Alright, listen up, financial dunces and snooze-button enthusiasts, it’s time to pull your head out of the sand and face facts: your botching one of the easiest opportunities to grow your wealth. You know that inbox cluttered with newsletters you never read? Well, toss those out and pin this article to your forehead because it’s your wake-up call. We’re talking about compound interest here—a magical concept that turns your paltry pennies into a deluge of dollars over time.Yes, it’s literally free money, and yes, you’ve been ignoring it like a gym membership.Your great-grandkids could be sipping piña coladas on a yacht, but rather, you’re here chugging instant ramen as you couldn’t be bothered. So, strap in and let’s dive into why ignoring compound interest is financial malpractice of the highest order. It’s about time you let your money do some heavy lifting, while you keep pretending to be busy.

compound Interest: The Magical Unicorn You’re Too Busy to Notice

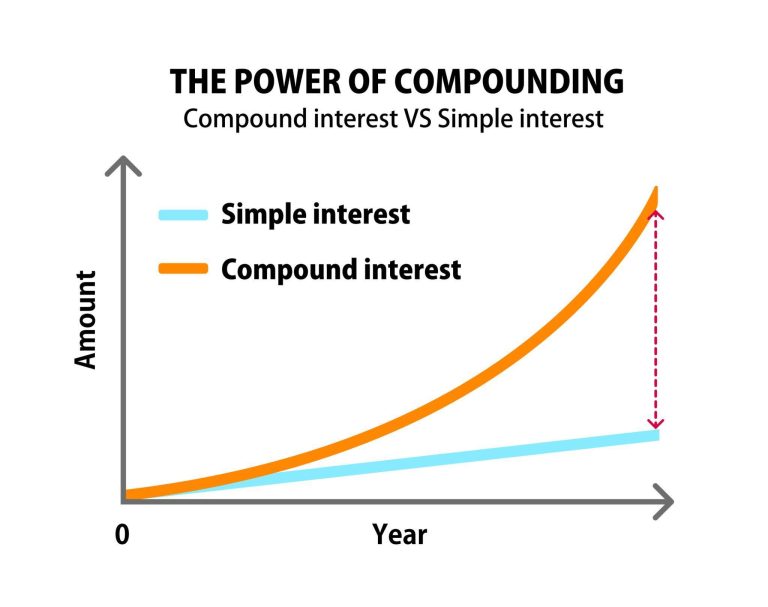

Okay, let’s talk about that math wizardry called compound interest. Imagine a money tree that actually works—plant the seed, wait, and watch it grow into a whole forest. The thing is, you’re too wrapped up binge-watching shows to notice this *financial unicorn* prancing around in plain sight. Here’s the deal: it’s like a free buffet for your money. You just gotta let it pile up on itself. Here’s the kicker—it works even if you do absolutely nothing apart from realizing it’s not just for bank nerds. Seriously, you’re leaving free money on the table by ignoring it!

- Let’s paint a picture: invest $1000. Let it compound annually at 5%.Do you sit and wait? Heck no!

- Year 1: $1,050. Not impressed? Wait for it…

- Year 10: Oh look, it’s $1,629! Thank your lazy self for staying out of its way.

| Year | Amount |

|---|---|

| 0 | $1,000 |

| 5 | $1,283 |

| 10 | $1,629 |

So, you gonna let your money be the sitting duck it is or turn it into a workhorse while you get on with your life? Maybe even retire early, sip cocktails, and yell at kids to get off your beachfront lawn. It’s the hustle without the sweat—you know, the kind of magic trick you wish you knew before sinking half your paycheck into fast food and overly hyped tech gadgets. So, stop ignoring this golden goose, or it might just waddle off to someone who truly gets it. Thank us later.

Oh, You’d Rather Give Up Free Money? That’s Genius!

Listen up, financial wizards-in-the-making! So, you’re telling me you’d skip over the magical art of compound interest? I didn’t know people loved donating their future wealth back to the universe! Picture this: compound interest isn’t just a fancy term to impress your accountant friends. It’s literally earning returns on your returns—double dipping in the world of finance.Seems wild to toss that aside, right? But hey, if you prefer the thrill of money woes to a more agreeable bank balance, who am I to judge?

- Time is your best friend: the earlier you start, the less you need to contribute over time. Isn’t that like a cheat code?

- Small amounts matter: Even a little bit of cash saved regularly compounds into something stupendously sizeable.

- Not interested? That’s fine—just understand you’re choosing to party with life’s financial struggles instead.

| Years | contributions ($) | Interest Earned ($) | Total Value ($) |

|---|---|---|---|

| 5 | 2,500 | 500 | 3,000 |

| 10 | 5,000 | 2,500 | 7,500 |

| 20 | 10,000 | 12,000 | 22,000 |

See that sweet, sweet table above? That’s cold, hard proof—it showcases how tiny sacrifices today turn into tomorrow’s filet mignon dinners instead of hot ramen soup every. single. night. Oh, you don’t need that? Feeling baller without it? Then, by all means, toss your chance to build effortless wealth in the “why bother?” bin. You do you!

Stop Wasting time and Start Rolling Your Pennies Today, Genius

Alright, smarty pants, you think rolling pennies is beneath you? Let’s knock some sense into that noggin. Compound interest is like finding a hidden stash of cash, thanks to all those coins you didn’t bother to roll. Seriously, grab a clue—every cent counts when it’s multiplying behind your back like rabbits on a sugar high. Here’s the deal: the earlier you start,the more you’ll have later. It’s not rocket science; it’s simple math. So, get to it and stop using excuses that even a toddler wouldn’t buy.

- Start small: Get over yourself and start with whatever you can.

- Stay Consistent: Even a lazy bum knows consistency can’t be beat.

- Celebrate Small wins: If you find a coin, roll it, and fantasize about that tropical vacation later.

| Years Saved | Initial $100 | At 5% | At 10% |

|---|---|---|---|

| 5 | $100 | $128 | $161 |

| 10 | $100 | $163 | $259 |

| 20 | $100 | $265 | $672 |

Here’s Your Ultimate ‘Get-Rich’ Starter Pack: Actually Saving

People love talking about that sudden big money win, like lottery jackpots or finding a rare Picasso at a garage sale, but honestly, folks, it’s time to face the truth. Instead of waiting for a ‘get-rich-fast‘ miracle, why not try the oh-so-boring yet ridiculously effective act of actually saving your money? Compound interest might sound like something only nerds care about, but surprise, surprise—it’s your ticket to easy street. No need for a doctorate in finance. You just sit back while your money makes babies, and these babies make babies. You get the picture. If you think keeping cash under the mattress is working for you, it’s time for a wake-up call.

Here’s a reality check: stop buying overpriced lattes and start putting that cash into a basic savings account where compound interest can do its magic.You’ll thank me later. Want some simple advice? Here you go:

- Open a savings account – Yes, really. Sign your name, set it, and forget it.

- Automate savings – Transfer money every payday. Trust me, future you will love it.

- Live below your means – Do you really need another pair of designer shoes?

- Reinvest earnings – Let that interest snowball until you’re swimming in cash Scrooge McDuck style.

But let’s break it down further with some quick maths, shall we?

| Monthly Savings | Interest Rate (annual) | Money After 20 Years |

|---|---|---|

| $100 | 5% | $41,103 |

| $200 | 5% | $82,206 |

Q&A

Q&A:

Q: What is compound interest and why should I care?

A: Oh, just the single most magical money-making phenomenon that banks and financial advisors have been sneaking past you while you were busy buying your 17th iced coffee this month. You should care because compound interest is like planting a money tree—your money earns money, and then that money earns more money. If you don’t care about free money, then by all means, ignore it.

Q: Is compound interest really free money? Sounds too good to be true.

A: Look, if someone offered you a lifetime supply of free pizza, would you question it or just start planning pizza-themed parties? Compound interest is like free money tickets that your bank gives out just as you’ve had the wisdom to park your cash for a while. The only string attached is time—which, let’s face it, you’re wasting on social media anyway.

Q: How does it work? Do I need a finance degree to get it?

A: If you can manage to binge-watch an entire Netflix series in two days, you can absolutely understand this. When you invest or save money, you earn interest on that initial amount. With compound interest,you earn interest on the interest. That’s money on top of more money! No finance degree needed, just a minimally functioning brain.

Q: what’s the catch? This sounds too easy.

A: The “catch” is our society’s insistent need to have everything right now. Compound interest rewards patience, something you might have forgotten on your quest to have everything yesterday. You have to give it time to grow, like a plant, but with less effort as you don’t even have to water it.

Q: Does compound interest really make a difference?

A: If you can’t figure out that earning exponentially more over time is a good thing, I’m just going to assume math wasn’t your best subject. A little now becomes a lot later—like opting for a large popcorn and getting an extra-large at no extra cost. The difference is that large versus gigantic accumulation of wealth later on.

Q: Is saving a few bucks a month worth the hassle?

A: Oh, let’s return to those iced coffees, shall we? If you save even a moderate amount habitually, compound interest will turn those tiny sacrifices into a financial empire. but sure, enjoy blowing it on meaningless stuff that won’t get you a dime in the future. Genius move.

Q: What’s the worst thing about ignoring compound interest?

A: Ignoring compound interest is like ignoring your mom when she tells you not to touch a hot stove. The worst thing is you end up with exactly what you have now—nothing more. Congrats, future-you is now cursing current-you for missing out on easy gains because you were too busy “treating yourself.”

Q: How do I get started?

A: Oh,so now you’re interested? Fine. Start by saving regularly in a savings account or investment that offers compound interest—the kind of account where your money will sit and multiply over the years. Think of it as setting up a trust fund, but for the responsible adult you’re procrastinating being.

to sum up

So there you have it, folks.Compound interest—your fairy godmother in the world of finance—just waiting to sprinkle a little magic on your pile of money. But hey,if you’re more into watching your cash stagnate like a forgotten carton of milk at the back of the fridge,be my guest. Keep pretending that ignoring compound interest is some kind of noble financial strategy instead of what it really is—financial malpractice.

For those of you who’ve finally decided to wake up and smell the interest, congratulations! You can now join the ranks of people who understand that this isn’t rocket science. Seriously, it’s like choosing between a free upgrade to first class or sitting in economy by choice. Who even does that?

So get your act together, start letting your money make money, and stop whining about how you can’t catch a break. You’ve just met your break—it’s called compound interest. Now,go out there and do something wise with it before someone else decides to wake up and snatch up all that free money. spoiler alert: It’s there for the taking. Quit stalling and start compounding!