Marriage is often celebrated as the union of two hearts, a day where confetti rains, and the air is thick with love and champagne bubbles. Yet in the midst of all this romance, there’s an uninvited guest lurking in the background — a guest that brings spreadsheets instead of flowers. Yes, we’re talking about the financial impact of marriage. Before you hastily shove that guest out the nearest window, let’s take a moment to understand just how crucial it is to be financially prepared. So grab your partner, your piggy bank, and maybe a stiff drink, because we’re about to dive into the dollars and cents of happily ever after. Spoiler alert: it’s not all doom and gloom—there’s plenty of humor to be found when love and finances mingle.

Love and Money: The Unexpected Roommates in Your Marriage

When two people say “I do,” they take on each other’s quirks and preferences, but they also take on each other’s financial habits. Suddenly, that quirky habit of buying artisanal cheese every week might seem less charming when it hits the joint budget. Here’s a quick peek at the surprising elements that can pop up:

- Impulse Purchases: Those spur-of-the-moment buys can really add up. Sorry, but do you both really need matching penguin onesies?

- Different Spending Priorities: One might save for a future home, while the other has an irrational fondness for limited-edition sneakers.

The good news is, with a bit of planning, you can find the balance between love and money. Here are some effective strategies:

- Budget Together: Seriously, budgeting is the new date night. Light a candle and bring out the spreadsheets.

- Set Joint Financial Goals: Dreaming of a European vacation or starting an organic alpaca farm? Outline these goals together.

| Action | Impact |

|---|---|

| Combine Finances | Easier to track expenses |

| Separate Finances | Maintains financial independence |

Joint Accounts and Secret Stashes: Finding Financial Harmony with Your Spouse

When it comes to merging your finances after saying “I do,” there are a few things to think about. One big decision couples face is whether to have joint accounts or keep some money stashed away individually. While joint accounts foster transparency and make bill-paying a breeze, some also value the sense of independence that comes with having a secret stash – a little fund you can dip into without the need for discussion. Both choices have their perks, and striking a balance is key.

- Joint Accounts: Makes financial planning simpler.

- Secret Stashes: Offers personal freedom and security.

How about a combination of both? Many couples find happiness with a joint account for shared expenses and individual accounts for personal spending. Here’s a quick look:

| Account Type | Purpose |

|---|---|

| Joint Account | Rent, Bills, Groceries |

| Individual Account | Hobbies, Personal Treats |

Regardless of your choice, open communication is crucial. Start with a fun conversation about your money habits over your favorite takeout; after all, talking about money doesn’t have to be dry!

Till Debt Do Us Part: Tackling Loans and Credit Scores Together

Joining finances can be exciting but also a bit scary. Tackling loans and credit scores together is like sharing a giant, financial sandwich—sometimes delicious, sometimes a bit messy. You both bring different ingredients to the table: some of them are tasty assets, while others might be a little sour, like debts. But just like any great recipe, it’s all about balance. Communicate openly about your financial history and current standing. You don’t want any unexpected flavors ruining the mix! Discuss your debts, incomes, and credit scores. Here’s a quick checklist of what to share:

- Outstanding loans and interest rates

- Current credit card balances

- Credit scores (yes, both good and bad!)

- Any upcoming major expenses

After all the financial cards are on the table, set some shared goals to get those scores soaring and debts dwindling. Create a game plan to pay off loans and keep each other accountable. A fun way to do this is by setting mini-milestones and celebrating each victory, like paying off that annoying credit card bill. You’ll need a solid strategy, and two heads are better than one! Check out this simple table to set up your financial game plan:

| Goal | Action | Reward |

|---|---|---|

| Increase Credit Score | Pay bills on time for 3 months | Movie night in! |

| Pay off Credit Card | Make double payments | Dinner out! |

| Build Emergency Fund | Save 10% of income each month | Weekend getaway! |

Marriage and Money Makeover: Action Plans to Keep Your Finances and Sanity Intact

Joining finances can feel like mixing chocolate and mustard – a totally weird combo! But fear not, with a pinch of planning and a whole lot of communication, it can actually be quite tasty. Here’s what you tackle first:

- Assess your debts: It’s crucial to know what you’re up against. Lay your debts out on the table (not literally, it’s messy), and make a plan to handle them.

- Set financial goals: Whether it’s jetting off to Paris, buying a house, or just surviving the next credit card bill, aligning your dreams will keep you both on the same page.

- Budget together: Sit down (with snacks!) and sketch out a budget. Make sure it’s realistic but also leaves room for fun – because who wants a boring financial plan?

| Item | Yours | Theirs | Combined |

|---|---|---|---|

| Debts | $15,000 | $8,000 | $23,000 |

| Savings | $5,000 | $7,000 | $12,000 |

Another key element is figuring out who pays for what. You don’t want to find out who’s supposed to pay the electric bill when the lights go out. Here are some strategies:

- Split evenly: Just like gym partners, you each take turns lifting (financial) weights.

- Proportional sharing: If one of you makes more, they contribute a slightly bigger slice of the pie.

- Designated responsibilities: Maybe one handles utilities while the other takes care of groceries. Who knows, you might actually end up balancing each other out!

Q&A

Q&A:

Q: What’s the first step I should take to financially prepare for marriage?

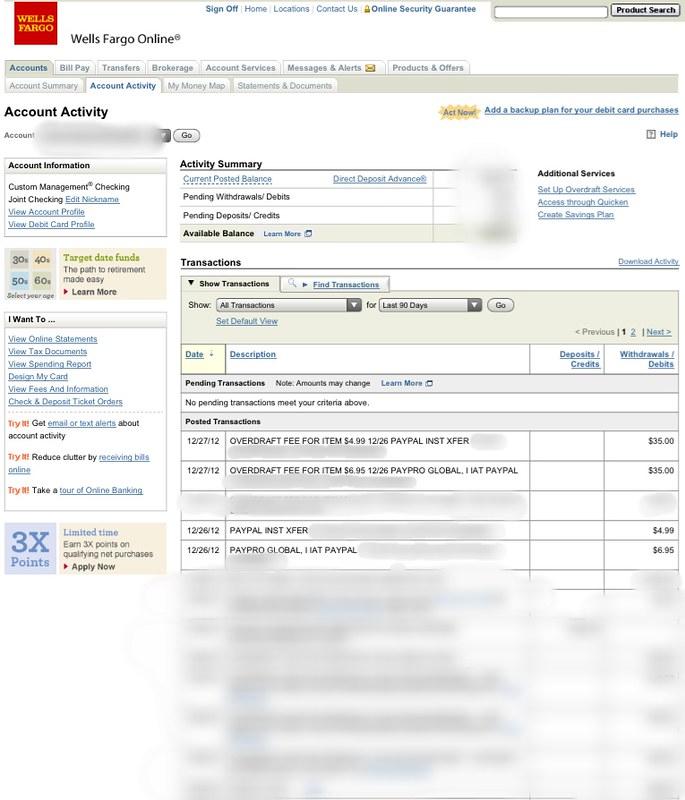

A: Ah, the age-old question! The first step is to hop on the same financial page as your partner. Sit down, pour a cup of coffee—or something stronger if needed—and have “The Talk.” Discuss your incomes, debts, savings, and those mystery transactions from late-night Amazon shopping sprees. Transparency is key! Remember, wedding vows include “for richer or poorer” for a reason.

Q: How can marriage impact our individual finances?

A: Think of marriage as a financial merger—you’re essentially forming a two-person corporation. There will be shared expenses, joint accounts, and, yes, potentially even shared debts. The good news is you might qualify for tax breaks and better insurance rates. The bad news? Well, let’s just say you’ll both have to agree on whether that new Playstation 5 is a “necessary home investment.”

Q: Should we combine our bank accounts or keep them separate?

A: Ah, the great debate! There’s no one-size-fits-all answer here. Some couples swear by joint accounts to streamline expenses, while others prefer the independence of separate accounts. And some do a hybrid—a joint account for shared expenses and individual accounts for personal spending. Whatever floats your financial boat! Just ensure you both agree on the system to avoid side-eye at the dinner table.

Q: What about creating a budget?

A: Creating a budget is a lot like planning the wedding—exciting in theory but potentially nerve-wracking in practice. Start by categorizing your expenses (housing, groceries, entertainment, etc.) and track both incomes. Make sure you also leave room for fun money. After all, date nights and spontaneous ice cream runs are essential for marital bliss!

Q: What are some common financial pitfalls for newlyweds?

A: Overspending on the honeymoon, underestimating the cost of setting up a home, and not accounting for joint debt are just a few. Also, beware of the “one-click buy” feature. It’s all too easy to go from “We need a blender” to “Why did we buy this life-sized gummy bear?”

Q: How do we plan for long-term financial goals like buying a house or retirement?

A: Start with small, concrete steps. Open a dedicated savings account for each goal. Use budgeting apps to track progress and make regular contributions, even if it’s a modest amount. And don’t forget to revisit and adjust your goals annually. It’s a bit like gardening—consistent care and attention will grow your financial dreams into reality, minus the dirt under your nails.

Q: Any advice for managing financial stress as a couple?

A: Communication is your best friend here. Regular, honest discussions about finances can prevent small issues from turning into full-blown financial feuds. Also, don’t shy away from seeking professional help if needed—a financial adviser can be the mediator you didn’t know you needed. And remember, laughter is free, and it’s great for stress!

Q: What should we know about taxes as a married couple?

A: Taxes are the real “for better or worse” in marriage! Filing jointly might save you money, but it can also complicate things if one partner has significant deductions or debt. Take the time to understand how your new marital status affects your tax situation—or better yet, consult a tax professional to navigate these choppy waters without losing your sanity.

Q: Any final words of wisdom?

A: Think of managing finances in marriage like a tandem bike ride: both people need to peddle and steer together to move forward smoothly. Embrace the ups and downs with a sense of humor—because, like all great adventures, a shared laugh can make the journey much more enjoyable. And if all else fails, just promise never to argue about money on an empty stomach!

Wrapping Up

As the wedding bells fade and the honeymoon tan lines slowly disappear, the financial realities of married life come into sharper focus. While love may be priceless, handling finances together doesn’t have to be a mystery. By communicating openly, planning wisely, and perhaps even borrowing your grandparents’ “honeymoon savings jar” strategy, you can turn the daunting task of managing money into a well-coordinated team sport. After all, two heads—and two wallets—are better than one. So here’s to laughter, learning, and love, both in sickness and in wealth, for richer, for poorer (but hopefully a bit more on the richer side). Now go forth and conquer those shared bank accounts, you financially savvy lovebirds!