Alright, listen up, financial procrastinators and retirement deniers, it’s time for a wake-up call. Stop swiping past those 401(k) emails faster than your ex’s texts. You’re ignoring what could be your gateway to Margaritaville, and—brace yourselves—it could make you richer than the entire Bezos family, Dynasty-style. That’s right, I’m talking about your 401(k), the money machine that’s trying to help you spin doctor your way into a comfortable retirement while you’re too busy blowing cash on yet another overpriced latte. It’s like finding a winning lottery ticket in your sock drawer and using it as a bookmark. So let’s cut through the crap and dive into why you need to stop treating your 401(k) like a ghosted Tinder date and start milking it for all it’s worth. Consider this your tough-love kick in the assets.

Ditch the Ostrich Routine: Shove Your Head into Your 401(k) Instead

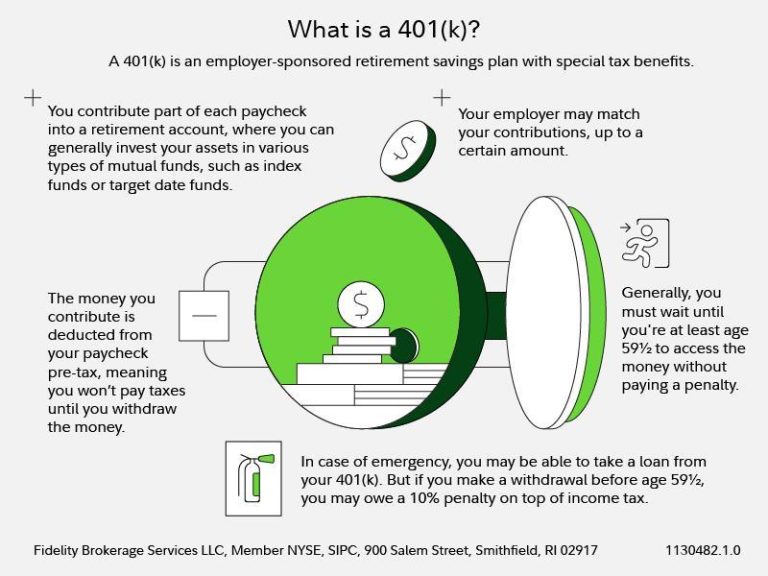

Hey, genius! You’ve buried your head in the sand long enough.It’s time to peak at your 401(k) before you waste another dollar on those useless fancy coffees. Look, your employer is practically waving “free money” in your face with matching contributions. Yes, that’s right—a rare chance to snag some cash without groveling. Yet, you’re treating your retirement savings like a mysterious relic you stumbled upon after binge-watching ancient Egyptian documentaries. Spoiler alert: When you contribute to your 401(k), you’re not just padding your savings; you are effectively paying yourself, and that future you wants to be sipping margaritas on a beach, not scrambling to find change in couch cushions.

Still not sold? let’s lay it out in a way even a goldfish could grasp:

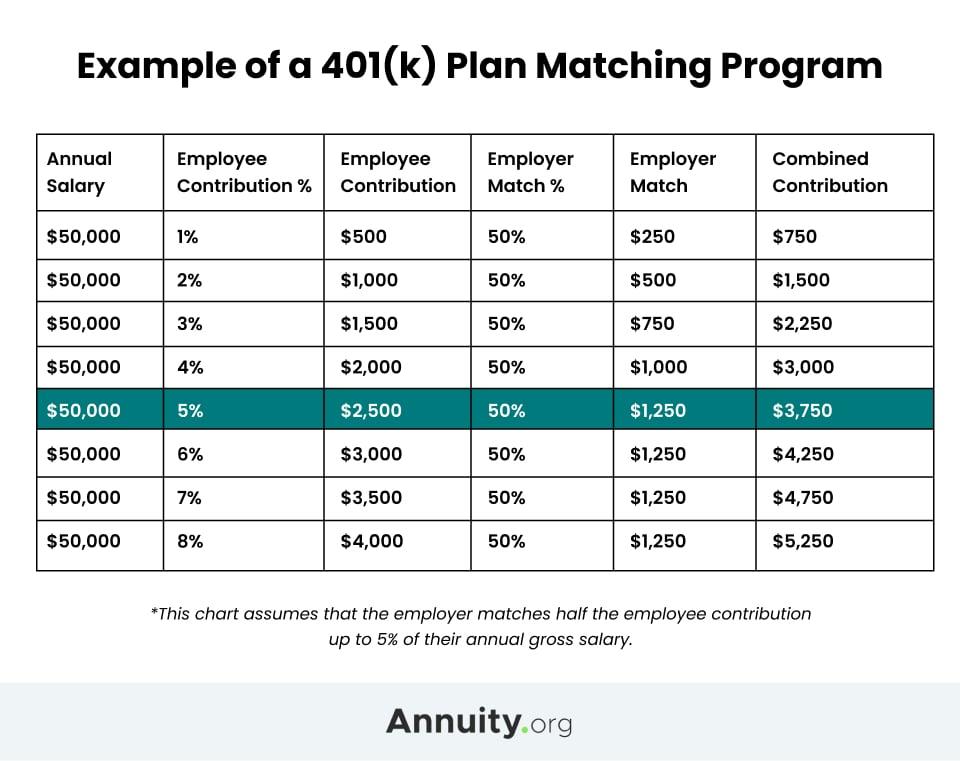

- employer Match: Some companies throw an extra 3-5% of your salary into your account, just because you decided to show up.

- Tax Benefits Galore: Lower your taxable income now and maybe throw a middle finger at Uncle Sam.

- Compound Interest, Baby!: Let your money do what it does best—grow like weeds, but in a good way.

Got commitment issues? Let’s get real for a sec:

| You’re probably doing this | When you should be doing this |

|---|---|

| Binge scrolling Twitter | Upping your 401(k) contribution by 1% |

| Rewatching that overrated TV series | Checking out your account balance (without crying) |

There you have it—no more excuses. Your 401(k) is the adult version of finding forgotten cash in your winter coat’s pocket. Except now, it might mean the difference between that retirement trip to Paris or a night at your high school reunion, pretending you still know how to “have a good time.”

Wake Up Call, Genius: why You’re Blowing Off a Sweet Stack of Free Cash

Let’s cut to the chase: You love money. Who doesn’t? But somehow,you’re giving a cold shoulder to the easiest way to pad your wallet—your 401(k).Seriously? You’re basically saying, “No thanks, I’m too good for free money.” Think of it like you’re standing in front of a cash machine that’s vomiting bills, and you’re just strolling by, like, “nah, I’m good with my change jar.” Spoiler alert: your employer is practically begging you to take their cash by offering matching contributions. Let’s spell it out for you: not using your 401(k) means you’re willingly saying no to free cash.

- Ever heard of compound interest? No? Of course not, you were too busy scuffing your heels somewhere.

- Want a rapid way to feel like a royal fool? Look at your aging coworkers thriving with that sweet retirement cushion.

- Still listening? Good. Just start contributing even a tiny bit. Your future self will thank you.Profusely.

Okay, need more convincing? Let’s put it in black and white for you:

| Scenario | Benefit |

|---|---|

| Contribute and get match | You actually get richer |

| Ignore it | You become the punchline at parties |

Be the smart cookie who cashes in on the walking ATM that is your 401(k). As spoiler alert: that magical new taco place you keep spending on won’t fund your retirement.

Stop trying to Be a Financial Wizard: Hit the Easy Button with Your 401(k)

Okay,listen up. You’re not a Wall Street genius, and that’s fine. Time to hit that 401(k) easy button.You know, the one you’ve been gleefully ignoring while you concoct investment schemes crazier than a cartoon villain? A 401(k) is like that magic printer in “Office Space” that spits out free money, minus the annoying beeps. Your company probably offers a match—here’s a newsflash: that’s cold hard cash you’re leaving on the table. Let’s skip the pretentious financial lexicon. You don’t need Fibonacci sequences or polynomial whatever to make smart decisions here. This is a no-hassle, plug-n-play retirement plan. because who wants to admire pie charts when there’s Netflix to binge? Spoiler alert: contributing at least enough to get the full match is your golden ticket.

And don’t start sweating over diversifying your portfolio like you’re about to go full Gordon Gekko. Remember, simple works.Opt for the target-date funds; they’ll glide you down the investment bunny slope without a helmet. Here, let the pros figure out what works best for you.Your job? Kicking in enough dough to guarantee that sweet, sweet company match. Why make life complex when you can’t even find your phone half the time? Look at the benefits quickly:

- Effortless Growth: Your money quietly multiplies while you’re busy not caring.

- Tax Advantages: Read my lips, less cash for Uncle Sam.

- employer match: This ain’t just monopoly money.

table {

width: 100%;

border-collapse: collapse;

margin: 20px 0;

}

th, td {

border: 1px solid #ddd;

padding: 8px;

}

th {

background-color: #f4f4f4;

}

| Feature | Description |

|---|---|

| Company Match | Free money for doing nothing. You’re welcome. |

| Low Effort | No need to channel your inner wolf from Wall Street. |

| Future You | Thinks you’re a genius for starting now. |

Face the Music: Your 401(k) Doesn’t Need a Crystal Ball, Just a Little Attention

Oh, you think your 401(k) is just gonna solve itself, do you? Look, your retirement fund doesn’t require a shaman or tarot cards. What it really needs is for you to stop being a clueless ostrich with its head in the sand. Throwing a peek at it once in a blue moon isn’t doing you any favors, darling. Rotate those eyeballs towards your statement; it’s practically jumping up and down for attention. Sure, it’s bleak and dry—like thrice-used teabags—but ignorance won’t make your nest egg hatch on its own.

Get your grubby little hands on that steering wheel, will ya? It’s really *not* rocket science. here’s what to do:

- Contributions: When they say “matching contributions,” they mean ”Hey genius, we’re giving you free money!”

- Investment Options: Stop spooning off your beige couch cash and check your asset allocations. Are you heavy on stocks or riding the bond train with grandma?

- Fees: Wanna pay more fees than Kim Kardashian’s glam team? I didn’t think so. Check what’s eating your returns like they’re all-you-can-eat nachos.

You don’t need a freakin’ crystal ball. Just a pulse and a pair of eyes will do.

Q&A

Q: What is this article really trying to say with such an eye-catching title?

A: Wow, look who finally decided to peek at their 401(k). The title isn’t trying to win a Pulitzer; it’s screaming at you to stop throwing away free money like it’s confetti at a parade. In other words, your employer’s match is basically cash they’re begging you to take. don’t be a fool—get with the program.

Q: Why do peopel typically ignore their 401(k)s?

A: Maybe they think retirement is a fantasy word invented by old people. Or perhaps they’re too busy binge-watching another series to spend 10 minutes thinking about their financial future. Either way, ignoring your 401(k) is like leaving free pizza on the table. Who does that?

Q: What exactly is so ‘free’ about this money?

A: Well, Mr./ms. Financially Clueless, the “free” part comes from your employer matching your contributions. It’s like oprah’s Favorite Things giveaway, except it’s money rather of a pair of outrageously expensive slippers. If you put in money, your employer does, too. It’s not rocket science, it’s free dough.

Q: Is it really that important to start a 401(k) contribution early?

A: Oh, no, feel free to start in your 50s if you love the idea of eating cat food in retirement.The earlier you start, the more compound interest can work its magic. Unless, of course, you prefer working forever or living out of a cardboard box.

Q: How can someone take action on their neglected 401(k)?

A: First, pull your head out of the sand. Second, log into your 401(k) account. If you don’t have one, what are you, allergic to money? Go start one with HR.Dial up the contribution amount until you hit at least what your company will match. It’s called not being a financial catastrophe.

Q: How frequently enough should people check their 401(k) and make adjustments?

A: How often do you check Instagram? That’s probably a bit much, but seriously, at least once a year wouldn’t kill you. Make sure your asset allocation isn’t a hot mess, and rebalance if needed. It’s like tidying up your closet, but unlike your questionable fashion choices, this actually matters.

Q: What’s the biggest misconception about 401(k)s?

A: That you need to be a financial wizard or some Wall Street hotshot to manage one. Spoiler alert: You don’t. Unless, of course, you want to dive into the rabbit hole of jargon-filled blabber. All you need is a pulse, a brain cell or two, and a commitment to not being broke in retirement.

Q: Any last words for people still ignoring their 401(k)?

A: If you’re still thinking about ignoring it, maybe you’re into playing financial roulette. Spoiler: The house usually wins in that game. put on your grown-up pants,get in there,and claim your free money. It’s the easiest way to not suck at adulting.

In Summary

And there you have it, folks—a thrilling ride through the land of 401(k)s. If you’re still sitting there, twiddling your thumbs, thinking your financial future is going to magically sort itself out, you might want to reconsider. Seriously, get your head out of the sand. Your 401(k) isn’t some mythical beast that’s going to eat you alive; it’s a golden goose that can lay some very lucrative eggs if you give it half a chance.

Stop pretending like you’ve got it all figured out while you ignore free money just waltzing past you like a parade float. It’s time to adult-up. Log into your account, pinch your nose if you must, and dive headfirst into your contributions. You’ll thank your past self when you’re lounging on a beach in retirement,sipping something expensive without a care in the world—or at least,without the care of wondering why you didn’t take advantage of what is essentially free cash.

So, what’s it going to be? Keep pretending everything’s okay as you ignore your elderly future self staring at you with cross arms and a disappointed scowl? Or start investing in your 401(k) and maybe, just maybe, actually give a future worthy of your potential a fighting chance? Remember, ”I told you so” is a dish best served to others—not heard from them at every family gathering. Get your act together and stop acting like you don’t need this. Because newsflash: You do.