Stop using “good debt” as your get-out-of-debt card. What a joke! You cling to it like a security blanket, sinking deeper every day. Wake up, cut the crap, and finally

Financial Literacy

Welcome to the stock market, where your hopes are crushed by baffling charts and self-proclaimed gurus. Don’t worry—you don’t need a fancy degree to grasp this financial nightmare. Just ditch

Let’s face it, your bank statement is a nightmare of mystery charges and “fun” fees. Grab a strong coffee and brace yourself as we tear apart the chaos, helping you

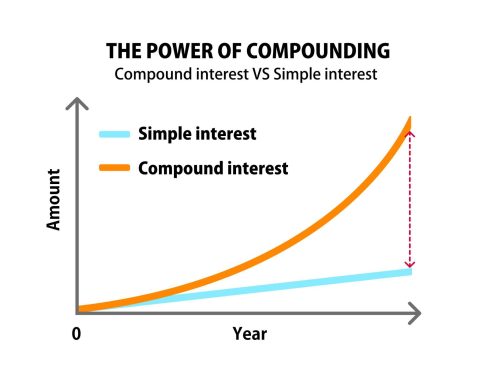

Stop pretending you’re too cool for compound interest—it’s not kryptonite. It's free money! Why let your cash rot when it can multiply just by, oh, I don’t know, existing? Wake

Listen up, genius. You're not inherently bad with money—you're just making a series of monumentally stupid choices. Stop blaming poor luck when you know it’s your habitual shopping therapy and

Look, if you're strutting around like a Wall Street guru but can't tell a stock from a sandwich, it's time to get real. Here are the no-fluff investment basics you

Still swiping like it's Monopoly money? It's 2023, people. Credit cards aren't magical debt erasers; they're a one-way ticket to financial faceplants. Wake up—make those cards work for YOU, not

Oh, sure—keep living like a frat kid while your future self begs for spare change. “Too young to care about retirement”? That’s just adulting procrastination with a credit card. Start

Newsflash: you’re not bad at math—you’re just a grown-up dodging your damn budget. Stop hiding behind lame excuses and face your spending head-on. Money won’t magically fix itself, so quit

“Listen up, Karen: Your budget isn’t some cryptic enigma wrapped in foggy spreadsheets. It’s just basic math. Stop dodging calculations and start dealing with dollars and cents like a grown-up.

Load More