Being a single parent is a bit like juggling flaming torches while riding a unicycle—during a circus performance you never signed up for. Financial planning, often, feels like the pièce de résistance of this unexpectedly complex juggling act. And let’s face it, as if the daily whirlwind of meals, school runs, and bedtime stories wasn’t enough, figuring out how to stretch a single income to cover all expenses can sometimes feel like trying to turn a paperclip into a life raft. But fear not! In this article, we’re diving into the delightful chaos of single-parent budgeting with a mix of sage advice and a sprinkle of humor, aiming to turn those tricky hurdles into a financial victory lap. So strap on your unicycle helmet and prepare for a ride through strategies and tips that promise to make your financial planning journey a bit smoother, and maybe even fun!

Financial Juggling: Turning Dime-Sized Budgets into Gold Reserves

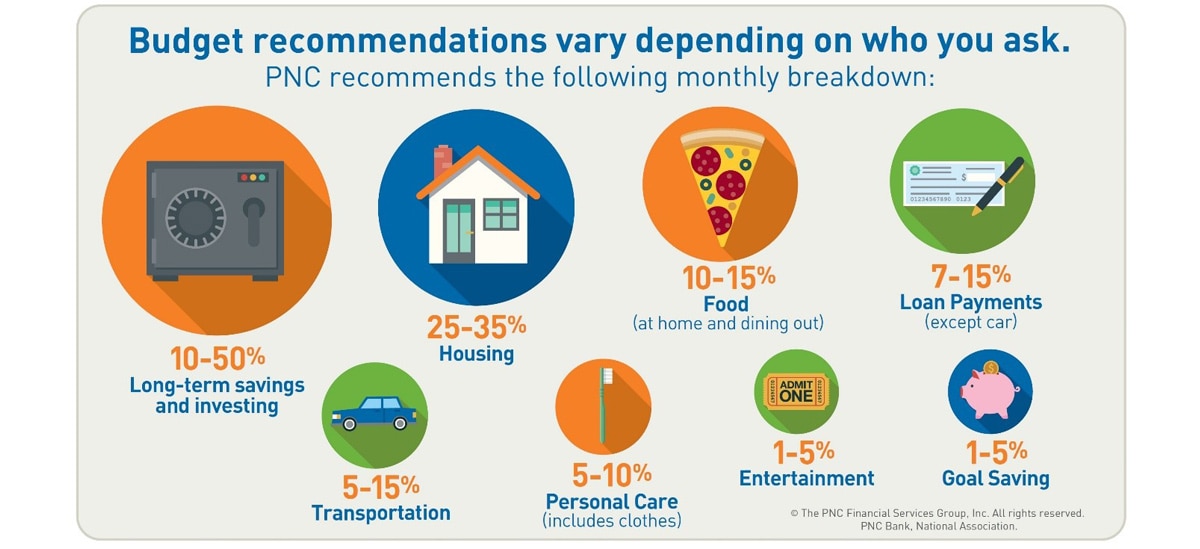

Single parents often find themselves in the exhilarating circus act known as financial juggling. Balancing bills, childcare, and groceries can feel like keeping a dozen spinning plates in the air, but don’t worry, you don’t need to be a professional acrobat to succeed! With a few clever tricks up your sleeve, it’s entirely possible to turn that dime-sized budget into something that glitters. For starters, take a deep breath and prioritize your expenses. Think of your finances like a game of Tetris—only the necessary blocks, or expenses, should make it to the bottom line. Focus on paying for housing, utilities, and essentials first. Then, move on to the discretionary stuff—Netflix can take a backseat if it means you have enough for groceries.

Budgeting apps can be your best friend in this tightrope walk. Imagine them as your lovable sidekick who makes sure you don’t fall off track. Some great options include:

- Mint: This app helps you keep tabs on your expenses, nudging you gently when you’ve overspent on takeout.

- You Need a Budget (YNAB): Think of it as a personal coach, encouraging you to give every dollar a job.

- PocketGuard: Always there to let you know exactly how much “fun money” you have left.

Armed with the right tools and mindset, you’ll soon find that even on a tight budget, you’re not just making ends meet—you’re creating a small (or even large) nest egg. And for those particularly challenging months, here’s a quick comparison of budgeting app features to help you choose the right sidekick:

| App | Main Feature | Free Option |

|---|---|---|

| Mint | Tracks Spending, Alerts | Yes |

| YNAB | Zero-Based Budgeting | No |

| PocketGuard | Simple Budget Overview | Yes |

Savings Strategies: How to Hide Money from Your Future Teenagers

When it comes to stashing some cash away from the prying eyes of your future teenagers, creativity and a little bit of humor can go a long way. Think of clever hiding spots like the back of the freezer or inside an old, rarely-used book. Here are some ideas to keep your savings safe and sound:

- Fake Containers: Invest in fake cans or cleaning supply bottles that look ordinary but open up to reveal a hidden compartment.

- Unlikely Hiding Spots: Slip a few bills into a ziplock bag and tape it behind the toilet tank. Not the most glamorous spot, but quite effective!

- Furniture Trick: Create a small hollow space under a desk drawer or inside the legs of a chair.

Still not feeling secure enough? Use the power of technology to your advantage. As single parents, we often don’t have the luxury of a perfect hiding spot that remains untouched. Consider setting up a digital piggy bank or a separate savings account that isn’t linked to your main card. Here’s a quick table of digital savings options for your reference:

| App/Service | Features |

|---|---|

| Chime | Automatic savings on every purchase |

| Qapital | Custom savings goals and rules |

| Digit | AI-driven savings based on spending habits |

These digital avenues ensure your savings grow while keeping them beyond the reach of your curious teens.

Debt-Free Dreaming: Paying Bills Without Selling an Arm

As a single parent, juggling your financial obligations can sometimes feel like performing a one-person circus act. You need a plan that doesn’t involve winning the lottery or selling a kidney! The good news is, you can tackle those bills with some clever strategies. Here’s what you need to keep in mind:

- Create a Budget: Think of your budget as your money GPS. It tells you where to go and where not to. Make sure you map out all your income and expenses.

- Emergency Fund: Life likes to throw curveballs. An emergency fund means you’ll be prepared when your car gets a flat tire or your kid decides a grape up their nose sounds like a fun idea.

Another savvy move is to get comfy with negotiation. Yes, even your bills can sometimes be talked down! Here’s where you can get creative:

- Call Service Providers: You’ll be amazed at what a friendly chat can do. Sometimes they’ll offer discounts just because you asked.

- Look for Discounts: From grocery stores to utility companies, many places offer discounts that are just waiting to be discovered. Channel your inner detective!

| Strategy | Benefit |

|---|---|

| Create a Budget | Tracks your spending, and no surprises at month’s end. |

| Emergency Fund | Peace of mind for life’s little surprises. |

| Negotiation | Lower bills, more savings. Win-win! |

Smart Investments: Because Even Single Parents Deserve a Caribbean Vacation

Many single parents find themselves juggling bills, school expenses, and everyday necessities. It often feels like saving for a big trip is out of reach. But guess what? Smart investments can change that! By putting your money in the right places, you can grow your savings without working extra hours. Imagine this: instead of spending $5 daily on coffee, you can invest it. Over time, those funds blossom, potentially turning into a fabulous Caribbean getaway. Trust in the wonders of compound interest!

So, where to start? Here are some simple investment options:

- High-Yield Savings Accounts: These accounts offer better interest rates than your regular savings.

- Certificates of Deposit (CDs): Lock away your money for a set period and come out ahead.

- Index Funds: Diversify your investments with low fees and lower risks.

Here’s a quick comparison to get you started:

| Investment Type | Estimated Returns |

|---|---|

| High-Yield Savings | 1-2% annually |

| Certificates of Deposit | 2-3% annually |

| Index Funds | 5-7% annually |

Q&A

Q&A Article: “”

Q1: Why is financial planning particularly challenging for single parents?

A1: Imagine juggling five flaming swords while riding a unicycle on a tightrope… over a pit of alligators. Now, add budgeting and financial planning into the mix! Single parents often face unique challenges because they’re essentially filling two roles—breadwinner and homemaker—while contending with limited time and resources. It’s not just about making ends meet; it’s about doing a cha-cha dance with your budget to balance immediate needs and future goals.

Q2: What are the first steps a single parent should take in creating a financial plan?

A2: Step one: Breathe. Step two: Get a nice, strong cup of coffee. Real talk, start by assessing your current financial situation. This means listing all sources of income and tracking every single expense. Go ahead and use that magnifying glass—yes, even the daily latte counts! From there, build a budget that prioritizes essential expenses like housing, food, and education. Think of it like constructing a sandcastle: start with a strong base before adding the fancy turrets.

Q3: How can single parents build an emergency fund without feeling like they need superhuman strength?

A3: Building an emergency fund might sound like scaling Mount Everest, but you don’t need a sherpa for this expedition. Start small. Even socking away $5 or $10 a week can snowball over time. Think of it as training for a marathon: you don’t start by running 26 miles on day one. You work up to it bit by bit. Also, automate your savings if possible—it’s like setting out your gym clothes the night before so you have one less excuse!

Q4: Any tips for managing debt while raising kids solo?

A4: Ah, debt—every single parent’s nemesis, right after Lego-camouflaged living room floors. Tackle high-interest debts first by focusing any extra funds on paying them down. You can also try the snowball method: pay off the smallest debts first to gain momentum and keep you motivated. And yes, resist the urge to treat those paid-off debts like exes you’d rather forget—keeping a close eye on credit reports and staying informed is crucial.

Q5: What are some saving strategies for future goals like college funds, especially when money already feels tight?

A5: Feeling like you need to win the lottery to send your kids to college? Not quite! Get creative with your savings. Look into 529 plans or other education savings accounts that come with tax benefits. Also, any spare change can help—those coins rattling in your car cup holder can be a start! Involve your kids, too. Teach them about saving and maybe even set up a small matching contribution program like you’re their very own 401(k).

Q6: How do single parents balance between saving for retirement and their children’s needs?

A6: Picture yourself on an airplane: remember how they always say to put on your own oxygen mask before helping others? The same rule applies here. Prioritize your retirement savings even amid the chaos. Use accounts that offer tax advantages like IRAs or employer-sponsored 401(k)s. The future-you will thank current-you for being so smart and parent-present.

Q7: Are there any financial assistance programs that single parents often overlook?

A7: Absolutely! Keep your eyes peeled for any and all assistance like tax credits (hello, Child Tax Credit!), grants, or community programs. Even if it feels like you’re diving headfirst into a bureaucratic rabbit hole, it’s worth it. Some programs are like finding hidden gems in an otherwise chaotic closet—you didn’t even know you had that extra financial help until you stumbled upon it!

Q8: Any parting advice for single parents feeling overwhelmed by financial planning?

A8: Rome wasn’t built in a day, and your financial empire won’t be either! Start with manageable goals and celebrate the small victories along the way. Seek professional advice if needed—think of financial advisors as your budgeting Yodas. Most importantly, remember you’re doing an amazing job, even if it sometimes feels like operating a three-ring circus. Keep your sense of humor—it’s free, after all!

And there you have it, folks. Financial planning might be a tad more complicated than assembling IKEA furniture, but with the right attitude and strategy, single parents can conquer it and then some. 🏆

Final Thoughts

navigating the labyrinth of financial planning as a single parent might feel like trying to herd cats while balancing a checkbook. But with a bit of courage, a dash of strategic thinking, and perhaps a strong cup of coffee, you can tackle these challenges head-on. Remember, you’re not just juggling numbers; you’re crafting a financial future that supports both you and your little (or not-so-little) ones. From budgeting like a boss to turning those loose dimes into dollars, you’ve got the tools and the tenacity to make it work. So, take a deep breath, pat yourself on the back, and keep moving forward. After all, if you can handle spontaneous glitter bomb crafts and impromptu midnight snack requests, you’ve got this financial planning gig covered. Happy planning!