Welcome, dear reader, to the no-holds-barred, gloves-off reality check you didn’t know you signed up for, but desperately need. If you’re looking to sugarcoat your financial fiascos, you’re in the wrong place. This isn’t your grandma’s pleasant financial advice column.No, this is a groundbreaking revelation for all those eager to point fingers at the universe, the economy, or the unfortunate alignment of the stars. Spoiler alert: the only direction your fingers should be pointing is right back at you. Yes, that means looking directly into the mirror. Step into the harsh, unflattering spotlight of accountability because, news flash—your financial mess didn’t just magically happen. It’s 100% your fault. So buckle up, swallow that bitter pill, and get ready to confront some hard truths about why your bank account is emptier than a politician’s promise.Welcome to the ride of responsibility,and spoiler—it’s not for the faint-hearted.

Your Spending Habits Are Worse Than a Shopaholic Squirrel on Black Friday

Seriously, how did you turn budgeting into a mythical creature? Every payday you promise yourself, “This month is different,” and then bam! Your wallet is thinner than your patience in a long meeting. It’s time to face the brutal truth: your spending spree antics aren’t charming—they’re catastrophic.

- Impulse Purchases: Because who needs savings when you can buy that neon lava lamp?

- Ignoring Sales: Wait, you mean buying things you don’t need just because they’re discounted is a problem?

- Subscription Hoarding: Five streaming services? Great, maybe you’ll actually use one…

Let’s break it down:

| Your Habits | Reality Check |

|---|---|

| Buying on a whim | Planned purchases |

| Chasing trends | Investing in essentials |

| Living paycheck to paycheck | building an emergency fund |

Stop Blaming Starbucks: Why Your lattes Aren’t the Reason Youre Broke

Oh, sure, your $5 daily latte is the *main* reason your wallet’s always crying. Let’s break it down: spending a few bucks on coffee every day adds up to a few hundred a year. But guess what? Your financial train wreck didn’t derail as of a fancy foam art. It’s because you’ve got bigger holes in your budget, like endless impulse buys and ignoring your savings plan.

Here’s what’s really sinking your finances:

- Living beyond your means: Think you can afford that third streaming service? Think again.

- No budget in place: Surprise expenses love catching you off guard.

- ignoring debts: Letting them pile up like your unopened mail.

Stop playing the blame game. Your financial mess is the result of your own poor decisions, not your barista’s latte art. Take responsibility, make better choices, and watch your bank account breathe a little easier.

Your Budget Is MIA: Time to Conduct a Full-Blown Financial Search Party

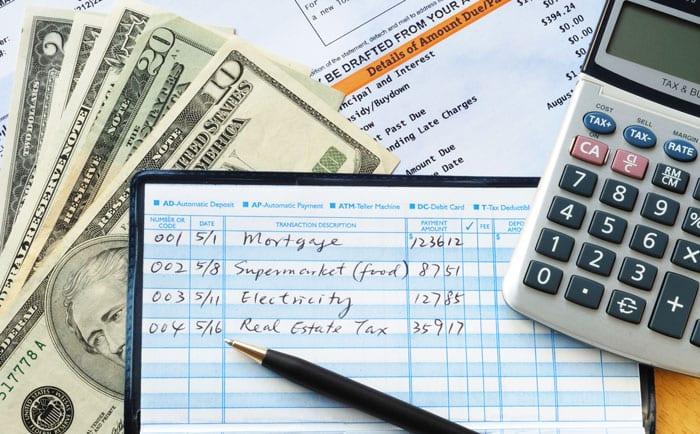

Wow, you’ve successfully turned your budget into a mythical creature. time to roll up your sleeves and play financial archaeologist. Start by digging through every pointless subscription and those sneaky daily expenses that are silently killing your bank account. Here’s your no-BS checklist to reclaim your money:

- Gather all financial statements: Because winging it has done you dirty.

- Track every expense: Yes,even that overpriced coffee habit.

- Identify wasteful spending: Hint: It’s not “essential.”

If you actually manage to sort through this mess, put it all in a table like this and maybe, just maybe, you’ll see where your money is vanishing:

| Category | Monthly Spend | Reality Check |

|---|---|---|

| Coffee Runs | $120 | Wake up or shut up. |

| Streaming Services | $80 | Are you binge-watching your finances? |

| Impulse Buys | $200 | Self-control isn’t your strong suit, huh? |

Wake Up and Smell the Debt: A 12-Step Detox Plan for Your Wallet

Let’s cut the crap—you’re drowning in debt because you couldn’t manage your spending, not because the universe is out to get you. Every impulsive buy, every ignored budget was a personal choice, and now you’re paying the price. It’s time to stop playing the victim and start taking responsibility for your financial wreckage.

Here’s your lifeline out of the fiscal abyss.Follow these no-nonsense steps to detox your wallet and kick debt to the curb:

- Assess Your Situation: List every debt and know exactly how much you owe.

- Create a Budget: Stop guessing and start planning your every dollar.

- Cut Needless Expenses: Identify and eliminate the junk eating up your money.

- Increase Your Income: Hustle harder or find new revenue streams.

- Negotiate with Creditors: Don’t be afraid to ask for better terms.

- Build an Emergency Fund: Prepare for unexpected expenses without going into more debt.

- Stay Disciplined: Keep your eyes on the prize and don’t slip back into old habits.

- Seek Professional Help: Sometimes you need an expert to guide you out.

- Monitor your Progress: Regularly check where you stand and adjust accordingly.

- Avoid New Debt: Resist the temptation to borrow more.

- Educate Yourself: Learn about personal finance to make informed decisions.

- Celebrate Milestones: Reward yourself for the progress you make without breaking the bank.

| Step | Description |

|---|---|

| Assess Your Situation | Get real about what you owe. |

| Create a Budget | Plan every penny. |

| Cut Unnecessary Expenses | Trim the fat from your spending. |

Q&A

Q&A:

Q: why should I believe that my financial mess is entirely my fault?

A: Oh, I don’t know, maybe as it’s your bank account that’s emptier than a Black Friday shelf. Sure, blame the economy, your parents, or even your astrologer if you want, but at the end of the day, you’re the one who decided a daily latte was as crucial as saving for retirement. Reality check: if you took half your excuses and turned them into actions, we’d be calling you the next Warren Buffett. But hey, keep blaming Mercury retrograde.

Q: Isn’t it a little harsh to say I’m not a victim at all?

A: Oh, poor baby. Welcome to the world where participation trophies don’t pay the bills. “Victim” implies something beyond your control, like a tornado, or maybe when your favorite character gets killed off in your favorite show. But unless your finances where obliterated by a swarm of locusts, it’s probably time to admit your knack for online shopping might be more devastating than biblical plagues. sure, life throws curveballs, but if you’re not even at bat, stop complaining when you strike out.

Q: What can I do to fix my finances if it’s all my fault?

A: Recognizing the root of your financial fiasco—spoiler alert: it’s you—is step one. Start by swapping your excuses for accountability. maybe try a spreadsheet; they’re not just for nerds anymore. Track your expenses like a stalker tracks an ex. Realize that “budget” is not a dirty word but your BFF. And for heaven’s sake, save something—anything!—because Netflix will stop being your chill buddy when the internet bill doesn’t get paid. Welcome to adulting!

Q: But isn’t it unhealthy to blame myself entirely? Shouldn’t I be kind to myself?

A: Being kind to yourself doesn’t mean patting yourself on the back as you charge another meal you can’t afford. reality slap: acknowledging your own poor decisions is not mean,it’s called growing up. It’s the first step to figuring out that sometimes tough love is the best kind of self-care. Sure, do some yoga, meditate, but also realize that clearing your mind won’t clear your debt.Own your choices, and make the next ones smarter. Namaste,indeed.

Q: So, is there any hope for someone like me?

A: Of course there’s hope, unless you plan on continuing this downward spiral of self-pity and denial.in which case, happy wallowing. But if you’re ready to pull your head out of the sand you buried it in, congratulations, you’ve taken step one on the road to recovery! Now roll up those sleeves, start making changes, because bankruptcy isn’t nearly as fun as the word “broke” sounds. being a financial genius is literally just not being financially stupid. Simple, right?

Concluding Remarks

So there you have it, folks. Your financial mess isn’t some mystical curse bestowed upon you by the universe or a result of Mercury in retrograde. Nope, it’s all on you! Maybe it’s time to put on your big kid pants and own it. Stop pointing fingers like a toddler in the midst of a tantrum and start taking responsibility for the choices you’ve made.

Sure, continue blaming the economy, the government, or that random guy on Twitter who clearly has all the answers. But deep down, you know it’s a cop-out. The only person who can fix this mess is staring back at you in the mirror.So close those 37 open tabs, unsubscribe from those ”deal” notifications that promise to save your wallet but don’t, and sit down with your finances like an adult.

Challenge yourself to cut the crap,make a plan,and—gasp—stick to it. Financial freedom isn’t just for the savvy few; it’s for anyone willing to step up,own their mess,and do the freaking work. So, what’s it going to be? Keep playing the victim, or grab the wheel and steer your financial destiny wherever the hell YOU want it to go? Your call.