So, you’ve meticulously plotted your financial empire—stocks, bonds, maybe even a side hustle selling artisanal beard oils. Congratulations, you’re practically a financial wizard.But hold your applause as there’s one glaring omission in your master plan: an estate plan. Yes, that dusty document you’ve been avoiding like your ex’s mixed signals. Let’s face it, thinking “I’m not dead yet” won’t save your hard-earned fortune from being squabbled over by relatives who can’t even agree on Thanksgiving dinner. So buckle up, buttercup, and let’s dive into why your so-called complete financial plan is more like a half-baked casserole without an estate plan to tie it all together.

Yeah, You’re Rolling in Cash, But What Happens When You’re Dead

Think you’re the next rockefeller? Congrats, as when you shamble off, your fortune might just become the family’s favorite soap opera.without an estate plan, your billions could get tangled in legal mumbo-jumbo longer than it takes to binge-watch that pointless series you love. And hey, nothing says “I care” like leaving your relatives to duke it out over who gets your prized collection of action figures.

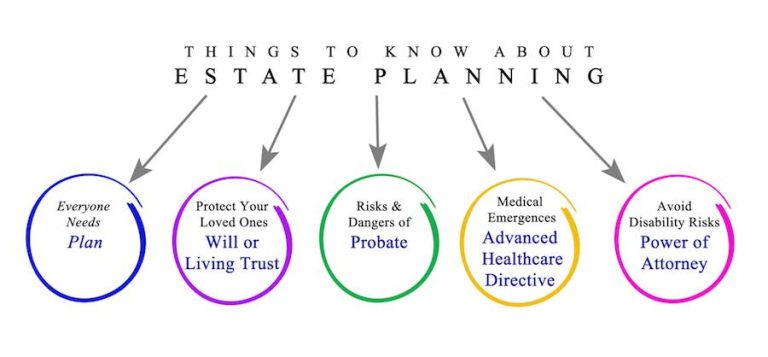

Here’s the delightful mess you’re signing up for without a solid estate plan:

- Endless Probate: Say hello to months, maybe years, of court drama.

- Sky-High Taxes: Your stash gets gobbled up by the taxman before your heirs see a dime.

- Family Feuds: Because what’s inheritance without a little sibling rivalry?

- Unwanted Surprises: Surprise gifts to distant cousins you never knew existed.

And if you’re the data-loving type, feast your eyes on this gem:

| Issue | Without Estate Plan | With Estate Plan |

|---|---|---|

| Probate Duration | 18-24 Months | 0-6 Months |

| Tax Burden | Higher Liabilities | Optimized Savings |

| Family Harmony | Potential Wars | Peaceful Transfers |

Bottom line? Don’t let your empire crumble into chaos. Get an estate plan sorted before your riches become someone else’s reality show plotline.

Your Financial Plan Isn’t a Funeral Plan Time to Get Your sh*t Together

Look, ignoring an estate plan is like leaving your financial house on fire and hoping it won’t burn down. you might think you’ve got everything figured out,but without a solid plan,your hard-earned money could end up in the hands of strangers or messy legal battles. Do you really want your family dealing with that chaos when you could’ve easily avoided it? Here’s the harsh truth:

- No Plan: The government decides who gets what, and trust me, they’re not your biggest fans.

- Legal Nightmares: Expect endless paperwork and court dates. fun times!

- Financial Loss: Probate fees and taxes can eat up a big chunk of your legacy. Flavorful, right?

Don’t be that person who thought estate planning was only for the rich or the elderly.It’s for anyone who wants control over thier financial destiny and to spare their loved ones from unneeded headaches.Get your shit together now, and take these steps:

| Step | Action |

|---|---|

| 1 | Draft a Will |

| 2 | Set Up Trusts |

| 3 | Choose an Executor |

| 4 | update Beneficiaries |

Stop Leaving your Loved Ones with Your Mess Crafting a Killer Estate Strategy

Alright, let’s cut the crap. You’ve been squirreling away your cash like a squirrel on a caffeine rush, but without an estate plan, all that hard work turns into a slapstick family circus when you’re gone. Imagine your loved ones fighting over your stuff as you didn’t bother to sort it out. Not exactly the legacy you wanted, right? So, stop being lazy and take a few minutes to:

- Clearly designate beneficiaries – No one enjoys a game of ”Who Gets What.”

- Set up trusts – Keep the broke cousins from draining the family treasure.

- Draft a will – Because “I leave everything to my dog” is not a solid plan.

- Appoint executors – Pick someone who won’t bail when things get messy.

and hey, if you need a visual reminder of how NOT to screw this up, check out the table below. It’s like a cheat sheet for not leaving your loved ones in financial purgatory:

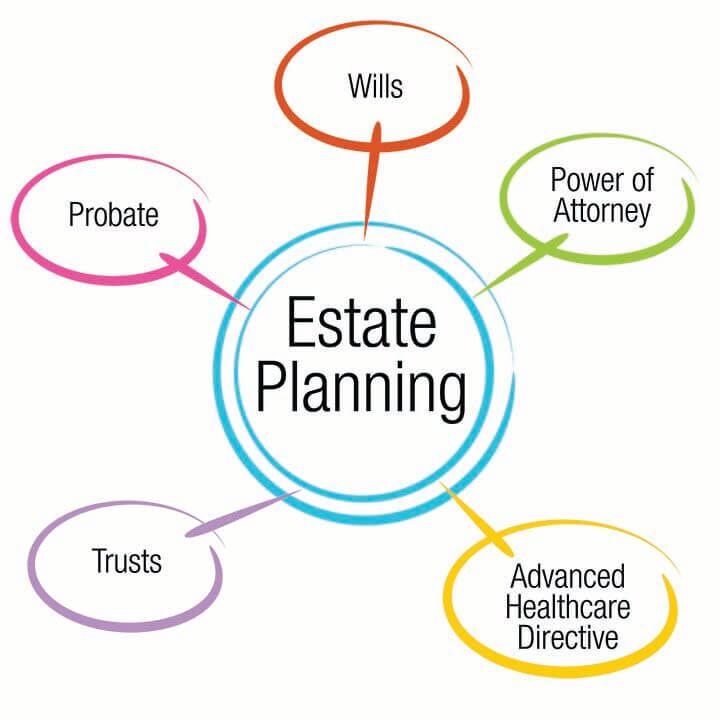

| Estate Planning Element | Why It Matters |

|---|---|

| Will | Prevents family feuds and legal nightmares |

| Trust | Protects assets from nosy relatives and taxes |

| Power of Attorney | Ensures decisions are made when you can’t |

Get your act together and create that estate plan. Your family—and your sanity—will thank you.

Don’t Be a Financial Ghost Integrate Estate Planning Before It’s Too Late

So, you think your financial masterpiece is complete without an estate plan? Brilliant move. Let’s see what happens when you ghost your estate planning:

- Family Feuds: Because who doesn’t want their relatives fighting over who gets what?

- Court Costs: Enjoy handing over your hard-earned money to the court because, why not?

- Delays: Your loved ones won’t know whether to celebrate or cry while waiting for decades-long probate processes.

But hey, if you decide to face reality and integrate an estate plan, here’s how it can actually save your sorry self:

- Peace of Mind: stop worrying about what happens when you kick the bucket.

- Control: Dictate where every penny goes instead of leaving it to fate (or the IRS).

- Efficiency: Make things easy for your family rather of burdening them with legal nightmares.

Q&A

Q: So, you’re telling me I don’t need an estate plan because I don’t plan on dying anytime soon?

A: Oh, absolutely! Because who doesn’t love leaving their loved ones a nice, tangled mess of legal nightmares and Uncle Bob fighting over your vintage comic book collection? Spoiler alert: without an estate plan, your assets might end up being distributed like leftover Halloween candy—chaotically and probably to the least interested family member.

Q: But isn’t estate planning just for the rich and famous?

A: Right, because apparently, having a decent nest egg or, gasp, some savings is only reserved for billionaires and celebrities. newsflash: whether you have $5,000 or $5 million, someone’s bound to argue over who gets your slightly used couch and that mysterious keychain from your trip to Narnia.Q: I’ve heard it’s expensive and complicated. Why bother?

A: Oh sure,spending some money upfront to avoid turning your family into reality TV contestants isn’t worth it. Who needs peace of mind when you can have endless Zoom calls with lawyers and agonizing over paperwork? It’s like paying for front-row seats to the greatest drama of all time—your family’s financial fallout.

Q: Can’t the government sort it out eventually?

A: Absolutely,as bureaucratic red tape and endless probate court delays are everyone’s favorite pastime. Why take control over your own legacy when you can leave it up to the system that’s about as efficient as a sloth on a caffeine high?

Q: What if I change my mind later?

A: Perfect! Let’s embrace the unpredictability of life and leave everything to chance. Who needs flexibility when you can have your estate plan reviewed once every few years by someone who barely remembers your last birthday? It’s like an amusement park ride—thrilling until it suddenly crashes.Q: Isn’t it morbid to think about death now?

A: Oh, absolutely. Let’s ignore the fact that none of us are getting out of this life alive and rather pretend everything’s sunshine and rainbows. As planning for the certain is so much more fun when you live in blissful denial, right?

Q: What’s the first step in getting an estate plan?

A: Glad you asked! Step one: Realize you need one and stop procrastinating like it’s your part-time hobby.Then, drag yourself to a reputable estate planning attorney who won’t charge you an arm and a leg—or at least try to negotiate so you don’t have to sell your soul and your prized collection of vintage Beanie babies.

Q: Any final words for the procrastinators out there?

A: Sure—keep living in the moment and leave everything to fate. After all, what’s life without a little uncertainty and potential legal chaos? Just kidding. Do yourself and your future generations a favor: Get an estate plan already. Your future family will thank you, and you can finaly rest easy knowing you didn’t leave them a messier legacy than a squirrel in a nut factory.

To Wrap It Up

So, there you have it. You’ve meticulously balanced your budget, maxed out those retirement accounts, and even remembered to switch off the toaster this morning. But guess what? Without an estate plan, all that financial wizardry is about as useful as a chocolate teapot when you kick the bucket. Don’t leave your loved ones scrambling through your digital chaos or playing a real-life game of “Find the Will.” Get your estate planning sorted now, because let’s face it, nobody wants their legacy to be a hot mess. Take control, dot those i’s, cross those t’s, and spare everyone the family feud you’re so good at avoiding—in life. Cheers to being the responsible adult you pretend to be!