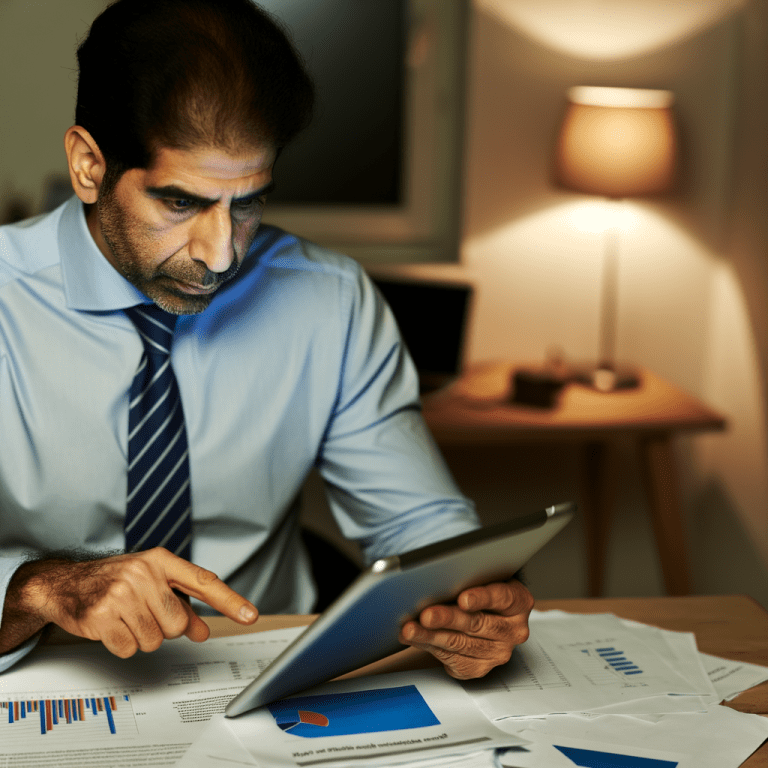

Hey there! Have you ever thought about how your financial goals and personal wellness plans are connected? In this article, we’ll explore the importance of integrating these two aspects of your life for a happier and more fulfilling future. Let’s dive in!

Setting financial goals aligned with personal wellness

When it comes to setting financial goals, it’s important to consider how they align with your personal wellness plans. Financial health and overall well-being go hand in hand, so it’s essential to create goals that support both areas of your life. By integrating your financial goals with your personal wellness plans, you can set yourself up for success in all aspects of your life.

One way to align your financial goals with your personal wellness plans is to prioritize saving for activities that bring you joy and improve your well-being. Whether it’s saving for a yoga retreat, a new hobby, or a vacation, setting aside money for things that contribute positively to your mental and physical health can increase your overall happiness. Additionally, focusing on reducing financial stress through budgeting, saving, and investing can help improve your overall well-being.

The importance of synergy between financial and wellness objectives

When it comes to achieving overall wellness, it is crucial to consider both your financial goals and personal wellness plans. The synergy between these two aspects can greatly impact your quality of life and sense of well-being. By integrating your financial objectives with your wellness goals, you can create a more balanced and sustainable lifestyle.

Benefits of aligning financial and wellness objectives:

-

- Reduced stress levels

-

- Improved physical and mental health

-

- Increased financial security

-

- Enhanced overall well-being

| Financial Goal | Wellness Plan |

| Save for retirement | Exercise regularly for physical health |

| Pay off debt | Practice mindfulness for mental well-being |

Strategies for successful integration of financial and personal well-being plans

One way to successfully integrate financial and personal well-being plans is to start by setting clear and achievable goals for both areas. Make a list of your financial goals, such as saving for a vacation or paying off debt, and your personal wellness goals, like exercising regularly or meditating daily. Prioritize these goals based on what is most important to you and what will have the biggest impact on your overall well-being.

Next, create a budget that aligns with your financial goals and lifestyle. Identify areas where you can cut back on expenses to save more money towards your financial goals, such as eating out less or canceling unused subscriptions. Additionally, allocate funds towards activities that support your personal wellness goals, such as investing in a gym membership or purchasing healthy groceries. By finding a balance between saving and spending on things that bring you joy and improve your well-being, you can create a sustainable plan for success.

| Financial Goals | Personal Wellness Goals |

|---|---|

| Save $1000 for emergency fund | Exercise 3 times a week |

| Pay off credit card debt | Meditate for 10 minutes daily |

| Invest in retirement account | Attend therapy sessions bi-weekly |

Q&A

Q: What is the importance of integrating financial goals with personal wellness plans?

A: Integrating financial goals with personal wellness plans is crucial because financial health and physical health are closely intertwined.

Q: How can setting financial goals help improve overall well-being?

A: Setting financial goals can provide a sense of purpose and motivation, leading to decreased stress and an improved sense of control over one’s life.

Q: What are some practical steps individuals can take to align their financial and wellness goals?

A: Some practical steps include budgeting for self-care activities, saving for future healthcare expenses, and investing in preventative measures like healthy food and exercise.

Q: Can you provide examples of financial goals that align with personal wellness objectives?

A: Yes, examples include saving for a gym membership, setting aside money for mental health therapy, or investing in nutritious food options.

Q: How can individuals track their progress towards both financial and wellness goals?

A: Utilizing apps or spreadsheets to monitor spending and savings, as well as keeping a journal to track progress in personal wellness activities, can help individuals stay on track.

To Conclude

So, whether your financial goals include saving for a dream vacation, buying a house, or simply getting your budget in order, don’t forget to consider how they align with your overall wellness. By taking a holistic approach to your financial and personal goals, you can create a roadmap for a healthier, happier future. Remember, it’s not just about the numbers – it’s about living a well-rounded life that brings you joy and fulfillment. Here’s to a future where your financial success and personal well-being go hand in hand. Cheers to a balanced life!

[…] way to start planning together is by setting shared financial goals. This could include saving for a down payment on a house, planning for retirement, or creating an emergency […]

[…] Have you ever wondered how your trusty smartphone can help you stay on top of your wellness goals? In this article, we’ll explore how tech-savvy millennials are using various apps and […]