Oh,so you think you’re gaming the system,do you? Racking up those credit card points like a champ,dreaming of first-class flights and five-star resorts? Bless your heart. Here’s a newsflash: you’re not the hunter; you’re the prey. While you’re busy fantasizing about sipping mojitos on a tropical beach, your credit card company is laughing all the way to the bank. Yep, those flashy rewards programs are designed to keep you spending like a Kardashian at a designer outlet. Spoiler alert—if you’re not careful, you’re footing the bill for those “free” perks. Welcome to the world where the glitter of rewards blinds you to the shackles of debt. But fear not, fellow sucker! We’re about to tear down the velvet curtains and reveal the dirty secrets of your credit card’s dark side. So buckle up and prepare for a reality check, because its time to stop being hustled by your own plastic magic wand.

Credit Card Companies Are Not Your Friends: Duh, They’re Trying to Rip You Off

So, you thought those credit card rewards were your ticket to free vacations and exclusive lounges? Think again, my friend. It’s time to pull back the velvet curtain of mystery and realize that those sparkling rewards are nothing more than a shiny little bait and you, well, you’re the fish. The entire programme is designed to entice you into spending money that you don’t have on things you don’t need.Welcome to the circus of consumerism,and here’s your front-row seat! Ever notice how the “must-spend-$3,000-in-the-first-three-hours” stipulation magically appears in the fine print? Yeah,that’s because nobody really reads that part. Don’t worry, you’re not alone, but seriously, get out your magnifying glass once in a while. You’re entering a battlefield here, not a day spa.

Here’s the unvarnished truth: you’re playing by thier rules. Stop letting them score points off you. If you’re trying to beat them at their own game, you should know who’s mastering the game board. Want to really rack up those points? Sure thing – just max out a card here, swipe another there, and whoops, look at all those shiny miles you’ve earned for every dollar of debt! Brilliant! Instead of getting suckered in, try flipping the script:

- Pay your balance every month. Shocker,right? But it effectively works like a charm every time.

- Only spend what you need. Radical idea, I know.

- Stop hoarding points for that perfect “someday” vacation. Use them strategically or watch them expire. Poof, gone.

| Credit Card Trap | How to Avoid |

|---|---|

| Spending just to Earn points | Set a budget. Stick to it. You’re not a Rockefeller, pal. |

| Ignoring Interest rates | Check before you swipe.It’s not Monopoly money. |

Rewards Program or Marketing Ploy? Spoiler: It’s the Second one, Genius

You know those shiny offers that scream “points, miles, cashback,” spinning in your face like a never-ending carousel of temptation? Spoiler alert: they want you hooked like a caffeine addict at dawn. To them,you’re not a valued customer; you’re a game piece in a way-too-complicated financial jumanji. Newsflash: those rewards tend to serve the bank’s bottom line more than yours.Here’s the reality check you didn’t know you needed—stop buying junk just to “earn” another celebratory dance of single-digit points. They count on you spending more than usual, so cool it with adding things to cart like Beyoncé just announced a flash sale.

- Impulse Purchases: “Double rewards on coffee? Bye salary!” Stop pretending it’s for the perks; you’re only fueling coffee wars.

- Debt Trap: Points don’t pay the bills, honey. Your bill shouldn’t resemble the GDP of a small country.

- Hyper-Annual Fees: You’re haunting ghost towns some call airports for “free” lounge access, but counting up the fees, you’re pretty much paying rent for a chair.

| Tactic | Reality check |

|---|---|

| Spend More to Earn More | Great—if you’re vying for World Record in Financial Stupidity. |

| Exclusive Offers | A.K.A. exclusive rights to your dwindling bank account. |

| “Limited-Time” Promotions | Oh yay, a panic attack with a side of buyer’s remorse. |

Stop Being a Points-Hungry Fool: Here’s How to Outsmart the Scheme

Alright, listen up, you credit card sleuths. Your dreams of rolling in reward points like Scrooge McDuck are leading you down a rabbit hole of overspending. Let’s be real: the companies throwing points at you like confetti are not your fairy godmothers. They’re sly foxes in plastic-looking tuxedos, laughing all the way to their vaults. Stop buying extra crap you don’t need just to rack up those pixels in your app.Newsflash: points don’t magically equal money unless you know how to play the game cleverly. Here’s a simple rule to follow: spend only on stuff you were already going to buy—not on that fifth electric toothbrush that’s so technological it might also be able to brush your pet’s fur. Seriously, pay attention to your wallet. The credit card dudes already have enough.

Feel like you’re living in a reality show called “The Points-Eating Bachelor?” It’s time for a plot twist. Think about diversifying your approach rather than dumping all your transactions into one glitzy portal that offers the “deal of a lifetime.” That’s what they want you to think.Use cards wisely: one might be great for groceries, another awesome for travel, and a third for dining out occasionally. Mix it up a little, like a financial DJ.Be smart and know the real value of your points. Yeah,they promise a cornucopia of delights,but unless you’ve got your eye on the prize (actual savings,not useless trinkets),you’re just playing Monopoly with your finances.Want a quick breakdown? Check out this handy table:

| Expense Type | Card Choice | Real Reward |

|---|---|---|

| groceries | The Cash-Back Crusader | Get money back, duh! |

| Travel | The Mile Master | Actual free flights, occasionally |

| Eating Out | The Dining Dynamo | Maybe a free dessert someday |

A Foolproof Plan to Get the Rewards Without Selling Your Soul (or Bank Account)

Here’s the deal: credit card companies love dangling shiny rewards in front of you like a cat chasing a laser pointer. It’s all fun and games until, surprise, you’re drowning in debt. But fear not—we’ve concocted a plan that’ll get you those sweet rewards without selling your soul to the plastic overlords.First off, let’s talk discipline. Like headlining at a yoga retreat, you gotta align those spending chakras. Paying off your balance in full each month is non-negotiable. Say it with me: “I’m not paying interest like a sucker.” Got it? Good.

Now let’s break down where to swipe that magic rectangle. Here’s the no-nonsense version—stick to a formula that even a hamster could follow. Focus on:

- Bills and groceries - Why not cash in on essentials you’re already buying?

- Travel and dining – If you’re blowing money for the ‘Gram, at least let it pay for itself.

Avoid:

- Impulse buying – Step away from late-night online shopping, Karen.

- Maxing out cards - Seriously, who needs a $500 designer toaster?

Respect these boundaries, and you’ll be rolling in rewards faster than you can say “why is my credit card bill so high again?”

Q&A

Q: Why do we even fall for these credit card reward schemes in the first place?

A: Oh, it’s simple. We all have an irresistible attraction to luminous, shiny things promising “free stuff.” Credit card companies dangle points and cashback like a magic carrot, and we’re the hopeful rabbits convinced that this time, we’ll snag the prize without falling down the rabbit hole of debt. Spoiler alert: the house always wins, and you’re not Alice in Wonderland.

Q: What’s the biggest mistake people make with credit card rewards?

A: The biggest mistake? Thinking you’re some sort of financial genius who’s going to outsmart a multi-billion-dollar credit card company. Hate to break it to you, but spending $200 on things you don’t need just to get $1.50 cash back doesn’t make you the next Warren Buffet. It makes you impulsive and, well, just another sucker.

Q: how can I stop falling for these schemes?

A: First, grab a mirror and practice saying, “No more BS.” Then, realize that if you’re carrying a balance to chase points, you’re basically burning money. Try this radical idea: only buy what you need and pay your bill in full each month. Chase experiences, not points. If you’re really itching for thrills, take up skydiving.

Q: But aren’t points and cashback worth something, though?

A: Oh, sure. They’re worth about as much as a single penny in a wishing fountain. Yes,technically you are getting some value,but it’s often pennies on the dollar.simultaneously occurring, if you’re paying interest, that value is eaten up faster than you can say “minimum payment.” It’s like running a marathon for the free banana at the end—except the marathon costs hundreds of dollars and the banana probably isn’t even organic.

Q: Can you actually come out ahead with these rewards?

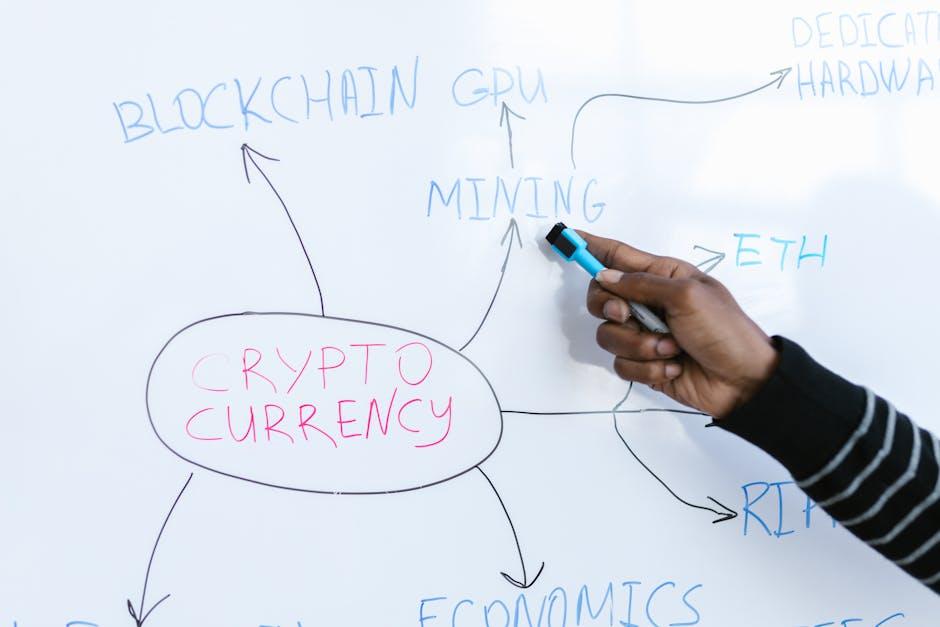

A: Possible? Sure, just like it’s possible you’ll win the lottery or that your cat will start paying rent. Realistic? Not unless you live like a monk, have a PhD in Rewardology, and treat your credit card like the world’s most delicate piece of glass. The effort required to truly “come out ahead” is more exhausting than trying to explain cryptocurrency to your grandparents.

Q: Any final words of wisdom?

A: Yeah, here’s a golden nugget for you: Use your brain, not your card. These companies spend millions finding new ways to part fools from their money, so start questioning if you’re one of the fools.Trust me, your future self will thank you while lounging on a debt-free beach somewhere unencumbered by credit card shackles. Now go forth and spend wisely, you savvy genius.

Final Thoughts

So there you have it, folks: the no-nonsense guide to stop letting your precious little credit card rewards bamboozle you into financial oblivion. Remember, the point isn’t to let these flashy reward schemes yank you around like a puppet on a diamond-encrusted string, but rather to make them work for you. Stop chasing dreams of luxury trips and sparkly bonus points like a dog chasing its own tail, and instead, focus on using your credit card like the sensible, astute human you claim to be.

if you thought that endlessly swiping your card to “earn” stuff was going to miraculously improve your life, think again. The only thing multiplying faster than those points was probably your debt. So, in the wise words that no one ever told you when you got your first card: earn where you can, spend responsibly, and for crying out loud, stop treating reward programs like a personal piggy bank of infinite wealth. Wake up, smell the credit, and start treating these schemes for what they really are—a tool to be used, not a lifestyle to be worshipped.if you genuinely can’t resist the allure of those rewards,then at least try to avoid the usual traps.When in doubt, ask yourself: is this really rewarding, or is it just another mirage that leads to nowhere? The choice is yours, Einstein.