Oh, so you’ve decided it’s time to stop treating your bank account like an overused credit card adn finally get your financial life together? Bravo. Maybe you’re sick of living paycheck to two-days-before-paycheck or tired of your wallet wheezing with tumbleweeds rolling through? Or perhaps you’re just ready to upgrade from that college-level budget of ramen and wishful thinking. Whatever your reason,welcome to the no-fluff guide on crafting a financial plan that’s so well-tailored,it might as well come with a bespoke suit. Here’s the kicker: making a financial plan that actually works for you isn’t about following some cookie-cutter spreadsheet designed for robots. It’s about navigating the minefield of bills, starting with not running away like a deer in headlights every time you hear “budget.” So strap in, grab a cup of whatever you drink when you’re ready to face life’s more unpleasant truths, and get ready to tackle this with a splash of humor and a hefty dose of reality.

Stop Playing the lotto: clearly Define Your Financial Goals, Genius

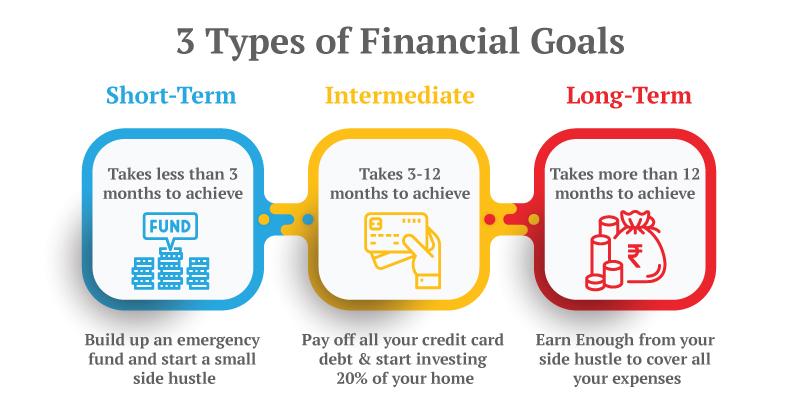

Alright, let’s face it: relying on winning the lottery isn’t exactly your best financial strategy, unless ‘financial plan’ means throwing money into the wind and hoping it carries you to Fiji. Instead, try planning your finances with actual outcomes in mind. What do you want? Peace of mind? Retire before your hair turns gray? Travel to see the Eiffel Tower and not just watch it on Instagram? Get specific. Vague goals like “I wanna be rich” are cute but about as useful as a chocolate teapot. Forget dreaming about the millions; focus on the steps you can actually take to get closer to those dreams without spending your entire paycheck on scratch-offs.

Once you’ve decided on your realistic goals,start cranking on a real plan—one that doesn’t count on luck but rather on clarity and determination. Consider these steps:

- Spending Habits: Monitor what you’re dropping cash on because those daily lattes could be your tropical vacation fund.

- Emergency Fund: Yes, it’s boring. No, you don’t want to be borrowing from Uncle Sam for a new furnace.

- Debt Management: Like cleaning out a garbage bin, you just gotta do it, starting with the worst debt.

- Investment Strategy: If investing sounds like a foreign language,time to get a dictionary or a financial advisor.

| Goal Type | target | Timeline |

|---|---|---|

| Emergency Fund | $10,000 | 12 months |

| Debt-Free | $0 Credit card Balance | 18 months |

| vacations | $5,000 | 2 years |

Remember, you might not become a millionaire overnight, but with a solid game plan, you’re on a one-way street to financial freedom. Now, that’s a jackpot worth pursuing. 🍾

Budgeting is NOT a Dirty Word: Craft your Spending Plan or Forever Be Broke

Let’s face it: if you continue to ignore the art of budgeting like a toddler refusing to eat anything green, you’ll find yourself in a never-ending cycle of debt, wondering where the heck all your money went. Crafting a spending plan isn’t about restricting your freedom; it’s about ensuring you’ve got the cash to make it rain when you really want to. Budgeting is an adult’s version of magic. Sure, it involves numbers and maybe a pinch of math, but who are you—a grown-up or a reckless teenager with a maxed-out credit card? Here’s the deal: write it down, put it in a spreadsheet, or tattoo it on your arm if you must. Without a plan, you’re just a squirrel trying to find a nut in a world where everyone’s goal is to swipe them up first!

- Track every cent, because the small stuff adds up quicker than you think.

- embrace technology—apps today make budgeting so easy, even your grandma could do it!

- Establish a savings goal. Seriously, your future self will thank you for those rainy day funds.

- Celebrate small wins; it’s budget, not punishment.

| Income | Essential Expenses | Fun Fund | Savings |

|---|---|---|---|

| $3,000 | $1,800 | $600 | $600 |

Think of this plan like a road map to your personal financial paradise. Your ultimate goal should be to outsmart your inner spendthrift and force them into submission with the iron fist of a solid budget. As let’s be real, if you don’t, your hard-earned cash will vanish quicker than your patience at the DMV.

invest in Investments, Not Your Neighbor’s Scheme: Pick Real Assets Like a Pro

alright, let’s get one thing straight: if your buddy from high school suddenly becomes an “investment expert” on social media, it’s probably a sign to run the other way. Instead of blindly tossing your cash into someone else’s sketchy scheme, you should be focusing on real assets. What does that mean,smartypants? We’re talking about things that actually grow value over time. Here, let me spell it out for you:

- Stocks: Like owning a tiny piece of Apple or Tesla—accept you don’t need to worry about the daily mood swings of billionaire CEOs.

- Real Estate: Buy some dirt and let it do the hard work for you. Bricks and mortar, baby!

- Bonds: The lesser-known cousin of stocks—more stable, less drama.

- Index Funds: As who has the time to pick individual stocks? Let some financial wizard do the heavy lifting.

Think managing your money is rocket science? Here’s a brain-buster: You don’t need a PhD to figure out that actual hard assets beat betting your retirement on your neighbor’s “can’t fail” chicken farming empire. Done right, investing in the tried-and-true stuff makes money while you sleep—or binge Netflix. Want a fast reference table? Of course, you do:

| Asset Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Real Estate | Medium | Medium-High |

| Bonds | Low | Low-Medium |

| Index Funds | Medium | Medium-High |

Emergency Funds Are Sexy: Why You Should Stop Ignoring Your Safety Net

Okay, let’s talk about your financial elephant in the room—emergency funds. They’re not just some boring piggy banks to ignore while you gamble on dogecoin, hoping to strike it rich. Forget what your Instagram influencer-wannabe friend says about investing in your fifth vintage jean jacket. Your safety net is as vital as that morning coffee you can’t live without. Imagine waking up to a surprise vet bill or that car breakdown that magically appears right before payday. Suddenly, saving money isn’t so “ugh” anymore, right?

- Peace of Mind: Sleep better knowing you don’t have to sell a kidney for a surprise expense.

- Freedom to Say “No”: Stop being a slave to your paycheck; emergency funds let you choose priorities without resorting to instant noodles.

- Avoid Debt Spiral: As who really wants to pay 25% interest on a credit card debt that rivals Mount Everest?

| Situation | Your Reaction Without emergency Fund | Your Reaction With emergency Fund |

|---|---|---|

| Unexpected Medical Bill | Panic and search “how to sell my sneaker collection fast.” | Pay the bill, have a tea, move on with life. |

| Car Breakdown | pray the mechanic is in a good mood or prepare endless bus transfers. | Get it fixed, plan a road trip you don’t need. |

| Job Loss | Live off ramen or that stack of sauces from Taco Bell. | take time to find the job you actually like. |

Q&A

Title: (Yes, YOU!)

Q1: Why do I need a financial plan?

A1: Oh, I don’t know. Do you enjoy stress,sleepless nights,and the impending doom of realizing your retirement plan consists solely of winning the lottery? If you’d rather have a plan than test your luck with scratch-off tickets,then yes,you need a financial plan. It’s what separates you from financial chaos and living in your parents’ basement until you’re 50.

Q2: What’s the first step in creating a financial plan?

A2: First, wake up and smell the coffee. Admit that you might not be a financial genius—and that’s okay as neither are most peopel. start by knowing where your money is going. I’m talking about tracking every dollar. Yes, even the $8 artisanal latte that you “deserve.” Get a budgeting app, a spreadsheet, or a stone tablet, and start recording your income and expenses, because denial isn’t free.

Q3: How do I set financial goals?

A3: Simple. Imagine a world where you actually achieve something. Crazy, right? Start by setting realistic goals. We’re not talking about buying a private island next year. begin with short-term goals (pay off that credit card,genius) and long-term goals (like not working until you’re 90). Prioritize paying off debt, saving for emergencies, and maybe—just maybe—retirement.

Q4: What about saving money?

A4: Ah, the elusive art of saving money. It’s not as mystical as finding a unicorn. Here’s a radical idea: Spend less than you earn. Groundbreaking, right? Automatically transfer a chunk of your income into savings before you can spend it on things you’ll regret later. Think of your savings account as a “Do Not Touch” zone. And trust me, future you will thank past you for not acting like a reckless teenager with their allowance.

Q5: How do I manage debt effectively?

A5: Step one: Stop pretending minimum payments are your best friend. They’re not.they’re the devil in a amiable costume. Focus on knocking out high-interest debt first. Snowball, avalanche, hurricane—whatever method makes sense to your math-challenged brain. Just pick one and stick to it. As nothing says “I’ve got my life together” like lessening the handcuffs of debt strangling your financial freedom.

Q6: Should I invest, and how?

A6: Yes, you should invest. No, it’s not okay to throw darts at a list of stock symbols. Start with baby steps, like a 401(k) or an IRA. And don’t just dive into the world of crypto as your cousin’s barber made a killing on it last week. Educate yourself with something other than TikTok or Reddit advice threads,and consider consulting an actual financial advisor rather of your buddy who still owes you twenty bucks.

Q7: How do I stick to my financial plan?

A7: Ah, the age-old battle between your present self and your lazy, impulsive self. first, keep your goals in mind and revisit them regularly. Celebrate small victories (without splurging!). Set reminders, alarms, post-it notes—anything short of a tattoo on your forehead to keep you focused.Remember,you’re not a cat; curiosity and distraction shouldn’t dictate your life choices.

In Conclusion:

There you have it—all laid out in black and white like a stern school principal’s memo. You wanted honesty? You got it. Now go make that financial plan and stop complaining about how adulting sucks. As newsflash: it’s going to suck a lot more if you don’t have your financial act together.Cheers to not being broke AF forever!

Concluding Remarks

So, there you have it, folks—how to create a financial plan that doesn’t suck. Stop pretending that burying your head in the sand and hoping for the best is a strategy. Spoiler alert: it’s not. the days of ignoring your bank account, while praying for a miracle lottery win, need to take a permanent vacation.

It’s time to drop the excuses, light a fire under your aspirations, and get this financial planning show on the road. sure, it means actually having to confront those years of latte addiction and shopping “therapy” bills, but hey, reality bites, and it’s time you get bitten once in a while.

You want financial freedom? Then act like it. Stop making those pathetic half-hearted promises and start setting real goals. So, put on those big kid pants, face your financial fears, and craft a plan that finally works for you.Because if you’re not planning your financial future, then who the hell is?

We’ve laid it all out for you. The roadmap’s in front of you,and if you’re still stuck in the depths of indecision,well,we can’t all be winners. But if you choose to step up, congratulations on joining the ranks of those who give a damn about what their financial future looks like. Now go seize it, unless, of course, you prefer to enjoy the adrenaline rush that only an empty wallet can provide. the choice is yours. Happy planning!