Think you can dodge life's curveballs without an emergency fund? Dream on! Stop tossing money into the abyss and actually save for when things go sideways. It’s not optional, genius—start

financial advice

Stop using “good debt” as your get-out-of-debt card. What a joke! You cling to it like a security blanket, sinking deeper every day. Wake up, cut the crap, and finally

If you actually think your savings account will fund your retirement, bravo! Prepare for decades of ramen dinners and “what were you thinking” moments. Time to ditch the piggy bank

Hate that you're terrible at saving money? Time to face facts: you’re bleeding cash like a leaky faucet. Our no-BS guide cuts through the crap with real tactics to finally

Balancing saving and spending without the eternal guilt trip? Welcome to adulthood, where you actually get to decide between avocado toast and that emergency fund. Stop being a miserly martyr—spend

Congrats, you've set financial goals as vague as your last Tinder bio. "Maybe save someday"? No wonder your bank account is crying in a corner. It’s time to ditch the

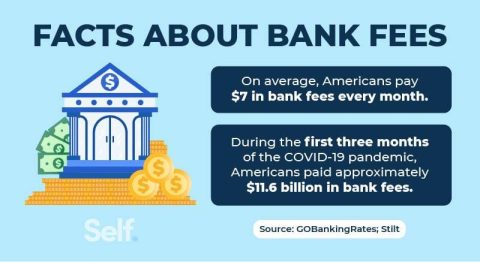

Tired of your bank siphoning off your paycheck with outrageous fees? It’s time to slap them with a reality check. Stop letting these fee-happy vultures plunder your hard-earned cash—take control

Face it: if you clutch your wallet every time you hear the word "invest," you're locking yourself in a padded cell of financial mediocrity. Stop being the scaredy-cat of your

Still living paycheck to paycheck? Wow, congratulations on winning the “perpetually broke” award! Instead of crying over your empty bank account, try taking control. This isn’t rocket science—fix your finances

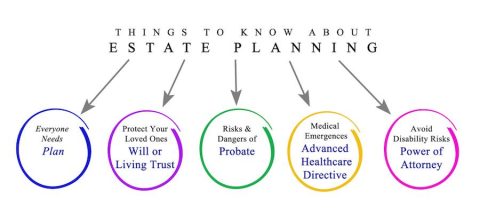

Sure, you've nailed your investments and savings—but what happens when you’re six feet under? Without an estate plan, your legacy turns into a family circus. So stop winging it and

Load More