Welcome to the joyless jungle of bank statements—the paper trail your bank sends to remind you just how incredibly you mismanaged your money. Yes, that delightful document filled with numbers that seem to have been concocted by a sadistic mathematician intent on ruining your day. If the mere sight of those tiny print fees and mysterious charges makes you want to curl up and weep, fear not. This no-BS guide is here to drag you kicking and screaming through the art of reading your bank statement without turning into a blubbering mess. Grab your sarcasm shield and your courage (or whatever’s left of it), because we’re about to decode the financial Frankenstein that your bank loves to torture you with.Let’s face it: understanding your bank statement shouldn’t require a degree in rocket science or the emotional resilience of a soap opera star. So, buckle up and prepare to tackle this nightmare head-on—with a smirk and maybe a snarky comment or two.

Stop Freaking Out Decoding the Gobbledygook on Your Bank Statement

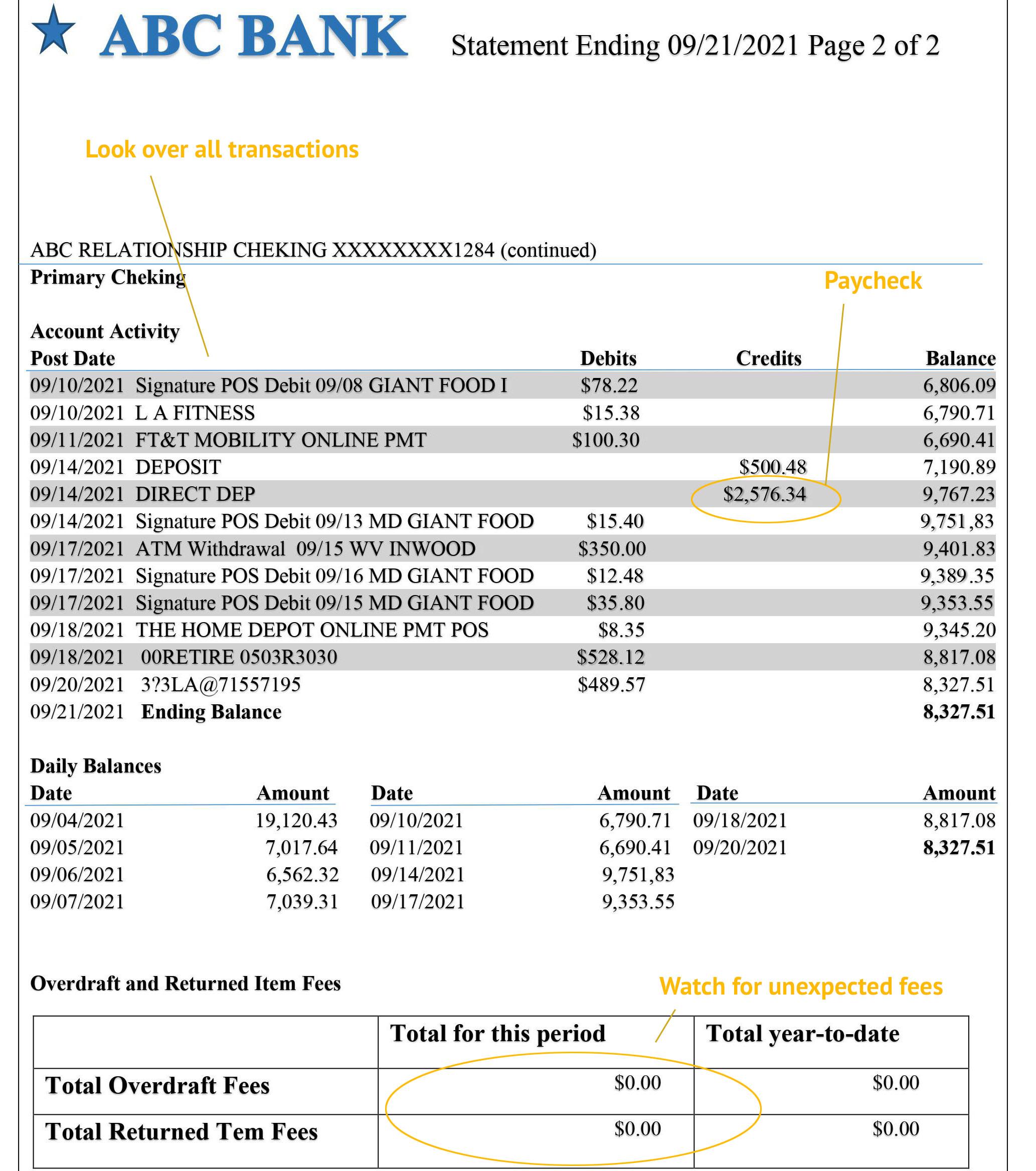

Alright, genius, let’s break down your bank statement so you don’t feel like you need a PhD in hieroglyphics. First off, forget the fancy terms like ACH Debits or NSF Fees—these are just adult ways of saying someone took your money or you bounced a check. Here are the key sections to focus on:

- Account Summary: Your current balance and all-time high. Yes, that’s how much you owe or own.

- Transactions: Every single thing you spent or got paid. Spoiler: It includes that $5 coffee you thought was an excellent idea.

- Fees: The bank’s way of reminding you who’s boss. Read them, cry a little, move on.

If you’re still lost, here’s a table for your fragile mind:

| Section | What It Means |

|---|---|

| Deposits | Money coming in, like that paycheck you actually needed. |

| Withdrawals | Money going out, weather you remember it or not. |

See? It’s not rocket science. Stop overthinking it,and maybe,just maybe,you won’t cry every time your statement arrives.

Expose the Sneaky Fees and Charges That Drain Your Wallet

Isn’t it lovely how your bank fees multiply faster than rabbits on steroids? let’s unveil the little gremlins silently draining your wallet:

- Monthly Maintenance Fees: Paying just to keep your account open? Brilliant business model, genius.

- Overdraft Charges: Because being broke isn’t embarrassing enough, let’s slap a fee on top.

- ATM Fees: Want to withdraw your money? Surprise! You’ll pay extra for that privilege.

- Foreign transaction fees: Travel the world and watch your spending spree turn into a fee fiesta.

But hey, don’t throw in the towel just yet. Here’s a handy table to help you recognize and dodge these wallet vampires:

| Fee Type | Typical Cost | How to Avoid |

|---|---|---|

| monthly Maintenance | $10–$15 | Choose no-fee accounts or maintain the required minimum balance |

| Overdraft Charge | $35 per incident | Link to a savings account or opt out of overdraft protection |

| ATM Fees | $2–$5 per withdrawal | Use in-network ATMs or get reimbursed by your bank |

| foreign Transaction | 3% of each purchase | Use a travel-friendly credit card with no foreign fees |

Craft a No-Nonsense Budget Plan to Keep Your Finances in Check

Alright,enough with the sob stories. Let’s get your finances in line without turning it into a therapy session.First off, stop pretending you have money you don’t. Dive into your bank statement and categorize every expense like a grown-up.Here’s a quick rundown:

- Essentials: Rent,utilities,groceries – the stuff you actually need.

- Debt Payments: Credit cards, loans, whatever keeps the collection calls at bay.

- Discretionary: Netflix binges, that unnecessary latte, and other frivolous crap.

Next, it’s time to play hardball with your spending. Set clear limits for each category and stick to them like your financial sanity depends on it (because it does). here’s a simple table to keep you on track:

| Category | Monthly Budget |

|---|---|

| Essentials | $1,200 |

| Debt Payments | $500 |

| Discretionary | $300 |

There you have it. A no-nonsense budget that keeps your bank statement from acting like a horror story. Now stop whining and start sticking to your plan.

Celebrate Small Wins Without Crying Over Your Numbers

Look, not every deposit is a jackpot and not every withdrawal is a black hole. Let’s cut yourself some slack and acknowledge the tiny victories. Maybe you resisted that impulse buy or actually remembered to log your expenses for a week. Whatever it is indeed, give yourself a pat on the back rather of bawling into your balance sheet. Here are a few things to celebrate without turning your bank statement into a sob fest:

- Small Savings: Every dollar not spent is a tiny rebellion against your inner shopaholic.

- Consistent Budgeting: Yes, you actually stuck to that ridiculous spreadsheet for a month.

- Debt Payments: Paying off a bit of debt? Congratulations, you’re one step closer to not being a financial disaster.

Remember, Rome wasn’t built in a day and neither is your bank account. Don’t let a few mediocre numbers make you want to throw your statement out the window. Instead, track your progress with something like this:

| Win | Impact |

|---|---|

| Skipped Lunch Out | + $15 in savings |

| Used Loyalty Card | + $5 cashback |

| Filtered Subscriptions | + $20 monthly |

See? It’s not rocket science. Focus on these nuggets of progress and stop whining about every fluctuation. Your future self will thank you for not turning your financial journey into a pity party.

Q&A

Q1: Why the hell should I even bother reading my bank statement? It’s just a bunch of numbers screaming “FAIL.”

A1: Oh, absolutely, keep ignoring it and watch your money vanish like your motivation on a Monday morning. But hey, if you enjoy surprise fees, mysterious charges, and the thrill of overdraft penalties, by all means, skip it. Otherwise, you might actually wake up to some financial clarity.

Q2: How the heck am I supposed to understand all these cryptic transaction codes and fancy terms?

A2: Welcome to the adult version of deciphering ancient hieroglyphics. Grab a magnifying glass, or better yet, a sarcastic friend who’s willing to translate “ACH TRANSFER” into “Where did I send my paycheck this month?” Spoiler: It’s probably paying for that latte addiction.

Q3: My bank statement looks like a horror movie. What’s the first step to stop the financial nightmares?

A3: Step one: Stop panicking. step two: Calmly identify where your money is actually disappearing. Spoiler alert—it’s not into a black hole or alien abduction. It’s likely subscriptions you forgot about or impulse buys from 2019.

Q4: I’m seeing charges I don’t recognize. Should I freak out or what?

A4: Freak out? Only if you enjoy late-night calls with customer service that could have been emails. instead, calmly (as calmly as one can) dispute them. Either they’ll disappear faster than your willpower at a dessert buffet, or you’ll discover you’ve been paying for something you totally forgot about.

Q5: How do I make sense of those pesky interest rates and fees? It sounds like financial Russian roulette.

A5: Think of interest rates and fees as the universe’s way of saying, “Congrats, you’ve successfully procrastinated on your finances.” To decode them, maybe read the fine print or use a calculator. Or just embrace the chaos and keep a steady diet of instant noodles—because who needs savings anyway?

Q6: what’s the deal with balancing my statement? It sounds like high school math I never cared about.

A6: Exactly, because balancing your bank statement is just as fun as balancing a spoon on your nose. Here’s a shocker: it actually matters. Matching your records with the bank’s means you’re not accidentally funding someone else’s yacht. Wild concept, I know.

Q7: Any tips to stop crying over my dwindling bank balance?

A7: Yes, stop emotionally attaching your self-worth to that number. Then, take practical steps: track your spending, cut unnecessary crap, and maybe, just maybe, learn what “budgeting” actually means instead of assuming it’s a trendy new yoga pose.

Q8: How often should I actually read my bank statement without napping halfway through?

A8: Ideally, once a month when you’re sober and have a functioning brain. if that’s too ambitious, set reminders more frequent than your diet resolutions. Your future self will thank you when you’re not living paycheck to paycheck on a steady diet of ramen and regret.

Q9: Can someone explain why my bank statement shouldn’t just be a work of abstract art?

A9: Because,shockingly,it’s supposed to show where your money is going—not be a modern art masterpiece you interpret as you wish.Unless your goal is to confuse every potential lender and keep your financial life as messy as your last Tinder date.

Q10: I hate math.How can I manage my bank statement without doing algebra?

A10: Welcome to the anti-math club, population: everyone with real money problems. Use apps that do the math for you, or enlist a friend who actually understands numbers. Or, you know, continue to ignore it and revel in the blissful ignorance of impending overdrafts.

Remember, your bank statement isn’t a cryptic message from another dimension—it’s a wake-up call to get your financial life together. So grab a strong coffee, channel your inner savage, and dive into those numbers like the responsible adult you pretend to be.

In Retrospect

So there you have it—your no-fluff, tear-free guide to deciphering the cryptic hieroglyphics that are your bank statements. Congratulations, you’ve officially graduated from the School of Financial Survival without losing your sanity. Now, the next time you get that monthly reminder that your spending habits resemble a reality TV showdown, you can actually understand what’s draining your wallet instead of instinctively reaching for the tissues. Remember,money doesn’t grow on trees,and neither will your patience for nonsense—so keep these tips handy,stop begging your bank for explanations,and take control of your finances like the adult you pretend to be. Cheers to fewer financial freak-outs and more hard-earned cash in your pocket. You earned it.