Oh, look at you—master of emotional rollercoasters and supreme commander of your own financial shipwrecks. Every time the market dips, you’re convinced it’s the apocalypse, and when stocks soar, suddenly you’re the next Warren Buffett. Newsflash: your feelings shouldn’t hold the reins to your wallet. If you’ve ever tossed your hard-earned cash into a glittery new gadget because it “felt right” or panicked into selling investments because your heart skipped a beat, it’s time for a reality check. Welcome to the no-BS guide on kicking your emotional baggage to the curb and finally making money moves that don’t require a tantrum. Let’s cut the crap and get your finances in line—before your feelings bankrupt you.

Quit Letting Your feels Drain your Bank Account

Look, crying over your bank balance isn’t going to magically refill it. Every time your emotions hijack your spending, you’re basically handing over your money to the Drama King in your wallet. Want to stop being a financial trainwreck? Start by recognizing your emotional spend moments:

- Retail Therapy Delusions: Just as shopping makes you feel better doesn’t mean it’s a enduring solution. Spoiler: It’s not.

- Impulse Buys Galore: That midnight gadget flash sale? Yeah,it’s not life-changing. Stop falling for it.

- Emotional Eating Purchases: You’re not feeding your soul with snacks; you’re emptying your bank account.

If you’re serious about not letting your feels bankrupt you, take a hard look at this table of common emotional spending triggers and how to kick them to the curb:

| Trigger | Solution |

|---|---|

| Stress | Go for a run, not a retail marathon |

| Loneliness | Call a friend, not your credit card |

| Boredom | Pick up a hobby that doesn’t involve spending |

Stop acting like your wallet is a bottomless pit for your emotional garbage.Set boundaries,track your spending,and for the love of all things fiscal,grow a spine when it comes to your money decisions.

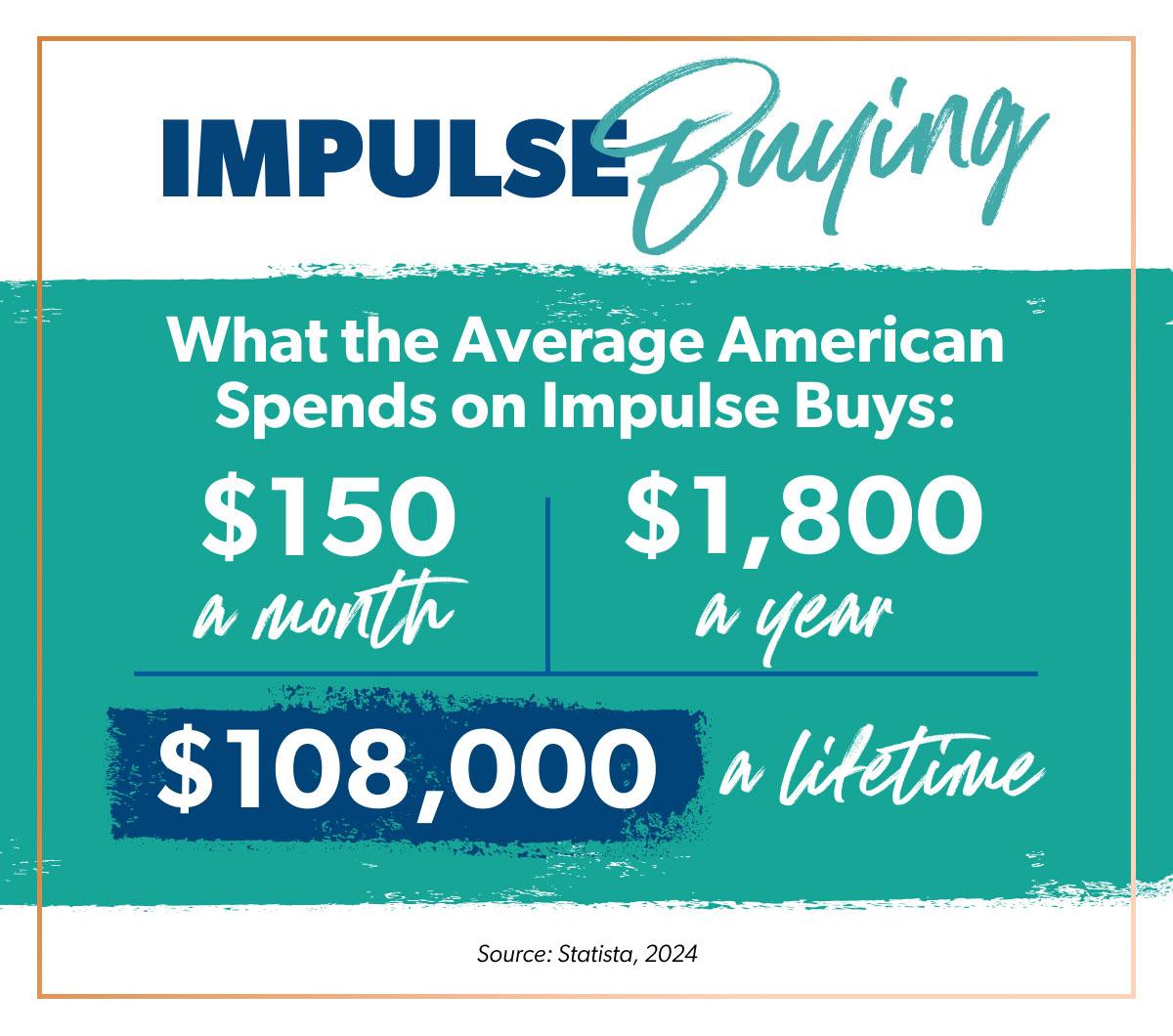

Stop Making Impulse Purchases and Start Using your Head

Look, we all know that feeling—seeing that flashy gadget or those irresistible shoes and thinking, “I absolutely need this right now.” Newsflash: your bank account doesn’t share your excitement. Before you swipe that card for the umpteenth time this month, ask yourself if you’re really living or just chasing temporary happiness.Here are some classic signs you’re about to make a regrettable impulse buy:

- Flash sales: As nothing says ”good decision” like a countdown timer.

- Emotional triggers: Buying stuff to feel better? Brilliant strategy, Sherlock.

- “Limited edition” nonsense: Spoiler alert: They’ll probably come back after you throw your money away.

Ready to break the cycle and use that big ol’ noggin of yours? Start by:

- Creating a budget: It’s like a diet for your wallet—painful at first,but worth it.

- Waiting 24 hours: If you still want it after a day, maybe it’s not THAT bad.

- Unsubscribing from retail emails: Less temptation equals fewer regrets.

| Impulse buy | smart Decision |

|---|---|

| Buys a fancy coffee every day | Makes coffee at home and saves $50 a month |

| Grants last-minute gadget desires | Waits, researches, and ensures it’s a needed upgrade |

Cut the Emotional BS: Create a No-Nonsense budget

enough with the fantasy budgeting. It’s time to kick your emotional spending habits to the curb and face your finances like a grown-up. Stop crying over every impulse buy and start tracking where your money really goes.Here’s the brutal truth: your wallet isn’t a magical bottomless pit, and your feelings aren’t a valid excuse for overspending. Get real about your income and cut out the nonsense that leaves you broke and regretful.

- List Your Income: No, daydreams about raises don’t count.

- Track Fixed Expenses: Rent, utilities, and that subscription you never use.

- Identify Variable Expenses: Spoiler alert: your daily coffee is here.

- set clear Savings Goals: because living paycheck to paycheck is so last season.

Here’s a no-frills example to slap some sense into your budgeting game:

| Category | Amount |

|---|---|

| Income | $3,500 |

| Rent | $1,200 |

| Utilities | $300 |

| Groceries | $400 |

| Entertainment | $150 |

| Savings | $450 |

There you have it. A straightforward budget that doesn’t cater to your whims. Stick to it, and watch your bank account stop crying in terror.

Take Control Now Implement these Actionable Money Moves

Kick Your Overspending Habits to the Curb: It’s time to stop feeding your shopping addiction. Here are some no-BS steps to reclaim your wallet:

- Create a Realistic Budget: Track every dollar like your financial life depends on it—because it does.

- Automate Your Savings: Set it and forget it. Let your money grow without begging yourself to save.

- Slash Unnecessary Subscriptions: Seriously,how many streaming services do you need? Cancel the rest.

Get Smart with Your Investments: Stop gambling and start making calculated moves. Follow these straightforward tips:

| Action | Description |

|---|---|

| Educate Yourself | Dive into credible financial resources instead of relying on gut feelings. |

| Diversify Your Portfolio | Don’t risk it all on one shaky investment.Spread it out. |

| Set Clear Financial Goals | Know what you’re aiming for instead of drifting aimlessly. |

Q&A

Q1: why do my emotions keep screwing up my financial plans?

Oh, poor you. Look, humans are walking, talking, emotion-fueled disasters by default. Your brain isn’t wired for cold, hard financial logic—it’s designed to chase dopamine hits and avoid pain. So surprise, surprise, your emotions are making you throw money at shiny things or panic sell at the first sign of trouble. It’s not personal, it’s biology.

Q2: How can I stop being a hothead when making money decisions?

Great question, Einstein. Start by recognizing that every gut reaction is a potential money pit waiting to happen. Before you make that impulsive buy, take a damn deep breath. Create a checklist for decisions and stick to it like your financial sanity depends on it—which it does.If you’re too emotional to decide rationally, maybe leave the money stuff to someone who’s not having a meltdown over a latte inflation.

Q3: Is it even possible to be emotionally detached from money?

Absolutely.It’s called being a robot, but achieving anything close to that is your best bet. you don’t have to love every dime you handle, just respect its power. Set rules so strict that your feelings don’t get a vote—like automatic transfers to savings or investments. Emotional detachment isn’t about coldness; it’s about making money part of your life, not letting it control yours.

Q4: What are some practical steps to keep my feelings in check?

Start by snoozing the emotional hamster wheel:

- Budget Like a Boss: Know where every penny goes so you’re not guessing and freaking out.

- Automate Everything: Bills, savings, investments—set it and forget it. Less chance for emotional spills.

- Educate Yourself: Understand your financial tools so you’re not making decisions based on fear or greed.

- Set Clear Goals: When you know what you’re aiming for, it’s harder for emotions to derail you.

- Limit Social Media Stimulation: Everyone else’s success or failure doesn’t have to be your emotional rollercoaster.

Q5: How do I deal with FOMO without making bad investments?

First,accept that FOMO is just social envy dressed up in shiny investment schemes. Here’s how to dodge it:

- Stick to Your Plan: If it’s not in your strategy, don’t touch it because someone else’s portfolio is popping.

- Do your homework: don’t invest in something just as it’s trending. Analyze the fundamentals or don’t bother.

- Diversify Like a Pro: Spread your bets so you’re not betting your financial future on the latest hype train.

- Remember Long-Term Goals: short-term glitter isn’t worth derailing your long-term financial empire.

Q6: What if my emotions are valid and tied to real financial stress?

a sensible question. yes, emotions are valid, especially when real money is on the line. Acknowledge them, but don’t let them lead. Seek professional advice if needed—someone who won’t let your panic or euphoria drive your finances. Create a support system that helps you stay grounded instead of spiraling into irrational decisions.

Q7: Can mindfulness actually help with financial decisions, or is that just New Age nonsense?

Believe it or not, mindfulness isn’t just for your yoga-loving neighbor. Being present and aware can definitely help you catch those emotional impulses before they wreck your wallet.It’s about pausing,reflecting,and making choices based on logic,not on whatever feels good in the moment. So no, it’s not nonsense—use it to keep your financial life from becoming a soap opera.

Q8: How do I handle the guilt of past financial mistakes caused by my emotions?

Stop dwelling in the financial faux pas Hall of Shame. Learn from your screw-ups and move the hell on.Regret is a waste of money and time you could be using to actually make better decisions.Create a plan to avoid repeating those mistakes and focus on what you can control now, rather of mourning over what you did when you felt like a complete moron.

Q9: What’s the first step to taking control of my emotional spending?

Congratulations, you’re already thinking about it. The first step is admitting you have a problem—stop being your own worst enemy. Track your spending like a hawk, identify the emotional triggers, and set boundaries to keep those impulses in check. It’s not rocket science, just consistent effort and a bit of self-awareness.

Q10: Can therapy help me stop my emotions from wrecking my finances?

Absolutely. Therapy isn’t just for crying or ranting; it can help you understand and manage the emotional baggage that’s sabotaging your bank account. A professional can provide strategies to cope with stress, impulsivity, and irrational fears or desires. Think of it as emotional software updates to keep your financial decisions from crashing.

To Conclude

So, there you have it. If you’ve been letting your feels drive your wallet into a ditch, it’s high time to get your act together. Money isn’t going to manage itself while you’re busy crying over overpriced lattes or celebrating every minor stock dip with a shopping spree. Stop being a puppet to your emotions and start taking some damn responsibility for your financial future. Sure, feeling things is part of being human, but letting those fuzzy feelings dictate where your money goes? Not so much. Get a grip, make some smart choices, and maybe—just maybe—you’ll actually wake up one day with more money in your bank account and fewer regrets. Now go forth and conquer your finances like the semi-responsible adult you’re pretending to be.