Have you ever found yourself lying awake at night, wondering if you’ve set yourself up for a secure financial future? You’re not alone. In today’s fast-paced world, achieving financial stability and mental peace can often seem like conflicting goals. But what if they didn’t have to be? Welcome to “,” where we’ll dive into practical strategies to help you manage your money without losing your cool. Whether you’re just starting out or already on your financial journey, this guide aims to bring clarity and calm to an often stressful topic. So, grab a cup of coffee, settle in, and let’s explore how you can pave the way to both fiscal health and inner peace.

Setting Up a Stress-Free Savings Plan

To begin, break your savings goals into small, manageable steps. It’s easier to stay calm when you don’t feel overwhelmed by a massive goal. Consider setting up mini-goals, like saving a specific amount each month or quarter. Utilizing automatic transfers can help you stick to your plan painlessly. Here’s a simple list to guide you:

- Start by calculating your current expenses.

- Decide on a reasonable savings target.

- Set up automated savings deposits.

- Track your progress regularly.

Another essential element is to create a flexible budget that accommodates life’s unexpected twists and turns. It’s important to include categories like an emergency fund and entertainment to ensure you can handle unexpected expenses without stress. Below is a basic table to organize your budget plans:

| Category | Monthly Amount |

| Essential Bills | $800 |

| Savings Contribution | $200 |

| Emergency Fund | $100 |

| Entertainment | $50 |

Understanding Your Financial Priorities

Taking the time to figure out what matters most to you financially is key to achieving peace of mind. Start by identifying your essential expenses, like rent or mortgage, utilities, groceries, and insurance. These are the non-negotiables that you need to cover each month. Next, consider your discretionary expenses, which include things like eating out, entertainment, and hobbies. Understanding the difference between these categories helps you allocate your income more effectively.

- Essential Expenses: Rent/mortgage, utilities, groceries, insurance

- Discretionary Expenses: Dining out, entertainment, hobbies

It’s also important to think about your long-term financial goals. This could include saving for retirement, buying a home, or setting up an emergency fund. Having clear goals helps you stay focused and motivated. Make sure to prioritize these savings by setting a specific amount aside each month. Here’s a simple table to help you organize your priorities:

| Financial Goal | Priority Level | Monthly Savings Amount |

|---|---|---|

| Emergency Fund | High | $200 |

| Retirement | Medium | $300 |

| Vacation Fund | Low | $100 |

Smart Investments for Long-Term Peace

When thinking about your financial future, try to focus on investments that offer more than just high returns. Look for those with lower risk and steady growth. Some great options include index funds, high-yield savings accounts, and real estate. These investments not only help build your wealth but also give you peace of mind, knowing your money is safe. Consider the following low-stress investment types:

- Index Funds: Diversified and relatively low risk.

- High-Yield Savings Accounts: Safe and easily accessible.

- Real Estate: Offers a tangible and potentially appreciating asset.

It’s also important to diversify your investments to minimize risks. Think about splitting your funds across various sectors and asset types. Here’s one way to balance your investments:

| Investment Type | Percentage Allocation |

|---|---|

| Index Funds | 40% |

| Real Estate | 30% |

| High-Yield Savings | 20% |

| Other | 10% |

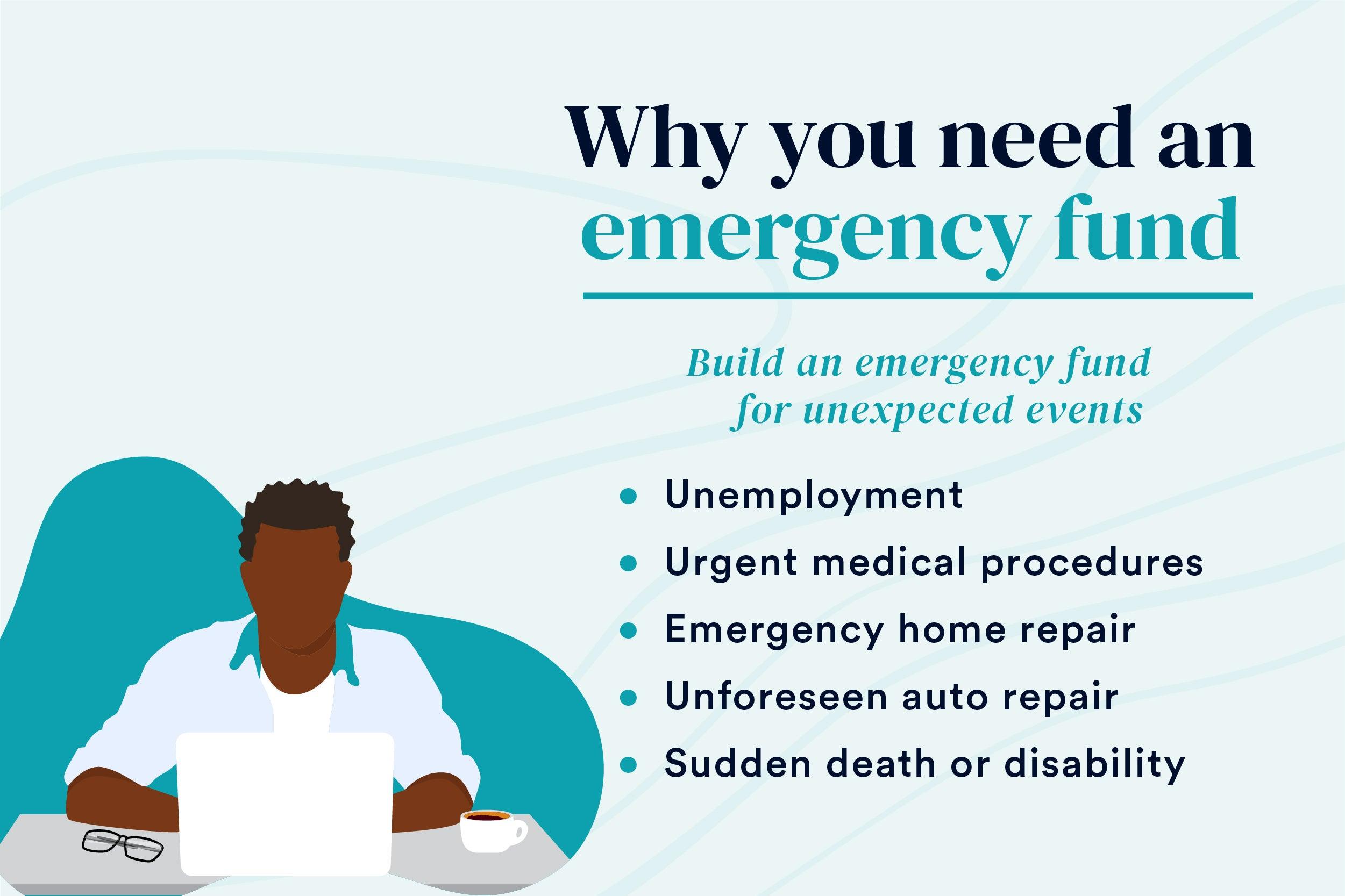

Building an Emergency Fund with Ease

Starting an emergency fund doesn’t need to be overwhelming. Begin by setting clear, small goals that are easy to achieve. This could be as simple as saving $50 or $100 per month. Look for ways to trim your expenses, such as cutting down on takeout or canceling unused subscriptions. Consider setting up automatic transfers to your savings account to make the process effortless. Once you see the progress, you’ll feel more motivated to continue. Highlight your successes to stay on track and keep your spirits high.

Another smart move is to diversify where you save your money. High-yield savings accounts or money market accounts can provide a better return than a standard savings account. You might also consider using a budgeting app to track your progress and identify areas where you can save more. Here are some ideal options to consider for your emergency fund:

| Account Type | Benefits |

|---|---|

| High-Yield Savings Account | Higher interest rates |

| Money Market Account | Easy access to funds |

| Certificates of Deposit (CDs) | Fixed interest rates |

Q&A

Q&A:

Q1: What’s the basic idea behind “Saving for Serenity”?

A1: “Saving for Serenity” is all about creating a financial plan that not only secures your future but also brings you mental peace. It’s about balancing savings and investments in a way that reduces money-related stress and lets you focus on enjoying life, both now and in the future.

Q2: Why is financial planning important for mental peace?

A2: Financial planning is crucial because money woes are one of the biggest sources of stress for most people. By having a clear plan, you can reduce uncertainty and worry. Knowing that you’re financially secure—or on your way there—can give you a sense of control and calm.

Q3: What are some first steps to start planning for financial serenity?

A3: Kick things off by assessing your current financial situation. List your income, expenses, debts, and any savings or investments you already have. From there, set some clear, achievable goals, like paying off debt, creating an emergency fund, or planning for retirement. Having these goals gives direction and purpose to your financial activities.

Q4: How can you make sure your financial plan stays relevant and effective?

A4: Regularly review and update your financial plan. Life changes—think new job, marriage, kids, or even world events—can impact your financial situation. By keeping tabs on your plan and tweaking it as needed, you’ll stay on course for achieving financial serenity.

Q5: What role does an emergency fund play in financial serenity?

A5: An emergency fund is a safety net that can prevent unexpected expenses from throwing your financial plan into disarray. Knowing you have a cushion for surprises like medical bills or car repairs can provide a huge mental relief, allowing you to face unforeseen challenges without added financial stress.

Q6: Are there any financial tools or apps that can help with planning?

A6: Definitely! There are loads of apps and online tools designed to help you budget, track spending, and manage investments. Apps like Mint, YNAB (You Need A Budget), and Personal Capital can offer insights and make managing your money much simpler.

Q7: What’s the best way to stay motivated while saving for long-term goals?

A7: Celebrate your milestones, no matter how small. Break your goals into manageable chunks and reward yourself when you hit them. Also, visualizing your end goals—a dream vacation, a comfortable retirement—can keep you inspired and focused.

Q8: How do you balance saving for the future with enjoying life now?

A8: It’s all about striking a balance. Allocate a portion of your income towards immediate enjoyment and another portion towards long-term savings. There’s no one-size-fits-all, so find a ratio that lets you live comfortably today while still preparing for tomorrow.

Q9: Can professional help make a difference?

A9: Absolutely. Financial advisors can offer personalized advice and strategies based on your unique situation and goals. If money matters feel overwhelming, seeking professional help can be a good investment in both your financial future and your mental peace.

Q10: Any final tips for achieving financial serenity?

A10: Be patient and stay consistent. Building financial security takes time and discipline, but every step in the right direction counts. Keep learning about personal finance, stay flexible with your plans, and don’t be too hard on yourself if things don’t always go perfectly. Remember, it’s about progress, not perfection.

Got more questions or tips of your own for saving peacefully? Share them in the comments below!

Insights and Conclusions

As we wrap up our journey through “,” it’s important to remember that financial planning doesn’t have to be a source of stress. By taking small, consistent steps, you can gradually build a solid financial foundation that supports both your monetary goals and your mental well-being.

We hope this article has offered you valuable insights and practical tips to start or refine your financial planning journey. Remember, the key is to find a balance that works for you—financial stability and peace of mind go hand-in-hand.

Feel free to revisit these tips whenever you need a refresher or a motivational boost. And if you ever feel overwhelmed, don’t hesitate to seek advice from financial professionals who can help guide you through the process.

Here’s to a future where your finances and your sanity are perfectly aligned. Happy planning!