In the brave new world of technology, where cats on the internet can become billionaires overnight and toasters can tell you the weather, blockchain has earned its rightful place as the rebellious teenager of the digital family—full of potential and prone to leaving traditional financial advisors scratching their heads. Just mentioning blockchain around your accountant is likely to elicit a reaction somewhere between a grimace and a nervous chuckle. But fear not, intrepid personal finance explorer! We’re here to unravel the mysteries of blockchain and see how it might just be the superhero your wallet has been waiting for. Strap in as we navigate this blockchain journey, filled with twists, turns, and possibly the regular appearance of the word ”crypto,” which might earn you a raise in Scrabble. Whether you’re a skeptic clutching onto your piggy bank or an eager enthusiast mining for Dogecoin in your basement, understanding the impact of blockchain on personal finance is crucial to deciphering the future of our digital economy—without breaking the internet or your piggy bank in the process.

How Blockchain Stole My Piggy Bank and Why That’s a Good Thing

Imagine your piggy bank running off to join a blockchain network, dancing on digital ledgers and making friends with cryptocurrencies. Sounds ludicrous, right? But there’s a silver lining — your savings are now in a tech-savvy realm where transparency, security, and efficiency reign supreme. Blockchain is like a civil engineer that designs roads leading your finances to safety, detouring away from pothole-ridden routes full of human error and fraud risks.

Here are a few delightful perks your digital piggy bank’s adventure brings:

- Security: All your transactions are recorded forever, making it as tough to alter or tamper with as convincing a cat to take a bath.

- Transparency: Like an open mic for transactions, where everyone can see but no one can sing off-key.

- Low Fees: Saying goodbye to cumbersome bank fees, blockchain transactions are more like a thrift store for records.

| Feature | Traditional Banking | Blockchain |

|---|---|---|

| Security | Moderate | High |

| Fees | High | Low |

| Transparency | Variable | Complete |

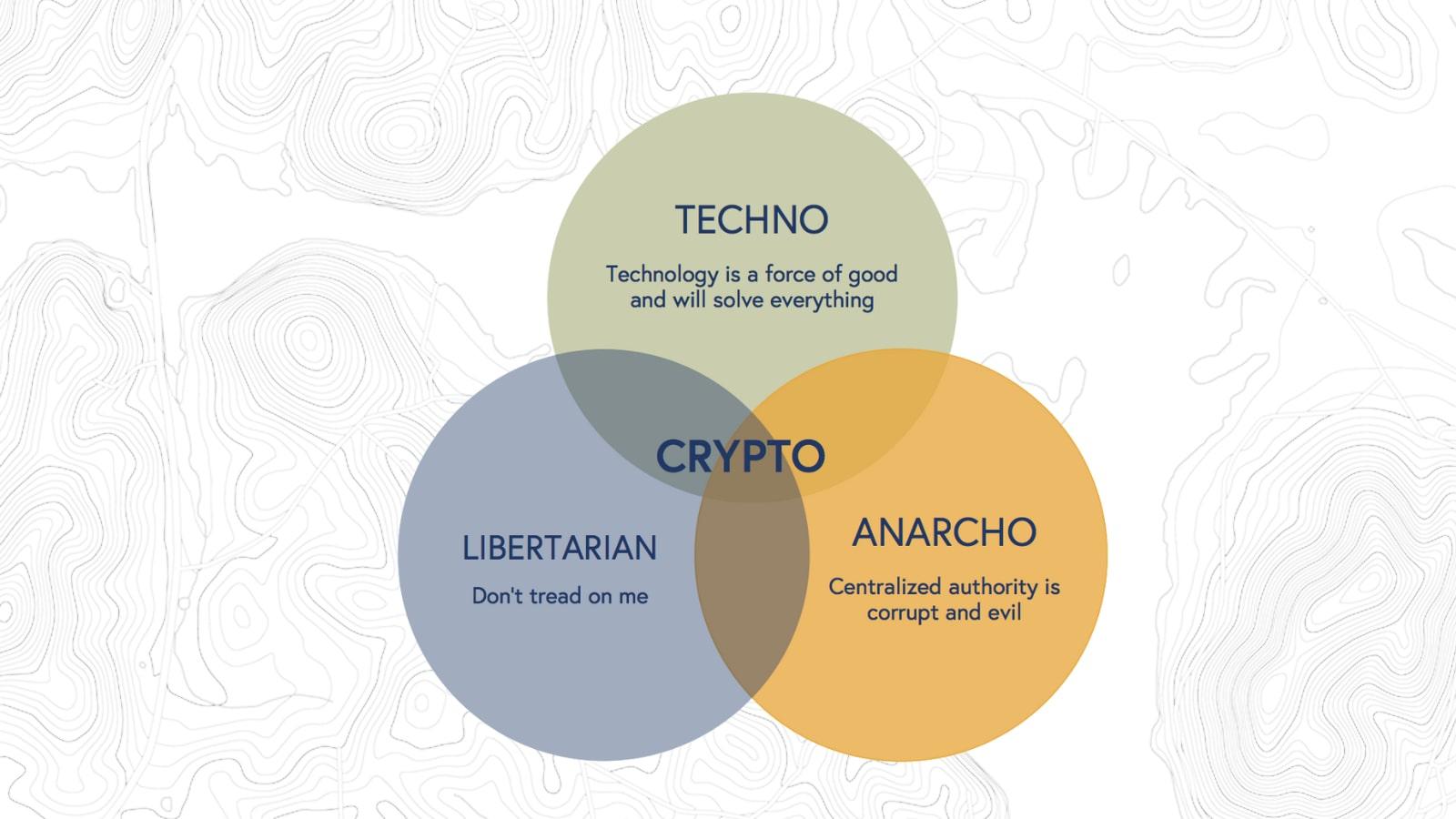

Cryptocurrency: Not Just for Buying Your Llama Anymore

The world of cryptocurrency has graduated from being the quirky playpen of tech enthusiasts to becoming a buzzword in personal finance. Think less ‘get-rich-quick’ scheme and more ‘get-savvily-wealthier’ opportunity. With blockchain technology transforming everything from how we store data to what we consider an asset, it’s time to look at digital currencies not just as a way to pay for the latest alpaca to join your homestead. Instead, consider its impact on your bank account, which, let’s face it, could use as much disruption as a cat at a dog show. Blockchain is the magical backbone that allows these digital transactions to be both secure and transparent.

- Investment Diversification: Cryptocurrencies are the avocado toast of the finance world—trendy and enriching. They’re showing up in everyone’s portfolios, from your grandma’s knitting friends to that dude who tried to sell you a pyramid scheme once.

- Decentralization: It means no more middlemen with their undue service charges. You’re skipping the toll booth, like when you pretend not to see the parking attendant.

- Smart Contracts: They execute themselves like a well-trained dog. No more human error or forgetting payments—just a digital handshake and off it goes!

| Feature | Benefit |

|---|---|

| Security | Let’s just say it’s Fort Knox’s flashier, digital sibling. |

| Cost Efficiency | Fewer fees mean more savings for your coffee fund. |

Decoding Crypto Jargon or How to Sound Like a Tech-Savvy Whiz at Parties

Oh, Blockchain, the buzzword that often leaves us nodding along at parties, pretending we totally get it. But here’s the kicker – it’s not that complicated! Imagine blockchain as a digital ledger that wants to be your BFF. Every time someone exchanges currency (crypto or regular), this ledger notes it down in an unchangeable, super-secure way that feels like writing with invisible ink. The cool thing? Nobody can secretly edit it, so there’s less room for financial mischief like double-spending coins. This rock-solid system is shaking up personal finance by making transactions faster, cheaper, and out in the open for everyone to see. Even grandma could become a savvy investor, knowing she’s working with clean and transparent quotes.

- Decentralization: The opposite of hoarding all candy in one bowl. Loans and investments don’t need banks anymore!

- Smart Contracts: Like having a robot lawyer who needs no coffee breaks. These are automated agreements that execute once conditions are met.

- Immutable: Think: permanent marker. Once info is on blockchain, it’s stuck there – no edits, just eternal truth.

Here’s a quick glimpse at why people think blockchain is the next big thing in managing money:

| Feature | What’s Cool |

|---|---|

| Lower Fees | Cut out midmen & brokerage fees go poof! |

| Speed | Transfers almost as fast as your texts. |

| Security | Guarded in chainmail-level encryption. |

Armed with these tidbits, you’ll not only understand blockchain better but also have a fun arsenal of knowledge for the next time someone tries to impress you with their tech talk—bring it on!

From Cryptophobia to Cryptocredentials: Practical Steps to Embrace the Future of Finance

Feeling a bit like you’re standing on the edge of a vast sea of blockchain mumbo-jumbo with no idea how to swim? Fear not, for you’re not alone! Many folks out there are navigating this new age of finance, and guess what? We’ve got some unsinkable life rafts to keep you afloat as you sail into the world of cryptocurrencies and blockchain technology.

- Peek into Potential: Blockchain isn’t just about Bitcoin anymore; it’s a daring new frontier that could transform how we save, spend, and even borrow money. Imagine, handling finances with no pesky middlemen involved!

- Safe & Secure: Think of blockchain like an ancient scroll that everyone agrees has never been tampered with, each transaction is a part of this communal scroll, transparent and permanent!

And why not toss in an easy-to-digest table of how blockchain impacts personal finance?

| Feature | Impact |

|---|---|

| Decentralization | Reduces reliance on banks |

| Transparency | Easy to track transactions |

| Security | Harder to commit fraud |

So, instead of shying away from the new world of financial possibilities, embrace it! With a dash of curiosity and perhaps a sprinkle of humor, watching your credentials evolve from cryptophobia to cryptocredentials will become a thrilling adventure. Who knew finance could be this entertaining?

Q&A

Q: What exactly is blockchain, and why should I care about it in terms of personal finance?

A: Picture your favorite digital piggy bank, but instead of coins, it’s holding a swirling cascade of incredibly secure, encrypted data blocks. Each block is like a page in a financial diary that can’t be tweaked once it’s written. Why care? Well, aside from making you sound smarter at parties, blockchain offers potentially lower fees, increased transparency, and a reduction in the need to trust your third cousin twice removed who claims he’s an expert in banks.

Q: How does blockchain affect my everyday financial transactions?

A: Imagine paying for your overpriced coffee without paying those pesky transaction fees. Enter blockchain, transforming you from a caffeine enthusiast suffering from decaf-induced bank fees to a brewing revolutionary. Blockchain can streamline payments, reduce intermediaries (bye-bye, middleman!), and speed up financial transactions, leaving you with more time to contemplate the next mind-blowing artisanal latte.

Q: Are cryptocurrencies and blockchain the same thing?

A: Ah, the question as common as trying to fold a fitted sheet! While they hang out in the same digital family tree, they are not identical twins. Think of blockchain as the super-secure digital infrastructure (like a vault guarded by cyber ninjas), while cryptocurrencies like Bitcoin are the dazzling jewels stored inside. So, while all crypto uses blockchain, not all blockchain hangs out with crypto.

Q: Can blockchain help me save or manage my money better?

A: If you’ve ever wondered where your money sneaks off to by the end of the month, blockchain technology could be your new best friend. It offers efficient tracking and verification processes that could help you budget better, avoid hidden fees, and even venture into decentralized finance (DeFi) for returns that may pop your socks off.

Q: Is my data safe with blockchain technology?

A: As safe as a squirrel’s secret stash of acorns! With blockchain, your data lives in a fortress of encryption, guarded by algorithms that would give a secret agent a run for their money. It’s decentralized, meaning no single point of failure, which reduces the chance of someone ferreting around your financials without your permission.

Q: What about the environmental concerns surrounding blockchain?

A: This is where blockchain does have a carbon footprint larger than Bigfoot on a treadmill. The energy consumption of blockchain is a hot topic unearthed like ancient treasure. However, innovators are tackling it with the creation of more eco-friendly consensus mechanisms that could soon reduce its environmental impact to being as gentle as a lamb munching on virtual grass.

Q: How can I start dabbling with blockchain in my personal finances?

A: Good old curiosity is your North Star here! Start with some research, dip your toes into educational resources about blockchain and cryptocurrencies. Maybe even join an online forum or an event where crypto enthusiasts gather (virtually or otherwise). After all, every blockchain expert today started as a curious explorer just like you—who knows, you might end up as the next blockchain financial aficionado, or at least win enough cryptocurrency to buy the aforementioned artisanal latte—and isn’t that what really matters?

In Conclusion

As we wrap up our whirlwind tour through the world of blockchain and its impact on personal finance, it’s clear that this technology is more than just a fleeting trend—it’s a financial phenomenon that’s here to stay. From crypto-kitties to decentralized lending platforms, blockchain is like that friend who always brings the most eccentric yet fascinating stories to the dinner party.

But let’s not get carried away. While blockchain promises a world of financial possibilities, it’s important to keep both feet on the ground. Sure, you might become the next wallet-wielding wizard of Wall Street, but remember: even wizards need to read the fine print. So, before you dive headfirst into the crypto pool, take a moment to understand the rules—or rather, the code—of the game.

As with all things marvelous and mysterious, a little skepticism is healthy. So arm yourself with knowledge, maybe a digital ledger or two, and perhaps a blockchain glossary for those pesky, perplexing terms. whether you’re a digital currency conquistador or a cautious newcomer, remember that personal finance, much like the blockchain, should be both secure and surprisingly fun. And with that, we hope you’ll consider this article a cryptographic cornerstone in your journey through the marvels of modern money management.

Now go forth, and may your crypto be as stable as your internet connection!