So, you think investing is only for rich people? Cute. Meanwhile, you’re blowing $8 on lattes and $15 on takeout like it’s yoru patriotic duty. Look, the harsh truth is that sitting around waiting to “have enough money” to invest is exactly why you never will. Wealth isn’t something that magically appears one day—it’s built, step by painfully small step. But hey, keep telling yourself that investing is “too complex” or “too risky” while bingeing TikToks about overnight millionaires. This article? It’s here to slap those excuses out of your mouth and show you that investing isn’t just for trust fund babies—it’s for anyone who’s willing to stop whining and start doing. Buckle up.

- Stop Crying About Being broke and Start Using That Spare Change Wisely

Oh, so you’re broke? Join the club. But instead of whining about it,how about actually doing something smart with the money you *do* have? That spare change you toss in your car’s cup holder like it’s worthless? Yeah,that could be making you money if you weren’t so lazy. Apps like Acorns and Robinhood let you invest *pennies*—literally, pennies. So what’s your excuse now? Don’t tell me you don’t have enough to invest when you just spent $5 on a coffee that tastes like burnt regret.

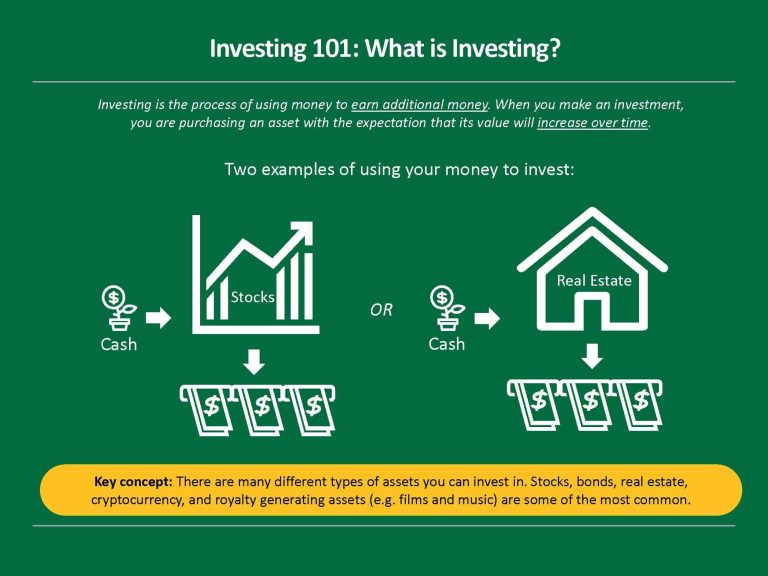

You think investing is only for people in suits? Newsflash: you don’t need a hedge fund to get started. Just take a fraction of what you’d normally waste on pointless stuff and put it into small investments. Here, let’s make it real simple for you:

- Skip a $10 fast food meal → Invest in an ETF

- Cancel that pointless subscription → Buy a stock share

- Rather of blowing $20 on drinks → Put it in a high-yield savings account

Still think you need to be rich to invest? Let’s break it down even further:

| Excuse | Reality Check |

|---|---|

| “I don’t have enough money” | You have enough for Netflix, don’t you? |

| “I don’t no where to start” | Google it. It’s free. |

| “Investing is too risky” | So is being broke forever. |

– Your Daily $7 Coffee Isn’t the Problem,Your Excuse-Making Is

Look,your fancy coffee habit isn’t what’s keeping you from investing. It’s your endless parade of excuses. You say you’re broke, but somehow, that daily oat milk caramel nonsense magically appears in your hand every morning.The problem isn’t the price of coffee—it’s the fact that you’d rather binge-watch Netflix than learn the basics of building wealth. Priorities, my friend.

Here’s the truth: you don’t need to be rolling in cash to start investing—you just need to stop lying to yourself. If you’ve got money for weekend drinks, new sneakers, or yet another streaming subscription you barely use, you have money to invest. Let’s break it down:

- One coffee a day ($7) x 30 days = $210 – That’s an actual investment portfolio.

- Your weekend bar tab ($50) x 4 weekends = $200 – Because “just one more round” isn’t building your future.

- That gym membership you never use ($40/month) – might as well put it somewhere that pays you back.

| Wasteful Habit | Monthly Cost | Potential Investment Value in 10 Years |

|---|---|---|

| Daily $7 Coffee | $210 | $42,000+ |

| Weekend Drinks | $200 | $40,000+ |

| Unused Subscriptions | $50 | $10,000+ |

Assuming an average 8% annual return.

So stop blaming society, inflation, or the fact that your paycheck disappears the moment it hits your account. That’s not a money problem—that’s a you problem. Budget better. Invest smarter. No more excuses.

– No, You Don’t Need to Be Warren Freaking Buffett to Buy Stocks

Stop acting like you need to be some Wall Street genius to invest. You don’t need a fancy finance degree, a yacht, or Warren Buffett’s brain. You just need to stop making excuses. The stock market isn’t an exclusive members-only club for billionaires sipping champagne—it’s open to literally anyone with a few bucks and an internet connection. These days, you can start investing with as little as $5. That’s less than your daily overpriced latte, by the way.

Still not convinced? Let’s break it down:

- Too complicated? No, it’s not. Apps literally let you invest with a few taps.

- Too risky? Sure, if you throw your money at meme stocks like a drunken gambler. But solid investments grow over time.

- Not enough money? Ever heard of fractional shares? You can own a piece of Amazon for spare change.

- Waiting for the “right time”? Oh please.The best time to start was yesterday. The second-best time is now.

| Excuse | The Brutal Truth |

|---|---|

| “I don’t know enough about stocks.” | Google exists. Use it. |

| “I’m waiting for the perfect moment.” | Newsflash: There isn’t one. |

| “I don’t have time to invest.” | Yet, somehow, you have time for TikTok? |

– Automation Exists So You can Stop Whining and Start Investing

Oh, you don’t have time to invest? You’re too busy scrolling social media and binge-watching shows you don’t even like? Guess what—automation has your back. With robo-advisors, automatic transfers, and set-it-and-forget-it investments, you can literally start building wealth without lifting a finger. Your excuses are officially useless. If you can schedule a Netflix subscription to auto-renew every month, you can schedule a measly $50 to go into an index fund.

Still not convinced? Here, let’s lay it out in black and white for you:

| Excuse | Reality Check |

|---|---|

| “I don’t know where to start.” | Google “best robo-advisors” and pick one. Problem solved. |

| “I’m bad with money.” | Perfect. Automation takes care of it so you don’t have to. |

| “I can’t afford to invest.” | Coffee costs $5. Index funds start at $1. Try again. |

Stop overcomplicating things. Click a few buttons, let automation handle the rest, and boom—you’re an investor now.Congratulations.

Q&A

Q&A: investing Isn’t Just for Rich People—So Stop Whining and Get to It

So, you think investing is only for the rich? cute. Let’s crush those excuses one by one before you waste another decade sitting on the financial sidelines.

Q: I don’t make enough money to invest. Shouldn’t I wait until I’m rich?

A: Oh, of course! Wait until a magical money fairy drops a suitcase of cash into your lap. That’ll happen any day now. News flash: You don’t have to be a millionaire to start investing. Thanks to fractional shares and apps like Robinhood or Fidelity,you can start with as little as $5. Eat one less overpriced latte per week,and suddenly,you have investing money.Shocking, I know.

Q: But I have bills to pay! Isn’t investing risky?

A: yeah, and guess what else is risky? Depending on one job, one paycheck, or Social Security (ha—good luck with that). Not investing is the real gamble as inflation will eat your savings alive. You don’t have to throw your life savings into Dogecoin—just start with broad-market ETFs and take it slow. Your future self will thank you.

Q: Aren’t stocks just a scam made for rich people to get richer?

A: No,stocks aren’t some evil rich-person conspiracy. Sure,the ultra-wealthy know how to use the market to their advantage,but guess what? So can you. The stock market isn’t some VIP club with a bouncer—it’s open to anyone with an internet connection and a working brain. The only thing keeping you out is your excuses.

Q: But isn’t investing complicated? I don’t know what to do!

A: neither did anyone else when they started, genius. You think Warren Buffett came out of the womb holding Berkshire Hathaway shares? No. Luckily, we live in the age of Google, where you can learn literally anything for free. Can you read? Can you watch YouTube tutorials? If so, then you can figure out investing.

Q: What if I lose money?

A: Oh, sweet summer child. Yes, you might lose money in the short term.That’s called volatility, and it’s normal. If you panic every time your portfolio dips, you don’t need investing advice—you need therapy. The market goes up and down, but over decades, it trends up. If you zoom out, you’ll see that historically, the stock market rewards those who stay in—not those who jump ship the second things get bumpy.

Q: I don’t have time to watch the stock market all day.

A: Good. Because you don’t need to. This isn’t day trading, and you’re not some Wall Street wolf (spoiler: Those guys lose a lot too). Get into index funds, set up automatic contributions, and go live your life. The market will do its thing while you do yours.

Q: But what if I mess up and pick the wrong stocks?

A: Then don’t pick individual stocks unless you know what you’re doing, genius. Stick to ETFs like the S&P 500, which tracks 500 of the biggest companies. It’s a set-it-and-forget-it approach that has worked for decades. Or, if you want someone else to do the thinking, get a robo-advisor.

Q: Okay, fine. Where do I start?

A: an intelligent question! Open an investment account—Roth IRA, 401(k), brokerage, whatever works for you.Start with an index fund like VOO or SPY. Set up automatic contributions, so you don’t rely on “maybe next month” (spoiler: next month never comes). Then, leave it alone and let time do the magic.

Final Thought: Get Over Yourself and Just Start

If you’re waiting for the “perfect time” to invest, congratulations—you’ll wait forever. The perfect time was yesterday. The second-best time is today. So stop making excuses, stop being scared, and start putting your money to work. Your future self will either thank you—or curse you for being a financial idiot. your choice.

Key Takeaways

So, there you have it. Investing isn’t some fancy club for billionaires sipping champagne on yachts—it’s for everyone, including you. Yeah, you. The one who’s been making excuses about not having “enough money” while dropping $7 on a daily oat milk latte. The one who thinks you need a degree from Wall Street University (not a real thing) just to put a few dollars into an index fund. Newsflash: You don’t.

The truth is, the longer you sit around whining about how investing is “too hard” or “too risky,” the more money you’re leaving on the table. And guess what? No one’s going to swoop in and do it for you. So stop overthinking, start doing, and let compounding do the heavy lifting. Future you will either be sipping margaritas on a beach or stressing over gas prices—totally your call.

Now, go open that damn investment account and quit making excuses.