Congratulations! You’ve graduated summa cum laude from the prestigious School of Procrastination! WhatS your specialty,you ask? Oh,it’s none other than the renowned “I’ll Start Saving Later” degree. you’ve mastered the art of convincing yourself that you’ll be just fine swimming in a kiddie pool of debt while future you drowns in a sea of regret.Welcome to the rollercoaster of financial disaster, expertly engineered by none other than — yes, you guessed it — yourself! Let’s dive right into dissecting this self-sabotaging mindset that’s about as useful as a screen door on a submarine. buckle up, because we’re about to call out your commitment to leisurely ignoring financial reality until it comes back to bite you in the unspeakables — and trust me, it will. This isn’t just a wake-up call; it’s your neon-lit, high-decibel summons to get your act together before Future You decides to time-travel back just to give you a swift kick in the rear.Ready? Let’s cut through the excuses and get to the part where you stop treating your savings account like a mythical creature that you assume exists without bothering to check.

Procrastination is Your Wallet’s Worst Enemy and Future You is a Sucker for Believing Otherwise

Alright, let’s get one thing straight: all those times you told yourself “I’ll start saving next month,” who were you trying to kid? Unless that magical “next month” comes with a money tree, you’re digging future you a hole so deep, you might as well call it the Grand Canyon. Seriously, do you actually believe that a fairy godmother will appear and turn your financial pumpkin into a golden chariot of wealth? Spoiler alert: she’s busy, and you’re hosed.

Look, procrastination isn’t just a habit; it’s practically a lifestyle choice that comes with a set of crappy accessories. Missing out on early savings? Here’s what you’re telling yourself:

- “I love living paycheck to paycheck!”

- “debt is the adult version of friendship bracelets.”

- “Who needs a retirement fund when I can work until I’m ancient?”

Let’s face it, choosing to save later is like deciding to wear flip-flops for a marathon—stupid and painful. Stop shooting yourself in the financial foot. The time to start saving isn’t soon, later, or tomorrow; it’s five years ago. But as you missed that boat, try today.Seriously,start putting your money where your mouth should be—preferably not consuming your 100th latte this year.

Secret Stash of Excuses: How You’re Betting on Future You’s Nonexistent Superpowers

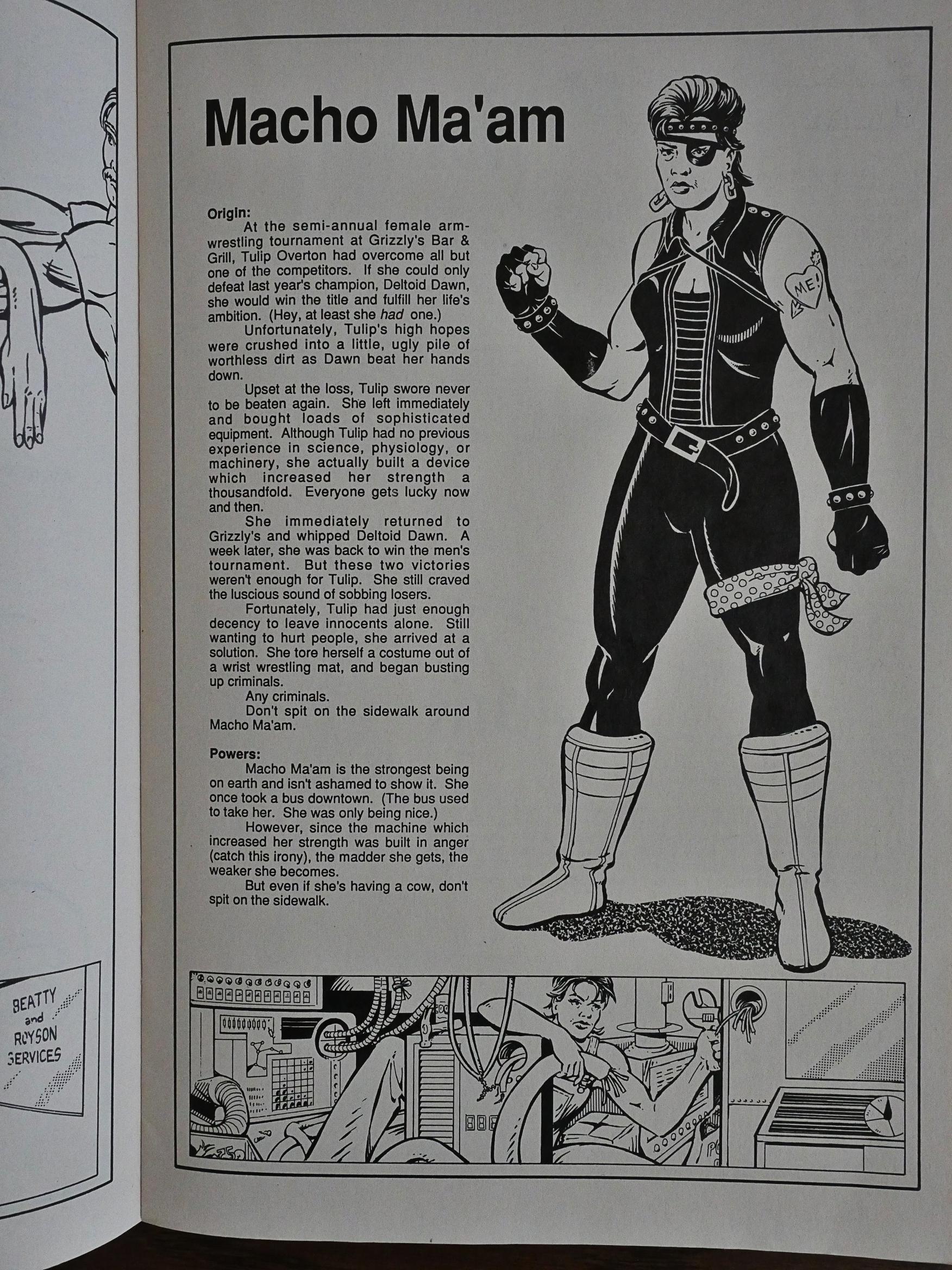

Oh look, it’s another excuse hopping into your excuse pocket. Neat collection you’ve got there.Let’s be honest, you’re stacking up excuses like some sort of procrastination currency, betting on Future You suddenly transforming into a financial superhero. Spoiler alert: future You is the same indecisive mess hashing it out with creamer options in the coffee aisle, not a magic money wizard. Think you’re saving by not saving? Genius calculation that’ll totally pay off—said no financial advisor ever.

Every time you say ”I’ll start saving later,” you’re practically signing a contract with imaginary superpowers. Here’s what your magical plan includes:

- Delusion: Believing tomorrow is the day you’ll morph into someone with financial discipline.

- Invisibility: Pretending your bills and emergencies will disappear like mist.

- Telekinesis: Hoping to just think your debt away with your mind.

Snap out of it! Future You is begging for a bailout plan, not a fantasy lineup of unfeasible abilities.

Empty Pockets, Broken Dreams: A Heartwarming Tale of Delayed Savings

Your “I’ll save later” philosophy is like telling your future self, “hey, dear, enjoy the cup ramen while you can because, guess what, things aren’t getting any tastier anytime soon!” Seriously, waiting for the perfect moment to start saving is like waiting for a unicorn to deliver your paycheck. You’ll end up with empty pockets and that fancy vacation will stay a distant dream. You know those friends who started saving a little bit here and there? Yeah, they’re sipping cocktails on a cruise ship, while you’re still arguing with the vending machine.

- Procrastination Champion:

- Excuses that top your list: “I’ll wait until I… graduate / get promoted / win the lottery.”

- Believable level: Zero

Embrace reality: future you is filing for an argument against past you for negligence. While you’re at it, take a good look at the math of laziness. Let’s break it down in a way even your procrastination-prone mind can compute. Here’s a table as bullet points just aren’t cutting it:

| Start Saving At Age | Amount At 65 |

|---|---|

| 25 | $500,000 |

| 35 | $250,000 |

| 45 | $100,000 |

Yep, that’s the wake-up call you were desperately trying to snooze. It’s time to stop the madness and start stashing away some cash unless, of course, you prefer your retirement plans served with a side of regret.

Grow Up and Get Real: Your Five-Step Reality Check to Stop sucker-Punching Future You

Let me break it down for you: that whole “I’ll do it later” mindset is about as helpful as a screen door on a submarine. Here’s the straight-up truth: delaying your savings is like procrastinating on showering—you can do it, but you’ll end up with a stink you can’t easily wash off. Future You is there, fists clenched in rage, waiting for you to get your act together as bills, unexpected expenses, and retirement costs won’t wait while you binge-watch that series for the third time. Get your priorities straight, buddy. Money won’t magically appear in your account like the Tooth Fairy just rode in on a unicorn.

So how do we give future You a break? It’s time to get practical. Here’s a no-nonsense guide to kicking those bad habits to the curb:

- Cut out the excuses: Your dog didn’t eat your budgeting homework—it’s time to face the numbers.

- Automate savings: You know what’s easier than clicking the ‘next episode’ button? Automating your savings so Future You isn’t rummaging through couch cushions.

- Track spending: Yeah, tracking is dull, but so is being broke at christmas. Know where every cent goes, no exceptions.

- Set clear goals: If your brain needs a little pick-me-up, set goals like a new car or a Swiss vacation, rather of that fourth cup of overpriced coffee in one day.

- Ditch toxic habits: Cancelling that pesky UberEats order just once a week could mean a cushier future—think about it.

Need some cold, hard truth to shake you awake? Let’s see how the numbers stack up:

| Savings Start age | Monthly Savings | Savings by Age 60 |

|---|---|---|

| 25 | $200 | $192,000 |

| 35 | $200 | $96,000 |

| 45 | $200 | $48,000 |

See the difference? So, what’s it gonna be—celebrating at the retirement home of your dreams, or flipping coins for your next meal? It’s in your hands, champ.

Q&A

Q: What’s the deal with this whole “I’ll start saving later” nonsense?

A: Oh,you mean the classic procrastination tactic where you convince yourself you’ll have more time—and money—later? News flash: Your future self is already rolling their eyes. The only thing you’re saving with that mentality is your spot on the list of peopel who’ll be working into their 70s.

Q: Why can’t I just enjoy life now and worry about saving later? YOLO and all that.

A: Ah, the YOLO defense! as, obviously, your future self will somehow be a wizard at money management. Spoiler alert: They won’t be. The fun you’re having now could mean ramen noodle dinners in your so-called golden years. Think about that the next time you’re about to swipe right on a luxury purchase.Q: But I don’t make enough money to save right now. Isn’t that a valid excuse?

A: Sure, if you also believe “I don’t have time to exercise” makes you magically fit. If the income fairy hasn’t blessed your bank account yet, start small. Even your pocket change can transform into a respectable pile of cash if given enough time to grow. Remember, no one’s asking you to bleed money; just don’t torture future you by starting with nothing.

Q: I heard investing is risky. Shouldn’t I wait until I know more?

A: Oh, absolutely. You should definitely wait to become a financial guru in your spare time between Netflix binges and social media scrolling.Or, you know, you could just start with the basics, let compounding interest do the heavy lifting, and slowly figure it out as you go along. But sure, risk it all on not taking risks. Smart move.

Q: What’s the worst that could happen if I don’t start saving now?

A: Picture yourself at 65, finally realizing that retirement might just be a mirage. Rather of sipping margaritas on a beach somewhere, you’ll be chugging coffee at a part-time job just to pay bills. But hey, at least you’ll still be “young at heart” while you’re working the register!

Q: Any tips for kicking this ”I’ll save later” habit in the behind?

A: Glad you asked. Start by setting up automatic transfers to a savings account because let’s face it, you’re not going to do it manually. Cement a minimalist budget that even your impulse-buying alter ego can tolerate. And continuously remind yourself that every dollar you save today is a slightly less crappy version of tomorrow.

Q: Final thoughts?

A: Stop kidding yourself. That “later” you’re banking on is a sitcom rerun you’ve seen before, and spoiler: it ends badly. So unless you enjoy the idea of cursing your past self in a few decades, drop the excuses, slap yourself with some financial reality, and start saving—like, yesterday.

Closing Remarks

So, there you have it. The cold, hard truth about your “I’ll start saving later” mentality. Look, we get it. the idea of saving money is about as exciting as watching paint dry, and who doesn’t love a little retail therapy or dining like you’re royalty? But wake up, genius! Future you is going to be absolutely thrilled when they realize they’re not living in the cardboard box of your procrastination nightmares.

Newsflash—life happens, and it gets expensive. Those designer lattes and spontaneous weekend getaways aren’t going to pay for your retirement yacht, no matter how manny times you tell Alexa you’re a billionaire. So stop kicking that can down the road because one day, you’re going to run out of road. And then what? Ask your dog to invest its savings in crypto?

The bottom line: grab a calculator,ditch the excuses,and start saving today. Future you deserves more than a pile of IOUs—you know it, I know it, and your wallet definitely knows it.it’s time to stop being your own worst enemy. After all, wouldn’t it be great to look back and laugh at the time you almost let your “Yeah, I’ll do it tomorrow” attitude turn your golden years into a financial horror show? Get with it, already. Your future self will thank you.