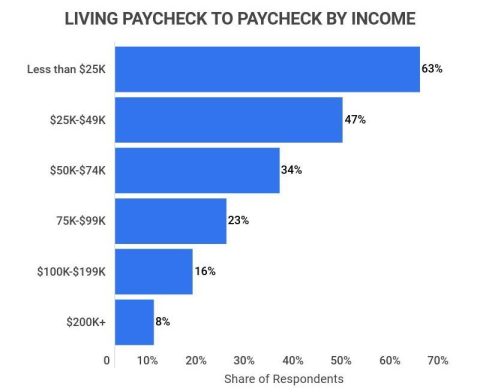

Are you still stuck in the paycheck-to-paycheck grind, where every Friday feels like a temporary lifeline? Let's dive into the brutal truth, aka your chronic financial denial, and why counting

Blog and Resources

Oh, look at you, living your best life with a closet full of clothes you’ll wear once and a phone that's smarter than your savings account. Maybe skip a few

Listen up, genius. You're not inherently bad with money—you're just making a series of monumentally stupid choices. Stop blaming poor luck when you know it’s your habitual shopping therapy and

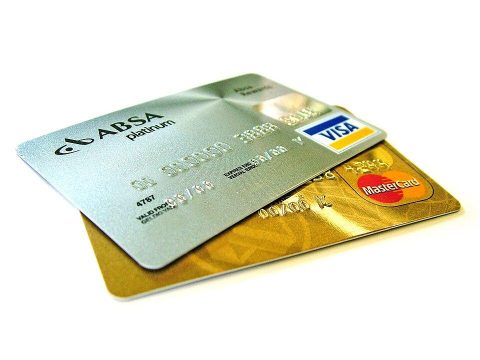

Still swiping like it's Monopoly money? It's 2023, people. Credit cards aren't magical debt erasers; they're a one-way ticket to financial faceplants. Wake up—make those cards work for YOU, not

Oh, so you're waiting for the universe to personally hand you success on a silver platter? Newsflash: fear is your convenient excuse. Lace up those boots and start walking, because

Congratulations! You’ve traded your sanity for the thrill of endless Zoom meetings and discount coffee. Spoiler: You’re not a startup mogul; you’re just exhausting yourself for spare change. Wake up!

Face it: if you clutch your wallet every time you hear the word "invest," you're locking yourself in a padded cell of financial mediocrity. Stop being the scaredy-cat of your

Oh, inflation's your scapegoat now? Cute. Maybe it's not those pesky price tags but your VIP subscription to every streaming service. Time to face the music: your wallet’s on a

Stop kidding yourself. You’re not saving; you're splurging on avocado toast like it's a personality trait. Drop the façade and own it: you're gambling your future on next month's salary.

Oh, so you're not rolling in cash? Clearly, it's because you're too busy binge-watching reality TV to bother understanding basic financial principles. Who needs savings when Netflix is calling, right?

Load More