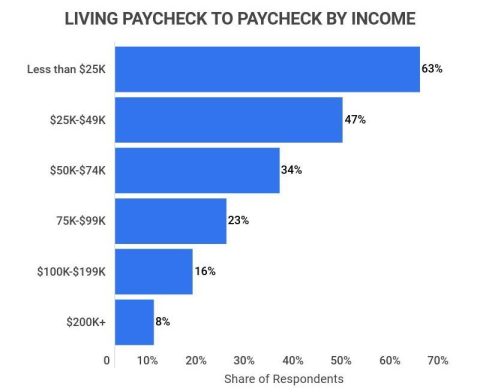

Are you still stuck in the paycheck-to-paycheck grind, where every Friday feels like a temporary lifeline? Let's dive into the brutal truth, aka your chronic financial denial, and why counting

Debt Management

Stop using “good debt” as your get-out-of-debt card. What a joke! You cling to it like a security blanket, sinking deeper every day. Wake up, cut the crap, and finally

Newsflash: your credit score is a dumpster fire because you’re a master at missing deadlines. If “on time” means “whenever,” congratulations on sabotaging your financial future. Time to grow up

Still swiping like it's Monopoly money? It's 2023, people. Credit cards aren't magical debt erasers; they're a one-way ticket to financial faceplants. Wake up—make those cards work for YOU, not

Oh, fantastic—another interest rate hike to nibble away at your bank account. Tired of watching your wallet cry? Buckle up for a no-BS guide to kicking those pesky percentages to

Tired of your credit card debt stalking you like an unwanted ex? Stop kidding yourself with "I'll pay later" and face the wallet wreckage head-on. Cut the crap, budget like

Oh, so your credit score is basically dumpster diving while thinking it's a treasure hunt? Surprise! It sucks because you’re clueless about the magic numbers behind it. Stop winging your

Oh, so your money woes are a mystery, huh? News flash: your bank account didn't spontaneously combust. Time to face the music—your financial mess is 100% your own chaotic masterpiece.

Sure, go ahead—swipe that credit card like you're royalty and the bill magically disappears. Oh wait, it doesn’t. Newsflash: That’s not free money, genius. It’s a loan. And guess what?

Using a credit card without nuking your finances? Shocking, I know. Stop swiping like there’s no tomorrow, pay that balance every month, and maybe, just maybe, you won't end up

Load More