let’s cut the crap and talk about the one financial secret that’s been doing everyone a favor while you’ve been busy throwing your money at the latest fad or overpriced avocado toast habit. Yes, I’m talking about compound interest—the so-called “magic” that most peopel conveniently ignore until they’re crying into their empty bank accounts.While you were busy believing that get-rich-quick schemes and financial gurus with dubious credentials had the answers, compound interest was silently working its algebraic wizardry, turning peanuts into fortunes. It’s time to stop being financially obtuse and realize that the only true magic in finance isn’t found in crypto unicorns or stock market sorcery—it’s that relentless, no-nonsense force called compound interest. Buckle up, buttercup, because if you’re ready to stop screwing up your finances, understanding compound interest is your first and only sensible move.

Stop Being a Financial Dunce Embrace the Power of Compound Interest

Look, if you’ve been snoozing on compound interest, it’s time to wake up and smell the money. While you’re busy playing financial dunce, your bank account is probably laughing all the way to the bank. here’s the cold, hard truth:

- Money grows exponentially – not just linearly like your excuses.

- Time is your best friend – unless you enjoy watching your savings do nothing.

- Ignore it, and you’re practically burning money – congratulations, you’ve mastered financial sabotage.

Still not convinced? Check out this enlightening table below. It’s like a slap in the face for your financial ignorance, but in a helpful way.

| Years | Simple Interest | Compound Interest |

|---|---|---|

| 10 | $1,000 | $2,593 |

| 20 | $2,000 | $6,727 |

| 30 | $3,000 | $17,449 |

There you have it. Stop being a financial dunce and let compound interest do what it’s damn well supposed to do. Your future self will thank you, or at least stop pretending to hate you.

Quit Throwing Your Money Away Let Compound Interest Do the Heavy Lifting

Stop flushing cash down the drain and start letting your money work for you. Seriously, who needs another fancy coffee when you could be sipping on a future yacht? Rather of wasting on pointless stuff, channel that dough into something that actually grows. Here’s a quick checklist to get your financial act together:

- Automate your savings – Set it and forget it, genius.

- Invest regularly – As timing the market is for magicians.

- Reinvest your returns – let your money eat its own.

Take a look at how patience pays off:

| Years | Investment ($1,000) | With Compound Interest |

|---|---|---|

| 0 | $1,000 | $1,000 |

| 10 | $1,000 | $2,594 |

| 20 | $1,000 | $6,727 |

| 30 | $1,000 | $17,449 |

See? While you’re busy blowing cash on the latest gadgets, your investments are quietly multiplying. Make smarter choices and let compound interest do what it’s supposed to do: turn your pennies into a pretty penny.

Stop Chasing Fairy-Tale Returns Here’s How to Make Compound Interest Work

Let’s get real: those “get rich quick” schemes are as useful as a screen door on a submarine. Instead of dreaming about unicorn startups or lottery jackpots, embrace compound interest—the only legit magic trick in finance. Here’s how to stop wasting time and actually let your money work for you:

- Start early: Time is your best friend. The sooner you begin, the less you need to stress about returns.

- Be Consistent: Regular contributions, even if small, add up faster than your favorite binge-watch session.

- Reinvest Earnings: Don’t cash out every time your investment grows. Let the interest snowball.

Forget chasing those fairy-tale returns. Compound interest is the no-BS strategy that actually delivers. Stop gambling with your finances and start building real wealth—one interest payment at a time.

Dump your Lazy Savings Start Investing Like a Pro with Compound Magic

Enough with the pathetic savings stashing! Your money is crying for a better life. Stop letting it gather dust in some low-interest account and shove it into investments that actually grow. Here’s your wake-up call:

- Automate everything: Set it and forget it, genius.

- Diversify: Don’t be a one-trick pony with your cash.

- Reinvest Dividends: let your profits breed more profits.

If you need more convincing, feast your eyes on this masterpiece:

| Strategy | Growth Potential | Effort Level |

|---|---|---|

| Lazy Savings |  crickets crickets |

Zero Zero |

| Pro Investing |  Rocketing Returns Rocketing Returns |

Minimal Minimal |

Q&A

Q: so, you’re telling me compound interest is the only magic in finance? What about flashy stocks or cryptocurrency?

A: Oh, absolutely. Forget about risky ventures that could make you filthy rich or leave you penniless overnight. Compound interest is the slow-burning torch that actually works. While your friends gamble on meme coins or hope their favorite stock rockets,you can sit back and watch your money do the heavy lifting. It’s not glamorous, but hey, at least it won’t bankrupt you after one bad tweet.

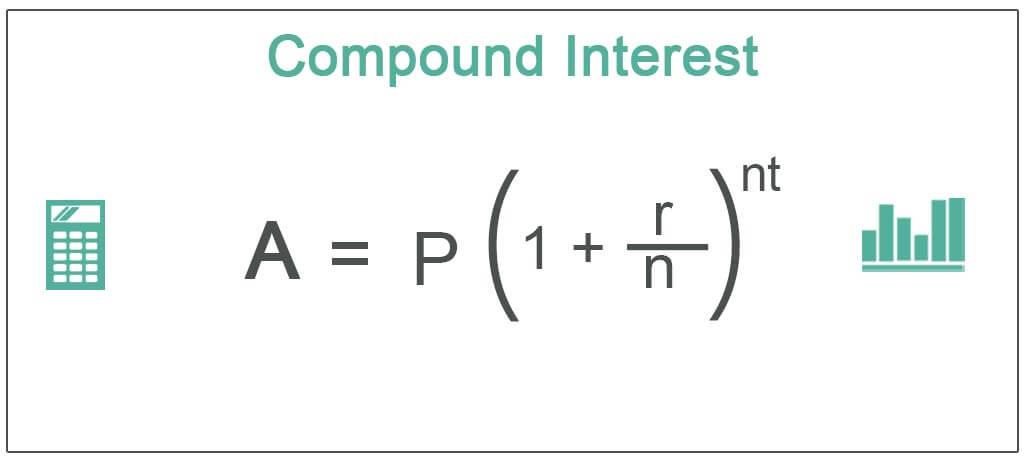

Q: I’ve heard compound interest is great, but how the heck does it actually work?

A: Imagine your money is a snowball rolling down a hill. At first, it’s small and barely noticeable, but as it keeps rolling, it gathers more snow and starts to impress.That’s compound interest for you—your initial investment not only earns interest but also starts earning interest on that interest. It’s the financial equivalent of your money getting a job promotion without doing any extra work. Nice,right?

Q: Why is everyone ignoring compound interest when it’s so obviously awesome?

A: Probably because compound interest is boring as hell. Nobody gets excited about watching numbers grow slowly over decades. It lacks the instant gratification of spending money or the adrenaline rush of high-stakes trading.Plus, admitting that your financial success is mostly about patience and not some genius investment move might bruise some egos. Yawn.

Q: Can I really rely on compound interest to secure my financial future?

A: If you’re not planning on living on borrowed time and enjoy the idea of your money growing steadily,then yes. It’s not going to make you rich overnight, but forget it not and it’ll slowly build a nice cushion. Just don’t count on it for your next yacht purchase next month.

Q: How much time and money do I need to start benefiting from compound interest?

A: Oh, just a measly few years of consistent saving and investing. No biggie.It’s not like you need a windfall or a lottery win to get started. Just set aside a portion of your income regularly, let the magic (read: math) do its thing, and maybe—just maybe—you won’t be living paycheck to paycheck forever. Easy peasy.

Q: What’s the biggest mistake people make with compound interest?

A: Thinking they can outsmart the system. People expect to tweak interest rates or jump ship too early,ruining the whole compounding process. It’s like trying to race a glacier by sprinting. Spoiler alert: it doesn’t work. The biggest win is patience, so stop trying to speed things up and let your money do what it’s supposed to do.

Q: Any last snarky advice on why I should care about compound interest?

A: Sure. Keep living paycheck to paycheck and watch your financial dreams fade away, or embrace the only reliable “magic” in finance and actually have a future. It’s your call, but if you’d rather have a predictable, steadily growing bank account than gamble on financial fairy tales, compound interest is your best bet. You know where to find me.

Future Outlook

So, there you have it. While some might still be out there believing in unicorns and leprechauns as financial advisors, the undeniable truth is that compound interest is the real sorcery in your wallet. Stop chasing flashy get-rich-quick schemes and start embracing the only magic that actually works. your future self will thank you, and hey, maybe even send you a congratulatory note for not being a complete financial dimwit. Remember, in the world of finance, patience and persistence aren’t just virtues—they’re your ticket out of mediocrity. So, quit the nonsense, harness the power of compound interest, and watch your money actually do what it’s supposed to do. cheers to being financially savvy, no fairy dust required.