Ladies and gentlemen, gather ’round, because it’s time to face the truth with a side order of sarcasm. Inflation is here,and it’s not just the toothless tiger you were hoping to ignore while clutching your precious piggy bank. Nope, think of it as a ravenous beast feasting on your savings buffet. Remember when you thought ignoring it would make it go away, just like those emails from your ex? Well, spoiler alert: it’s not working. Welcome to the world where your money loses value faster then you can say “outrageous gas prices.” So, stop pretending this isn’t happening, and let’s dive into why turning a blind eye to inflation is about as smart as playing chess with a pigeon. Buckle up, buttercup, it’s time to face reality.

Inflation: The Silent Thief That’s Emptying Your Piggy Bank While You Pretend Everything’s Fine

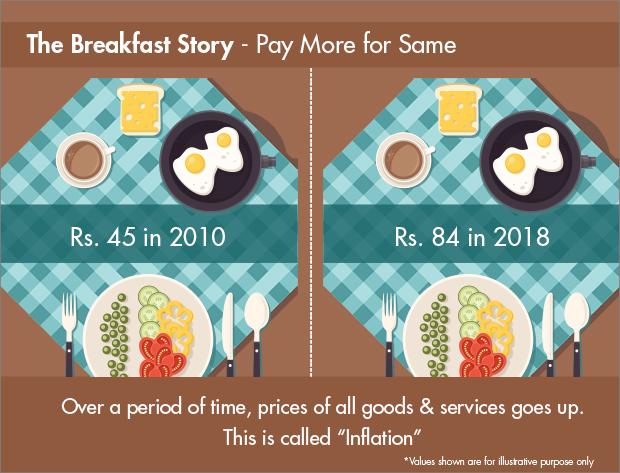

Let’s face it, folks, inflation is like that obnoxious younger cousin who swoops in during family reunions and snacks on your plate when you’re not looking. It sneaks into your life quietly, and before you no it, your hard-earned savings are worth less than that overpriced latte you pretend not to enjoy every morning. You can keep living in a fairy tale,strolling through life as if budgeting is only meant for accountants,but maybe it’s time to wake up and smell the overpriced coffee. Inflation is greedily chipping away at the value of your money, and unless you’re one of those mystical wizards who make cash appear out of thin air, you’re going to feel it sooner or later.

- Your Grocery Bill: Remember when bread was cheap enough you didn’t need to sell a kidney? Pepperidge Farm remembers.

- Gas Prices: Filling up your tank feels like playing a game of ‘How much can I cry today?’

- Housing Costs: The brick walls are just as massive, but your wallet feels like a lean brick.

| Expense | Cost in 2020 | Cost Now |

|---|---|---|

| Coffee | $2.50 | $3.25 |

| Movie Ticket | $10.00 | $13.00 |

| Rent | $1,200 | $1,500 |

You can keep on pretending inflation is just something those wall Street bigwigs talk about, but here’s the brutal truth: it’s a beast that’s pried open your piggy bank with the dedication of a raccoon rifling through a trash bin. Quit shoving your head in the sand, and grasp the reality that your financial ‘plan’ isn’t bulletproof because inflation’s armor-piercing bullets are coming for it. Start managing your money like a responsible adult and stop feeding this silent thief with your blissful ignorance, or continue booking that one-way ticket to Broketown, population: you.

Wake Up and Smell the Inflation: Your Savings Account Isn’t Taking Care of itself

Ever notice how the price of that fancy latte you treat yourself to every Friday is creeping up? it’s not just the caffeine talking, it’s inflation, folks! Yep, that sneaky economic villain that’s quietly nibbling away at your savings while you binge-watch your favorite shows. And your savings account? Spoiler alert: It’s not magically turning pennies into pounds while you snooze. In fact, if you keep stuffing cash under your virtual mattress, you’re basically handing out free lunch to the inflation monster. Hop on it,because those hard-earned bucks in your account today might not buy the same stuff tomorrow.

Let’s cut the cutesy talk and knuckle down to business here. Your money deserves better.Wanna know who’s been helping themselves to your financial pie without asking? Meet Inflation. Here’s what you gotta do:

- Grab the bull by the horns and consider low-risk investments like bonds. They don’t bite.

- Throw some of your dough into stocks. Scary? Maybe. but sitting on cash is scarier.

- How about real estate? Own a piece of the world and let your bank acct breathe.

| Investment option | Expected Return | Risk Level |

|---|---|---|

| Bonds | 3-5% | Low |

| Stocks | 7-10% | Medium |

| Real Estate | 6-8% | Medium |

Ignoring inflation is like ignoring that flashing fuel light on your car dashboard, buddy. Address it now, because your future self doesn’t want to be stuck in a pit of pennies while the world moves on. Make sure your savings grow faster than those weeds in your backyard. You’ll thank yourself later—or not, and stay broke.Your call.

Smart Ways to Protect Your Cash from Being Chewed Up Like a Dog’s Favorite Toy

Listen up, as your wallet has been screaming for help, and it’s about time you stopped ignoring it. inflation is like that sneaky ninja you didn’t see coming—that is until your cozy savings started bleeding money.Here’s a tip: stop hoarding cash under your mattress and get smart. Diversify that outdated stash! Consider investing a portion into stocks or bonds. We know, bonds sound as exciting as watching paint dry, but they can be a reliable sidekick to fend off inflation. Also, give a side-eye to the high-yield savings accounts; they’re not all glitter and gold, but better than your plain old savings account that’s doing jack-all.

Let’s talk beyond the obvious. Do you know that coffee you’ve been buying every freakin’ morning? Yeah,time to put a leash on that. Small everyday expenses accumulate faster than you think. Create a friggin’ budget spreadsheet. It doesn’t hurt, unless Excel is your arch-nemesis. Here’s a cute table to put things into perspective:

| purchase | Monthly Cost | Yearly cost |

|---|---|---|

| Daily Coffee | $90 | $1,080 |

| Streaming Services | $30 | $360 |

| Takeout | $150 | $1,800 |

Feeling queasy yet? Cut some of these costs and enjoy that invisible money staying in your bank account. It’s about working smarter, not harder. So, buckle up, and don’t let your money vanish like Houdini.

Don’t Just Stand There—arm Yourself with These Inflation-Fighting Strategies

So,you’re just going to watch inflation gobble up your hard-earned cash like it’s an all-you-can-eat buffet? Good luck with that strategy.Instead, slap on your financial armor and actually do something about it. Consider avenues like investing because saving under the mattress is so last century. Try these no-nonsense strategies: invest in a diversified stock portfolio, explore real estate opportunities, or even consider the charm of cryptocurrencies—but don’t just plow in like a blindfolded bull, know your game.And yes, cutting back on those frivolous expenses (looking at you, daily artisanal latte habit) might just turn out to be crucial.

Think you can’t outsmart inflation? Think again. Boost your skills and become so invaluable that even an economic apocalypse wouldn’t dare touch your paycheck. Network like your life depends on it as, spoiler alert, it might.Here’s a spicy idea: start a side hustle that taps into your never-ending sarcasm or whatever other talents you’ve got stuffed up your sleeve. Need a swift visual? Check out this ultra-simple, you-can’t-mess-this-up table:

| Strategy | Potential Benefits |

|---|---|

| Diversified Investing | Gives your money a fighting chance against inflation |

| Skill Upgrading | Makes you irreplaceable at work |

| Side Hustle | Extra cash to cushion the inflation slap |

Q&A

Q: What is inflation and why should I care?

A: Oh, you must be living under a rock if you’re asking this. Inflation is that invisible little gremlin that sneaks into your wallet and eats away the value of your money. It’s like the silent pickpocket of your savings—you don’t see it happening, but one day you wake up and realise that your hard-earned cash buys you a whole lot of nothing.So, unless you’re planning to retire on Monopoly money, you should definitely care.

Q: How does inflation affect my savings?

A: Imagine your savings account is a juicy steak, and inflation is a pack of ravenous wolves. Every year inflation gets at that steak, leaving you with nothing but bones to chew on. In simpler terms, your money just sits there, losing purchasing power faster than a snowball melts in hell.The more you ignore it, the more it consumes your future dreams.

Q: Why isn’t my bank saving me from inflation?

A: Spoiler alert: Your bank isn’t your knight in shining armor. Banks make money by lending out your savings to others at higher interest rates than they’ll ever dream of giving you. They might throw you a pity party with a 0.5% interest rate on your savings account, which is about as useful against inflation as a paper umbrella in a hurricane.

Q: Can I beat inflation, or am I doomed to watch my savings waste away?

A: Well, congratulations! You’ve actually stumbled upon the right question. You can beat inflation—by not just sitting there like a deer in headlights. Consider investing in stocks, bonds, real estate, or even learning about that magical thing called a ”diversified portfolio.” It’s not rocket science, and you don’t need to be Warren Buffett to realize keeping your money stashed under your mattress is financial suicide.

Q: Is it true some things get cheaper, even with inflation going on?

A: Oh sure, in Fantasyland. In the real world, inflation mostly makes essential stuff like housing, food, and healthcare more expensive while your favorite junk suddenly becomes the real “bargain.” But sure,go ahead and tell yourself gadgets you don’t need are cheaper. Simultaneously occurring, good luck affording a decent place to live.Q: So, what’s the takeaway here? What’s the first step to stop this madness?

A: Simple. Stop pretending inflation isn’t that monster under your bed, ready to grab your financial ankles if you don’t take action. Start by educating yourself and making smarter financial moves. Stop letting your savings gather dust and actually put that money to work. It won’t make you a millionaire overnight,but doing nothing will leave you with pennies in your pocket and regret in your soul.

Closing Remarks

So, there you have it—your money’s been on a diet, and that snack-happy monster called inflation is the culprit, gnawing away at your savings like it’s some all-you-can-eat buffet. You’ve been blissfully ignoring it, hoping it’s just a phase, like bell-bottom jeans or eating Tide Pods. Wake up, folks! This isn’t a drill, and it sure as hell isn’t going to fix itself while you binge-watch another season of whatever mind-numbing show you’re obsessed with.

The reality is harsh, and no, sticking your head in the sand won’t help unless you’re trying to offer inflation a bigger target. It’s time to take the wheel and steer your financial ship away from those treacherous waters, unless you’re content watching your buying power swirl down the drain. Remember, ignorance might be bliss, but in this case, it’s also hella expensive.So, what’s it gonna be? Sit there and let your savings melt faster than a popsicle in July, or dust off your financial plan and start acting like the adult you’re supposed to be? Your call, but just remember: your future self is counting on today’s you to stretch beyond the comfort zone and kick inflation’s sorry butt. Until next time, keep those eyes wide open and wallets fortified. Peace out!