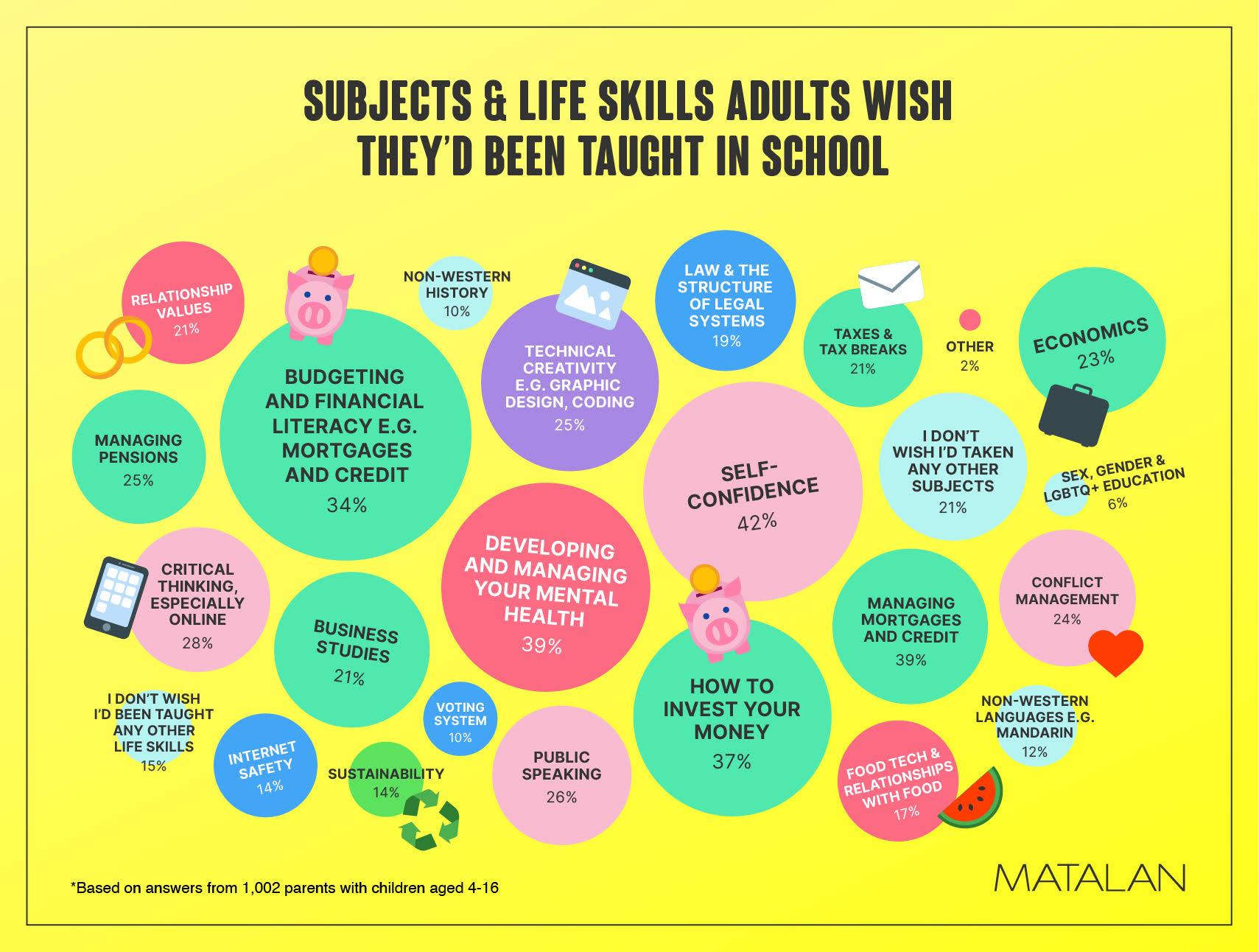

Welcome, dear reader, to teh financial smackdown you probably didn’t ask for but desperately need. If you’re rummaging through your pockets for loose change or wondering why your bank account weeps every time you check your balance, let’s face it: you’re not necessarily doomed to a life of financial ineptitude. Nope, you’re just making dumbass choices—and it’s time someone had the guts to say it. This isn’t about sugarcoating pathetic spending habits or holding your hand while you explain for the umpteenth time why you just “had” to buy another artisanal avocado slicer. We’re diving deep, headfirst, into the cold, hard truth about why your wallet is perpetually on life support, and spoiler alert: it’s not Wall Street’s fault. So, strap in, because this no-holds-barred guide is about to tear down your fortress of excuses faster than you can say “retail therapy”.Get ready to face your financial fiascos with a smirk and maybe, just maybe, turn those dumb decisions into smarter ones.

Stop Playing the Victim Card and Own Your financial Blunders

Let’s cut the crap and face facts: your financial mess isn’t some grand conspiracy against you. Here are the classic excuses you’re tired of hearing from yourself:

- “I never had the money to invest.” Yeah, as wishing worked on bank accounts.

- “I need that new gadget to keep up.” sure, because keeping up never drains your wallet, right?

- “Unexpected expenses always ruin my budget.” Surprise! Life has surprises, deal with it.

It’s time to stop whining and start owning up to your poor decisions. Here’s how you can actually take control:

- Create a realistic budget and stick to it like your financial future depends on it—because it does.

- Track your spending obsessively until you actually know where your money is going instead of pretending it’s a mystery.

- Prioritize saving over instant gratification. your future self will thank you, maybe.

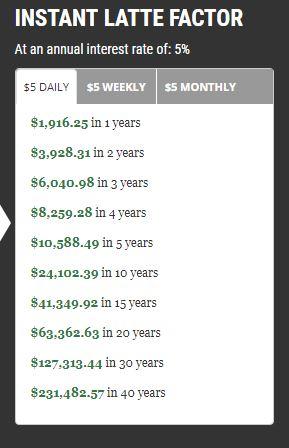

Wake Up! Thinking latte Expenses Are Your Downfall is a Cop-Out

Let’s get one thing straight: whining about buying a $5 latte every morning won’t magically fix your bank account. Sure, those little splurges add up, but they’re just the tip of the iceberg. If you’re constantly scraping by, it’s time to stop pointing fingers at your coffee habit and start looking at the real reasons you’re broke.

Instead of playing the blame game, tackle the actual money leaks:

- Unlimited online shopping binges – Seriously, when was the last time you needed another gadget?

- Ignoring your budget – You have one for a reason, genius.

- High-interest debt – Paying more to the bank than yourself?

Stop using minor expenses as a convenient excuse and take responsibility for your financial chaos. It’s time to make smarter choices instead of hiding behind your overpriced frappuccino.

Swipe Left on Excuses and Right on Real Money Management Skills

Let’s cut the crap: blaming lack of time, bad luck, or your horoscope for your financial fiascos isn’t just lazy—it’s pathetic. You think budgeting apps will magically fix your spending habits? Newsflash: they require discipline, something you clearly lack. Stop whining about your income and start owning your choices. Here are some classic excuses you can finally delete:

- I don’t have enough money. Ever heard of saving?

- It’s just one more purchase. Spoiler: It adds up.

- I’ll start next month. And next month, and the next…

Ready to actually manage your money like an adult? Here’s how to stop being your own worst enemy:

- Create a realistic budget and stick to it.

- Track every expense—yes, even that latte.

- Set clear financial goals and prioritize them over impulse buys.

| Bad Choices | Smart Moves |

|---|---|

| Impulse Shopping | Planned Purchases |

| Ignoring bills | On-time Payments |

| Living Paycheck to Paycheck | Building Savings |

Grow Up and Start Treating Your Wallet Like an Adult

Stop acting like your wallet is your personal piggy bank and start treating it with some respect.Dump those pointless impulse buys, cancel the unneeded subscriptions, and quit the endless splurging on “treat yourself” nonsense. Believing your bank account will fix itself is the fastest way to financial ruin.

Here’s how to finally adult with your money:

- Create a budget and actually follow it—no more wishful thinking.

- Track every expense; stop pretending you know where your money goes.

- Build an emergency fund; stop living paycheck to paycheck and prepare for real life.

Q&A

Q&A for the Article: “”

Q: Why does my bank account always seem to be empty?

A: Oh, it’s really a mystery, isn’t it? Could it possibly be because you spend more time exploring Amazon deals than you do planning your finances? Your inability to resist those sneaky little sale stickers isn’t cute—it’s a dumbass choice. Maybe if you swapped your late-night online shopping sprees for some financial literacy, your bank account wouldn’t be crying itself to sleep every night.

Q: What’s wrong with treating myself once in a while?

A: Nothing—if you actually knew the definition of ’once in a while.’ But let’s face it, “treating yourself” isn’t every Friday’s call for a $5 latte or another week’s worth of takeout. How about exercising a bit of self-control and investing in something long-term,like cooking skills or,I don’t know,a savings account?

Q: I don’t have time to budget. Isn’t it too complicated?

A: Sure, sure, as if binge-watching that entire season of the latest Netflix hit wasn’t time-consuming at all. Using that excuse to ignore budgeting is a dumbass choice, and guess what? It’s as easy as pie (which you seem to manage eating just fine!). Allocate your expenses, track them, repeat. If you can order a venti caramel macchiato with exact syrup pumps,you can handle a budget.Q: Isn’t investing something only rich people do?

A: Oh, honey, the classic misconception. No one’s asking you to buy out the stock market, Warren Buffet-style. Investing is for anyone with a dollar and a brain, despite your current imbalance of the latter. If you’re willing to blow twenty bucks on a mediocre brunch,diverting ten of those to stocks or retirement savings wouldn’t make you any poorer—just smarter.

Q: I try to save, but I always end up spending it. What gives?

A: You,thinking that a savings account is just an ‘in-case-I-run-out-of-fun-money’ account,that’s what gives. Newsflash: saving isn’t a whimsical suggestion; it’s an essential habit. Lock that money away where your itchy fingers can’t reach it—maybe even shrink-wrap your debit card while you’re at it.

Q: How do I stop making these so-called dumbass choices?

A: fantastic question! Start by acknowledging you’re the author of your financial dumpster fire. Then, take responsibility. Sketch out a plan, educate yourself, and maybe, just maybe, stop pretending that ‘future you’ will magically be a billionaire wizard. Here’s some tough love: reality check, adult up, and quit with the dumbass decisions already.

in summary

So, there you have it, folks—your golden ticket to the land of financial competence, where the grass is greener, your wallet is thicker, and your money habits aren’t the butt of a cosmic joke. Look, it’s painfully clear: you aren’t cursed, destined for poverty, or just naturally inept at handling your cash flow. nope, you’re simply holding an honorary degree in Dumbass Choices 101.

It’s time to face the music and stop using your bank account as a scratch-off card for disappointment. Stop ordering avocado on everything and maybe, just maybe, learn to distinguish between ‘want’ and ‘need’—two words that, as it turns out, have fully different meanings. Spoiler alert: throwing a $30 succulent in the shopping cart isn’t a need. Who would’ve guessed?

And let’s not forget the living organism that is your savings account, which, incidentally, deserves more than just the dollar bill echoes of yesteryear. Feed it, nourish it, for crying out loud, it’s not supposed to be an extinct creature in your financial zoo.

So, the next time you’re poised to blame fate or witchcraft for your money woes, give yourself a little slap and remember: the choices you make define your financial health. The power is in your hands—yes, the same hands that, until now, have had a poor track record with choices. But hey, it’s never too late to graduate to smarter, adultier decisions. Get out there, turn it around, and for God’s sake, stop being your own worst investment.