Oh, Karen, bless your heart. You’ve been treating your budget like it’s some ancient, inscrutable artifact, shrouded in mystery and guarded by financial sorcery. newsflash: It’s not a cryptic puzzle meant to baffle the masses. Your budget isn’t a mystery—it’s just math,Karen. Yes, simple arithmetic that doesn’t require a phd in Hogwarts-level wizardry. It’s time to ditch the mascara-tinted lenses through which you view your expenses and face the cold, hard numbers. Let’s break down this budgeting charade, strip away the BS, and unveil the straightforward math that’s been hiding in plain sight. Ready to stop pretending your wallet is a black hole? Let’s dive in.

Stop Blaming Everything Except yourself for Your Budget failures

Let’s face it, blaming your barista for your skyrocketing latte expenses or pointing fingers at your streaming services for your dwindling bank account isn’t going to balance your budget. It’s time to own up to your spending habits and stop playing the victim. Here are some all-too-familiar excuses you’re probably using:

- “I need this for my mental health.” Sure, buying another gadget will totally solve your problems.

- “Sales happen once a year.” Spoiler alert: they happen every week, if you know where to look.

- “I didn’t have time to budget.” procrastination isn’t a financial strategy.

If you’re ready to stop the blame game and actually make your budget work, take a hard look at these harsh realities:

| Excuse | Reality |

|---|---|

| “I can’t save, I’m living paycheck to paycheck.” | Analyze your spending and cut out the nonsense. |

| “Unexpected expenses are out of my control.” | Build an emergency fund and stop whining. |

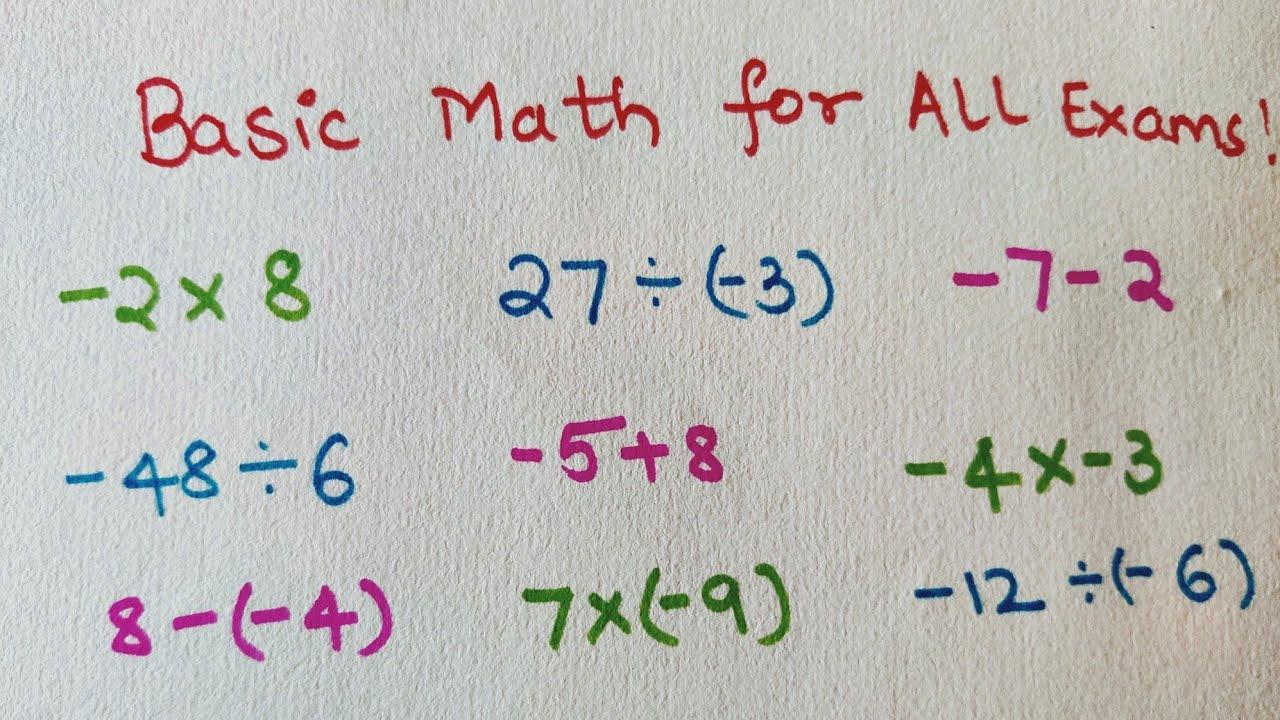

Master the Basic Math Before You Pretend You’re Financially Savvy

Let’s get one thing straight: managing your money isn’t rocket science. If you can’t add up your income and expenses without crying, maybe it’s time to rethink your financial ”expertise.” Stop pretending that you understand compound interest when your bank statement looks like a ransom note.Here are a few basics you might be missing:

- Income Tracking: know how much you’re actually making, not just what you think.

- Expense Categorization: Differentiate between needs and wants—yes, avocado toast counts as a want.

- Savings allocation: Pay yourself first instead of always paying others.

to visualize how it’s done, take a look at the table below. It’s simple enough for anyone, even if math isn’t your strong suit:

| Category | Amount ($) |

|---|---|

| Income | 3,000 |

| Rent | 1,200 |

| Groceries | 300 |

| Utilities | 150 |

| savings | 300 |

| Total Expenses | 1,950 |

| Remaining | 1,050 |

See? It’s not magic. If you can’t handle this, maybe hit the books before throwing around terms like “financial freedom.”

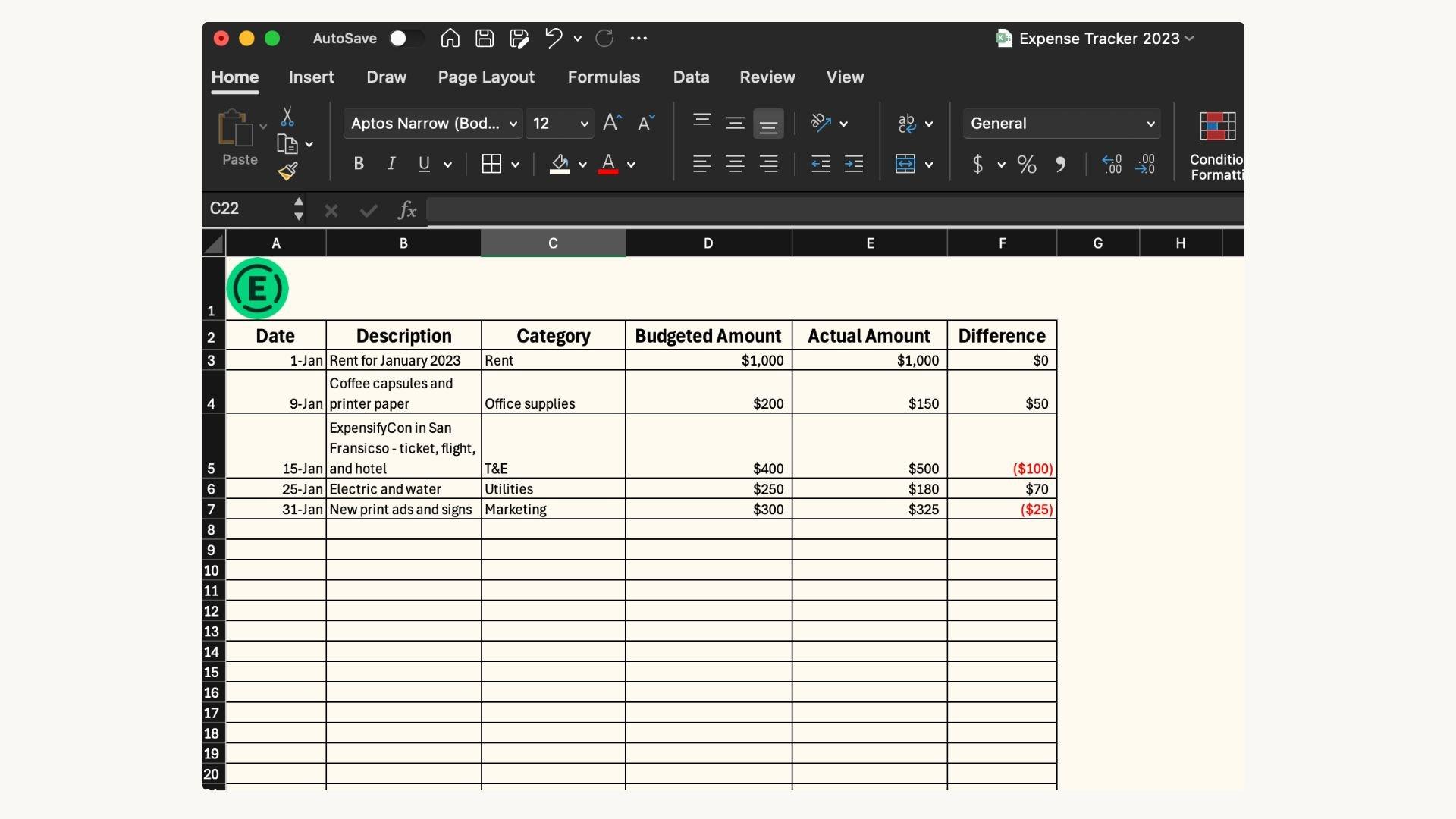

Track Your Spending Like an Adult Rather than Living in Fantasyland

Congratulations, you’ve mastered the art of living paycheck to paycheck without a clue where your money disappears. but guess what? Growing up means actually knowing where every single dollar goes. No more pretending your wallet has a magic black hole. It’s time to face the music and track your spending like the responsible adult you’re pretending to be.

Here’s a reality check:

- List Your Expenses: Yes,every latte counts.

- Set Realistic Limits: Stop dreaming about that yacht.

- Use Apps: As scribbling on receipts is so last decade.

| Category | Budget | Spent |

|---|---|---|

| Groceries | $300 | $350 |

| Entertainment | $150 | $200 |

| Utilities | $100 | $90 |

see? It’s not rocket science. Get a grip, start tracking, and maybe, just maybe, you won’t be living in financial fantasyland forever.

Develop a Real Action plan Rather than Dreaming About Riches

Stop daydreaming about yachts and Lambos, and let’s get down to brass tacks. Here’s how you actually build a plan that doesn’t rely on lottery numbers:

- Track Your spending: Yes,every single latte and impulse buy. Use an app or good old spreadsheets – whatever keeps you honest.

- Set Realistic Goals: Forget the millionaire overnight scheme. Aim for something achievable, like paying off that annoying credit card debt.

- Create a Budget: Allocate your hard-earned cash to needs, wants, and savings. No, “winging it” is not a category.

- Monitor and Adjust: Life happens. Review your budget monthly and tweak it so you don’t end up broke every payday.

| Step | Action | Deadline |

|---|---|---|

| 1 | List all income sources | End of week |

| 2 | Identify and categorize expenses | End of Week |

| 3 | Set spending limits | Next Payday |

| 4 | Review and adjust monthly | Monthly |

There you have it. Follow these steps instead of fantasizing about your nonexistent fortune,and maybe,just maybe,you’ll actually get your finances under control.

Q&A

Q&A:

Q: Karen here. I’ve always thought budgeting was some sort of mystical art. Can you explain why I need to track every penny?

A: Oh, Karen, bless your heart for thinking money magically disappears without a trace.Tracking every penny is called basic arithmetic, something fundamentally essential if you want to stop wondering where your cash Houdini acts it’s performing. Spoiler alert: It’s not magic; it’s math.

Q: I love spontaneous shopping! How does having a budget kill my fun?

A: Spontaneity is adorable until your bank account files for divorce. A budget doesn’t kill fun; it gives your fun a designated area instead of letting it wreak havoc on your finances. Think of it as fun with boundaries—yes, boundaries. Revolutionary, right?

Q: I’m terrible at math. how can I possibly create a budget without feeling like I need a calculator for my calculator?

A: Terrible at math? Welcome to the club where members survive on budgeting apps and basic addition. Thankfully, budgeting doesn’t require Einstein-level genius—just the ability to subtract and stop spending like your last paycheck depends on it.Oh wait, it does.

Q: So, you’re saying I can’t just wing it with my money? What’s the worst that could happen?

A: Exactly, Karen. Winging it might sound fun until you realize you’ve rented a yacht on a lemonade stand budget. The worst? Financial stress, debt spirals, and the thrilling experience of eating instant noodles every night. Fun times!

Q: How detailed does my budget need to be? I don’t want it to take up my entire notebook.

A: oh, the horror of not having your budget leak onto every page of your precious notebook. Keep it simple: income minus expenses equals hopefully not living on ramen. If that takes two pages, grab a bigger notebook because your financial life clearly warrants a small library.

Q: What if unexpected expenses ruin my budget?

A: Welcome to adulthood, Karen, where surprise expenses are life’s way of keeping you humble. Your budget should have an emergency fund—yes, that boring pile you’d rather ignore. As when life hits you with a bill for something you didn’t budget, going back to math becomes your only savior.

Q: can budgeting really make me wealthy, or is it just for penny-pinchers?

A: If by “wealthy” you mean having enough to afford avocado toast every now and then, sure. Budgeting isn’t just for the tight-fisted; it’s for anyone who wants to stop living paycheck to paycheck and start building something slightly resembling financial stability. Welcome to the grown-up world.

Q: I still think budgeting sounds too restrictive. How can math be liberating?

A: restrictive? Maybe when you realize freedom is paying off debt instead of financing impulsive purchases. Math liberates you from financial chaos, giving you control instead of letting your money control you. think of it as the scalpel to your monetary mayhem.

Q: Any last piece of advice for someone who thinks budgeting is just a nerdy obsession?

A: Yes, Karen—stop being a statistic for bankruptcy rates.Budgeting isn’t nerdy; it’s the adult version of knowing your ABCs. Master it, and maybe, just maybe, you won’t have to explain to your future self why you couldn’t afford that “necessity” you bought last week.

There you have it,Karen. budgeting: it’s not a mystery, it’s math. Time to do the numbers or keep playing financial hide and seek—your choice.

wrapping Up

So, Karen, there you have it. Your budget woes aren’t the result of some mystical financial black hole—they’re just basic math. Shocking, I know. Next time you find yourself squinting at your bank statement like it’s ancient hieroglyphics, remember: add it up, subtract the nonsense, and maybe, just maybe, you’ll stop wondering where all your money disappeared to. Until then, keep those calculators handy and your excuses to a minimum. After all, mastering your budget isn’t rocket science—it’s just good old-fashioned arithmetic. Cheers to less confusion and more cash, as if math isn’t your thing, Karen, maybe it’s time to take a fresh look at those numbers.