Sure, you've nailed your investments and savings—but what happens when you’re six feet under? Without an estate plan, your legacy turns into a family circus. So stop winging it and

Estate Planning

Think you're invincible at 25? Adorable. While you're busy YOLO-ing, your future self is plotting revenge for skipping estate planning. Spoiler alert: Mortality doesn't care about your weekend plans.

Planning your digital afterlife may sound futuristic, but it’s crucial unless you want your heirs to inherit your love for cat memes. Navigate passwords and profiles now, so your digital

Juggling bills, savings, and future goals can feel overwhelming, especially with a growing family. But with smart financial planning, you can pave the way for both financial security and emotional

Sure! Estate planning might sound like something only the ultra-wealthy need, but it’s essential for everyone. Think of it as creating a safety net for your assets and ensuring your

Sure, we often hear about saving for retirement or building an emergency fund, but what about life insurance? It's that safety net you hope to never need, but are super

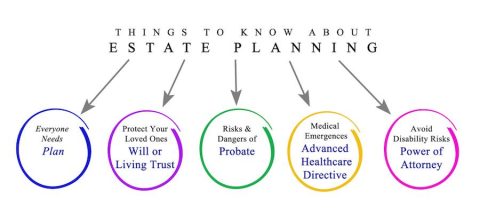

Sure thing! Here's a short excerpt: "Estate Planning Made Simple: What You Need to Know" – because nothing says 'good morning' like contemplating your (hopefully distant) demise! Learn the essentials

Estate planning is more than a financial strategy; it’s a proactive step towards peace of mind. By organizing your assets and wishes today, you ensure that your future, and that