Hey there, we’ve all made money mistakes at one point or another. Whether it’s overspending on a shopping spree or missing a credit card payment, financial wounds can take a toll on your peace of mind. In this article, we’ll explore mindful approaches to managing money mistakes and healing your financial wounds. Let’s dive in!

Recognizing Money Mistakes

We all have those moments when our financial decisions don’t quite hit the mark. Often, these blunders are easy to overlook when life’s daily grind takes precedence. But taking a step back to identify and acknowledge the missteps can be a game changer. Here are some common financial mistakes many of us make without realizing:

- Impulse Purchases: It’s easy to get swayed by sales and promotional offers.

- Neglecting Savings: The ’I’ll save what’s left’ mentality rarely leaves money for savings.

- Ignoring Budget Plans: Without a budget, it’s difficult to track spending and manage resources wisely.

- Underestimating Small Expenses: Little purchases can add up to surprisingly large sums over time.

Reflecting on the impacts of these mistakes is essential. It’s not just about recognizing them, but also understanding the repercussions they have on your financial health. Below is a simple table illustrating typical effects of common money mishaps:

| Mistake | Potential Consequence |

|---|---|

| Impulse Buying | Accumulated debt |

| Neglecting Savings | Insufficient emergency funds |

| No Budget Plan | Overspending |

| Underestimating Small Costs | Drained bank account |

Developing a Mindful Budgeting Plan

Creating a mindful budgeting plan involves a blend of awareness and sensitivity towards your financial status and spending habits. Start with a clear mind and take inventory of your current financial situation, detailing your income sources, fixed expenses, and discretionary spending. It’s helpful to use a mindfulness-based approach where you periodically check in with your emotional state before making spending decisions. This practice can help you identify emotional triggers that lead to unnecessary purchases.

Once you have a clear picture, organize your numbers into a simple budgeting table. Here’s an example you can follow:

| Category | Budgeted Amount | Actual Amount |

|---|---|---|

| Rent/Mortgage | $1200 | $1200 |

| Groceries | $300 | $280 |

| Entertainment | $100 | $150 |

Key practices to incorporate include:

- Regular reviews: Schedule time every week to review your budget and reflect on your spending.

- Intentional spending: Before making a purchase, ask yourself how it fits into your overall financial goals.

- Compassionate adjustments: Be kind to yourself and make adjustments as needed without guilt or judgment.

Practicing Self-Compassion and Forgiveness in Financial Recovery

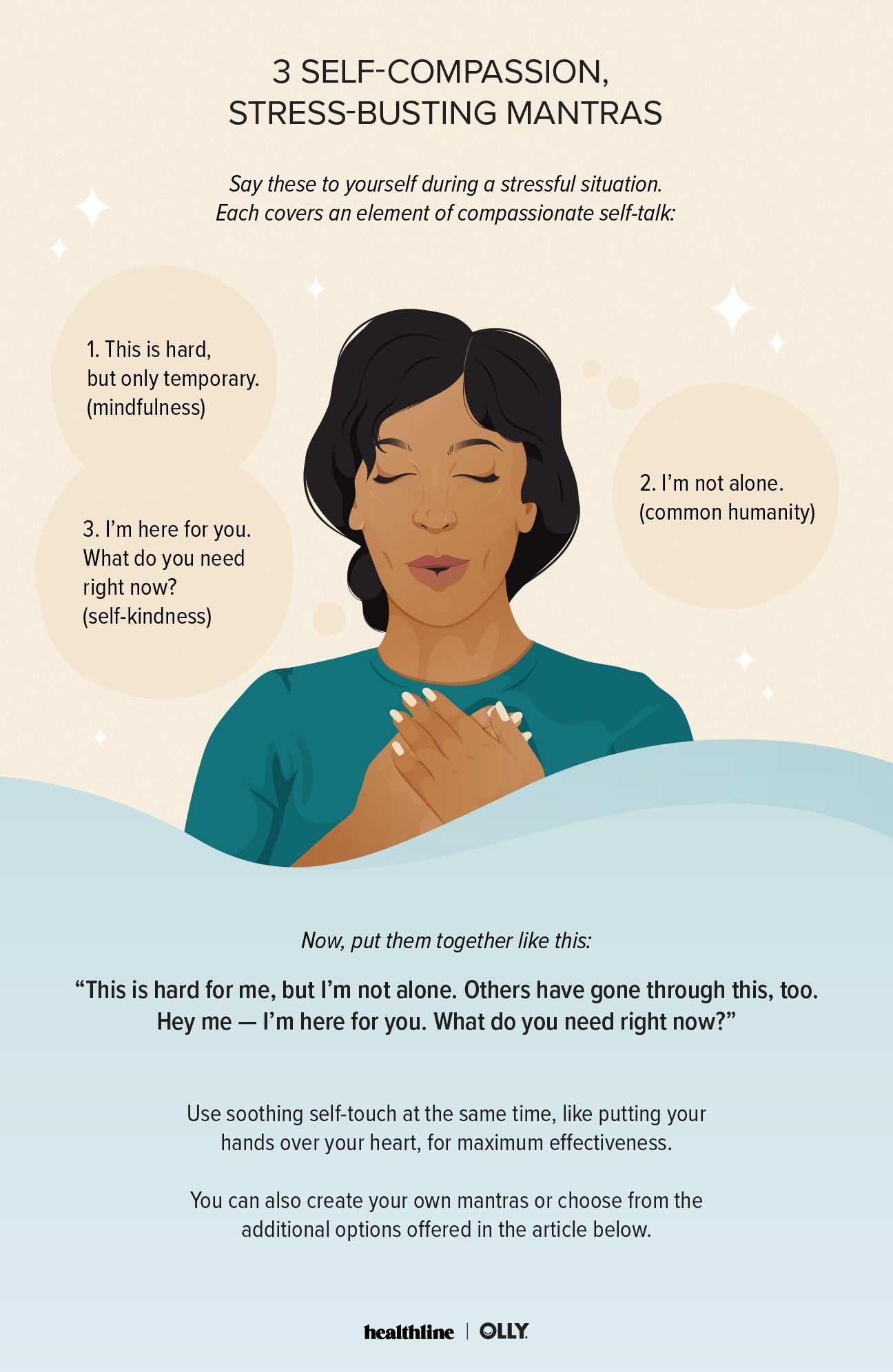

It’s all too easy to get stuck in a cycle of regret and self-blame when you’ve made financial mistakes. Instead of dwelling on the past, practicing self-compassion can be transformative. Remember that nobody’s perfect. We all make poor financial choices at some point, but what’s important is how we respond to them. By treating yourself with kindness rather than criticism, you’re more likely to cultivate a healthy mindset that fosters better decision-making. Here are a few steps to start practicing self-compassion:

- Acknowledge your mistakes without judgment.

- Understand that setbacks are a natural part of personal growth.

- Shift your focus from what went wrong to what you can do better next time.

Forgiveness plays an equally pivotal role in financial recovery. Holding onto guilt or resentment can cloud your judgment and hinder progress. To forgive yourself, you can start by recognizing the lessons learned and making a conscious decision to move forward. A helpful approach could be to create a simple plan to avoid repeating the same mistakes. Consider this straightforward strategy:

| Step | Action |

|---|---|

| 1 | Identify the mistake and its impact on your finances. |

| 2 | Analyze what led to the error and what you could have done differently. |

| 3 | Create a plan to mitigate similar mistakes in the future. |

Seeking Professional Help and Support

It’s crucial to understand that admitting you need help doesn’t signify failure but rather a step towards financial wellness. Seeking guidance from a professional can provide valuable insights and tailored strategies that you might not have considered. Here are a few types of professionals who can offer assistance:

- Financial Advisors: Help you craft a strategic plan for your finances.

- Credit Counselors: Assist in managing and improving your credit score.

- Therapists Specializing in Financial Stress: Aid in addressing emotional and psychological impacts.

<table class="wp-block-table">

<thead>

<tr>

<th>Professional</th>

<th>Role</th>

<th>Benefits</th>

</tr>

</thead>

<tbody>

<tr>

<td>Financial Advisor</td>

<td>Strategic Planning</td>

<td>Long-term goals</td>

</tr>

<tr>

<td>Credit Counselor</td>

<td>Credit Management</td>

<td>Improved Credit Score</td>

</tr>

<tr>

<td>Therapist</td>

<td>Emotional Support</td>

<td>Reduced Stress</td>

</tr>

</tbody>

</table>

Q&A

Q: What are some common money mistakes that people make?

A: Common money mistakes include overspending, impulse buying, not saving enough, and living above one’s means.

Q: How can mindfulness help with managing money mistakes?

A: Mindfulness can help individuals become more aware of their spending habits, emotions around money, and make more intentional choices when it comes to finances.

Q: What are some practical tips for practicing mindfulness with finances?

A: Some practical tips include tracking expenses, setting financial goals, creating a budget, and regularly checking in with your financial situation.

Q: How can someone start healing their financial wounds?

A: To start healing financial wounds, individuals can acknowledge past mistakes, forgive themselves, and focus on making positive changes moving forward.

Q: Are there any resources or tools that can help with managing finances mindfully?

A: Yes, there are a variety of apps, books, and websites that can help individuals track expenses, create a budget, and develop better money habits.

Final Thoughts

So there you have it – some mindful approaches to help you heal from financial wounds and manage money mistakes. Remember, everyone makes mistakes with money, but the key is to learn from them and use them as opportunities for growth. By practicing mindfulness in your financial decisions, you can begin to heal and make smarter choices moving forward. So be kind to yourself, be patient, and trust that you have the skills to overcome any financial challenges that come your way. Thanks for reading!