Alright, folks, listen up. If your grand master plan for retirement involves polishing your lucky penny and praying for a mega millions miracle, it’s time for a reality check. “Your Retirement plan Isn’t ‘Winning the Lottery’—Do Better.” Spoiler alert: banking on a one-in-a-billion shot isn’t exactly the financial genius you think it is. Sure, dreaming about telling your boss to shove it as soon as that jackpot hits is amusing. But let’s be honest—clinging to this fantasy is like planning your diet around kale smoothies and then inhaling a dozen donuts. it’s delusional, at best. This article is your wake-up call. So buckle up, buttercup, as we’re about to dismantle your lottery dreams and introduce you to the grown-up world of actual retirement planning. spoiler: it involves more than a scratch-off ticket and divine intervention.

Your Future Isn’t a Jackpot: Stop Fantasizing and Start Planning Now

Let’s get real for a second. Sitting around daydreaming about that blissful call from the lottery office isn’t going to fund your way through retirement. Newsflash: nearly zero people win the lottery. Instead of fantasizing,why not put that finger-pointing energy into planning? You’ll thank yourself later when sipping margaritas by the beach isn’t just a pipe dream. Look,unless you enjoy working your fingers to the bone well into your 80s,you’d better start taking this seriously. Here’s the deal—making a solid plan is like a cheat code for adulting.

We’re talking simple steps here folks, not rocket science. Probably the most efficient way is by leveraging these bad boys:

- 401(k): As investing in your future is better than betting it away.

- IRAs: Conventional or Roth, pick your poison (but actually pick the Roth, you’re welcome).

- Stocks: Don’t be scared, embrace the wild ride—just do your homework first.

To simplify the perceptions and misconceptions, here’s a table to chew on:

| What You Think | Reality Check |

|---|---|

| Lottery win will save my future. | Your chances are 1 in 292.2 million. (Good luck with that.) |

| Retirement accounts are confusing. | Check the internet. Ever heard of Google? |

| No time to plan. | You once binge-watched every episode of some series, but can’t spend 20 mins on this? |

So, stop dreaming and start planning. your future self will high-five you, and who doesn’t love high-fives?

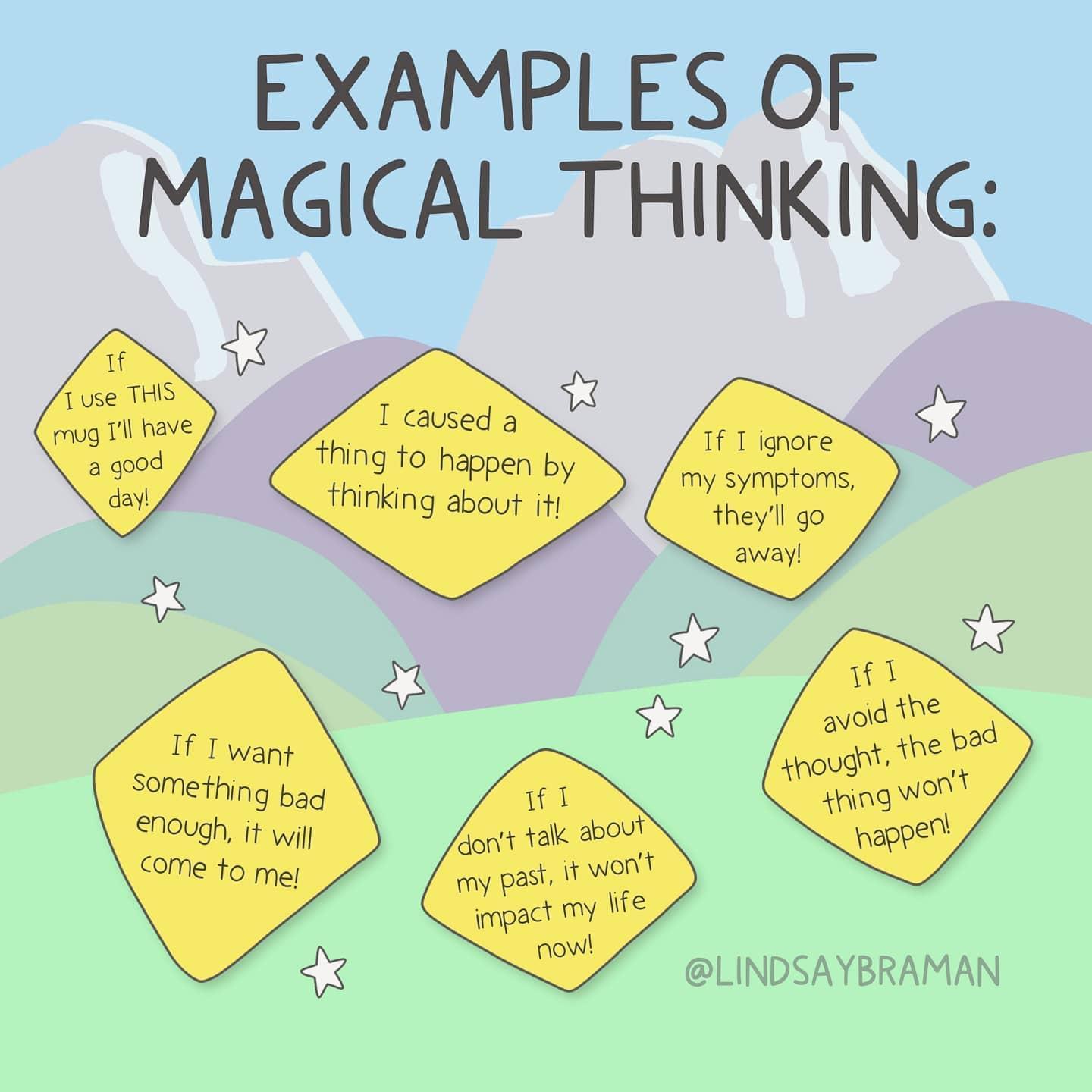

Magical Thinking Alert: why Relying on Luck for Retirement is Pure Madness

Thinking you can roll the dice and count on sheer luck to secure your golden years? Newsflash: that’s as smart as believing a unicorn is going to trot up and deliver you a pot of gold. The “let’s see what happens” approach is great for a night in Las Vegas,but when it comes to your future,it’s akin to asking a squirrel to handle your finances. Here’s a hot tip: the money fairy doesn’t exist! So, snap out of dreamland and start thinking pragmatically, unless you want to spend your senior years as a mall walker desperately searching for loose change under food court tables.

The harsh truth? Relying on luck is financial suicide. Need proof? Let’s put it this way: the odds of you winning the lottery are about 1 in 13.98 million. But you know what’s more certain? Taxes, death, and running out of toilet paper at the worst possible time. So instead of clutching a rabbit’s foot and hoping for a windfall, focus on creating real financial strategies. Start with these no-brainers:

- Save: Get over the latte habit and stash away some cash. Spoiler alert: Your future self will thank you.

- Invest: Open that dusty book you’ve been avoiding titled “Basic Investing 101.” Stocks, bonds, index funds—they’re your golden ticket, not a scratch-off.

- Plan: Instead of betting all on black,create a detailed retirement blueprint because “winging it” doesn’t fly when you’re 65.

If you’re still not convinced, check out this little table of dreams versus reality:

| Dream | Reality Check |

|---|---|

| win lottery and retire at 30 | Return to the 9-to-5 grind |

| Inherit a fortune | Find out you’re as related to a millionaire as you are to a banana |

| Live in luxury | Budget lunches at home |

Get Your Head Out of the Clouds: realistic Strategies That Actually Work

Thinking your retirement strategy involves hitting a nine-digit jackpot? Get over it.Here’s the deal: wishing and hoping are not strategies. The reality is, most of us won’t be buying private jets or castles in the south of France. But hey, we can still retire comfortably. What you need are strategy and consistency, not leaps of fortune. We’re talking about simple actions like: maintaining a steady savings plan, cutting needless expenses (do you really need yet another streaming service?), and being aware of your spending like a hawk guarding its treasured nest.

Consider other options like contributing to a 401k as, surprise, they exist for a reason. Think for a moment about investments instead of splurging on today’s fleeting rainbow-infused lattes. Here’s a quick list of things that actually work:

- Automated savings – so you don’t ‘accidentally’ blow it all on midnight snacks.

- Diversified investments – because putting all your eggs in one basket never ends well (ask Humpty Dumpty).

- Monthly budget reviews – if you’re ignoring this, you’re basically playing checkers when you should be playing chess.

| method | Benefit |

|---|---|

| 401k Contributions | Tax advantages now,freedom later. |

| IRAs | Another smart place to stash some cash. |

| Budgeting | The foundation of any sane financial plan. |

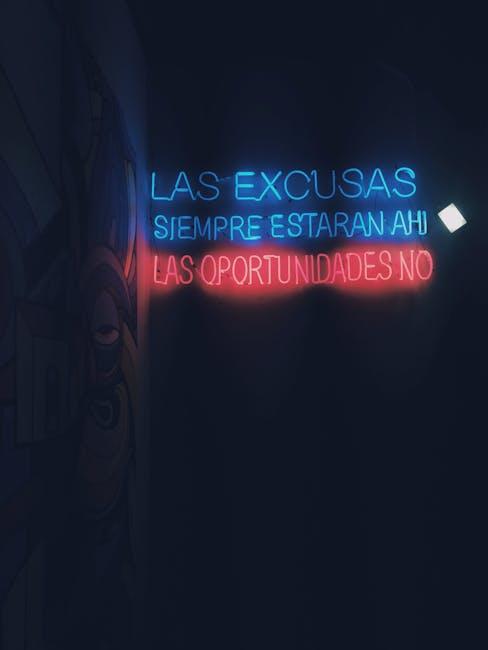

Kick Your Excuses to the Curb and Build a Sensible Retirement Strategy Today

You’ve watched enough reality TV to know that relying on a jackpot to fund your golden years is as likely as a snowstorm in July. get off the couch and start crafting a retirement strategy that doesn’t resemble a slot machine in Vegas. As let’s face it, the odds are not in your favor. Here’s a news flash: grown-uping requires planning, and “winging it” isn’t planning. First, wrap your head around saving consistently; skip the avocado toast if you have to. Next, invest like a responsible adult—no, that doesn’t mean pouring your life savings into the latest meme stock, but rather a diversified portfolio that doesn’t cause heart palpitations every time Elon Musk tweets.

- Step 1: Contribute to a 401(k) or IRA. You’re not too young, and you’re definitely not too broke to start.

- Step 2: Be a cheapskate in a smart way. Automate your savings so you forget you even had that cash in the first place.

- Step 3: educate yourself. No, not YouTube comments kind of education, legit sources!

Feeling that tinge of adultness creeping in? Good. Here’s a quick dose of reality in an easy bite-size table, ’cause, who has time for War and Peace when it comes to finances?

.wp-block-table {

width: 100%;

border-collapse: collapse;

}

.wp-block-table th,.wp-block-table td {

border: 1px solid #ddd;

padding: 8px;

text-align: center;

}

.wp-block-table th {

background-color: #f2f2f2;

}

| Myth | Reality |

|---|---|

| Wait till I’m older to save | Start now, thank yourself later |

| Social Security will cover it | Ha! Maybe buy gum… |

| It’s too intricate | Google it, genius. |

Q&A

Q: So, I’ve got this foolproof retirement plan: winning the lottery. Thoughts?

A: Oh, brilliant! Because nothing screams “financial genius” like banking on 1 in 292 million odds, right? Might as well plan your career around becoming a unicorn trainer. Here’s a pro tip: instead of throwing cash at lotto tickets, maybe look into something crazy—like an actual retirement account. You know, those boring things that offer a smidge more certainty than “maybe I’ll get lucky.”

Q: Why shouldn’t I just take all my savings to the casino and let lady luck handle my retirement?

A: Excellent strategy if your goal is to perfect the art of living in your parent’s basement past the age of 75. Here’s the reality check: casinos aren’t in business as they’re generous. They’re practically built on the tears of those with delusions of grandeur. How about investing smartly? It’s so crazy, it just might work!

Q: Isn’t investing just like gambling, though?

A: Oh sure, if you consider meticulously researched decisions and diversification the same as tossing dice on a craps table. Investing is about strategy, patience, and not thinking you’ll become a millionaire overnight just as you saw it in a movie.It’s not about wooing the slot machine into coughing up your retirement funds.

Q: but the lottery gives instant results—investments take forever!

A: Aw, someone’s looking for instant gratification! Sure, you coudl wait around for those magic numbers or take a bit longer with investments—because slow and steady might not win the race but definitely won’t land you begging for scraps.Get-rich-quick schemes are great and all—until they aren’t.

Q: Why is everyone always harping on about financial planning?

A: Gee, I don’t know.Maybe because not living off cat food in your golden years sounds appealing? Planning isn’t just some buzzword financial advisors use to bore you into submission. It’s the adult version of drawing maps to that treasure marked “pleasant retirement.” Ignore it at your peril.

Q: I want to live comfortably later. What’s better than lottery tickets for this?

A: I was hoping you’d ask. Try putting money into a 401(k), an IRA, or some diverse stocks and bonds—which, believe it or not, have actual value. Think of it this way: planning and proactive saving are like planting seeds,and by retirement,you might just have a money tree that isn’t invincible to termites. Still with me, or are we daydreaming about Scratch-Offs again?

Q: Alright, let’s say I give up on the lottery. What’s my first step in a real retirement plan?

A: Oh, look at you, ready to join the big leagues! First step: assess where you’re at—preferably not at the local convenience store buying lotto tickets. Get an idea of your current savings, your projected needs, and start contributing to retirement accounts.And maybe, just maybe, talk to a <a href="https://mindfulmint.org/2023/12/12/budgeting-for-mental-peace-strategies-for-financial-and-emotional-balance/” title=”Budgeting for Mental Peace: Strategies for Financial and Emotional Balance”>financial advisor instead of your “lucky charm” guru. Welcome to the world of realistic expectations!

In Conclusion

And there you have it,folks. If your retirement plan consists of crossing your fingers and hoping that a lottery ticket will magically transform you into the next instant millionaire, it might be time to wake up from that little daydream. Let’s face it, the odds of that happening are about as slim as you getting struck by lightning while holding a four-leaf clover in one hand and a leprechaun’s pot of gold in the other. So maybe, just maybe, it’s time to concoct a plan that involves less wishful thinking and more reality.

Remember, your financial future isn’t a game of chance—unless, of course, you’re playing roulette with your bank account, in which case, good luck with that! Why not take a hot second to sit down with someone who knows a little more about finance than your Uncle Bob who’s convinced he’s got the perfect lotto numbers. Trust me, investing in knowledge and strategy never bankrupted anyone.

Bottom line: it’s time to do better. If you’re relying on the lottery as your golden ticket to sipping margaritas on a tropical beach in retirement, you might end up serving those drinks rather. So, buckle up, buttercup, and start planning. Your future self will either thank you or curse you, and trust me, you don’t want to be the butt of your own jokes ten years down the road. Get your act together and craft a retirement plan that’s based on strategy, not fantasy. It’s time to stop dreaming and start doing—unless you actually like the taste of instant ramen in your golden years.