Ah, taxes—everyone’s favorite financial torture device. They’re like that insufferable acquaintance who shows up at your party uninvited,eats all the chips,and overstays their welcome. Every year, just when you’re making headway on your financial goals, here comes Uncle Sam with his hand out, demanding a chunk of your hard-earned cash—and too add insult to injury, he doesn’t even say thank you.You’ve got dreams of beachside margaritas and early retirement, but the taxman has other plans for your wallet. Well, it’s time to stop blindly handing over your money and start playing the game like a pro. In this no-nonsense guide, we’re going to show you how to manage your taxes without letting them steamroll your financial ambitions. Buckle up, because it’s time to kick those tax hurdles to the curb and take charge of your financial destiny like the boss you are.

Stop Whining and Understand the Damn Tax Code Already

Alright, friends, it’s time to put on your big kid pants and finally grasp the tax code instead of rolling your eyes and pretending it’s written in ancient hieroglyphics. Taxes aren’t going to sprout arms and legs and chase you, so quit the drama. The tax code is not a monster under your bed; it’s a freaking playbook, and if you don’t know the rules, you’re just another player lost on the field. You want to achieve your financial goals? Then stop acting like a deer in headlights every April and start taking control. This isn’t rocket science; it’s arithmetic, plus a bunch of forms and some fine print.

Let me spell it out for you – get organized, learn the basics, and use the damn resources available to you. Tax deductions aren’t magical unicorns; they’re real, existent opportunities to save your hard-earned cash. Here’s a tip: stop trying to find loopholes like you’re some sort of sneaky tax ninja. You’re not. Instead, focus on what’s practically right in front of you. start by keeping a solid record of your expenses and knowing what qualifies as deductible. Consider this your tax survival guide:

- Track your expenses like you’re safeguarding the Hope Diamond.

- Understand your filing status – you’re not James Bond; choose the one that fits your actual life.

- Take advantage of tax credits – this isn’t Monopoly money; it is the real deal.

- Claim every last deduction – don’t be a martyr; list them all.

| What’s a Tax Credit? | Examples |

|---|---|

| directly reduces the amount you owe to Uncle Sam | Child Tax Credit, educational Credits |

Wrap your head around this, and you’ll be on your way to not letting taxes squash your financial dreams like a bug.

Dodge Tax Drama with These Unbelievably Simple Strategies

If you’re tired of screwing up your bank account every April, listen up.stop acting like taxes are some mystical creature you can’t handle. They’re numbers on paper, not a Minotaur in a maze. You just need a plan. First, put away that shoebox full of random receipts and try something high-tech like an app or, shocker, a spreadsheet. Next, for the love of all that’s financially stable, track your deductions.I mean, how many times are you gonna pay the government before realizing that a little institution could save you a ton?

Get a grip on your tax life by totally giving in and hiring a professional. That’s right, let the experts earn their pay while you chill and bask in the joy of a drama-free tax season. Let them sweat the small stuff. But hey, if you insist on going full DIY because you’re a control freak or just too cheap, at least stick to these musts:

- Automate your savings: Just set it and forget it.

- Understand taxable income: It’s not that complicated.

- Time your expenses: Like a pro, not an amateur.

| Tip | Why Bother? |

|---|---|

| Hire a Pro | Because your time is more valuable than pretending you know tax law. |

| Automate Savings | Because you’ll forget otherwise, let’s be honest. |

Real Life Hacks That Actually Work to Outsmart Tax Drainers

Alright, let’s cut the crap. We all know that taxes can be a giant leech on your hard-earned cash. It’s like, you bust your butt all year onyl to funnel a chunk of it into a black hole called “taxes.” But fear not! Here are some slick hacks to keep more of your dough without ending up in an orange jumpsuit.First off, if you’re not maxing out your retirement accounts, you’re practically begging the IRS to take you for a ride. Stuff those 401(k)s and IRAs to the brim—it’s free money and tax-deferred bliss.Want to outsmart Uncle sam even further? Check out HSA accounts if you qualify. They’re like Swiss Army knives, tax-wise. Triple tax advantages, folks! It’s like finding a unicorn in a sea of tax goblins.

Oh,and if you’re not using deductions,it’s like waving a white flag and letting the taxman waltz right in. here’s a rapid list of what you ought to be doing: Keep receipts like a paranoid hoarder; invest in energy-efficient home upgrades, as even your thermostat doesn’t want to see you robbed; and for crying out loud, track your mileage if you’re a gig worker—every mile counts! Don’t want it to be this complicated? Get a tax-savvy accountant who actually knows their stuff.Think of it as investing in your sanity. Check out this no-nonsense table for quick wins:

| Strategy | Why It Rocks |

|---|---|

| Retirement Accounts | maximize contributions to shrink taxable income |

| HSAs | Enjoy triple tax perks |

| Track Mileage | Reduce tax liability with every road trip |

Get Off Your Backside and Create a Tax-Friendly Financial Plan

Listen, if your idea of a financial plan involves crossing your fingers and hoping for a miracle, it’s time for a wake-up call. Taxes don’t only visit once a year like your long-lost aunt; they’re a constant drain if you don’t play it smart. So, what’s the first thing you need to do to dodge the tax wrecking ball? Get organized, for crying out loud. This isn’t rocket science but it does involve a bit more than finding crumpled receipts under your couch cushions. Start with a good ol’ fire-drill of your expenses and income. examine everything and sort them into neat little piles. You’re not just doing this for kicks; uncover where you can legally shrink that tax bill.

Next, get a clue about the tax breaks and credits staring you right in the face. Turn those tax monsters into tax kittens by pumping up your retirement account contributions, or milk a side hustle for everything it’s worth in deductions.And let’s not even talk about overlooking interest payments on that student loan, like those were just your donation to society. Check out this table of common tax-saving moves you might be waving goodbye to without realizing it:

.wp-table {

width: 100%;

border-collapse: collapse;

}

.wp-table th, .wp-table td {

border: 1px solid #ddd;

padding: 8px;

}

.wp-table th {

background-color: #f2f2f2;

text-align: left;

}

| Tax Saving Method | Why You’re Ignoring It |

|---|---|

| Retirement Contributions | Thinking about merging with Netflix instead |

| Health Savings Account (HSA) | Pretending perfect health forever |

Q&A

Q&A:

Q: Why do taxes always feel like a personal attack on my wallet?

A: Because they are. It’s as if the government has a secret vendetta against your savings account. but let’s be real: taxes are part of the deal. You want roads, schools, and all those public goodies? You gotta pay up. Think of it as society’s membership fee—an annoyingly steep one, at that.

Q: Can I really do anything about the money vacuum known as taxes?

A: Surprise, surprise—yes, you actually can! While taxes are certain, overpaying is not. The key is to quit acting like a clueless deer in headlights. Educate yourself, plan ahead, and maybe stop waiting until the last freaking minute to tackle this beast.

Q: How can I make sure I don’t overpay Uncle Sam?

A: Two words: Tax. planning. get your head out of the sand and do some prep work. Max out your 401(k) and IRA contributions. No, it’s not as thrilling as that spontaneous online shopping spree, but it’s time to adult up and focus on the future.You’re essentially paying yourself rather of the taxman. Genius, right?

Q: Is hiring a CPA worth the money, or is that just a fancy way to blow cash?

A: Unless you enjoy attempting to decipher tax laws written in ancient hieroglyphs, a CPA is worth every damn penny. They can unearth deductions you’ve never heard of and keep you out of prison. You wouldn’t do surgery on yourself, right? Well, don’t perform financial surgery either.

Q: Are there any quick tricks to reduce my tax bill?

A: Sure, let me wave my magic wand. Look, if you’re expecting easy tax hacks, you’re dreaming. Though, you can adjust your withholding—stop giving the IRS an interest-free loan. And keep track of deductions like a hawk; charity donations, home office expenses, those 27 cats if you can somehow make them legit. Get creative, within legal boundaries, smarty pants.

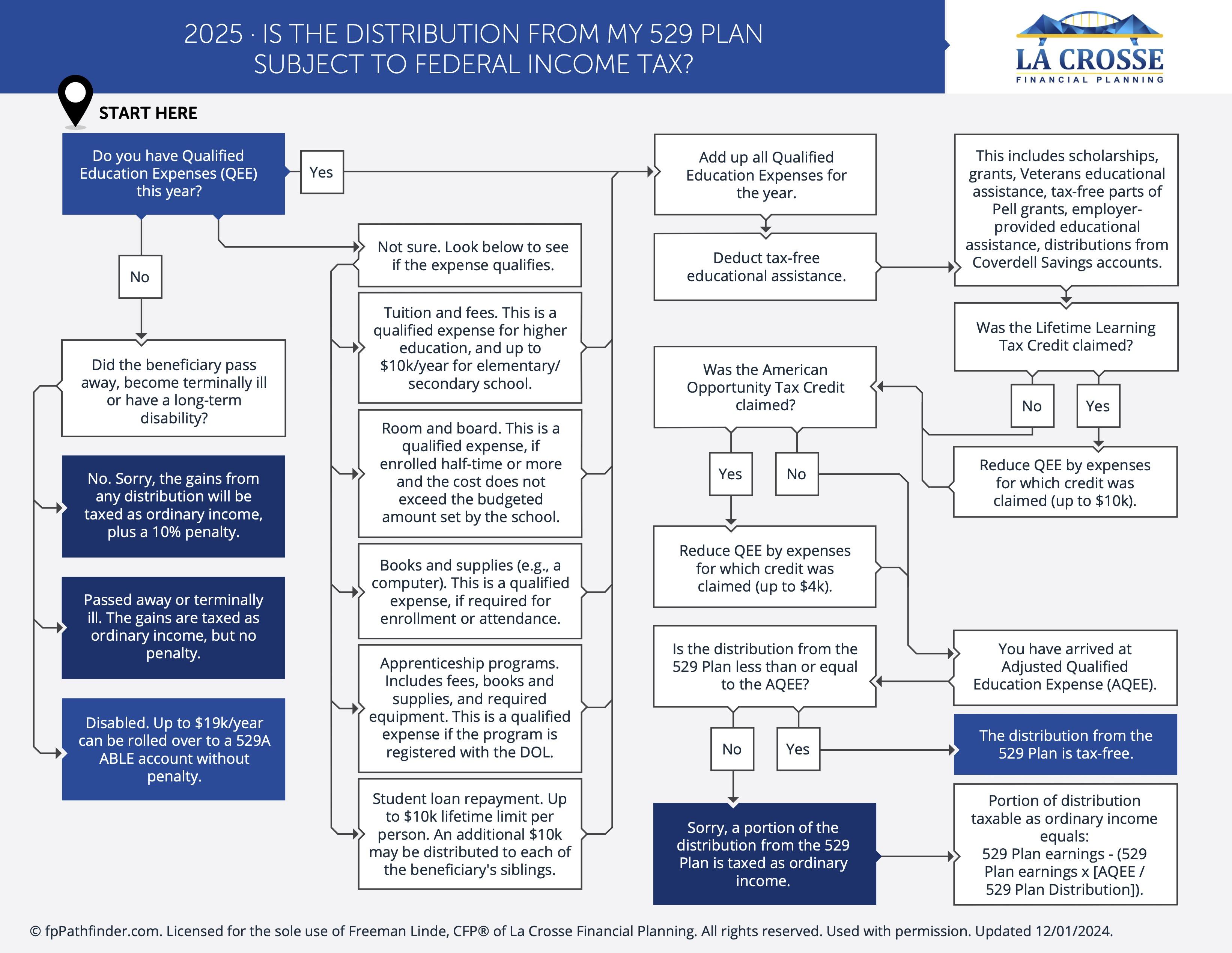

Q: What’s the deal with tax credits?

A: Think of tax credits as your golden tickets. They’re like a tax deduction’s cooler, more valuable cousin. A tax deduction lowers your taxable income, but a credit directly reduces your tax bill. Finding them is like spotting a unicorn—do the work, own lots of them, and enjoy the magical tax-saving ride.

Q: Can someone really be ‘proactive’ about their taxes without fully losing it?

A: Proactive is the name of the game, buddy. It might sound as appealing as a dentist appointment,but it saves you from pulling a hair-ripping panic attack come April. schedule a couple of tax check-ins throughout the year. Embrace spreadsheets, and, if need be, therapy. Your blood pressure will thank us.

Q: Final thoughts on taxes and achieving financial goals?

A: Listen, taxes might be sucking the joy out of your savings, but they don’t have to be your financial undertaker. Grip the bull by its boring, IRS-sized horns. Plan, execute, and maybe grumble a little less.And next year, when tax season comes around, try not to look like you’re preparing for Armageddon. You got this. Or at least you will, if you actually follow this advice.

To Wrap It Up

So, there you have it, folks. If you want to stop letting taxes stomp all over your financial dreams like a toddler on a sugar high, it’s time to pull your head out of the sand. Start planning, start organizing, and for heaven’s sake, start paying attention. Letting taxes be the excuse for your financial flops is getting old.Spoiler alert: the tax man is coming weather you invite him or not, so you might as well get your act together.

Think of it this way: you’ve been handed the keys to a shiny roadster of tax efficiency, and you’re just sitting there revving the engine, going nowhere. Knock it off. You’ve got the tools,the know-how,and now no more excuses. Go out there and crush those financial goals like you’re squashing a bug.

And remember, the next time you’re ready to whine about how taxes are the big bad wolf of your monetary fairy tale, take a good, hard look in the mirror. Aren’t you, just a tiny bit, part of the problem? Yeah, thought so. Now get out there and show taxes who’s boss. Spoiler alert: it should be you.