Welcome to the glamorous arena of the stock market—the place where everyone from your barista to that guy at the gym suddenly thinks he’s Warren Buffett, armed with nothing but unsolicited advice and a sparkly app. If you’ve ever felt like understanding stocks is akin to deciphering ancient alien scripts, you’re not alone. This no-BS guide is here to yank you out of your financial fog and into the harsh, sometimes hilarious reality of trading without feeling like the village idiot. Forget the pretentious jargon and get ready for some straight-up truth bombs, served with a side of sarcasm.Let’s cut the crap and actually make sense of the stock market, shall we?

Stop Treating the Stock Market Like a Casino Night

Newsflash: The stock market isn’t Vegas, so stop treating it like one. Betting your paycheck on a bunch of random stocks and hoping for a jackpot is a surefire way to end up crying into your empty wallet. Here’s what you need to quit doing instantly:

- Chasing penny stocks because “they could be the next big thing”

- Listening to every “expert” who couldn’t predict last week’s market dip

- Using your investment account as a personal slot machine

Instead of gambling, start acting like someone who actually knows what they’re doing. Focus on these basics to build real wealth:

- research: Understand the companies you’re investing in, not just their ticker symbols

- Diversification: Don’t put all your eggs in one overpriced basket

- Long-term planning: Think years, not minutes

| Casino | Stock Market |

|---|---|

| Pure luck | Informed decisions |

| Swift cash, high risk | Steady growth, managed risk |

| Entertainment | Wealth building |

Decoding Charts Without Losing Your Mind

Alright, let’s tear down these confusing stock charts so you can stop feeling like you accidentally wandered onto a Wall Street trading floor. First off, realize that charts are just fancy drawings pretending to predict the future. Here’s what you need to focus on to avoid a headache:

- Line Charts: The simplest torture. Connect the dots and voilà, you’ve got a trend. easy enough.

- Bar Charts: More info, same confusion.open, high, low, close – it’s like a stock’s daily report card.

- Candlestick Charts: The moodiest charts around. Each “candle” shows whether the stock was a winner or a loser that day.

Next, let’s tackle those annoying indicators that everyone swears by but make about as much sense as algebra to a toddler:

- Moving Averages: They smooth out the chaos, showing you the general direction. Think of it as the stock’s average mood.

- RSI (Relative Strength Index): Tells you if a stock is too hot or too cold. Basically, is it overhyped or overlooked?

- Bollinger bands: Stretchy lines that measure volatility. When the bands are tight,things are boring. When they’re wide, buckle up.

| Chart Type | Best For | Complexity |

|---|---|---|

| Line | Quick Trends | Basic |

| Bar | Detailed Daily Moves | Intermediate |

| Candlestick | Visual Traders | Advanced |

There you have it. Now go forth and analyze without tears. Just remember,no chart is a crystal ball – but at least you won’t feel like a total moron trying to make sense of it.

Ditch the So-Called Experts and Trust Your Own Research

Let’s be real: the so-called experts are frequently enough just glorified guessers who throw around fancy jargon to make themselves sound critically important. Rather of relying on their outdated advice, take matters into your own hands. Here’s why doing your own homework trumps listening to these _“gurus”_ every single time:

- Control Your Destiny: You’re the one with the skin in the game, not some armchair commentator.

- Stay Updated: Experts love to rest on their laurels, but the market never does.

- cut the Bullshit: Filter out the nonsense and focus on what actually matters to you.

Still not convinced? Check out this handy comparison:

| Trusting Experts | Doing Your Own Research |

|---|---|

| Relies on others’ opinions | Builds your own insights |

| Frequently enough one step behind | Always up-to-date |

| May have conflicts of interest | 100% vested in your success |

Stop letting self-proclaimed experts dictate your financial future. Arm yourself with knowledge, make informed decisions, and watch your confidence soar as you navigate the stock market like a pro.

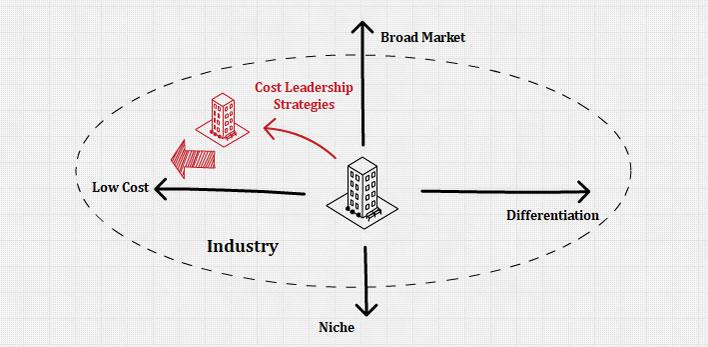

Build a Strategy That Doesn’t Suck Your Money Dry

Let’s cut the crap and get real about crafting a strategy that doesn’t leave your wallet gasping for air. First off, you need to define your investment goals—unless you enjoy throwing money into the abyss with no plan. Are you in it for the long haul or just a quick buck? Knowing this helps you dodge the common pitfalls that turn newbies into broke enthusiasts.

Next, embrace the magic of diversification. Seriously, stop putting all your cash into that one shiny stock your cousin’s friend swears by. Here are a few non-BS strategies to keep your portfolio from becoming a financial horror story:

- Spread Your Investments: Don’t bet everything on tech stocks.

- Asset Allocation: Mix it up with bonds, real estate, and maybe some gold if you’re feeling fancy.

- regular Rebalancing: Keep your portfolio in check instead of letting it spiral out of control.

And because we love wasting your time less, here’s a quick reference to keep you on track:

| Strategy | Expected Outcome |

|---|---|

| Diversification | Reduces risk by spreading investments |

| Asset Allocation | Balances potential returns with your risk tolerance |

| Regular Rebalancing | Keeps your portfolio aligned with your goals |

Q&A

: A Snarky Q&A

Q1: Why does the stock market feel like deciphering ancient hieroglyphics?

A1: Oh, because what screams “fun” like throwing around terms like “alpha,” “beta,” and “liquidity” to ensure everyone feels like they need a PhD just to say hello. Welcome to the glamorous world of financial cryptography.

Q2: I’m clueless.Where the hell do I even start with understanding stocks?

A2: Fantastic question! Begin by binge-reading every Investopedia page until your eyes bleed. Then, pretend to nod thoughtfully in conversations while secretly Googling what “diversification” means. Effective? Maybe. Sanity? Not so much.

Q3: What’s up with all these acronyms like P/E ratio, ROI, and EBITDA?

A3: Oh, you mean the financial alphabet soup everyone loves to dish out to look smart? P/E is Price-to-Earnings, ROI is Return on Investment, and EBITDA… well, that’s just another way to say “we did some fancy calculations.” Use them sparingly unless you want to sound like a walking ticker tape.

Q4: Should I mess around with individual stocks or just stick with ETFs to avoid looking like a noob?

A4: If you enjoy the thrill of perhaps losing all your money while screaming at your screen, go for individual stocks.If you prefer a safer, less heart-attack-inducing approach, ETFs are your buddy. Either way, prepare for emotional roller coasters. Welcome to adulthood.

Q5: How the heck can I tell if a stock is a good investment or just another overhyped dumpster fire?

A5: Grab your magnifying glass and start digging into financial statements, market trends, and maybe a crystal ball if you’re into that. Or, you know, ignore all advice and hope for the best, just like every other option trader out there. Spoiler: It’s usually not pretty.

Q6: What’s the deal with bull and bear markets?

A6: Bulls charge at you with overpriced stocks during booms, while bears swipe left on your portfolio in downturns. It’s Mother Nature’s way of ensuring your stress levels stay as high as your investment fees. Fun times.

Q7: Is day trading the golden ticket to easy money or just another casino without the free drinks?

A7: If you think flipping stocks every few hours will make you rich and popular on Instagram, good luck with that illusion. Day trading is less “get-rich-quick” and more “get-frequently-asked-why-are-you-crying.” Think Las Vegas, but with more spreadsheets and existential dread.

Q8: How important is it to keep up with financial news and trends without losing my mind?

A8: About as crucial as deciding what to watch on Netflix—sometimes you need it, and other times it’s just background noise to your anxiety. Stay informed enough to make educated decisions, but don’t let every headline make you want to self-destruct. Balance, champ.

Q9: What’s the best way to manage risk without becoming a paranoid hermit?

A9: Diversify your investments so you’re not putting all your doom in one basket. It’s like not betting your life savings on whether your favorite reality TV show gets canceled. Smart, huh? Now you can worry selectively.

Q10: Any last words of wisdom for someone about to dive into this madness?

A10: Congratulations, you’re about to enter a world where your emotions are tested daily, and your bank account might take a hit. Do your homework, don’t follow every “hot tip” from random internet gurus, and remember: nobody really knows what they’re doing. But hey, at least you’ll have some entertaining stories for the inevitable tears.

There you have it. Now go forth and conquer the stock market,or at least survive it without completely losing your marbles. Good luck!

Concluding Remarks

So, congratulations! You’ve just navigated our no-BS, brutally honest guide to not looking like an absolute idiot in the stock market. Remember, investing isn’t about memorizing Wall Street buzzwords or desperately chasing the next hot tip that’s gone bust before you can say “pump and dump.” It’s about using your common sense, not sweating every flicker on those fancy charts, and definitely not letting your emotions turn your portfolio into a circus act. So go forth, armed with this wisdom, and stop feeling like the dunce at the trading table. If all else fails, at least you can laugh at how absurd the whole game really is. Happy investing, genius.