In today’s digitally driven world, personal financial management has become increasingly reliant on sophisticated online tools that promise to streamline complex debt management processes and bolster financial health. As the global economy reels from recent uncertainties, individuals and households face mounting pressures to oversee their finances with greater precision and accountability. In this context, technology has emerged as a pivotal ally, offering a suite of platforms and applications designed to empower users with real-time data, personalized insights, and actionable strategies. This article delves into the array of online tools currently available that are revolutionizing the way we manage debt and enhance our fiscal well-being, examining their features, benefits, and the technological advancements driving their efficacy.

– Introduction to Online Debt Management Tools

Managing debt can be a daunting task, but with the advent of online tools, it’s now easier than ever to keep track of finances and work towards improving financial health. These tools offer a range of features tailored to meet diverse debt management needs. Most importantly, they provide a convenient way to monitor and organize multiple debt accounts, ensuring that you never miss a payment and can strategize on how to pay off debts faster. Many of these platforms are equipped with debt payoff calculators, budgeting tools, and financial goal setting features to assist users in making informed decisions about their finances.

One major advantage of using online debt management tools is their ability to present complex financial data in a simple and digestible format. Here are some popular features you might find:

- Automatic Payment Tracking: Keep track of due dates and amounts for all your debt payments.

- Debt Snowball Method: Help prioritize debt repayment by targeting smaller debts first.

- Interest Rate Analysis: Analyze and compare interest rates across different debts.

- Progress Visualization: View progress through dynamic charts and graphs.

| Feature | Description |

|---|---|

| Budgeting Tools | Create and stick to a budget to manage spending and increase savings. |

| Debt Payoff Calculators | Estimate payoff dates and interest costs for various debts. |

| Credit Score Monitoring | Track and improve your credit score over time. |

– Utilizing Budgeting Apps to Track Expenses and Save Money

Harnessing the power of budgeting apps can be a game-changer for effectively managing your finances. These apps help you track expenses, set savings goals, and monitor spending habits in real-time. Some apps even categorize your expenditures automatically, so you can see where your money goes without the hassle of manual entry. Popular budgeting apps include:

- Mint: Offers budget planning and bill tracking features.

- YNAB (You Need A Budget): Focuses on giving every dollar a job, promoting mindful spending.

- PocketGuard: Keeps expenses in check by showing what you have left to spend.

Tracking your expenses with these apps can reveal spending patterns and unexpected costs, enabling you to make informed financial decisions. Many of these tools also offer customizable features, allowing you to tailor the app to your specific needs. Here’s a quick comparison table of key features:

| App | Platform | Free Features | Premium Features |

|---|---|---|---|

| Mint | iOS, Android, Web | Budgeting, Bill Tracking | Credit Score Monitoring |

| YNAB | iOS, Android, Web | Goal Tracking | Personalized Coaching |

| PocketGuard | iOS, Android, Web | Expense Categorization | Advanced Reporting |

– Debt Payoff Calculators for Developing a Repayment Plan

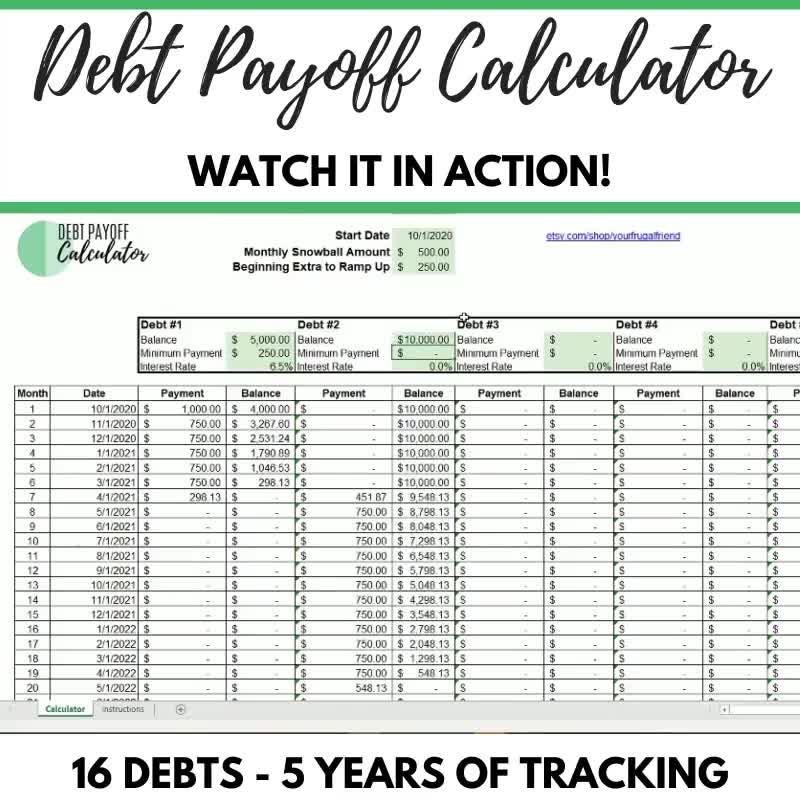

Debt payoff calculators are essential online tools that make it easier to develop a personalized repayment plan. These calculators take into account various details such as total debt amount, interest rates, and repayment periods, helping you visualize the timeline and cost of eliminating your debt. By adjusting monthly payments and other variables, you can see how small changes can significantly impact your debt-free date and total interest paid. These tools empower you to make informed financial decisions, showing you the most efficient strategies to clear off debt.

Here are some key features you can expect from a debt payoff calculator:

- Amortization Schedule: Detailed breakdown of each payment, showing how much goes towards principal and interest.

- Extra Payment Options: Allows you to input additional payments to see how they can speed up debt reduction.

- Comparison Charts: Visual aids that compare different repayment scenarios.

Check out the table below to see a snapshot of how these calculators can help you:

| Feature | Benefit |

|---|---|

| Customizable Inputs | Tailored repayment strategies |

| Interest Savings Calculation | Understand potential savings |

| Debt-Free Date Projection | Clear timeline for financial freedom |

– Credit Score Monitoring Platforms for Enhancing Financial Stability

Using specialized platforms to keep tabs on your credit score can significantly bolster your financial stability. These platforms provide regular updates on your credit status, helping you identify and rectify potential issues. Noteworthy features include:

- Real-time Alerts: Instant notifications about changes in your credit report.

- Score Simulators: Tools to forecast the impact of financial decisions.

- Personalized Tips: Tailored advice for improving credit scores.

Choosing the right monitoring platform can make a substantial difference. Here is a comparison of popular options:

| Platform | Features | Cost |

|---|---|---|

| Credit Karma | Free reports, real-time alerts, score simulators | Free |

| Experian | Comprehensive reports, personalized tips, fraud protection | Free & Paid Options |

| MyFICO | Detailed credit reports, score tracking, advanced simulators | Paid |

Q&A

Q: What are some of the online tools available for managing debt?

A: There are several online tools such as debt management calculators, budgeting apps, and debt payoff planners that can help individuals track their debt, create repayment plans, and monitor their progress.

Q: How can using online tools improve financial health?

A: By utilizing online tools, individuals can gain better insights into their financial situation, create a realistic budget, track their spending, and set financial goals. This can help them better manage their debt, save money, and ultimately improve their overall financial health.

Q: Are online tools secure to use for managing debt?

A: Most reputable online tools use encryption technology to protect users’ personal and financial information. It is important to research and choose tools from trusted sources to ensure the security of your data.

Q: Can online tools help individuals negotiate with creditors?

A: Some online tools offer resources and guidance on how to negotiate with creditors, consolidate debt, or explore other debt relief options. However, it is recommended to consult with a financial advisor or credit counselor for personalized advice in these situations.

Q: How can individuals stay motivated to use online tools for managing debt?

A: Setting specific financial goals, tracking progress regularly, and celebrating small milestones can help individuals stay motivated to use online tools and stick to their debt repayment plans. Additionally, seeking support from friends, family, or online communities can provide encouragement and accountability.

Concluding Remarks

utilizing online tools can be a valuable resource for individuals looking to effectively manage debt and improve their financial health. From budgeting and tracking expenses to setting financial goals and receiving personalized recommendations, these tools offer a comprehensive approach to tackling debt and achieving financial stability. By harnessing the power of technology, individuals can take control of their finances, make informed decisions, and work towards a brighter financial future. Embrace the convenience and efficiency of online tools, and pave the way towards a more secure financial foundation.

[…] in mystery for many. Whether you’re looking to make sense of cryptic credit reports, demystify the gurus’ jargon, or unlock secrets to enhancing your […]

[…] dealing with multiple servicers, but be cautious—sometimes this stretches out your repayment period, leading to more interest over time. You don’t want life to be one long Facepalm […]

[…] a quick comparison table to show the difference between a will and a trust when it comes to pet […]

[…] Imagine being able to read your bank statements, credit reports, and loan agreements without needing a degree in Financespeak. Financial literacy equips you with […]