Ah, retirement—the golden years when you can finally trade in your time card for a beach chair, and your office attire for, well, anything with elastic. But what happens when you’ve hit the big Five-O and the only thing you’ve saved is your old Beanie Babies collection? Fear not! “” is here to transform your financial dread into monetary zen. Whether you’re a procrastinator by nature or just woke up one day realizing that your future-self might actually want to eat something other than cat food, this guide will help you sprint to the finish line with savvy strategies, investment insights, and a dash of humor. Because, let’s face it, if we can’t laugh at our retirement plans, how are we ever going to laugh all the way to the bank?

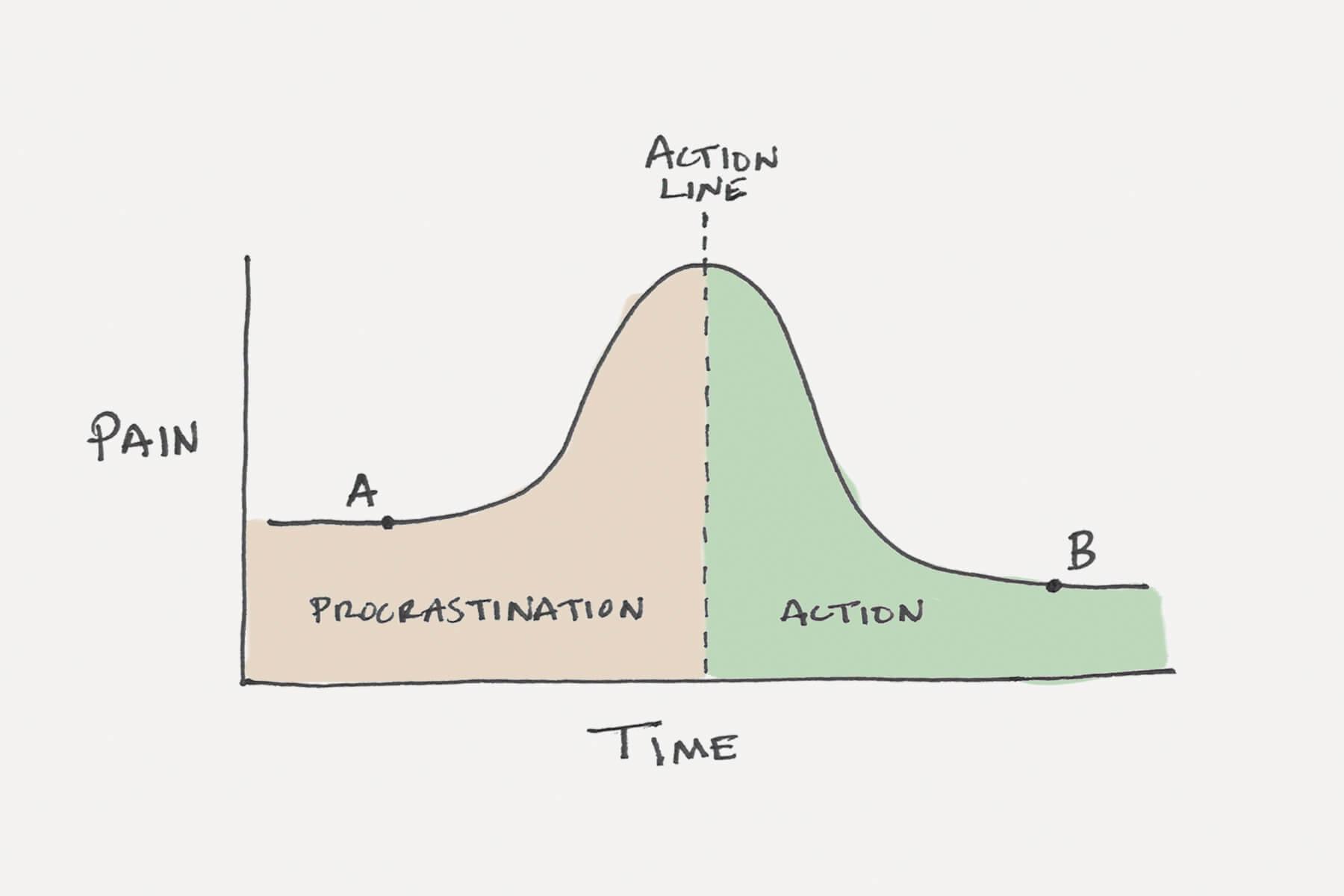

Procrastination Station: Why You’re Not Alone in Starting Late

Ever feel like you’re the only one who’s behind on your retirement planning? Well, take a deep breath—you’re not alone! Many folks find themselves in the same boat. Sometimes life just happens: kids, mortgages, surprise vet bills for your Great Dane’s designer diet. The good news? You can still finish strong. Tons of people have started late and managed to build a solid nest egg. It’s all about making some smart, strategic moves now. Consider this your friendly nudge to get going!

Maybe you’re wondering *how* to catch up. Here are a few ways to make up for lost time—without sacrificing your coffee habit:

- Maximize contributions: Up your 401(k) or IRA contributions. If you’re 50 or older, take advantage of catch-up contributions!

- Cut unnecessary costs: Maybe that gym membership you never use can go. More Netflix, less treadmill?

- Invest wisely: Consider a mix of both safe and slightly riskier investments to balance growth and security.

| Strategy | Benefit |

|---|---|

| Maximize contributions | Boosts your savings significantly |

| Cut unnecessary costs | More money to invest |

| Invest wisely | Potentially higher returns |

Crunch Time: Maximizing Savings When You’re (Fashionably) Late to the Party

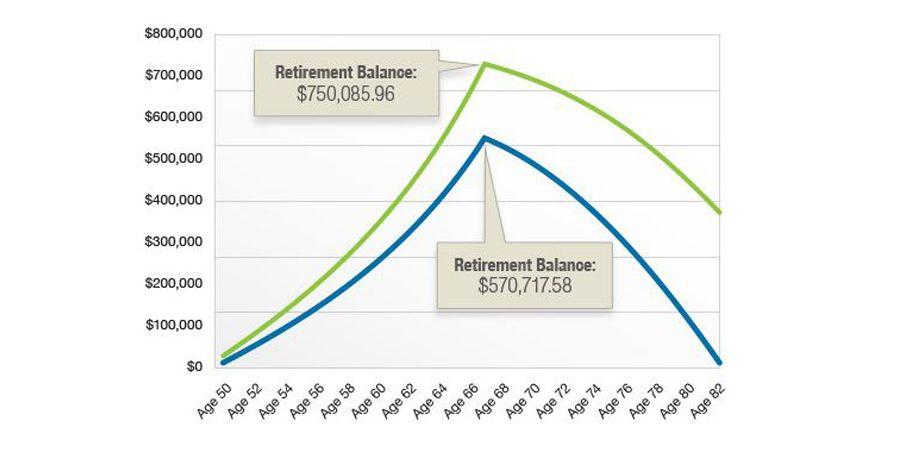

Let’s face it: sometimes life happens, and before you know it, you’re closer to retirement than your high school prom. But don’t worry—you can still save big even if you’re fashionably late. First off, crank up those contributions! Max out your 401(k) and consider stashing extra cash in an IRA. If you’re over 50, take advantage of catch-up contributions. Remember, every little bit counts and compounds over time.

- 401(k) Contributions: Increase the percentage you’re contributing. Even small percentage boosts can make a difference.

- IRAs: Both traditional and Roth IRAs offer unique benefits. Extra points if you can contribute to both!

- Catch-Up Contributions: Anyone over 50 can contribute extra to their retirement accounts. Consider it a reward for making it this far.

An often overlooked strategy involves getting a little budget-savvy. Think about slashing unnecessary expenses and reallocating those funds to savings. Even cutting out your daily coffee shop latte can free up significant funds. Look at this simple table to get an idea:

| Expense | Monthly Savings |

|---|---|

| Daily Coffee Shop Latte | $90 |

| Dining Out Weekly | $200 |

| Cable TV Subscription | $120 |

By cutting just these three expenses, you can save $410 per month! That’s a chunk of change that could be working toward your retirement rather than contributing to your calorie count.

Catch-Up Contributions: Turbocharging Your Savings in Record Time

Did you know that if you’re 50 or older, you can put extra money into your retirement accounts? Think of it as your financial superhero cape! These extra contributions are called catch-up contributions. For instance, with a 401(k), you can sock away an additional $7,500 per year. And for those trusty IRAs, you get to contribute an extra $1,000! This means you can turbocharge your savings in no time.

Here’s how these contributions can help speed up your savings journey:

- Less Taxable Income: More contributions mean fewer taxes. Uncle Sam gets a smaller bite of your earnings.

- Compound Interest: The more you save, the more interest you earn, and it keeps growing like a snowball rolling downhill (but without the cold toes).

- Peace of Mind: You’ll sleep better knowing you’re padding your retirement nest egg.

| Account Type | Regular Contribution Limit | Catch-Up Contribution Limit |

|---|---|---|

| 401(k) | $22,500 | $7,500 |

| IRA | $6,500 | $1,000 |

The Late Bloomer’s Guide to Investing: Making Your Money Hustle

So, you’ve been more of a “free spirit” with your finances until now—no judgment here! It’s never too late to start investing for your golden years, and the good news is, you can still make your money work hard for you. Let’s debunk the myth that investing is only for early birds. With the right strategies, you can catch up and even surpass some of those early starters. Here’s how to supercharge your nest egg as a latecomer:

- Max Out Retirement Accounts: Take full advantage of contribution limits. Your 401(k) and IRAs are your best friends.

- Diversify, Diversify, Diversify: Think of your investments like a cocktail—mix stocks, bonds, and mutual funds for the perfect blend.

- Catch-Up Contributions: Over 50? You get a special bonus! Catch-up contributions allow you to sock away extra funds.

- Focus on High-Growth Investments: Time is shorter, so your risk tolerance might need to be a bit higher to catch those bigger gains.

| Starting Point | Investment Strategy |

|---|---|

| Ages 40-49 | Split focus on growth and income funds |

| Ages 50 and up | Catch-up contributions, heavier on growth |

Q&A

—

Q: Is it ever too late to start retirement planning?

A: It’s never too late! Sure, you might not have started in your 20s like that one friend who annoyingly always had it together. But starting late just means you’ll need to channel your inner superhero for some quick, effective strategies. Think of it as assembling the Avengers of your financial portfolio.

Q: What’s the first step for late starters in retirement planning?

A: The first step is to avoid the panic button. Instead, take a deep breath, grab a cup of coffee, and start by assessing your current financial situation. List your assets, debts, and any savings. This is your financial selfie – no filter needed.

Q: How important is it to set realistic goals?

A: Very! Aim for achievable milestones. Don’t set your sights on buying a private island by 65. Instead, focus on practical, rewarding goals like paying off debt, boosting savings, or ensuring you won’t be living off instant noodles in retirement.

Q: What role does cutting expenses play in late-stage retirement planning?

A: It’s crucial. Channel your inner Marie Kondo and declutter your expenses. Ask yourself, does that subscription service spark joy, or could those funds be better used in your growing retirement fund? Remember, every penny has retirement potential.

Q: Should late planners consider working longer?

A: Absolutely! While retirement at 65 sounds dreamy, working a few extra years can significantly boost your savings. Plus, it keeps you active and helps delay the drawdown on retirement funds. So, hold off on those retirement slippers for a bit longer.

Q: How can one maximize their 401(k) or IRA contributions?

A: Max those suckers out! If you’re 50 or older, take advantage of catch-up contributions, which let you stash away more cash. It’s like getting extra legroom in the economy class of retirement savings.

Q: What about investing in the stock market? Is it too risky for late starters?

A: Investing can still be a smart move, even if you’re fashionably late to the party. Diversify your portfolio with a mix of stocks, bonds, and other assets. Think of it as a financial buffet – you want a little bit of everything, but not too much of one thing.

Q: How can Social Security benefits be optimized?

A: Timing is everything. If you can, delay claiming Social Security until you reach full retirement age or beyond. Each year you delay up to age 70 adds a sweet bonus to your benefits. Patience really does pay off!

Q: Any final tips for late-starting retirement planners?

A: Don’t go it alone. Seek advice from a financial advisor who can tailor strategies just for you. And remember, it’s not about how you start, but how you finish. Keep your sense of humor, stay focused, and you’ll waltz into retirement with style – perhaps even with a celebratory dance move or two.

Remember, your financial journey is your own. It’s never too late to make a difference, and doing it with a smile makes the milestones even sweeter!

Closing Remarks

it’s never too late to start planning for a comfortable retirement, even if you’ve procrastinated a tad (or a lot) along the way. Remember, the only thing that’s “too late” is last night’s pizza by morning—investing in your future doesn’t fall into that category. So, flex those financial planning muscles, catch up on those contributions, and maybe hold off on that daily artisanal latte (or don’t, we get it). With a mix of determination, smart strategies, and—let’s face it—a bit of luck, you can still cross that retirement finish line looking like you had it all planned out from the start. Here’s to your golden years being more ‘golden’ than ‘how-did-I-get-here’? Cheers!