Welcome to the glamorous realm of modern banking, where your hard-earned cash takes a delightful detour through a labyrinth of sneaky fees and dastardly charges. Congratulations! You’ve officially outsourced your money to institutions that treat your account like their personal piggy bank—minus the charm and with double the cunning. If you’ve had enough of watching your funds vanish behind outrageous overdraft fees, maintenance charges, and that mysterious “miscellaneous” fee no one bothered to explain, your in the right place. Grab your sarcasm shield and no-nonsense attitude, as it’s time to kick those fee fiends to the curb and reclaim what’s rightfully yours. Let’s cut the BS and get down to the gritty truth about how to stop letting your bank fees pilfer your precious pennies.

Break Up With your Bank Stop Dating Institutions That Drain Your Wallet

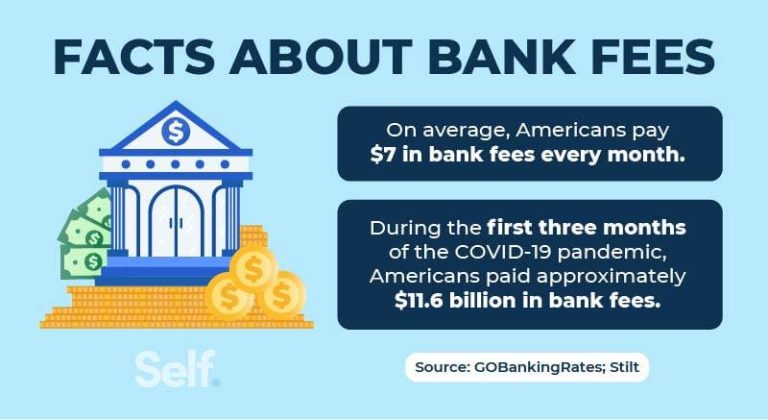

your bank has been treating you like a cash cow, bleeding you dry with unnecessary fees and charges. It’s time to call their bluff and show them you’re not signing up for this financial vampirism anymore. From baffling monthly maintenance fees to outrageous overdraft charges, these institutions have perfected the art of wallet drainage. Here are some common ways they suck your money dry:

- Monthly maintenance Fees – Because keeping your account open totally costs them money.

- ATM Fees – Enjoy paying extra every time you need to access your own cash.

- Overdraft Charges – When your bank magically makes your account go negative, promptly charging you for it.

It’s time to sever ties and explore better options that actually respect your hard-earned cash.Consider switching to online banks or credit unions that offer:

- No Hidden Fees – Transparency isn’t rocket science.

- Higher interest Rates – Let your savings actually grow rather of feeding their fees.

- Superior Customer Service – As you deserve to be treated like a human, not a number.

| Bank Type | Common Fees | Benefits |

|---|---|---|

| Customary Banks | Monthly Fees, ATM Charges, Overdraft Fees | Extensive Branch Network, Established Reputation |

| Online Banks | Minimal or No Fees | Higher Interest Rates, Easy account Management |

| Credit Unions | few Fees, Often Lower Fees | Member-Owned, Community Focused |

Unmasking Hidden fees Because Your bank Won’t Tell You They’re Stealing from You

Let’s be honest: your bank is like that sneaky friend who always finds a way to charge you for everything. From the moment you open an account,they’re lining their pockets with your cash through a parade of hidden fees. Here are some classic culprits they’d rather you didn’t notice:

- Monthly Maintenance Fees: As maintaining your account shouldn’t come cheap.

- ATM surcharges: Enjoy accessing your money… for a price.

- Overdraft Charges: Oops! Didn’t think you’d spend that much? Neither did they.

- Foreign Transaction Fees: Planning a vacation? Get ready to pay extra for living like a tourist.

But fear not, you can fight back against these fee-bleeding fiends. Here’s how to keep more of your hard-earned money where it belongs:

- Switch to a No-Fee Bank: Yes, they exist and they’re waiting for you.

- Maintain Minimum Balances: Dodge those pesky maintenance fees by keeping just enough in your account.

- Use In-Network ATMs: Avoid surcharge fees by sticking to your bank’s own machines.

- Monitor Your Spending: Keep an eye on your finances to prevent those dreaded overdrafts.

| Fee Type | Typical Cost | How to Avoid |

|---|---|---|

| Monthly Maintenance | $10 | Maintain minimum balance or choose no-fee account |

| ATM Surcharge | $3-5 per transaction | Use in-network ATMs |

| Overdraft Fee | $35 per occurrence | Set up overdraft protection or monitor account closely |

| Foreign Transaction | 3% of transaction | Use credit cards with no foreign fees |

Master the Art of Fee Avoidance Outsmarting Banks at Their Own game

Ever feel like your bank is playing a sneaky game of “How to Squeeze Every Penny”? It’s time to pull the rug out from under their fee-filled schemes. Start by demanding transparency—literally, ask for a fee schedule and scrutinize every line. Don’t settle for the first account they shove down your throat; instead, shop around for banks that actually respect your money. Look for perks like no monthly maintenance fees or free ATM access as, surprise, your hard-earned cash deserves better.

Next, master the fine art of account management to keep those pesky fees at bay. Here’s how:

- Maintain minimum Balances: Avoid overdraft fees by knowing your account limits and staying above them.

- Automate Transactions: Set up automatic payments to dodge late fees and keep your finances on track.

- Opt for Digital Banking: Delete those branch-hungry fees by going online—who needs physical branches anyway?

And if you’re really feeling rebellious, consider switching to credit unions or online banks that aren’t in the business of nickel-and-diming their customers. It’s time to take control and stop letting your bank treat your money like it’s their personal cash cow.

Switch or Stay Navigating the Bank Battlefield Without Losing Pennies

So, you’ve decided enough is enough and those sneaky fees are draining your wallet dry.Congrats on your brilliant decision! But before you jump ship like a panicked sailor, consider these brutally honest truths about switching banks:

- Hidden Costs Galore: moving your money isn’t as free as your bank might have you believe. Hell, you might even get hit with some exit fees.

- time-Consuming Hassles: Transferring direct deposits,updating automatic payments—oh joy,more tedious chores to add to your overflowing to-do list.

- Potential Service Drop: New banks often lure you in with sweet promises, but can they actually deliver the decent customer service you deserve? Doubtful.

But hey, sticking with your current bank isn’t exactly a walk in the park either.Here’s how to battle those fees without jumping ship:

- Know Your Terms: Read those fine print documents like your financial life depends on it (because it does).

- Maintain Minimum Balances: If your bank charges for being too lazy with your money, show them you’re not lazy by keeping the required balance.

- Automate everything: Avoid late fees by automating your payments.Yes, adulting is hard, but your wallet will thank you.

| Action | Affect |

|---|---|

| switch Banks | Possible fee waivers, but comes with transition headaches |

| Stay & Negotiate | Potential fee reductions, keeps your life less of a nightmare |

Bottom line? Whether you choose to rage quit or play the long game, just don’t let those banks laugh their way to your hard-earned cash.

Q&A

Q1: My bank keeps sneaking fees onto my account like a financial ninja. How do I stop this madness?

A1: Ah, the elusive stealth fee—sneaking past you when you’re not looking. first, wake up and actually read those gloriously lengthy fee schedules your bank sent you at account opening (because ignoring them worked so well so far, right?).Then, call your bank like a champ and demand a detailed explanation for each mysterious charge. Threaten to switch to a credit union or, gasp, an online bank that doesn’t charge you an arm and a leg for basic services. Often, they’ll remove the fee just to keep you from leaving and opening a competitor. Survival tip: Keep an eye on your account regularly.Think of it as stalking your bank until they stop trying to bleed you dry.

Q2: I’m broke enough already—how am I suppose to avoid overdraft fees?

A2: Congratulations on making it to the broke club. To avoid those delightful overdraft fees, channel your inner hawk and monitor your account religiously. Set up account alerts so you’re notified every time your balance dips below, say, $50. Alternatively, invest in good old-fashioned math—track your spending meticulously. If you find that even that is too much work, consider opening a no-fee checking account elsewhere. Yes,that might mean actually choosing a bank that doesn’t treat you like a walking ATM.Revolutionary!

Q3: Every time I use an out-of-network ATM,I get hit with a fee.Any radiant ideas to dodge this joy?

A3: Oh, the tyranny of ATM fees—because apparently, your bank thinks it’s hilarious to charge you every time you need cash outside their precious network. Solution? Stop using their atms like it’s your lifeline.Search for out-of-network ATMs that don’t charge you—or, you know, actually stick to your own bank’s ATMs. or carry a bit more cash to minimize trips. If all else fails, embrace digital payments until you actually need to handle physical money. Revolutionary, I know.

Q4: My bank loves charging for absolutely everything. How can I get out of this toxic relationship?

A4: Time to break up, champ. Start by researching banks that offer free checking, no hidden fees, and maybe even treat you like a human being.Credit unions are your friends here—less corporate greed,more community spirit. open an account with your shiny new, fee-free bank and transfer your funds. Cancel the old relationship that drains your wallet for no reason other than to pad their profits. Remember, you’re not stuck; there are plenty of better options out there that won’t guilt-trip you for withdrawing your own money.

Q5: What’s the deal with those “monthly maintenance fees”? Can I just tell my bank to shove it?

A5: Oh, monthly maintenance fees—the classic way banks act like they’re doing you a favor by existing. While telling them to shove it might feel satisfying, the smarter move is to eliminate the fee without burning bridges.Check if you can ditch the fee by meeting certain criteria: maintain a minimum balance, set up direct deposits, or haul your sorry self into the near-bank’s lobby to negotiate. Alternatively, switch to a no-fee account altogether. Because let’s face it, your money should work for you, not your bank.

Q6: I’m tired of unexpected charges popping up. How can I make sure I’m not being ambushed by my bank?

A6: Surprise fees are the bank’s version of “Happy Birthday,” except you’re not thrilled.To prevent these ambushes, read every fine print you can stomach and keep a vigilant eye on your account statements. sign up for paperless statements and notifications to catch fees as they happen. If a sneaky fee appears, call customer service and demand an explanation. Often, they’ll waive it just to avoid further drama. Stay proactive,stay informed,and show those banks you’re not their personal cash pit.

Q7: are there any legitimate ways to fight back against bank fees without losing my sanity?

A7: Absolutely. Start by educating yourself about your bank’s fee structure—knowlege is power, and apparently, money. Use technology to your advantage: budgeting apps can help you track spending and avoid unnecessary fees. Automate your finances to prevent overdrafts and missed payments. Shop around for better banking options and don’t be afraid to switch. And for the love of your hard-earned cash, stop giving your bank free money through fees. it’s your money, not their entitlement. Fight smart, not hard.

Q8: How do I convince my friends and family not to fall into the same bank fee traps I did?

A8: Share your saga of suffering with flair. Craft the tale of how your bank treated you like a walking beneficiary for their fees, highlighting every excruciating charge.Recommend specific no-fee banks or credit unions, and maybe even offer to help them switch. Host a “Let’s Kick Bank Fees to the Curb” party—complete with budgeting snacks and financial freedom cocktails. Enlighten them on setting up alerts and tracking their finances like the responsible adults they’re pretending to be. in short, be the hero they never knew they needed in the fight against financial exploitation.

There you have it—a brutally honest, no-BS guide to not letting your bank bleed you dry with fees. Remember, you deserve a bank that respects your money as much as you do. Now go forth and reclaim what’s rightfully yours.

Key Takeaways

So, there you have it. Stop being the unwitting patsy in the bank’s grand scheme to siphon off every cent you’ve earned with their delightfully sneaky fees.It’s high time you gave those fee-laden account statements the cold shoulder and took back control of your money. Remember, banks thrive on your ignorance and complacency—don’t let them continue their amateur pickpocketing right under your nose. Arm yourself with knowledge, demand transparency, and if they can’t play fair, show them the door. Your wallet isn’t a charity case, and it’s about damn time your bank acted like it. Cheers to keeping your hard-earned cash where it belongs: in your pocket, not lining someone else’s bonus.