In today’s fast-paced world, money often feels like a daunting topic, overshadowed by stress and anxiety. But what if we could transform the way we think about our finances? Imagine approaching your bank account and bills with the same calm and intention you bring to your morning meditation or yoga practice. Welcome to the concept of a mindful money ritual. In this article, we’ll explore daily practices that can help you foster a healthier, more balanced relationship with your finances. Whether you’re a budgeting newbie or a seasoned saver, these tips are designed to bring a sense of peace and purpose to your money management routine. Ready to get started? Let’s dive in!

Setting Intentions for Your Financial Journey

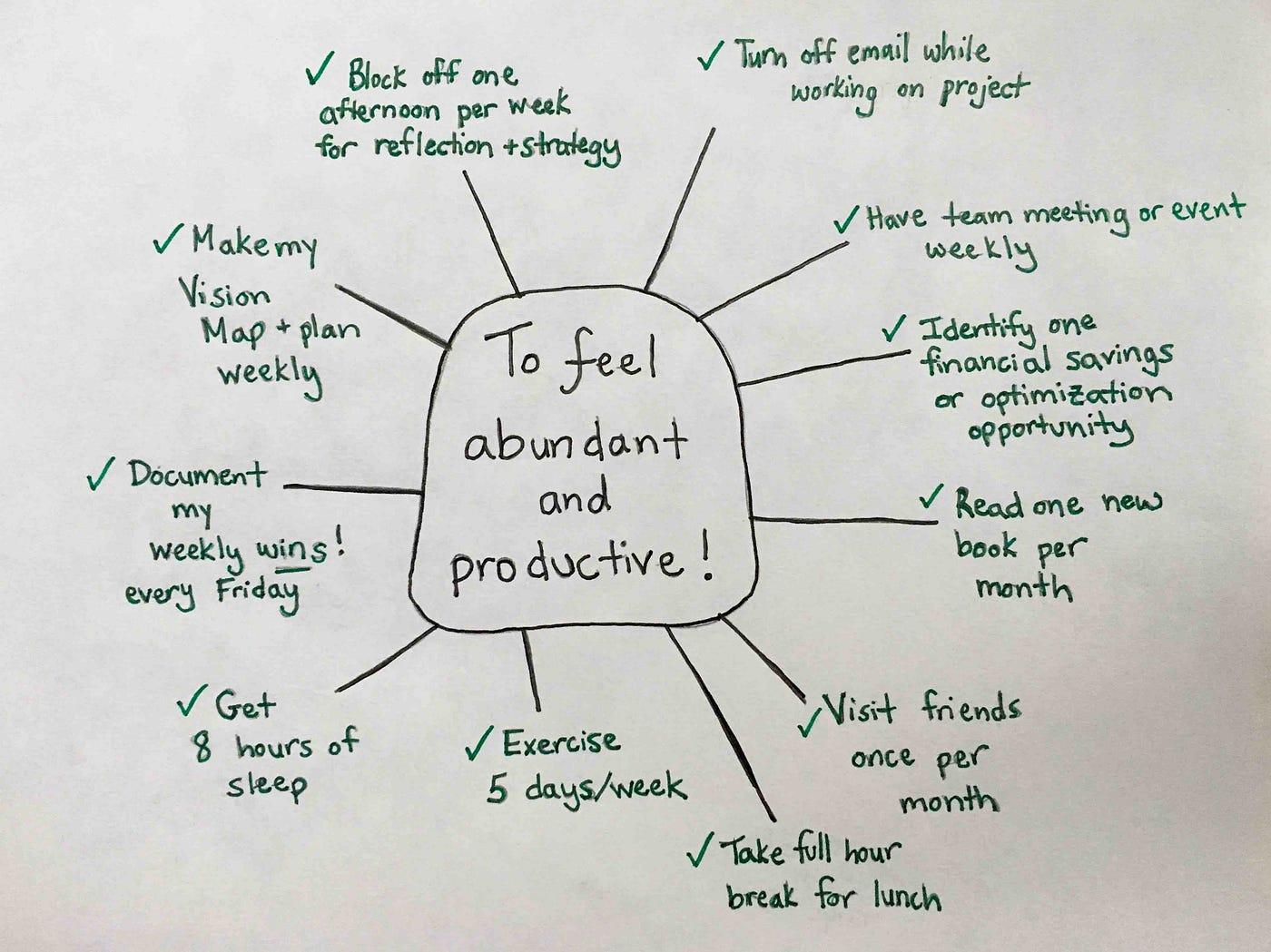

Cultivating a thoughtful approach to your financial habits begins with setting clear, achievable intentions. Start by defining what financial wellness means to you. Is it about saving for a dream vacation? Paying off debt? Building an emergency fund? Once you have a clear vision, break it down into actionable steps. Consider setting weekly check-ins with yourself to track progress and adjust your strategy as needed.

- Identify Core Values: Understand what matters most to you financially.

- Create Realistic Goals: Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals.

- Maintain a Positive Mindset: Practice self-compassion and patience.

To stay organized, consider using simple tools like tables to map out your goals and monitor your progress. Here’s a basic example:

| Goal | Action Steps | Target Date |

|---|---|---|

| Build Emergency Fund | Save $100/month | 12 months |

| Pay Off Credit Card Debt | Extra $50 payment/month | 6 months |

Building a Daily Money Check-In Routine

Start your day by spending just five minutes reviewing your money. It doesn’t take much time, but it sets a positive tone for the rest of your day. Open your banking app or log into your online bank account and take stock of these key details:

- Account Balance: Check how much money you have available.

- Recent Transactions: Look at any recent spending or deposits.

- Scheduled Payments: Be aware of any upcoming bills or automatic payments.

Consistency is key, so make sure to fit this routine into your daily schedule. Whether it’s over your morning coffee or before you go to bed, integrating this habit consistently will help you become more mindful of your financial well-being.

| Time of Day | Routine Step |

|---|---|

| Morning | Review your daily budget |

| Afternoon | Categorize expenses |

| Evening | Reflect on daily spending |

Mindful Spending: Tips for Conscious Consumption

Every time you reach for your wallet or click ”buy now,” pause and ask yourself a few key questions: Do I need this? Will this purchase improve my life? Is there a better alternative? Building this mindful habit can shift your purchasing mindset from impulse to intention. Consider also keeping a small notebook or using a notes app on your phone to jot down purchases you contemplate but don’t go through with. This can help you recognize patterns and triggers in your spending.

Creating a daily budget check-in can also reinforce mindful spending. Set aside a few minutes each evening to review your daily expenses and assess how they align with your financial goals. Use tools like spending apps or a simple spreadsheet to track your progress. Here’s a quick way to organize your daily financial check-in:

| Task | Estimated Time |

|---|---|

| Review today’s expenses | 5 mins |

| Log purchases | 3 mins |

| Reflect on spending | 2 mins |

Seeing your spending laid out can offer clarity and help you make more informed choices moving forward.

Harnessing Gratitude to Foster Financial Abundance

Imagine starting your day by focusing on the good things in your life. Gratitude can have a powerful effect on your mindset. By acknowledging what you’re thankful for, you create a positive frame of mind. This isn’t just fluff – science backs it up! To harness this power, try these simple practices:

- Each morning, write down 3 things you’re grateful for.

- Reflect on any positive financial moments, like a small bonus or a gift.

- Share your gratitude with someone else, spreading positivity.

Incorporating gratitude into your daily routine isn’t just good for your mood – it can also help you achieve financial abundance. By focusing on what you have, rather than what you lack, you’re more likely to make thoughtful and positive decisions about your money. Here are a few more tips to blend with your financial mindfulness:

- Keep a gratitude jar where you drop notes about unexpected financial gains.

- Set a monthly reminder to donate or support a cause dear to you.

- Regularly review your financial milestones and celebrate them.

Q&A

Q: What is a mindful money ritual?

A: A mindful money ritual is a set of daily practices aimed at creating awareness and intentionality around your finances. It’s about integrating financial wellness into your routine in a thoughtful way, helping you develop a healthier and more confident relationship with money.

Q: Why should I consider creating a mindful money ritual?

A: Creating a mindful money ritual can help you gain better control over your finances, reduce stress, and make more intentional financial decisions. It’s like self-care for your wallet—it promotes financial awareness, planning, and security.

Q: What are some daily practices I could include in my mindful money ritual?

A: Here are a few ideas to get you started:

- Morning Check-In: Spend a few minutes reviewing your accounts and recent transactions.

- Set Daily Intentions: In the morning, set a spending intention or a financial goal for the day.

- Track Spending: Keep a log of all your expenses throughout the day.

- Reflect in the Evening: Review your spending at the end of the day and reflect on how you did.

Q: How much time should I dedicate to my money ritual each day?

A: It doesn’t have to take long—even just 10-15 minutes each day can make a big difference. The key is consistency and making it a regular part of your daily routine.

Q: Any tips for staying consistent with my money ritual?

A: Sure! Here are a few tips:

- Set Reminders: Use your phone or a planner to remind you to dedicate time to your ritual.

- Make It Enjoyable: Pair it with something you enjoy, like a cup of coffee in the morning or relaxing music in the evening.

- Stay Flexible: It’s okay to adapt and change your ritual as needed to fit your lifestyle.

Q: How will doing this impact my long-term financial health?

A: Over time, practicing mindful money rituals can lead to greater financial clarity, improved budgeting skills, and reduced anxiety around finances. Ultimately, it can help you build a stronger, more secure financial future.

Q: Can I personalize my mindful money ritual?

A: Absolutely! Customize it based on what works best for you. The goal is to create a ritual that feels natural and supportive—whether that’s adding journaling, setting monthly financial goals, or meditating on your financial intentions.

Q: Is there anything I should avoid in my mindful money ritual?

A: Try to avoid making it feel like a chore or something that adds stress. If a particular practice isn’t resonating with you, feel free to adjust or replace it with something that does. The focus should be on creating a sense of peace and clarity around your finances.

Q: What if I have a busy schedule?

A: Even with a busy schedule, you can still incorporate brief check-ins and reflections. It might be helpful to break the ritual into smaller chunks throughout the day. Remember, the goal isn’t perfection, but progress and mindfulness.

Insights and Conclusions

And there you have it, folks! Cultivating a mindful money ritual doesn’t have to be complicated or stressful. By integrating these simple daily practices into your routine, you’ll not only foster a healthier relationship with your finances but also reap the benefits of financial wellness. Remember, the key is consistency and self-compassion. It’s okay to start small and make adjustments along the way. So go ahead, give these tips a try, and take charge of your financial journey—one mindful step at a time. Happy saving!