. Choose your dance partner wisely and let this duo-step keep your data waltzing in safety.

- Easy Dance Moves: Use a trusted app like Google Authenticator or Authy.

- Text Message Timesteps: Opt for SMS if you can’t use an app (though keep in mind it has some vulnerabilities).

- Backup Boogies: Keep backup codes secure in case you lose access to your phone.

| 2FA Method | Security Level | Convenience |

|---|---|---|

| Authentication App |      |

|

| SMS |    |

|

| Backup Codes |     |

|

Embrace the security dance to keep your finances safe from digital missteps! Remember, your password might be the star of the show, but 2FA is the solid supporting act ensuring your grand finale is free from unexpected interruptions.

Q&A

Q: Why should I even bother protecting my data on financial apps?

A: Well, aside from avoiding the heart palpitations that come with unauthorized charges and identity theft, protecting your data ensures that your cash stays yours—not a hacker’s shopping spree fund. Plus, your future self will thank you when you’re not explaining to a bank representative why you seem to have bought five jet skis in Antarctica.

Q: What’s the first step in safeguarding my financial app data?

A: Start with a strong password, my friend. None of that “123456” nonsense. Think of your password as a club bouncer—tough and hard to crack. Consider using a passphrase like “I<3Br0cc0li!” No one wants to mess with a healthy eater.

Q: Should I really enable two-factor authentication? Isn’t my password enough?

A: Enabling two-factor authentication is like wearing a seatbelt. Annoying sometimes, but game-changing. Even if a sneaky hacker cracks your award-winning password, they’ll have a hard time crossing the moat that is two-factor authentication. Plus, getting a text saying “Is this you?” when it’s absolutely not you is immensely satisfying.

Q: How do I ensure my app is secure? Is there an app for that?

A: Meta, but indeed, kind of! Regularly update your apps, because app developers are like superheroes in disguise, constantly battling newly emerging bugs and threats. Ignoring updates is like refusing a hack-proof shield because it looks “not cool.”

Q: Should I use public Wi-Fi to manage my finances on the go?

A: Sure, if you also leave your house unlocked with a “Free Stuff Inside” sign. Stick to using your own mobile data or a secure home network. Public Wi-Fi is basically free candy to hackers—deliciously easy to compromise.

Q: Can I trust all financial apps on the app store?

A: If you want to flirt with danger, then sure. Otherwise, look for apps from reputable sources with lots of positive reviews from actual humans (beware of “I am totally not a bot and I love this app” kind of reviews). Your app store is a lot like a dating app—best to vet matches carefully before committing.

Q: Any other tips for keeping my data safe?

A: Certainly! Avoid sharing too much personal information and oversharing isn’t just terrible at parties. Keep your devices’ security software updated, and just like in the world of friendship bracelets, sharing isn’t always caring—beware of phishing scams claiming to be your financial ‘BFF’. Secure your devices, trust cautiously, and always, always keep a slice of skepticism served on the side.

In Summary

As we close the vault on our exploration of data protection in financial apps, let’s recall that safeguarding your digital ducats is no laughing matter—though we’ve sprinkled a little humor to keep the encryption decryption process light. As you navigate the bewildering world of passwords, two-factor authentication, and app permissions, remember that a little caution now can save a lot of cleanup later.

Picture yourself as the James Bond of the digital space—minus the espionage, of course. Just like Bond wouldn’t stroll into a villain’s lair without a gadget or two, you shouldn’t wade into financial apps without our practical tips. Secure those passwords, scrutinize those app permissions, and vet your app choices as if they were unsolicited friend requests from distant relatives.

Hopefully, by now you’re fully briefed on how to keep your financial data safer than a squirrel’s stash of acorns. But remember, in the grand scheme of things, even digital ninjas trip over their own cables sometimes. So if you ever find yourself in a pickle, take a deep breath, retrace your steps, and follow the breadcrumbs back to security. And, if all else fails, call in tech support—but now you’re equipped to grill them like a pro.

So go forth, be vigilant, and may your financial data be ever in your favor (and your apps never crash). Until next time, stay secure and remember: when it comes to data protection, a byte of prevention is worth a terabyte of cure!